Summary:

- Capital One plans to acquire Discover Financial in a $35 billion all-stock deal, creating the largest credit card company in the US.

- The acquisition presents opportunities for synergies, with total synergy opportunities estimated at $2.6 billion.

- COF will gain access to DFS’s payment network, allowing it to compete with Mastercard and Visa, but integration and building up Discover may be costly and challenging.

Joe Raedle/Getty Images News

In one of the largest announcements in the banking industry, Capital One (NYSE:COF) has announced it’s planning to purchase Discover Financial (NYSE:DFS) in a $35 billion all-stock deal. Not only will the deal provide Capital One its own payment network, but it’s a massive acquisition given that Capital One itself is a $50 billion company, that will need to integrate a large company.

As we’ll see throughout the article, though, the company’s strong assets and opportunity for synergies make Capital One a strong investment.

Capital One Discover Financial Acquisition Overview

The acquisition is massive. However, given the similarities between the businesses, there’s a strong opportunity for synergies.

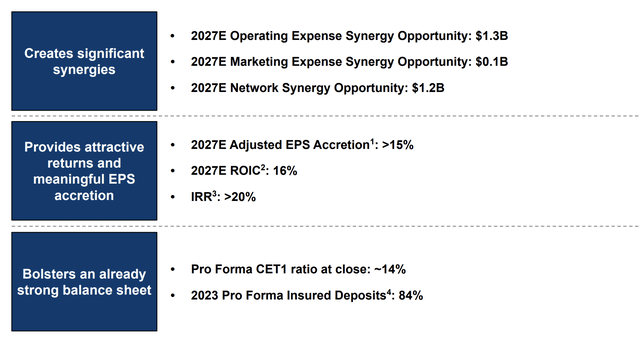

Capital One Investor Presentation

The company sees total synergy opportunities at a massive $2.6 billion, which means >15% EPS accretion. The 2027 timeline for these, 3 years away, is a long time for a synergies forecast and shows how expensive integrating a banking acquisition is. Still, the company expects strong double-digit returns. In the meantime, the financials of the deal are sound.

That’s not surprising given the all stock transaction.

Capital One’s Payment Network

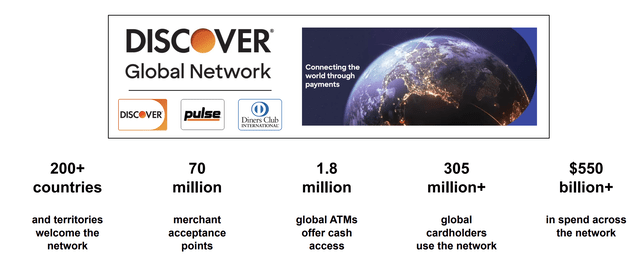

The crown jewel of Capital One’s ambitions as one of the youngest banks/credit card businesses is Discover’s payment network.

Capital One Investor Presentation

Out of the big 4 payment networks, Discover has by far the smallest. Of course, when 3rd place is 3 times the value of your company, you settle for 4th place. The company’s goal is to combine Discover with Capital One to make the largest credit card company in the world and use that to elevate the payment network to be a major player.

There is a risk here. Building up Discover to compete with Mastercard and Visa will be expensive and other credit card issuers are unlikely to want to use the network given the fact that it is run by Capital One, a competitor. That means the company will need to work to build it up to be competitive with American Express.

In the meantime, customers might be against Capital One credit cards, which do not offer them the widespread use that current Visa or Mastercard might. The company needs to time all of this incredibly well to achieve its goals.

Capital One Credit Card

The crown jewel of the combined companies will be a credit card network, along with co-branding.

Capital One Investor Presentation

Capital One will have the largest credit card network globally post acquisition, beating out JPMorgan Chase. The company expects that synergies with the network will bring in $1.2 billion in savings, and shared expenses will drive $1.5 billion worth of savings. That means almost $3 billion of total savings as the businesses merge in 2025.

The size of the credit card network will enable Capital One to increase offerings, as the company has become more competitive in the premium travel credit card space. The success of the transaction hinges on Discover lowering transaction fees and enabling more merchants to accept it, while Capital One benefits from owning both the cards and the transaction fees sides.

This could hypothetically result in lower prices for credit cards across the board, but overall, this is the crown jewel and a strong move by Capital One.

Capital One Banking

Capital One has separately also been building up a strong banking business.

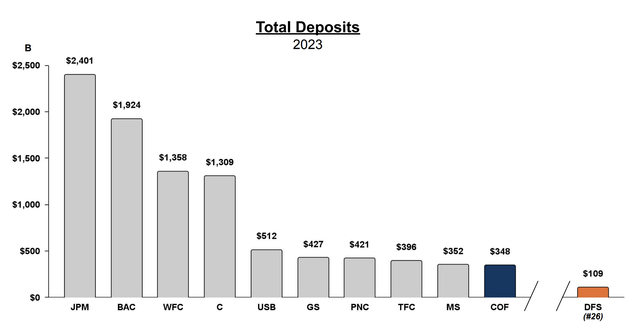

Capital One Investor Presentation

The company is already one of the largest banks in the United States, with almost $350 billion worth of deposits. Discover Financial Services will add more than $100 billion. The combined bank will be the 6th largest bank in the U.S., in spitting distance of U.S. Bancorp which with a $65 billion valuation is at 80% of the combined Capital One + Discover valuation.

That doesn’t count the value of Capital One + Discover’s entire network, or how fast the banks have been growing due to their brand recognition as the focus of marketing the banks. Discover’s U.S. bank has doubled in size over the last 5 years in terms of deposits. We expect this to quickly put the bank within spitting distance of the $1 trillion market by the end of the decade.

Capital One Financial Results

The bank is focused on maintaining financial performance as a complicated transaction goes through.

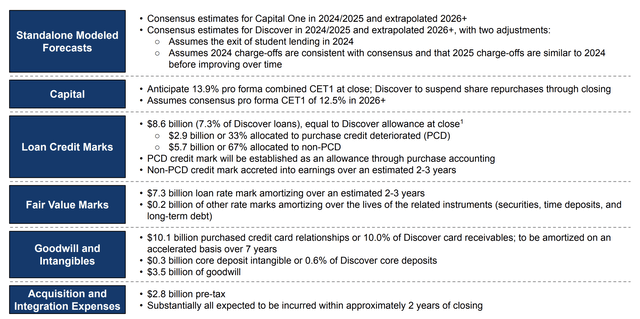

Capital One Investor Presentation

Discover Financial has been aggressively repurchasing shares, which will be halted, and Discover is exiting its student loan business. The combined business will have a 13.9% pro forma combined CET1 ratio, relatively strong, and we’d like to see share repurchases resume after the transaction closes. Loan credit marks and fair value marks are expected to be amortized due to changing rates, but we don’t expect them to be significant.

Goodwill and intangibles are fairly expensive ($10+ billion in credit card relationships) but we don’t think are unreasonable given the scale of the acquisition. Overall, given that it’s an all-stock transaction, it should be easily affordable and comfortably paid down. The net transaction is expected to result in 2027 EPS accretion of >15%.

Thesis Risk

The largest risk to our thesis is integrating a big acquisition at a premium is expensive. Capital One relying on a Discover credit card network that is much smaller than its peers could substantially hurt the popularity of its existing credit cards. There are lots of ways the acquisition could not pan out as the company gets merchants on board, which could hurt returns.

Conclusion

Capital One has an impressive portfolio of assets as it’s been growing rapidly as a credit card company and building up a bank. The company has also made a brilliant decision with the announcement that it was going to acquire Discover Financial. That gives the company access to the Discover payment network and makes it the largest credit card company in the U.S.

Payment networks are very valuable, and banks are very valuable. Not only will Capital One be able to rapidly grow the credit card network, but it’ll be able to use its credit card banking reputation to rapidly build a conventional bank business. That combination, combined with synergies, and a low valuation means this will be a profitable transaction for Capital One.

Let us know your thoughts in the comments below!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.