Summary:

- Capital One trades at an attractive valuation but faces risks from consumer credit trends, stress tests, and an uncertain economic environment.

- Provisions for credit losses are rising, and the bank may confront regulatory constraints on capital returns.

- The macroeconomic environment adds complications that could negatively impact credit performance, but earnings upside is possible due to higher interest rates and solid cost control.

Gary Yeowell

Investment Thesis

Capital One (NYSE:COF) trades at an attractive valuation under 8.3x forward earnings. However, many risks around consumer credit, Federal Reserve stress tests, and an uncertain economic environment warrant a cautious outlook. While solid share repurchases and high interest rates benefit COF in the near term, long-term risks may emerge that require this excess capital somewhere else. I rate COF a HOLD as the current discount is counterbalanced by macroeconomic uncertainties.

Deep Dive into Risks

Capital One faces headwinds from normalization in consumer credit trends after years of stimulus and extraordinary credit performance. The 30+ day delinquency rate on domestic cards has risen 139 basis points year-over-year to 3.74%, nearing pre-pandemic levels. Meanwhile, net charge-offs also climbed over 200 basis points to 4.38% annually.

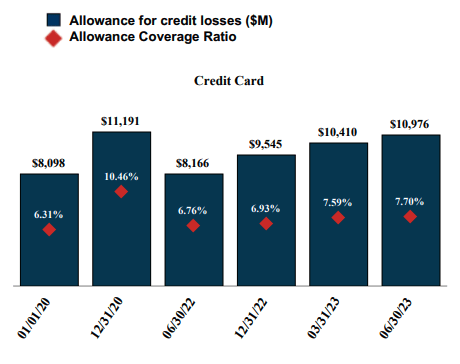

Provisions for credit losses are rising steadily, up $1.5 billion year-over-year. On the Q2 earnings call, CEO Richard Fairbank noted “the consumer excess savings on average is of course winding down, but it’s still there. But of course credit losses play out at the margin not just on average.”

Allowance for Credit Losses (Capital One)

Management expects further increases in provisions as the economy worsens, unemployment rises, and inflation erodes purchasing power. This view was echoed by CFO Andrew Young on the call: “We continue to assume material worsening of labor markets with the unemployment rate rising from today’s very low levels to above 5% by the end of 2023.”

Capital One may also confront regulatory constraints on capital returns in the future. Results from the latest Federal Reserve stress test suggests the bank could face challenges in an adverse economic scenario. Its stress capital buffer increased to 4.8%, requiring more robust capital ratios than many peers.

This buffers Capital One in the near term with a Common Equity Tier 1 ratio of 12.7%. However, returning excess capital via buybacks and dividends becomes questionable when uncertainties loom. Management stated they will operate above the 11% target for now until gaining clarity on economic and regulatory fronts.

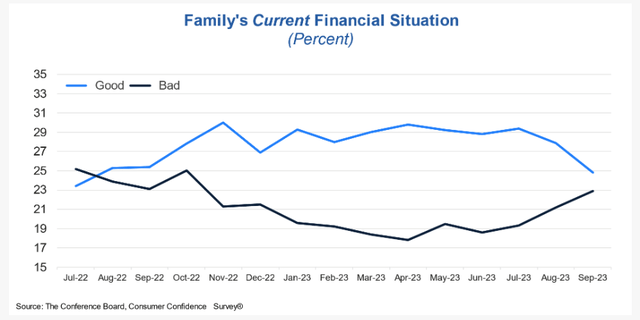

The macroeconomic environment adds significant complications that could negatively impact Capital One’s credit performance and necessitate retaining capital. Persistently high inflation is expected to hinder consumer credit by compressing real incomes. Additionally, the impact of unprecedented Federal Reserve tightening remains highly unpredictable. Rapidly rising rates make borrowing more expensive for consumers and businesses. This huge shock to the economy could easily tip the US into recession given the historical correlation between rate hikes and recessions. If a downturn unfolds, credit losses would climb substantially for Capital One, and the reactionary rate cuts would hurt interest income.

Between the compression of real incomes from persistent inflation and massive uncertainty regarding Fed policy tightening, the macro environment poses substantial credit risk. Potential consumer credit deterioration appears likely in the coming quarters. With these heightened risks of stresses in their loan portfolio on the horizon, it seems prudent for Capital One to retain capital to insulate against downturns rather than overly aggressive capital returns to shareholders. The macroeconomic backdrop adds uncertainty that merits caution as consumer lending stocks rarely do well in a declining economy.

Earnings Upside Possible

That said, positive catalysts may boost Capital One’s stock price in the coming quarters. Elevated interest rates widen net interest margins, evidenced by a 59% increase in net interest income annually.

Higher rates enabled a 7% rise in quarterly revenue. CFO Young noted on the call that “where we go from here is going to be impacted by a number of factors, customers’ appetite for different deposit products, our focus on customer relationships, industry competition, funding needs.”

Solid top-line expansion combined with disciplined cost control drove operating leverage. Operating expenses as a percentage of revenue improved 120 basis points annually. Continued operating leverage could sustain earnings growth in the low double digits.

Capital One also maintains a strong balance sheet, with $118 billion in liquidity reserves. A fortress balance sheet helps weather downturns and provides flexibility for strategic investments when competitors falter.

Valuation and Conclusion

Trading at 8.3x forward earnings, Capital One appears undervalued compared to large bank peers. However, the discount reflects justified concerns around credit normalization, stress test results, and economic risks.

Earnings upside remains possible, but a prudent view hedges for potential credit deterioration and constraints on capital return. We rate Capital One a HOLD – the current valuation compensates for risks, but clarity is needed before turning bullish.

While short-term traders may see opportunity if earnings surprise, long-term fundamentals hinge on the consumer’s resilience through macro turmoil. Until confidence increases, a neutral stance balances Capital One’s upside and downside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.