Summary:

- Market loan delinquency rates are slowing, indicating a reversal of the previous trend.

- The debt-to-income ratio remains healthy while the inflation rate is subdued, suggesting no signs of consumers’ financial deterioration.

- Capital One will benefit from lower provisions for credit losses.

Heather Shimmin

Introduction

In May 2023, I had a buy rating on Capital One (NYSE:COF). At the time, my argument depended on manageable delinquency rates, strong deposit inflows, and attractive valuation. Today, after about a 56% increase in the company’s stock price, I believe Capital One offers an attractive entry point for investors. The pace at which the delinquency rates are increasing shows signs of slowing hinting at an improving charge-off environment in the coming quarters. This likely creates a 30%+ net income and valuation appreciation potential. Finally, given the bullish factors, I believe Capital One’s valuation is still attractive at current levels. Therefore, I continue to believe that Capital One is a buy.

Delinquency Rate Growth is Slowing

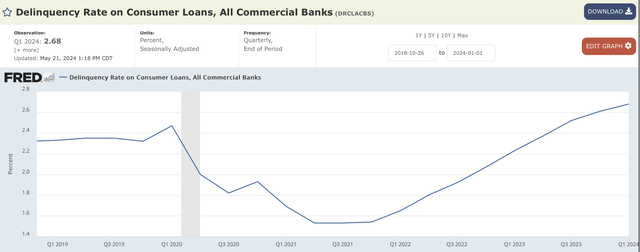

During the pandemic and a few quarters immediately following this period, consumer loan delinquency was extremely low due to a massive government stimulus and a strong labor market following a loose monetary and fiscal policy. However, as the direct stimulus into the economy slowed in times when inflation became rampant, consumer loan delinquencies started to show strong increases pushing companies like Capital One to incur higher charge-off costs and provision for credit losses. Fortunately, in the past few quarters, early signs of slowing consumer loan delinquency rate growth have emerged, creating a macroeconomic tailwind for Capital One.

Federal Reserve Bank of St. Louis

[Source]

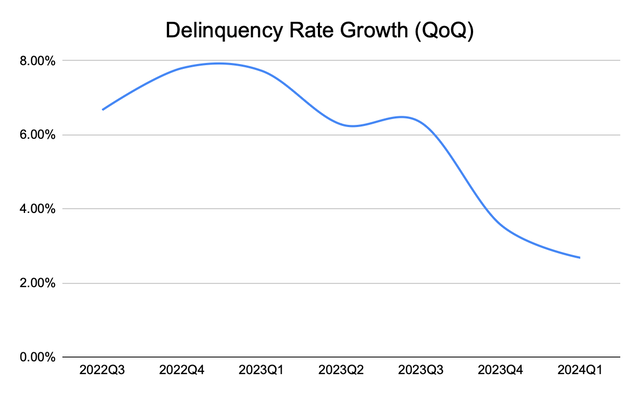

The chart above shows that the overall consumer loan delinquencies sharply increased from the pandemic lows before starting to level off in recent months. Looking at the chart, the leveling off may not be clear, but the underlying data tells a different story. The quarter-over-quarter consumer loan delinquency rates have been sharply slowing down since hitting their peak in late 2022 and early 2023. The chart below depicts a quarter-over-quarter change in the consumer loan delinquency rate growth, and it clearly depicts a trend where the consumer loan delinquency increases are slowing.

Federal Reserve Bank of St. Louis

[Chart created by author using Source]

Therefore, I believe the current macroeconomic trend of slowing delinquency rate growth will create a massive tailwind for Capital One in the coming few quarters as the slow increases turn to no increases or even decreases in the overall delinquency rate.

Strengthening Trend

The loan delinquency data from the past several quarters suggest that the overall trend of decreasing growth has already started with no clear signs of this trend ending, but how realistic is it to argue that the current trend will continue for the foreseeable future?

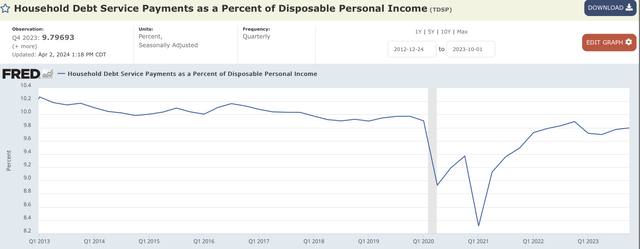

I believe the consumer loan delinquency rates will continue their constructive trend toward an eventual decline in the consumer loan delinquency rates as inflation is slowing and consumers’ debt service as a percent of disposable income remains healthy or in line with the pre-pandemic time periods.

First, the chart below shows household debt payment as a percent of disposable income, and it clearly shows that households are not burdened by debt. The level of debt payments is similar to that of the pre-pandemic levels, which in my opinion, implies that the current loan delinquency increase is simply a normalization trend that will eventually settle near the pre-pandemic delinquency rate levels.

Federal Reserve Bank of St. Louis

[Source]

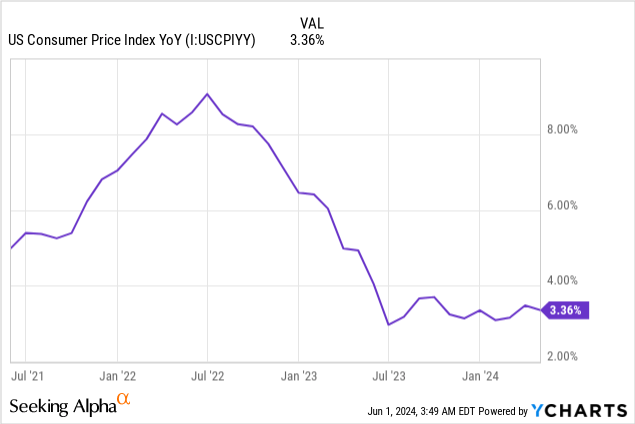

Further, as the chart below shows, the consumer price index depicting inflation has been slowing from its peak. While it is true that the Federal Reserve is struggling to bring the inflation rate closer to its target 2% range, the inflation has successfully stabilized near 3% levels while the Federal Reserve is continuing its effort to suppress it further likely reliving the consumers from an additional financial burden.

[Chart created by author using YCharts]

Finally, Capital One shares a view that the current increase in consumer loan delinquencies is temporary. During the 2024Q1 earnings call, the company’s management team said that “the pace of year-over-year increases in both the charge-off rate and the delinquency rate have been steadily declining for several quarters and continued to shrink in the first quarter.”

Therefore, given these catalysts supporting the consumers’ financial health, I believe it is reasonable to argue two things. One, the improving trend of consumer loan delinquency rates will continue for the foreseeable future. Two, after this period of normalization, consumer delinquency rates will likely return to pre-pandemic levels.

How Will This Be Beneficial?

Capital One will most certainly benefit from the declining growth of consumer loan delinquency, but to what magnitude will the company see its profits increase?

Building off of the previous arguments, assuming that the consumer loan delinquency rates are heading toward a pre-pandemic level of about 2.47% in 2020Q1, Capital One could see its bottom line expand significantly.

First, Capital One will be able to lower its allowance coverage ratio for potential credit losses. As of 2024Q1, the company’s credit card allowance coverage ratio was 7.81%, which is significantly higher than the pre-pandemic level of the coverage ratio of 6.31%. As such, given that the delinquency and charge-off trends normalize, Capital One will be able to release the reserve. For the sake of argument, if Capital One can lower the coverage ratio closer to the pre-pandemic level of 6.50%, Capital One’s bottom line could see about an additional $1.971.55 billion addition for a period where the company reduces the allowance coverage ratio. Given that Capital One reported an annual net income of $4.77 billion in 2023, the tailwind from the lower coverage ratio could be significant as the $1.971 billion equates to about 41.3% of the 2023 net income.

Second, Capital One could see a significant net income expansion as a result of lower provisions for credit loss requirements. In 2024Q1, Capital One’s net charge-off costs were $2.616 billion. However, in 2023Q2, when the market consumer loan delinquency rates were 2.37%, which is similar to the pre-pandemic delinquency rates, Capital One reported net charge-off costs of about $2.185 billion. With the rise of the overall consumer loan delinquency rates from 2.37% to 2.68%, Capital One’s net charge-off costs also increased. As such, if the consumer loan delinquency growths ease and eventually start to decline towards the pre-pandemic levels, Capital One’s provision for credit losses could see a gain of $431 million each quarter without accounting for any organic growth. The company’s net income for 2024Q1 was $1.28 billion, so lower provision for credit losses could add about 37% to the bottom line.

Declining charge-offs and numerous other factors, including the current macroeconomic state and the forecasted macroeconomic conditions will determine the reserve ratio. Also, Capital One’s net income and provisions for credit losses differ quarter by quarter. However, I believe one thing is clear. As the market consumer loan delinquency rates start to decline in the coming quarters, Capital One will likely see outsized gains of potentially over 30%+. Therefore, considering both the potential, I believe Capital One has a significant valuation appreciation opportunity in the coming quarters from a potential bottom-line expansion.

Risks to Thesis

In my bullish thesis, I am expecting a positive macroeconomic tailwind to unfold, which includes a continual decline in the overall interest rate along with the strength in the consumers’ financial health. However, if this is the case inflation proves to be persistent in a way that it starts increasing, consumers could see further financial pressure from both daily costs of living and potentially even higher interest rates. Therefore, the current trend and momentum of delinquency rates could reverse adversely affecting Capital One and my bullish thesis.

Summary

The momentum at which the delinquency rates are increasing has continually weakened, which could eventually lead to the decline of the delinquency rates from the current high levels to a level similar to the pre-pandemic times. This trend is backed by strong consumers’ financial position along with declining overall inflation rate, which creates a positive tailwind for Capital One. As the pressure from higher loan delinquency rates eases, Capital One could see over 30% benefit to its bottom line and subsequently to its overall stock price. Therefore, I believe Capital One is a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.