Summary:

- I maintain a bullish rating on Capital One due to decelerating consumer loan delinquency rates and improved macroeconomic conditions.

- The Federal Reserve’s aggressive rate cuts could create an additional tailwind.

- Despite a temporary spike in provisions for credit losses due to Walmart program termination, COF’s loan delinquency trends show quarter-over-quarter improvement.

- Capital One’s organic growth is evident with a 5% increase in credit card purchase volume and improved revenue margins, supported by healthier customer credit profiles.

Heather Shimmin

Introduction

I had a bullish opinion on Capital One (NYSE:COF) in my previous article. At the time, I argued that the company had over 30% growth potential in the coming years. The main thesis driving the buy rating was the declining consumer loan delinquency rate growth, which could lead to lower provisions for credit losses and a potential release of the allowance for credit losses. Since this publication, the company’s stock has appreciated by about 8% while the bullish thesis solidified. Not only did the consumer loan delinquency rate growth continue to decelerate, but the underlying macroeconomic conditions have continued to signal a strong consumer, suggesting that this trend could be persistent. Further, Capital One’s organic growth showed strength. Therefore, I believe my bullish thesis still stands, leading to a buy rating.

Macroeconomic Argument Solidifies

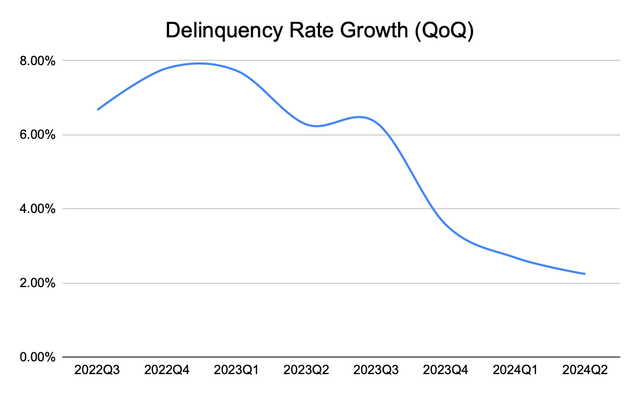

Since the publication of my previous article, the macroeconomic conditions have improved. As the chart below shows, the consumer loan delinquency rate growth slowed from 2.68% to 2.24% quarter-over-quarter. Based on this data, it is evident that the consumer loan delinquency rate will be reaching its peak in the near future. The current trend of slower delinquency rate growth slowing has been ongoing since 2022 with no clear signs of a reversal. As such, I believe it is reasonable to argue that Capital One will start to see a positive impact from the current trends as the growth plateaus, and a potential reversal or even stabilization is on the horizon.

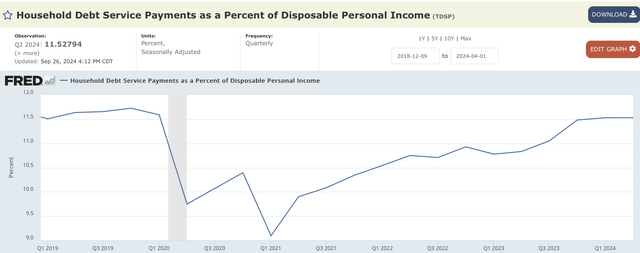

Beyond the clear direction of the chart supporting the argument that the current trend will persist, the underlying strength of the consumer further supports this claim, which has not shown signs of deterioration since the previous article. As the chart below shows, the household’s debt payment as a percent of their income has not only plateaued since 2023Q4, but the current level of debt payment is near the levels that were administered before the pandemic times.

Finally, in September, the Federal Reserve announced a 50 basis point federal funds rate cut. The aggressive cuts with an expectation for an additional 50 basis points, as shown in the dot plots, suggest that the macroeconomic conditions will further strengthen, creating a stronger tailwind for Capital One. Consumers will likely have an easier time paying down their debt, while the lower interest burden on existing or new loans could boost their discretionary income. Therefore, the macroeconomic conditions have strengthened; delinquency rate growth has slowed while the consumers’ financial health remains resilient.

Impact on Capital One

I thoroughly discussed the financial impact Capital One will see as a result of a lower allowance coverage ratio, potentially pushing the bottom-line growth by about 37% in my previous article. For this information, please refer back to here.

I have been arguing that the lower consumer loan delinquency rates could allow Capital One to realize lower provisions for credit losses. Yet, despite the consumer loan growth rates slowing, Capital One’s provision for credit losses sharply increased in 2024Q2. The company reported a provision for credit losses of $2.259 billion in 2024Q1 before reporting a provision for credit loss of $3.545 billion. The sharp increase came even as the net charge-off remained stagnant quarter-over-quarter, from $2.574 billion to $2.686 billion. On the surface, this may suggest that the company is negatively viewing the economic condition and expecting a meaningful spike in the upcoming delinquency rates; however, this is not the case. Capital One has announced an $826 million impact from Walmart (WMT) program termination, which is responsible for the majority of the increase in the provisions for credit losses. Thus, I do not believe 2024Q2 data fully reflects the direction in which Capital One is heading, as it is likely transient.

Capital One’s loan delinquency trends support this further argument. In 2024Q2, the company’s 30+ days delinquent loan rate stood at 4.14 compared to the 2024Q1 rate of 4.48, showing a clear quarter-over-quarter improvement. Therefore, as both the overall market of consumer loan delinquencies and Capital One’s credit card delinquency are improving, I believe it is reasonable to argue that the 2024Q2 jump in provisions for credit losses is temporary.

Overall, the market is continuing to show a favorable improvement. The growth of loan delinquencies is continuing to slow, while Capital One is seeing a positive effect.

Organic Growth Strength

Beyond the current argument revolving around the conditions of the consumer loan delinquency rates and the resulting costs, Capital One’s growth in loan growth, especially credit cards, provide a clearer indication of the health of the company.

In 2024Q2, Capital One’s credit card business saw a 5% increase in total purchase volume year-over-year. The growth likely means that the existing consumers increased their spending on Capital One cards beyond the inflation rate of about 2.5% while new customers were introduced into Capital One’s network. Further, even as the growth in the business was achieved, the net revenue margin showed a slight increase from 17.95% in 2023Q2 to 18.03% in 2024Q2. The increase comes while the provisions for credit losses dramatically increased in the second quarter. Thus, the company was successful in balancing the loan growth and the increase in delinquency. Finally, the underlying customer credit base became healthier. According to the 10-Q data, the share of domestic card customers with a FICO score of 660 or above increased by 100 basis points to 69% year over year. Therefore, considering the increase in the purchase volume, improvement in the revenue margin, and strengthening underlying customer credit health, I believe it is reasonable to argue that Capital One’s organic growth is strong and has the potential to complement the macroeconomic tailwind.

Risk to Thesis

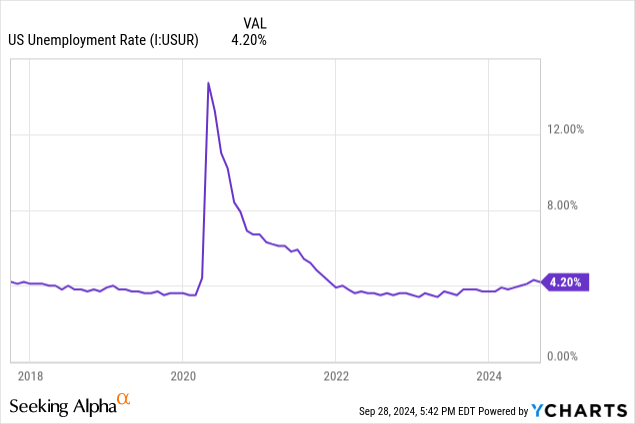

Largely, the bullish thesis revolves around the potential macroeconomic tailwind that may be emerging as a result of the declining consumer loan delinquency rate growth. However, if the economic conditions worsen, pushing the delinquency rates to move higher, the bullish thesis could become obsolete. Throughout 2024, the unemployment rate, as the chart below shows, has shown a sharp increase, and the weakening labor market could potentially impact consumer credit health posing a risk to my bullish thesis.

Summary

There is much to like about Capital One. Consumer loan delinquency rate growth is slowing, which has the potential to positively affect the company’s delinquency rates positively for the foreseeable future, allowing Capital One to reduce its coverage ratio. Further, Capital One’s organic growth in its credit card business is showing strength in both top and bottom-line numbers, suggesting that the favorable macroeconomic conditions are not the only bullish factor supporting the company. Therefore, I continue to believe Capital One is a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.