Summary:

- Capital One’s shares have rallied about 15% since being classified as a “strong buy” in early September.

- The company’s deposit franchise and outlook for the consumer are key factors to consider for investors, and the outlook is looking better.

- Capital One’s net interest margin improved in the third quarter thanks to wide credit card yields, and it has been outperforming the industry in terms of deposit growth.

- Given rising disposable income, we should not see significant further credit deterioration.

Win McNamee

Capital One (NYSE:COF) has been recovering strongly in recent weeks, pushing shares up 23% over the past year. Since classifying shares as a “strong buy” in September, shares have rallied about 15%. Given updated results and recent macro developments, I continue to see the company poised to earn at least $14 per share with the prospect of more meaningful buybacks in H2 2024 seeming more likely. I would stay long, even after this run.

In the company’s third quarter, it earned $4.45, blowing past estimates of $3.24. For Capital One in particular, I believe investors need to focus on the strength of its deposit franchise, as well as the outlook for the consumer. COF is one of the leading credit card issuers in the country. Even as the company has seen credit quality deteriorate from extremely strong levels in 2021-2022 when government stimulus drove income gains, the company continues to generate significant income. The bullish thesis is that funding costs are stabilizing and that credit quality will not worsen dramatically. We are seeing progress on both fronts.

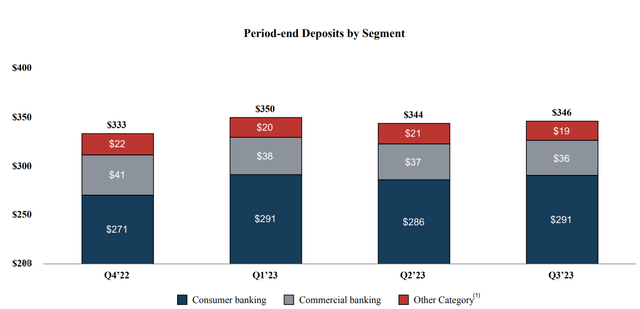

Touching on funding first, we have seen an industrywide fight for deposits in the wake of Silicon Valley’s failure earlier this year. That shock, combined with ongoing fed rate hikes, has increased funding costs for the entire industry. COF is no exception to this, but we can see that the company is doing relatively well in regards to the competition. During the third quarter, deposits increased by $2.3 billion to $346 billion.

As you can see below, deposits actually rose significantly in Q1 as COF was seen as a safe haven bank. As conditions calmed, its deposits drifted lower in Q2, but they have recovered in Q3. Given its focus within online retail banking, its deposit base is fairly sticky with 80% of deposits below FDIC insurance limits.

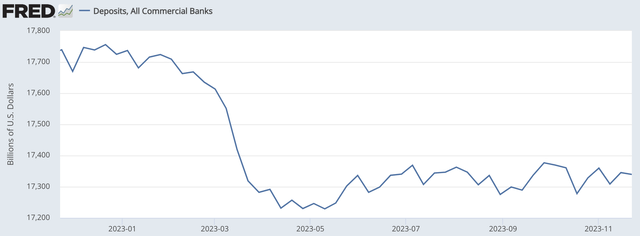

With about 4% deposit growth year to date, COF has been a significant outperformer. As you can see below, deposits are down about 2% industrywide, so COF has outperformed banks in aggregate by about 600bp. This rising deposit base is allowing it to continue to grow its interest-earning loan book and boost profitability.

I think it is important to note that industry deposits are no longer falling. They have been essentially flat for six months now. This stabilization in deposits for the industry should help to slow the pace of deposit rate increases, as banks are no longer fighting over a shrinking pool of funds. We have already seen deposit yields rise more slowly, though they are still rising.

On its $291 billion of consumer deposits, rates rose 39bp sequentially to 2.85%. They rose a more modest 25bp to 2.93% in COF’s commercial franchise. These rates are relatively high already compared to peers, a reason why COF has seen deposit inflows (it can afford high deposit rates because of the rates it earns on its larger credit card franchise, discussed in further detail below). Just given a higher exit rate, I do expect an increase in deposit costs in Q4, but there should be a deceleration in the rate of change. Management has cautioned that deposit rates could rise if the Fed raises rates again, but that appears increasingly unlikely with markets pricing in several cuts next year.

Impressively, even with this higher deposit cost, Capital One’s net interest margin improved 21bp sequentially to 6.69%, though this was down 11bp from last year. This was as higher credit card balances and yields more than offset higher deposit rates. Most banks, with larger securities portfolios, are likely to see NIM bottom in Q4 or H1 2024. It appears that COF is ahead of this process. That is because the rate on its domestic card franchise rose to 18.24% from 17.76% last quarter.

This 48bp increase was higher than the increase in deposit rates, contributing to wider margins. Additionally, COF grew its overall loan book by 1% to $315 billion. Domestic credit card balances grew even more quickly and ended Q3 at $140.3 billion, which was up 3% sequentially and 16% from last year. With cards growing more quickly, the average yield on its asset base is increasing, providing a tailwind to interest margins.

Now, this can be a double-edged sword. Credit card yields are the highest of the major loan categories, but they are also the riskiest. They are not government-guaranteed like most mortgages or secured by an asset like an auto loan. So when there is a default, the severity of the loss can be quite high,

We essentially want to see balances rising, so long as they are not rising because consumers cannot pay them back. Here is where Capital One has been a controversial stock, and why it trades at a fairly low multiple. There is a concern about the trajectory of credit card losses as the economic cycle ages. Indeed, we have seen credit losses increase.

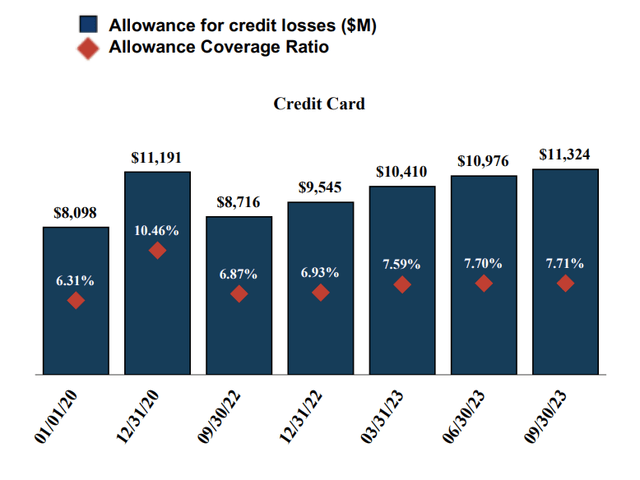

In the quarter, COF took $2 billion net charge-offs. That included $1.6 billion in credit cards, or about $531 million per month. In total, COF took $2.3 billion in provisions for credit losses, adding $322 million on net to reserves, and it now carries $14.96 billion in allowances for credit losses, covering 4.75% of loans. Charge-offs were 4.4%, and delinquencies rose to 4.31% from 3.74% last quarter. With this reserve build, loan coverage is 84bp higher than a year ago and 140bp above pre-COVID levels.

In other words, Capital One is reserving for higher losses and prepared its balance sheet for such. It is also important to emphasize that COF earned $4.45 in EPS even with $2.3 billion in credit costs. COF can continue to see this level of charge-offs and maintain similar profit levels because it is earning over 18% on balances. When a bank funds at 3%, loses 5%, but earns 18%, that is still an extremely profitable business. COF will add about $2 billion to credit card reserves this year while generating over $13 in EPS.

Now, every $500 million in quarterly credit costs is about $1 in EPS. The question becomes whether losses will accelerate significantly from Q3 levels. Well, in October, Capital One reported a 5.08% credit card charge-off rate ($591 million) with a 4.48% 30+ day delinquency rate ($6.4 billion) while period-end balances were $142 billion. Balances rose about 1% in the month, so consumers continue to spend and borrow. We did see delinquencies rise about 17bp, and charge-offs are running about $60 million higher than Q3 levels.

This does point to some weakness. Now, historically, delinquencies tend to rise from June through January, and then they tend to fall back down in February-April as consumers receive their tax refund checks, which can be put toward bills they have fallen behind on. As such, some deterioration is to be expected, but there is also likely some modest worsening. This does point to a slower increase than seen last quarter.

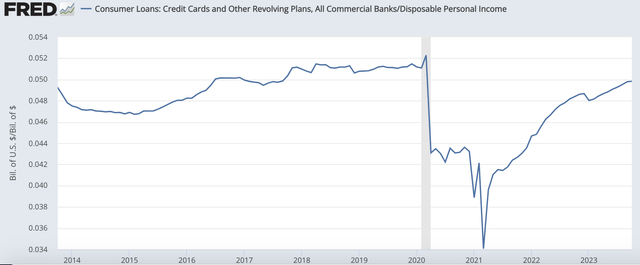

While the future is notoriously difficult to predict, I remain in the camp that further credit deterioration should be modest. Credit card balances have risen, but so has income. As you can see below, credit card balances relative to disposable income are actually still somewhat below pre-COVID levels, and I felt quite good about the economy at the end of 2019. It is also worth noting that COF is reserving substantially more than on January 1, 2020, even with credit card debt looking equally, if not slightly more, sustainable. This supports my view COF’s reserves are conservatives, and builds should be modest from here.

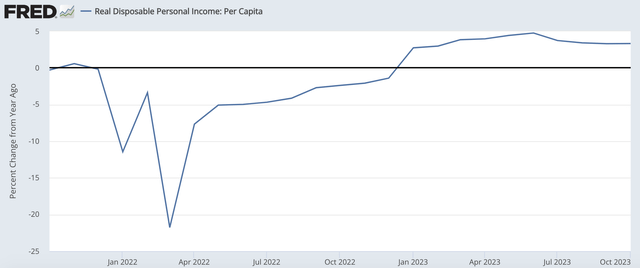

Now, even if balances seem fine today relative to income, this could become a problem if incomes were to fall. However, real incomes are now actually rising from last year, as wages have held on while inflation has slowed. With oil prices moderating further, consumers’ real incomes should continue to rise in coming months. All else equal, that will increase their capacity to pay down credit card balances.

All of this is to say that credit costs may continue to rise modestly-provisions could move from $2.3 to $2.5-$2.7 billion, but we are unlikely to see a rise to $3+ billion, unless there is a meaningful deterioration in employment levels and the economic outlook. With the economy seemingly migrating towards a soft landing, that risk appears increasingly remote.

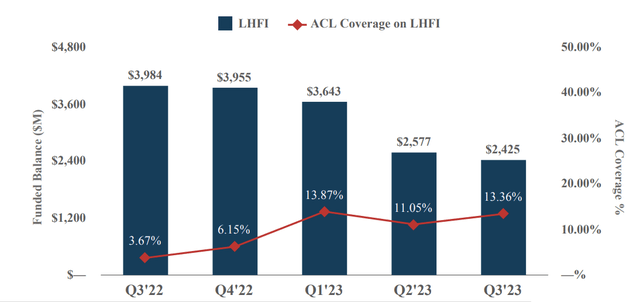

Aside from credit cards, I would note that COF has only limited exposure to the office sector, an area with clear secular headwinds. It has worked down its office exposure by about 40%, and at $2.4 billion, it accounts for less than 0.8% of all loans. It has also built reserves to over 13%. That provides insulation from a significant rise in defaults. I view COF’s very modest exposure to office as a clear positive.

Beyond loans, like most banks, Capital One has an investment portfolio of fixed income securities. This portfolio is at $74.8 billion, down from $78.4 billion last quarter and $75.3 billion last year. The yield nudged up 2bp to 2.86%, as securities matured. Because these securities were purchased when rates were lower, there is a large unrealized loss, which is why COF has a $12.2 billion loss in accumulated other comprehensive income (AOCI).

COF has a very healthy 13% common equity tier 1 capital ratio (CET1). That was up 30bp sequentially and 50bp from a year ago. Now, as a bank with over $100 billion in assets, it will have to begin phasing in AOCI losses in late 2025. Pro forma for these losses, CET1 is still about 10%. Now, over time as bonds mature and pull to par, these losses will continue to shrink, lessening the impact on CET1. Further, the recent decline in interest rates will lessen the unrealized loss.

I would note Capital One retained $1.5 billion of capital during the quarter, even after doing a small $150 million repurchase and paying its dividend. COF will need to retain about $6-8 billion in capital over the next two years to bring capital to 11% with AOCI. It can do that by continuing to retain all capital over the next year, and then aggressively begin a buyback in 2025, or gradually accelerate repurchases through 2024 and 2025. Assuming the macro environment does not deteriorate, I do think buybacks could become an increased focus in H2 2024. Additionally, AOCI losses are phased in over several years, reducing its initial impact on reported capital levels.

At this level of NIM, even assuming a further $300 million in deterioration in credit provisions given the October rise in charge-offs, I believe COF is set to earn $15-16 in 2024. That leaves shares with a less than 8x multiple. As we see credit deterioration moderate around this more normal level, investor confidence in the sustainability of earnings should improve. Combined with the potential for buybacks, I see that momentum lifting shares towards $150, or 10x earnings. I would continue to stay long Capital One, even after this impressive run.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.