Summary:

- Capital One Financial Corporation has much higher exposure to deteriorating consumer credit stability as living costs rise, and consumer debt issues mount.

- The bank’s higher subprime auto loan exposure will likely be a significant issue, considering subprime auto defaults are at a record, even without a recession.

- Considering U.S. consumer credit stability is so weak today despite solid employment, Capital One faces tremendous risk should employment levels decline in 2024.

- Capital One is likely fairly valued today if we assume an eventual reduction in interest rates and moderation in consumer credit, both of which seem unlikely based on economic data.

ProArtWork

At the beginning of the year, I published my bearish outlook for Capital One Financial Corporation (NYSE:COF) in “Capital One: Defaults May Soar In 2023 Due To Deteriorating Household Financial Stability.” At that time, I expected the company to face difficulties due to growing strains on the consumer lending market. Since then, the stock has lost around 16% of its value and is now trading near the support level it has held since last year.

Post-market on Thursday, October 26th, the company is expected to announce its Q3 earnings report. In my view, although its report may be better than expected, investors may want to avoid or sell the stock due to the significant potential for higher-than-expected loan losses, as well as a decline in its 2024 outlook.

Capital One faces numerous key issues. For one, the bank’s overall capitalization has deteriorated dramatically since 2021 due to a sharp increase in securities losses on its RMBS portfolio. More importantly, its loan losses are rising dramatically, with a credit card delinquency rate of 4.09% in August, up from 3.49% in 2019 before the pandemic. Further, its net charge-off rate rose to 4.55%, up from 4.25% four years ago, due to growing losses in its auto loan segment. Although the stock may appear to be discounted today, I generally expect it to break below its support level over the next month due to the combination of weaker solvency and significant exposure to growing consumer credit risk factors.

Continued Consumer Credit Stability in 2024

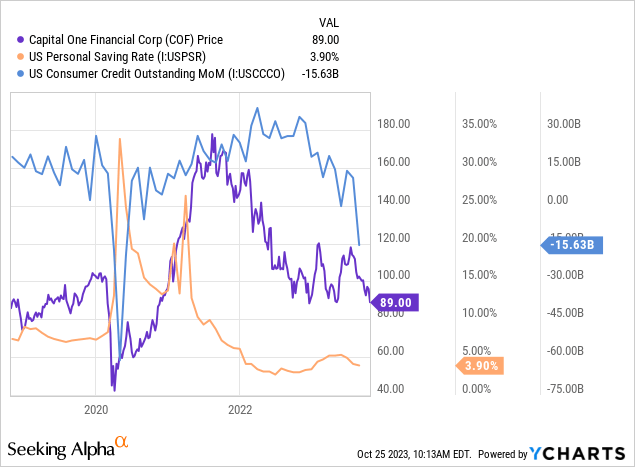

Coming out of 2022, many investors expected 2023 to be a strong year as the pandemic strains became a relic of the past. 2021-2022 was relatively strong for consumers, mainly due to tremendous economic stimulus efforts such as zero interest rates and QE. In general, that excessive stimulus promoted high consumer credit debt growth due in part to record high FICO scores created by “pandemic savings.” Of course, that stimulus has also resulted in high inflation, causing a massive decline in overall savings levels. More recently, consumer credit growth has also plummeted at an alarming pace. See below:

Last year, consumer borrowing levels were extremely high while savings were low, indicating people were borrowing to make up for rising inflation and a lack of discretionary income. This year, savings rates remain low and are falling again, but consumer borrowing is also plummeting, indicating default rates are now rising very quickly. Nonrevolving credit fell very fast last month, likely due to the massive increase in auto loan defaults. Nationally, auto loan defaults are now at a 30-year high, while subprime auto defaults are at a record level, despite both being at a decade low just last year.

Capital One has very high exposure to this risk, with around 25% of its total lending portfolio being in auto loans. Those auto loans carried a delinquency rate of about 5.95% in Q2 and likely much higher in Q3 due to the national increase in auto loan defaults. The bank also has lower lending standards, with 48% of its auto loans having a FICO score below 660 at origination and 28% being below 620 (subprime). Its credit card portfolio (42% of total loans) is also relatively exposed, with 31% having FICO scores below 660. These data are pulled from its Q2 10-Q pg. 29-41 and its balance sheet.

The bank’s focus on lower lending tiers may boost its revenue and net interest income in strong periods, such as 2021; however, in weakening consumer periods, such as today’s, it exposed the company to tremendous financial risks. At the end of Q2, national credit card delinquencies were already materially above pre-pandemic levels. This month, student loan repayments will finally continue, wiping out an additional few hundred dollars in discretionary income for many Americans, straining personal savings even more. Combined with the meteoric increase in auto loan issues over the past month and the sharp decline in total consumer credit lending, I believe we can expect a continued increase in consumer credit defaults over the coming quarters, particularly for those with lower FICO scores which likely have net negative savings today.

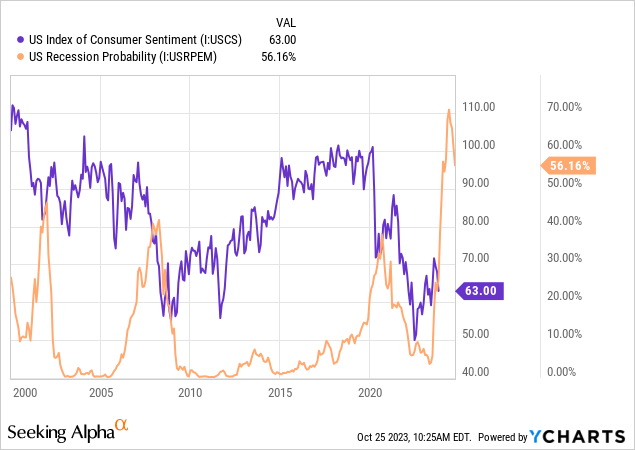

Of course, all of this is occurring during relatively strong employment levels. Usually, auto loan defaults are only as high as they are when many U.S. borrowers are grappling with unemployment due to a recession. Thus, given the weak state of consumer sentiment and the high recession risk level in 2024, I can only imagine what will happen when the default rate in unemployment rises with a recession. See below:

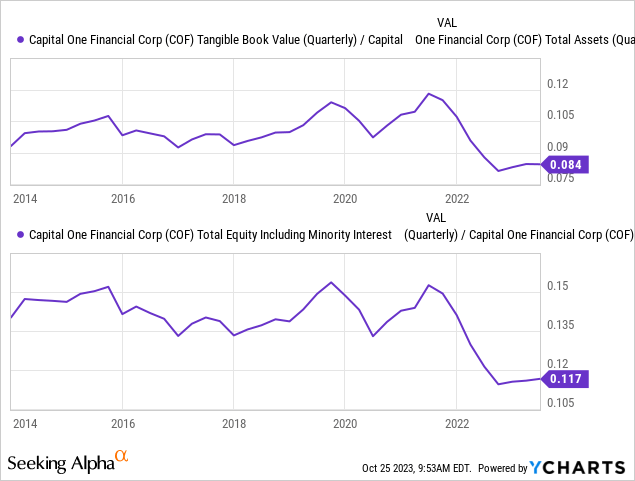

Further, due to significant securities losses, Capital One’s financial solvency is not great. Capital One was among the few large U.S. banks to nearly fail its stress test this year. Of course, stress tests are not necessarily functional, considering they would have failed to predict all of the bank failures seen this year. The core issue with stress tests is they are not designed for “stagflation” and usually assume interest rates decline in a recession, which is not currently indicated in the yield curve due to supply-side inflation factors. At any rate, Capital One’s solvency is historically poor today due to losses on securities assets last year. See below:

Capital One’s securities portfolio is primarily made up of mortgage-backed securities assets. Unlike many banks, essentially all of its securities are listed as “available for sale,” so losses are accounted for in its balance sheet even if not realized. However, because these assets are long-term (20-30-year maturity), I do not believe we should assume banks will hold them to maturity; thus, declines in securities values due to higher interest rates do create new financial strains. Most RMBS assets have a duration of around 6X, so a 1% rise in long-term Treasury or mortgage rates will lower their value by about 6%. Mortgage rates have risen by about 1% since the end of Q2, likely reducing the value of Capital One’s securities book (~$90B in Q2) by ~$5.4B from Q2 to today. Hypothetically, that should lower its common tangible equity ratio to ~7.2%, though the total decline will not be in its Q3 report since rates rose higher in recent weeks.

Capital One’s TCE of ~7.2% is not necessarily bad compared to most larger banks; however, it is poor considering COF’s assets are much riskier assets with nearly 5% charge-off rates (and rising). In my view, strains on consumer credit are now far above “normalization” since they’re firmly above pre-pandemic levels. Additionally, these strains are set to grow due to wage stagnation, rising living costs, student loan repayments, and much higher borrowing costs.

Even without a recessionary unemployment spike, I expect Capital One will continue to see financial deterioration. However, should unemployment rise in 2024, as I expect, then Capital One may be among the most exposed banks, given it is among the few to nearly fail its last stress test. Of course, the stress test likely overpredicts bank health because it does not assume inflation and interest rates can remain high in a recession; hence, it would have passed the banks that failed this year.

What is Capital One Worth Today?

I estimate that Capital One’s common tangible equity value is likely around $34B based on estimated securities loan losses from Q2 to today. Indeed, it may be a bit lower due to an expected increase in loan losses in Q3, meaning its tangible book value may be as low as $30B. Capital One is currently trading at a $34B market capitalization, which is likely near or slightly above its tangible book value.

Its TTM “P/E” appears very low at 6.8X, which is around 30% lower than its typical pre-pandemic valuation. That said, its TTM EPS is likely far above its forward EPS because its net interest income was extremely high at the end of Q2. Its savings account deposit rate is now 4.3% to attract depositors in this increasingly competitive environment. At the end of Q2, its interest-bearing deposits (over three-quarters of total liabilities) had an average rate of 2.9%, meaning its NIM is likely going to be around 1-2% lower over the coming quarters due to higher borrowing costs. Its NIM was 6.48% in Q2, giving me a forward net interest income estimate of $4.9B per quarter, down from $7.1B in Q2. This change may erase all or more of its net income of $1.4B at the end of Q2, particularly if we consider rising loan loss provisions.

The analyst consensus shows COF’s expected quarterly EPS falling from $3.52 in Q2 to $2.63 in Q4. In my view, its EPS should fall even more due to higher deposit borrowing costs this quarter. Further, I expect its net interest margins will remain depressed because short-term rates are currently expected to remain high for years, likely leading to a continued increase in savings account rates and depositor competition. Further, based on trends in consumer lending, I believe we’ve only seen the beginning of Capital One’s loan loss strains. Should a recession cause unemployment to rise next year, then I think Capital One’s long-term survivability will fall at the mercy of government bailouts due to its weaker capitalization, NIM compression, and high consumer exposures.

The Bottom Line

I am very bearish on COF and believe it is among the riskier large banks on the market today. Based on its book value and TTM “P/E,” it is not necessarily significantly overvalued if, and only if, we assume that historical conditions will continue. Based on economic trends regarding consumer credit, that is most likely not the case, as consumer credit strains are incredibly high today in light of low unemployment. Again, total U.S. consumer credit strains are starting to look as they would during a recessionary increase in unemployment.

Thus, I expect abnormal strains should unemployment increase. Even without employment issues, many borrowers will face a quick decline in credit stability due to student loan repayments this month, coming after staggering strains in the auto loan market. The auto loan segment will be attractive to watch because the securitization quality of those loans is falling due to the decline in car prices.

While I am bearish on COF, I would not bet against it because government efforts, including the Federal Reserve, may be able to alter its performance if strains continue to grow dramatically. Personally, I doubt the government can pursue the same degree of stimulus as it had in 2020 due to inflation pressures and political gridlock; however, it is historically lethal to bet against the government’s resolve to “kick the can” down the road regarding debt issues.

Still, in a best-case scenario where consumer strains decline or stabilize from here, I believe COF would be roughly fairly valued at its current price. However, should those headwinds continue to grow, as I expect, Capital One Financial Corporation could lose much of its equity value due to the combination of lower NIM outlooks, weakened solvency, and increasing credit loss risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.