Summary:

- Capital One Financial has seen a strong upward revaluation of its shares in the past three months, but now has limited upside, in my opinion.

- The bank has benefited from favorable deposit momentum in the first quarter which defied broader industry trends. Capital One Financial also has a high insured deposit share of 78%.

- I am downgrading Capital One Financial from strong buy to hold, as other regional banks offer stronger total return potential and materially higher dividend yields.

Heather Shimmin

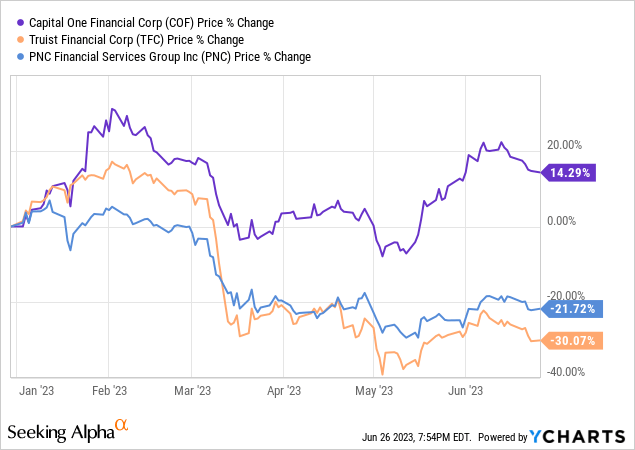

I recommended Capital One Financial (NYSE:COF) as a speculative buy at the end of March in my work: Buy The Bank Panic. While I still like the bank’s strong liquidity coverage ratio and the fact that Capital One Financial has seen a $17B quarter over quarter gain in deposits, contradicting broader industry trends, shares of Capital One Financial have seen a sharp upward revaluation since my last publication. I have now sold COF to take advantage of deeper value opportunities like Truist Financial (TFC) and PNC Financial (PNC) and I am downgrading Capital One Financial from strong buy to hold!

Deposit strength has resulted in significant price appreciation, limiting future upside potential

Capital One Financial has seen a significant drop in its valuation in the aftermath of the financial crisis in the first-quarter, but shares have out-performed my expectations in just three months: COF today is trading at about the same valuation as it did before the crisis.

When I first worked on Capital One Financial, I pointed to the regional bank’s strong liquidity coverage ratio of about 143% as well the low probability that the Fed would let a major bank fail and thereby drag the entire financial sector into the abyss as key reasons to buy COF. Since my last publication, the bank’s liquidity coverage ratio improved another 5 PP quarter over quarter in Q1’23, so Capital One Financial really has a very comfortable liquidity profile.

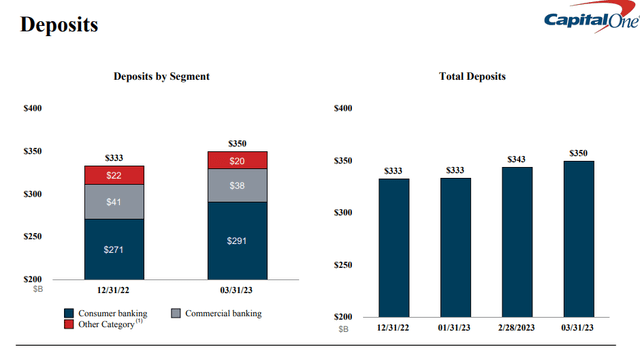

Capital One Financial further disclosed massive inflows of deposits in the first-quarter, an indication that investors see the financial institution as a safe place for their money. Deposits rose from $333B at the end of FY 2022 to $350B at the end of the first-quarter, showing an increase of $17B (+5% Q/Q). By reporting a growing deposit base, Capital One Financial defied the broader industry trend of declining deposit balances in the regional banking market.

Growth in deposits was chiefly due to Capital One Financial’s consumer banking segment which attracted $20.6B in new deposits just in the first-quarter. On the other side, commercial bank deposits declined $2.4B quarter over quarter.

At the end of Q1’23, Capital One Financial carried $273.4B in insured deposits on its balance sheet which calculated to an insured share of 78%. Other regional banks such as Truist Financial and PNC Financial had insured deposit shares of 57% and 55%.

Commercial office exposure is not a serious risk factor (in my opinion)

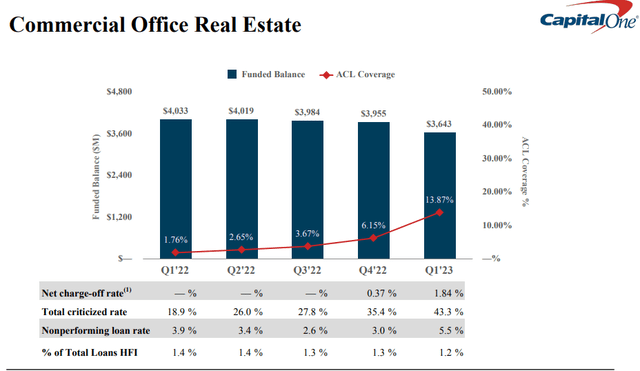

Higher interest rates have led to plunging valuations for U.S. office real estate in recent quarters which has made banks’ commercial real estate exposure an area of interest for investors. However, as shown below, Capital One Financial has very limited exposure to the office real estate sector: commercial office real estate accounted for just 1.2% of the bank’s total loans that are classified as held-for-investment at the end of Q1’23. Although the bank’s net charge-off ratio has risen from 0.37% in Q4’22 to 1.84% in Q1’23, the bank’s overall exposure to office real estate is very small in relation to the bank’s total loan book.

I am taking profits, here’s why

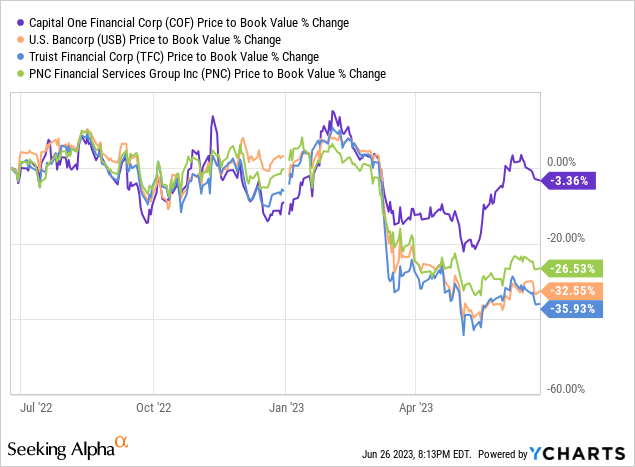

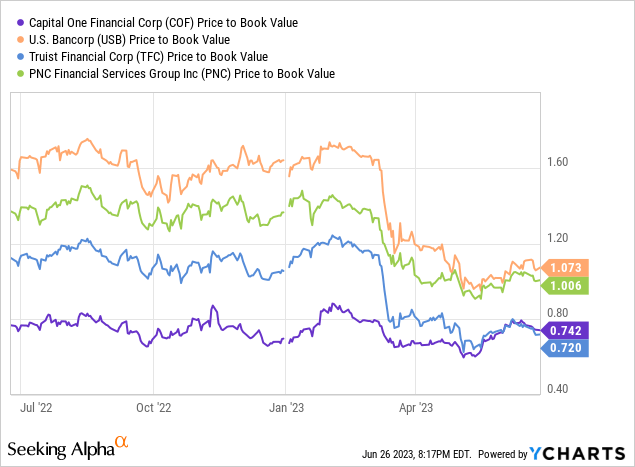

Capital One Financial has seen strong share price revaluation to the upside in the last three months and the bank is now trading at about the same price it traded at before the financial crisis. In other words, while Capital One Financial is still trading at a 26% discount to book value, the bank has already recovered almost all of its losses sustained during the March regional bank meltdown.

Other regional banks, namely Truist Financial, PNC Financial and U.S. Bancorp (USB) continue to trade well below their pre-crisis price-to-book ratios…

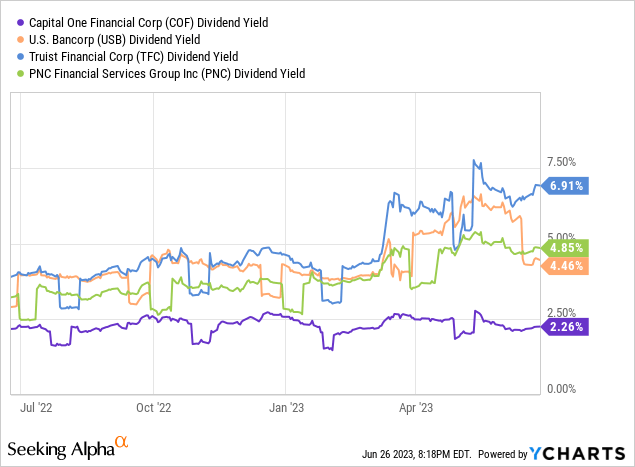

In my opinion, U.S. Bancorp, Truist Financial and PNC Financial offer investors not only stronger recovery potential regarding price growth, but also much higher yields. Truist Financial especially is an interesting choice for dividend investors, in my view, with a current yield of almost 7%.

Risks with Capital One Financial

The main risk that I see with Capital One Financial is the bank’s significant credit card business which is deeply cyclical and reliant on healthy consumer spending. A deterioration of Capital One Financial’s credit quality would obviously be a major issue for the bank and its investors. Although I am confident that the regional banking crisis is mostly resolved, there is also a risk of new bank failures which could impact Capital One Financial’s deposit business.

Closing thoughts

While I still like Capital One Financial, I believe that the strong price appreciation that has taken place in the last 3 months makes the regional bank about fairly valued, chiefly because Capital One Financial has returned to its pre-crisis valuation, and I sold my shares last week.

Since COF has returned to its pre-crisis valuation, I believe there is little upside left on the table for investors to take advantage of. The bank’s yield has also dropped to just 2.3% while other regional banks like U.S. Bancorp, Truist Financial and PNC Financial all offer yields of 4.5% or higher. Given the, in my opinion, limited total return potential after a strong increase in the bank’s share price, I am downgrading my recommendation from strong buy to hold as well!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of USB, FITB, PACW, WAL, CMA, KEY, MTB, TFC, PNC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.