Summary:

- Capital One gets its prior hold rating reaffirmed, as uncertainty and potential legal challenges facing its buyout of Discover Financial continue looming.

- The bank has growth indicators in its card segments, but an uncompetitive profit margin vs peers.

- Indicators of continued consumer demand and spending should support this bank going into 2025.

- The dividend yield and growth are not competitive vs peers.

- Beyond the merger risk, some other risks to consider are Fed decisions impacting interest rates, and rising trends in credit loss allowances.

hapabapa/iStock Editorial via Getty Images

Portfolio Sector: Financials

Today’s article is part of my new ongoing series on Seeking Alpha called The Whole Investor: Growing a Future-Minded Portfolio.

With a strategy of portfolio diversification, today’s article focuses on the banking sector in the US, covering Capital One Financial (NYSE:COF).

Pixabay

The Thesis

My thesis argues that this stock is a hold, which is a reaffirmation of my last rating of this stock in January when I called it a hold.

The positive factors contributing to this rating are the potential acquisition of peer Discover Financial that could expand the overall business greatly, growth indicators in the credit card portfolio and improving interest margin, positive EPS growth estimates from the analyst consensus, a positive trend of intentional consumer spending growth, and a low debt-to-equity ratio for the overall firm.

At the same time, offsetting factors pulling down the rating include pending merger uncertainty due to legal challenges especially from US states, a share price at a 10-year high and well above 200-day SMA while the valuation picture is mixed, a YoY decline in consumer and commercial loan growth, a profit margin not competitive vs peers and the sector average, a dividend growth and yield that is unimpressive, and not enough diversification beyond consumer banking and credit products.

Compared to today’s rating consensus on the stock’s page, I’m essentially agreeing with the SA analyst consensus of hold, while less bullish than Wall Street and the SA quant system today.

Stock & Sector Overview

Capital One is listed by Wikipedia as #11 on its list of largest banks in the US.

Financial site Bankrate.com in August 2024 listed this bank as among the major credit card issuers in the US. In fact, the site says that “since the company’s inception, Capital One has grown to have one of the largest credit card portfolios worldwide.”

Beyond credit cards, we know from the firm’s Seeking Alpha profile that it also is into other banking products as well, such as loans, capital markets, and consumer checking products, among other things.

A key piece of news this year is its pending merger with Discover Financial (DFS). From a Nov. 6th article by Yahoo Finance, we know that the merger “is pending approval from the Federal Reserve and the Office of the Comptroller of the Currency.”

The article expects that the new federal government set to take office in January in the US, after this November’s Republican Party victory, will be more friendly to this type of merger completing. According to the article:

Republicans have historically been kinder than Democrats to deals of all kinds, including those that involve banks, and Trump would have authority to appoint a number of banking regulators.

However, in the US the merger can also be challenged legally at the state level, and according to an Oct. 23rd article by Reuters it seems the New York State Attorney General is investing the merger, to see if it violates the “state” antitrust law.

The article goes on to say:

The all-stock merger, announced in February, would create the largest U.S. credit card issuer with more than $250 billion of outstanding loans, surpassing JPMorgan Chase (JPM), and access to more than 305 million cardholders.

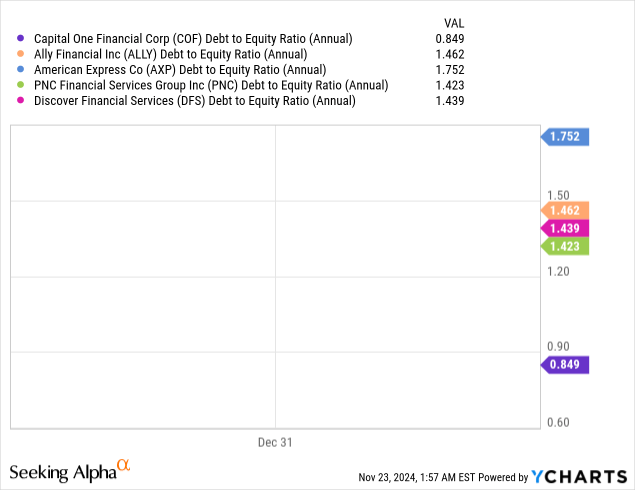

In this case, to pick 4 comparables to use for this article I focused on US-based banks that could be peers and competitors, with strong consumer-driven businesses. These are: American Express (AXP), Discover Financial (DFS), Ally Financial (ALLY), and PNC Financial (PNC).

Price and Valuation

To backtrack for a second to my original coverage of this stock in May 2023, when I said to hold on to this one, it has since gone up nearly +110%. At the time, I was not very bullish on the stock as there was the risk of a recession in 2023 and I saw this bank as too exposed to the consumer segment. The recession never materialized, so in hindsight I may have been overly cautious at the time, as some other analysts were too.

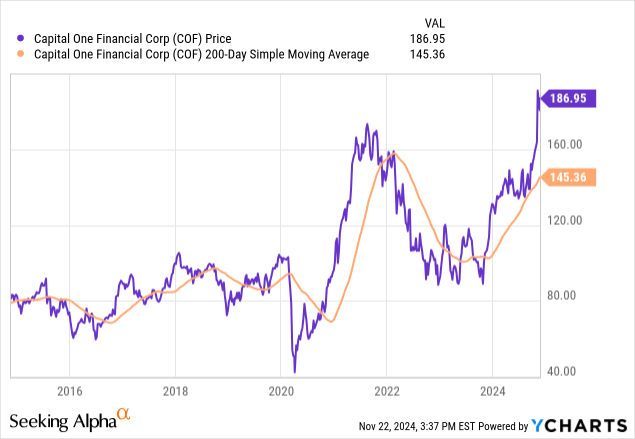

As of Friday afternoon’s trading on the NYSE, the stock is hovering around $187, far above its 200-day SMA and has broken past its 10-year high reached in 2021.

Correlating with this bullish trend, is the fact that the financial services sector has seen a one-year growth of nearly +43% and has been the top one-year performer among all sectors tracked by Seeking Alpha, according to sector data.

This overheated bullishness on both the stock and sector may have some investors questioning how much further upside there could be if buying this stock now.

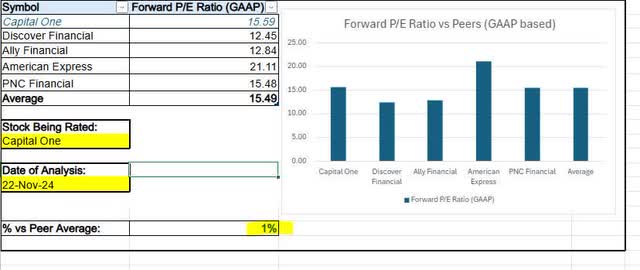

To add some additional data points to this picture, using peer data let’s consider the valuation metric of forward P/E ratio (GAAP-based), which shows Capital One around 1% overvalued to the peer average P/E, which seems like it is in line with the average.

Capital One – P/E vs peers (author worksheet / Seeking Alpha data)

I believe this indicates the market is expecting this stock to have future earnings performance rather in line with several peers.

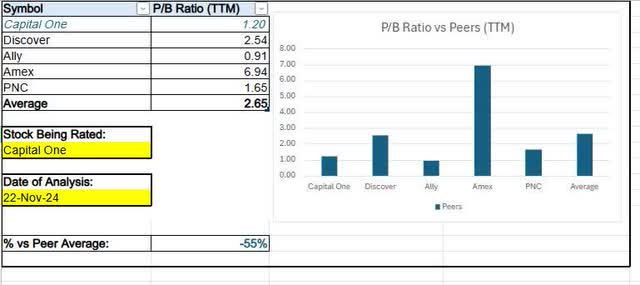

If we take a second valuation metric to have an additional data point to consider, I usually pick the trailing price/book ratio, also using peer data.

Capital One – PB ratio vs peers (author & SA data)

In this situation, I will call it a “mixed” valuation picture, since the stock is in line with peers on forward earnings multiples but quite undervalued to peers on trailing price/book multiples.

With such an elevated share price, and a mixed valuation, it does not present an undervaluation opportunity, but understandably I think the pending Discover merger has likely given a lot of future-minded investors a lot of hope about a much bigger firm emerging.

In addition, according to a Seeking Alpha article in September, Citi gave this bank an upgrade, so I think that added to the bullish tailwind on this stock, which is why it is probably not going to be undervalued right now.

At the same time, one can also argue that a positive merger outlook is already priced in and there is not a lot more up to go right now for the share price. There is also the chance of more state-based challenges to the merger, which could emerge, so that could pose at least some downside risk.

Future Top-Line Revenue Drivers

When I think about this type of business, what comes to mind as drivers of future revenue flows and growth would be things like recent trends indicating growth in loans and credit card customers, since both contribute to future interest income for this bank.

From the firm’s Q3 results that came out on Oct. 24th, I would call out the following notable points:

- Credit card segment: average loans up 7% YoY.

- Domestic card segment: average loans up 7% YoY.

- Consumer banking segment: average loans down 1% YoY.

- Commercial banking segment: average loans down 1% QoQ.

In this case, their card segments have shown growth so they should contribute to future interest income, while the consumer and business loans have not grown but will have to depend on existing customers continuing to pay off their loans and not default.

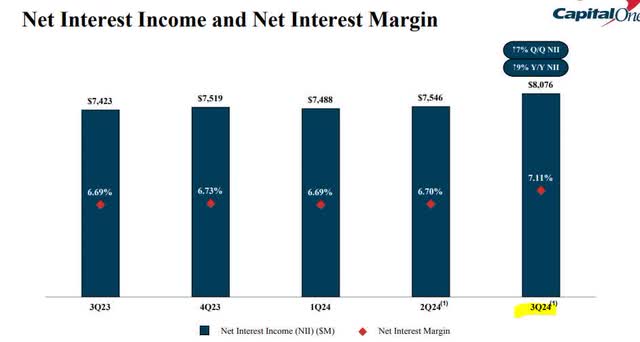

The other point that is worth mentioning, is the impact of interest rates and how they affect net interest margin.

For instance, the chart below from Q3 results shows a relatively steady interest margin for several quarters and then a spike in Q3 to a NIM of 7.11%, which also correlates with higher net interest income /NII.

Capital One – net interest margin (capital one q3 results)

The company attributed the higher margin to “higher asset yields and growth in our credit card loan portfolio, partially offset by higher rates paid on interest-bearing deposits.”

Because interest rates also can be impacted by Fed decisions, that is one future risk to consider since those are decisions outside the control of Capital One.

Future Earnings Drivers

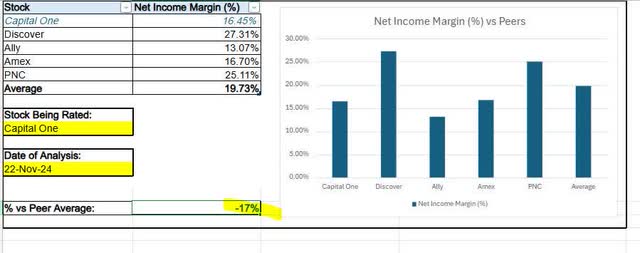

As far as what could help the bottom line going forward, one data point I use often is the profit margin in comparison to peers, to get a sense of how efficient a firm is in turning revenue into profit.

Using peer comparables, I made this sheet which shows Capital One has a profit margin 17% below this peer average.

Capital One – profit margin vs peers (author / SA data)

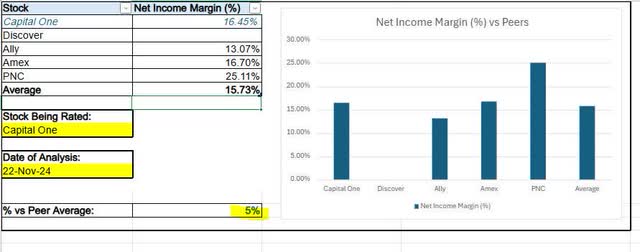

Because Discover seems to be skewing the average in the above chart, and Capital One is pending a merger with them, I took them out and did a 2nd study of this peer group without Discover, and in this case Capital One beats the peer average by 5%.

Capital One – profit margin vs peers – v2 (author worksheet / SA data)

So, being 5% above this peer average is not exactly phenomenal, and considering that Seeking Alpha data shows this firm’s profit margin is nearly 25% below its overall sector (financials).

To help me understand what could be driving costs at this firm, I found from Q3 results that “total non-interest expense increased 7 percent,” and of this rise in costs it seems part of it was an 8% rise in operating expense.

Holistically, it appears that going forward this firm is somewhat less cost-efficient than I would like it to be as an investor, but if the merger goes through it points to the question of will there be massive “synergies” unlocked and a cost-cutting drive throughout the new, combined company.. making it a bigger but leaner machine.

For the short-term, though, the analyst consensus looks positive, with 14 upward revisions and positive EPS YoY growth expected in the next two fiscal years. This positive guidance from other analysts may continue to fuel some more upside to this share price or at least support it, justifying a hold at this time.

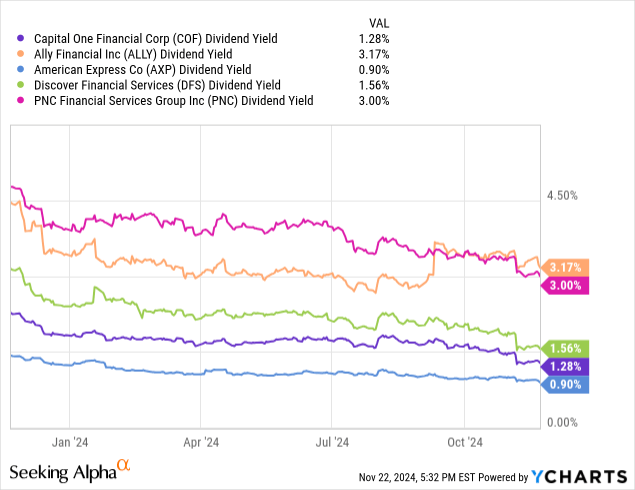

The Dividend Case

Since this stock is a dividend payer, for my readers focused on growing future dividend income flows from this stock I am including this brief discussion on dividends.

First, let’s talk about dividend yield. When comparing this stock’s yield of 1.28% to this peer group, it is on the lower end, so not as attractive to a new buyer as some other stocks have a +3% yield, giving you more return. I think we should also consider that the bullish share price also can bring down the yield.

Besides comparing to just these peers, if compared to the overall sector it’s in, this stock’s dividend yield is far below its sector average, according to yield data from Seeking Alpha.

The stock’s track record of 10-year dividend growth has not been steady, and from history we see they have kept it at $0.60/share for several years now.

We also can see clearly from its income statement that YoY earnings growth has been rather flat, when comparing FY2024 Q3 with the same quarter a year prior, so I don’t expect a dividend hike just yet, and we may not see one soon as I think the firm will attempt to hold on to more cash to gear up for the merger with Discover, and potential legal battles it may have to fight in court.

The other future-think item to consider is when and if the merger does go through finally, Capital One will be the one acquiring Discover in an all-share transaction, so it’s difficult at this point to say what kind of dividends we can expect after that point, from the newly combined company.

The Macro Picture: Consumer Spending

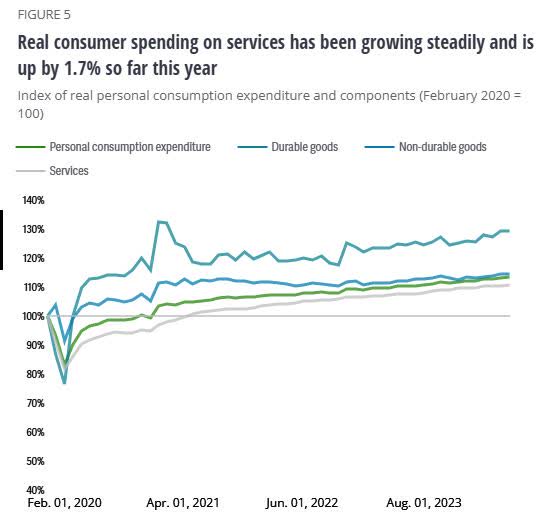

A future-minded factor to consider is what the outlook is for continued strength in consumer spending going forward, as this could continue boosting demand for credit cards as well as balances that have to be paid off, which favors banks like these.

On a positive note, a September research report by Nielsen IQ summed up that heading into 2025 we can expect continued consumer momentum, driven by intention rather than caution.

The global outlook for consumers is improving.

.. consumers will redirect their spending to where it matters most, shifting from cautious to intentional consumption.

In addition, from an October study by Deloitte, the chart below shows that real consumer spending has been on a steady recovery trend upward since the 2020 pandemic era.

Deloitte – growth of consumer spending (Deloitte)

I think these positive indicators should continue to add tailwind to consumer card-driven banks like Capital One, as we head into the holiday spending season and early 2025, after which is the spring and summer travel spending season, another thing I think is good for credit card spending. In fact, CNBC said in late October that “There will be an increased desire for authentic, off-the-beaten-pathexperiences, states the opening line of Booking.com’s 2025 Travel Predictions.”

Financial Risk Profile

Taking a step back to look at the bigger financial picture of this firm, to get a sense of a few risk factors an investor can expect, I want to talk about debt-to-equity, regulatory capital, credit ratings, and allowance for credit losses.

First, we can see from the ychart I created below that Capital One has the lowest debt-to-equity of this peer group, giving it a stronger debt-risk profile I think than several peers.

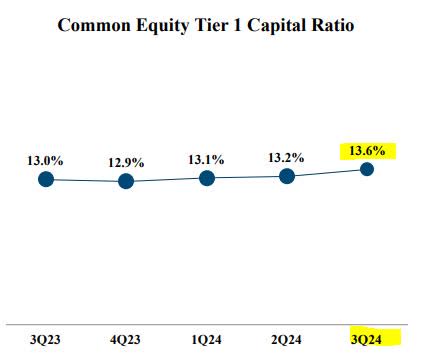

Next, from Q3 results the regulatory capital metric I want to focus on is CET1, and from the chart below we can see this bank’s CET1 has consistently been well above regulatory minimums which is around 6%.

Capital One – regulatory capital (Capital One q3 results)

In addition, notable to mention is that two ratings agencies gave the overall firm “stable” ratings, however as of July it seems Moody’s still has the bank under review for a downgrade, which is concerning as this could create a future downside risk to the share price in the event of a downgrade.

Capital One – credit ratings (capital one website)

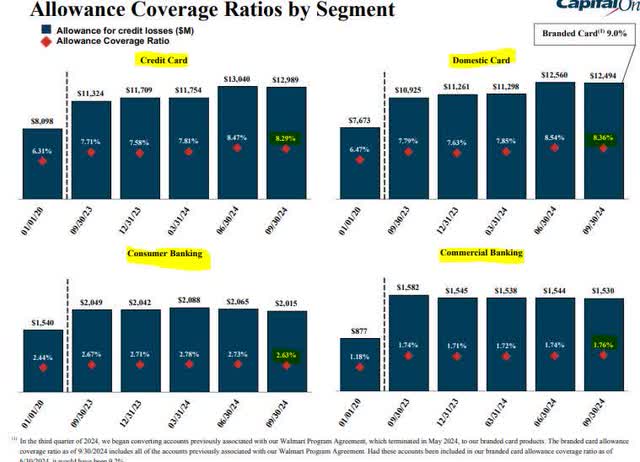

Finally, when it comes to allowance for loan losses (sometimes also called allowance for credit losses), what sticks out is that the allowance ratio is significantly higher among the card segments than the consumer and commercial banking (loans) segments, as seen below, taken from Q3 results.

In particular, the chart shows a steady rise in the allowance ratio for the card businesses. For example, in the credit card segment it went from 6.31% in 2020 to 8.2% in the last quarter.

Capital One – allowance for loan losses (Capital One)

I think that because this bank is such a consumer card-driven business, and does not have as much diversification into some other segments like a fee-driven wealth management business that can compete with a Morgan Stanley (MS) and similar firms, it also exposes this bank more heavily to the downside risk of losses on those card customers who went on a shopping spree and couldn’t pay their card bill later on.

However, Capital One does have a capital markets business for commercial clients, so for the future I would like to see the firm grow this more so as to increase diversification beyond being overly concentrated in cards and consumer lending/banking.

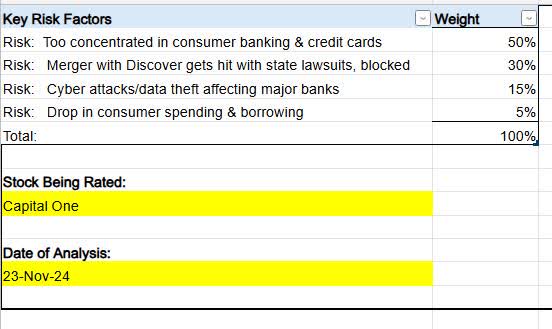

Risk Chart

I picked 4 key risks I think investors should think about when it comes to this stock, and gave them a different weight, giving the greatest weight to the risk that the bank is overly concentrated in consumer banking and cards.

Risk table (author)

Here is a visualization of the above risk table.

Risk chart – visualization (author)

As you can see, the lowest risk posed to this bank right now seems to be a drop in consumer spending in borrowing, since the indicators I presented point to continued consumer demand.

Conclusion

In summary, I remain in the middle on this stock.

The growth indicators in the card segment, strong consumer spending, and an overall firm with strong regulatory capital and stable credit ratings should provide support to the share price, along with confident investors expecting the Discover merger to go through.

However, buying right now at a 10-year high and mixed valuation does not make sense, particularly with such a low dividend yield, risk that the Discover merger will face lawsuits in the US states, and an uncompetitive profit margin in relation to peers.

I also would not call for selling it just yet either, since the Discover buyout going through could mean owning a piece of one of the leading financial firms in the consumer segment.

In conclusion, I welcome your reader commentary on any of the topics in this article, particularly the risks you see with the pending merger. Do you think it will occur or not, and why?

Albert Anthony

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.