Summary:

- Capital One Financial is a strong contender in the banking sector due to its size, market position, and strategic focus.

- The company’s focus on high-risk, high-reward credit card business translates to superior profitability.

- COF generates the majority of its income from credit card loans, leveraging its underwriting expertise and direct-to-consumer marketing approach for above-average returns.

Heather Shimmin/iStock Editorial via Getty Images

Investment Thesis

Capital One Financial (NYSE:COF) is a prominent financial institution renowned for its significant focus on credit card issuance. Embracing the digital era, the company has strategically streamlined its front and back office operations, boosting efficiency and effectively managing costs. This approach is integral to its direct-to-consumer mode and one of the reasons it surpasses industry peers in consumer satisfaction surveys. Earlier in May, COF hired ex-Amazon (AMZN) executive Prem Natarajan as its Chief Scientific Officer to lead its AI and digital transformation efforts. In 2020, COF became the first bank to operate entirely in the cloud. My experience applying for a credit card was exceptionally smooth, entirely digital, and remarkably quick, reflecting a highly efficient and streamlined digital process. As a customer in the UK, I am impressed by the company’s strong presence in the UK’s online advertising space. Their marketing campaigns, highlighting their return to the UK market, not only demonstrate their commitment to the region but also signal a significant growth opportunity in international markets. COF started scaling back its UK operations a decade ago after the Great Recession.

With a rich history in the consumer finance market, COF has accumulated a vast amount of data, allowing for the effective segmentation of its customer base. This data-centric strategy is key to developing sophisticated statistical models that enhance risk management. The company has honed its underwriting process by adjusting interest rates in line with expected delinquencies and charge-offs within specific customer segments, allowing it to generate attractive risk-adjusted returns for shareholders.

As the fourth-largest credit card issuer, COF is one of the most regulated financial institutions in the US. The level of regulatory compliance since the Dodd-Frank Act not only bolsters the company’s safety profile but also enhances its attractiveness as a viable investment option.

Recent Trends

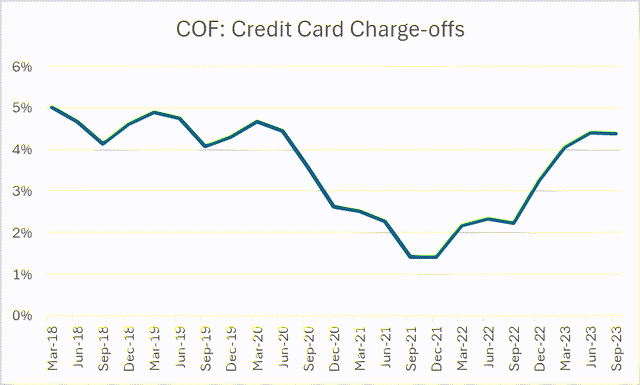

In Q3 2023, COF’s credit card charge-off rates, the percentage of balances recognized as losses due to prolonged non-payment, nearly doubled to 4.4%, a significant rise from 2.25% in the same period last year. This spike has raised criticism. However, a 4.4% charge-off rate is actually within COF’s typical range. The lower rates in 2021-2022 were outliers, largely due to fiscal stimulus and government handouts, which temporarily distorted the averages. Now, as these rates return to their standard levels, these figures are not particularly alarming, as shown in the chart below.

COF, Graph Created by the Author

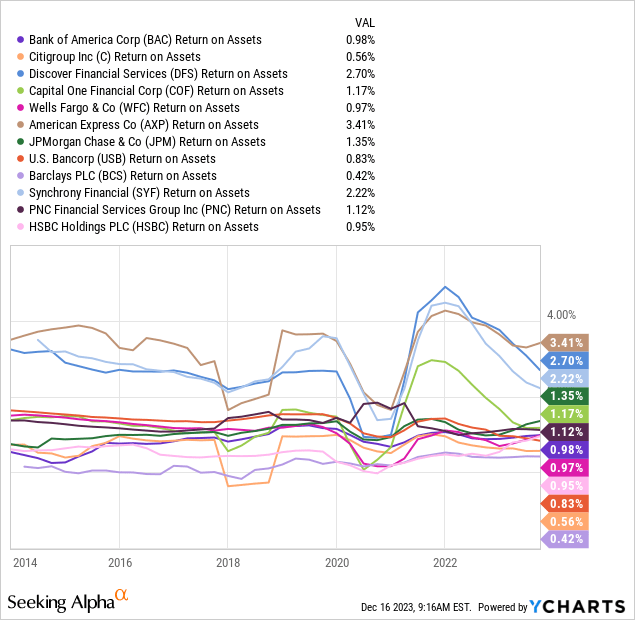

Although COF’s charge-off rates are higher than the industry average in absolute terms, this is counterbalanced by their above-average interest rates. Additionally, the company’s return on assets consistently ranks above the industry average, ranking 5th among the 12 top US credit card issuers.

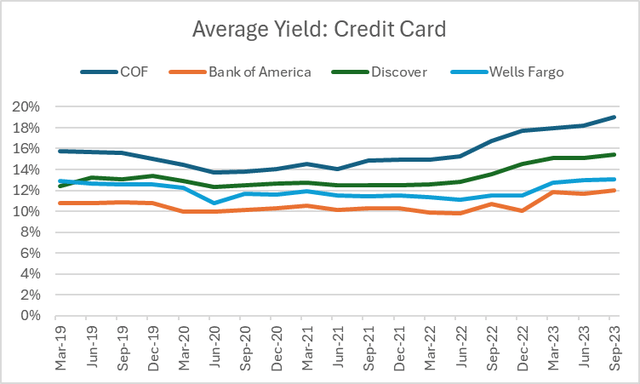

COF’s high interest spreads position them well to compete for funds, especially in a high-interest rate environment. This strategic advantage has helped COF secure one of the best customer satisfaction surveys in the banking sector. Additionally, the responsive fiscal and monetary policies of the US government and the Federal Reserve since the turn of the century provide significant support to the finance industry at times of challenges. This support particularly benefits those at the lower end of the credit score spectrum, who form a major part of COF’s credit card customer base, its primary source of income.

SEC Filings. Graph created by the author.

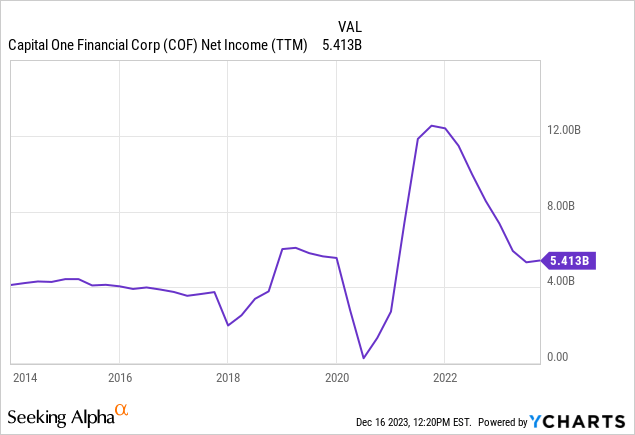

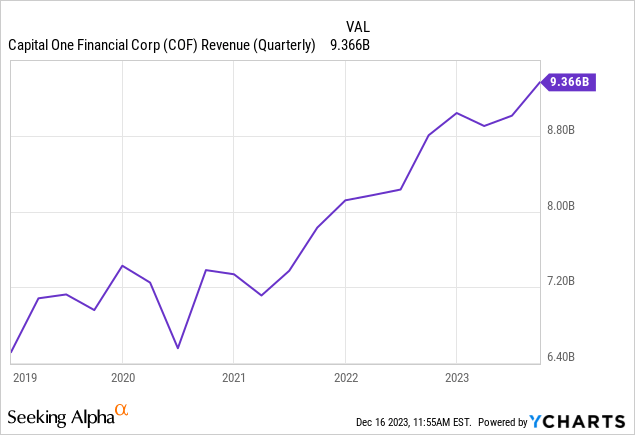

Profitability and Growth

The sales and earnings of companies such as COF are subject to a variety of factors. It’s important to understand that expecting linear progress in this sector is unrealistic. In recent months, higher charge-offs and allowance for bad debt squeezed net income margins. The increased cost of funds didn’t help either. Net income has been decreasing in recent months, returning to its 2019 levels, but this should not be a cause of concern, as it is impacted by increased competition for funds, normalization of charge-offs, and prudent management that is increasing the provision for credit losses. All these factors have resulted in a squeeze in net income margins despite rising revenue. Again, we see an attractive risk/reward opportunity despite these dynamics.

We’re optimistic about COF’s growth prospects in the long run. This optimism is based on their success in attracting deposits and expanding loans while maintaining high customer satisfaction surveys, demonstrating that their financial products resonate well with the public. One can’t ignore the seamless, digitalized customer service operations contributing to long-term growth. Their newly-updated mobile app has 4.6 stars on Google Store based on 1.5 million reviews, more than Ally Financial’s (ALLY) 3.1 stars, SoFi’s (SOFI) 4 stars, Chase Mobile’s (JPM) 4.4 stars, and comparable to Discover (DFS) 4.6 stars.

Strategically, COF has a competitive edge over Category 1 or ‘too-large-to-fail’ banking institutions in the current environment thanks to its focus on high-yield credits, allowing it to compete more for deposits and enhancing our confidence in its ability to maintain its revenue and deposit expansion momentum.

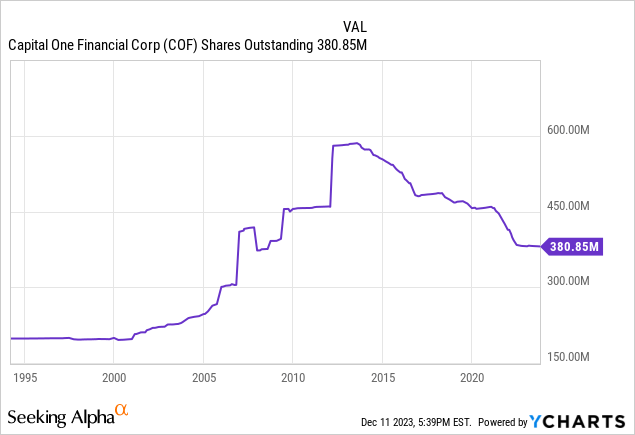

Share Buybacks and Dividends

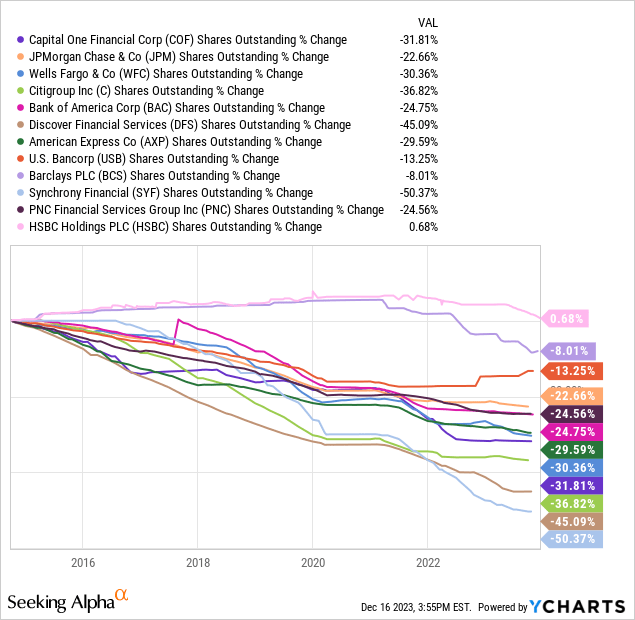

Back in 2012, when Capital One strategically took over the credit card arm of ING Groep (ING), a move required by European regulators bailing out the Dutch financial giant, COF’s management committed to returning capital to shareholders when pitching the deal to shareholders. They followed through with their promise, and it was impactful, leading to a 33% decline in COF’s shares over the following decade. This speaks volumes about their management, run by COF’s co-founder and CEO, Richard Fairbank, and the commitment to shareholder returns.

Looking at the chart above, it is evident that they have been savvy in executing their buyback strategy, always keeping an eye on maintaining a comfortable capital cushion above regulatory capital needs more than anything else while returning excess cash to shareholders. This is a critical balance, and not many get it right, with most either running mediocre share buyback programs such as U.S. Bancorp (USB) or being chased by regulators for inadequate capital like Credit Suisse (CS). COF, on the other hand, has an incredible focus on returning capital to shareholders while maintaining a pretty strong balance sheet.

Last year, with all the disruptions with the Fed’s rapid ramp of interest rates, COF, as expected, hit the pause button on their buybacks. It was a measured move, reflecting their cautious stance amid those unpredictable economic times. But now, with things looking more stable and monetary policy returning to normal mode, COF will likely reaccelerate its buyback program. It would be in line with their longstanding approach of returning capital to shareholders during economic stability.

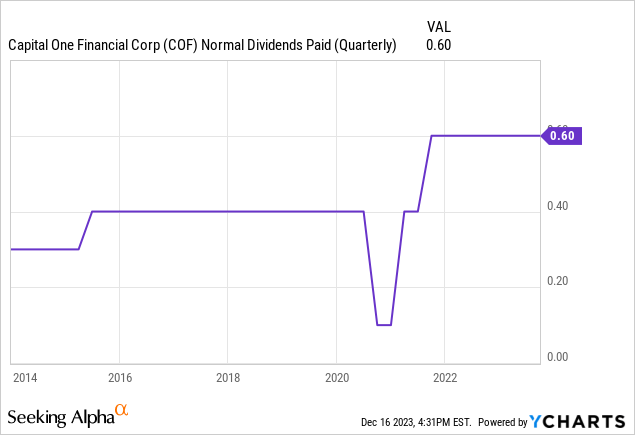

Building on that point, COF has been consistent with their dividends, adopting a predictable distribution model, with gradual strategic growth only intermitted during emergencies and high risk, including most recent uncertainties related to the pandemic. The company keeps the payout ratio modest, which really aligns with its aim to keep dividends stable, given the cushion that absorbs the ups and downs in a cyclical sector.

Valuation Risk

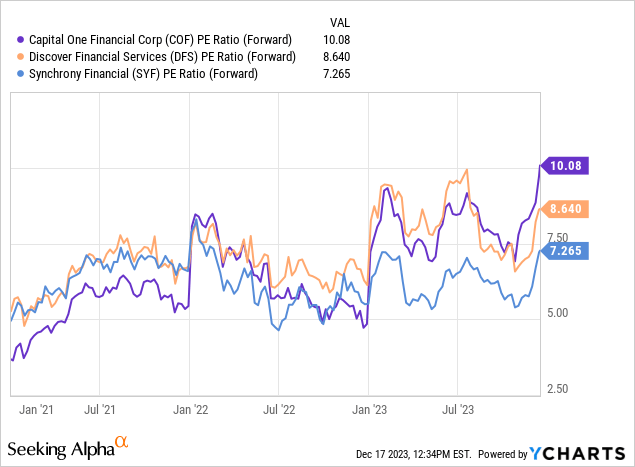

Our bullish outlook on COF is partly based on its current 10x Forward PE ratio, which is appealing in absolute terms. However, considering COF’s 40% share price increase this year, the company appears fully valued relative to its historical trading range. It’s important to note the presence of other attractive opportunities in the finance sector, which investors have recently overlooked. For context, Discover Financial and Synchrony (SYF) are trading at 8.6x and 7.3x forward PE, respectively. While my analysis often leans towards absolute PE ratios, the comparative discrepancy here is noteworthy.

Summary

COF stands out for its proven ability to navigate economic challenges while maintaining profitability. One example is their effective response to the recent rise in credit card charge-off rates and strategic management of high-interest credit products. Despite market fluctuations, their success in consistently increasing deposit and loan balances exemplifies their resilience. As economic conditions normalize, COF’s well-calibrated strategies in digital banking, risk management, and shareholder value creation position it favorably for future growth. This makes COF a strong candidate for investors seeking exposure to the credit card and consumer finance business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.