Summary:

- Warren Buffett and Michael Burry both loaded up on Capital One stock in Q1. What were they thinking? We dig in.

- Credit cards are a better business than you think. Capital One made money every year through the 2008 crisis/recession and is poised to easily do the same going forward.

- When you charge 18-20% to credit card customers and pay 2-3% on deposits, making a profit isn’t rocket science.

- Differences in COF’s business model compared to competitors are overstating COF’s charge-off rate.

wdstock

What’s In Your Wallet?

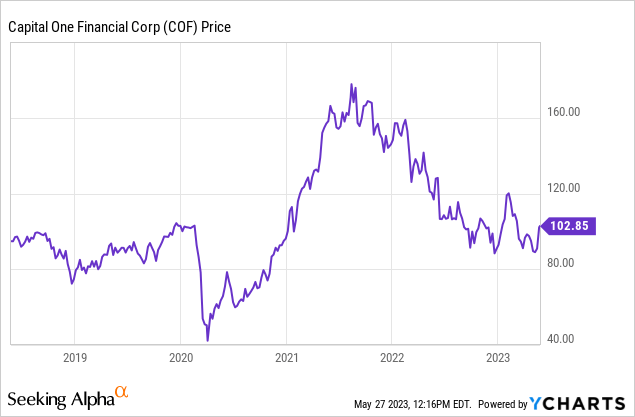

Recent 13-F filings show that Warren Buffett and Michael Burry both added shares in Capital One (NYSE:COF) to their portfolios in Q1. Berkshire Hathaway (BRK.B) (BRK.A) seems to have pumped about a billion dollars into Capital One, while Burry put in $7 million of his fund into COF stock as well, accounting for roughly 3% of his total assets under management. Dr. Burry is a value investor who got rich from his participation in The Big Short of the 2000s housing bubble, while Buffett is the king of buy-and-hold value investing. They both seem to love Capital One. But with the stock well off of 2021 highs, what are they seeing?

Credit Cards Are a Heck of a Business Model

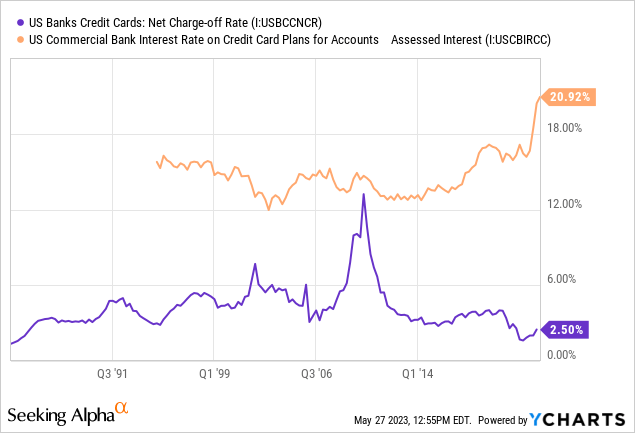

Capital One makes its money primarily from credit card lending. With average interest rates on credit cards at or near record highs, that means Capital One can rake in the profits– if they can collect on their credit card loans at any reasonable rate. With the Fed now poised to hike interest rates even more, the company is set to see its interest income increase further. When you dig into the business model, it’s not rocket science why it might be worth the risk to buy some Capital One shares.

If you flip to page 11 on their 10-Q, you’ll see that they’re charging 18% on credit cards and paying 2.4% on deposits. Doing that, it’s hard not to make money as more than 15% of credit card loans will have to be charged off before the company starts to show a loss. The highest this ever got in the 2008 recession for COF was about 10%. Capital One made an operating profit every year during the Great Recession. Then and now, they also have some car loans and some commercial loans, but credit cards are where most of the money is made. The company’s Q1 earnings disappointed investors, but the stock has mainly sold off this year based on a broader financial-industry selloff that doesn’t have much effect on its core business. And the core business, while likely to see a downturn with any softening in the economy, is not as risky as the market thinks it is. Some interesting tidbits from their most recent quarterly conference call include the company’s conservative default assumptions and credit loss provisioning, its 12.5% common equity tier-one capital ratio, and the having two fewer days in the company’s latest quarterly results than the year before. Additionally, Capital One’s current credit loss provisions are modeled on U.S. unemployment rising above 5%, this is likely not true for all banks!

Credit card lending is perceived as a risky business. But decades of data show that it’s actually safer than mortgage and business lending, and it’s not even close. Here, we see credit card charge-offs over the past 40 years, and we can readily compare them to the interest rates that banks are currently charging– around 20%.

Wild, right? Even in the depths of the 2008-2009 recession, credit card companies still made money. Supposedly safe mortgage lending to “prime” borrowers sunk many banks, on the other hand. And this “risky” lending makes it so that COF doesn’t really have to fear the economic cycle as much, simply because they’re making so much in interest. This business model is likely what Buffett and Burry are seeing in Capital One, despite investor fears over the banking system at large.

Credit card companies also have some tools to collect from borrowers that are not widely recognized by analysts, such as garnishing wages (in states that allow it). Most people don’t know this, but nobody sues more delinquent borrowers than Capital One. Most big banks sell their loans to debt collection companies for pennies on the dollar. Capital One tends to work on them in-house, meaning that they collect the money from borrowers over time rather than selling the sour loans off to debt collection companies. This causes their charge-offs to artificially appear to be higher than other banks at the top of the credit cycle (i.e. now). COF will collect from borrowers over time and will collect more money than banks that sell loans to third parties for quick cash. However, most financial analysts and quantitative investors that simply use the company’s charge-off rates in their models won’t pick up this nuance. This is also why Capital One’s auto loans don’t particularly scare me off owning the stock, the company has a huge infrastructure in place to chase down delinquent borrowers, and in the case of the auto loans they have physical collateral as well.

COF Stock Is Dirt Cheap

Capital One made about $14.58 in EPS in 2022, and analysts expect the company to pull in about $12.07 for this year and about $14.27 in 2024. Before the pandemic, the company was making about $11.

COF stock trades for about $103 as of my writing this, good for a PE ratio of about 8.5x. Even if the business doesn’t grow at all, you could expect roughly a 12% annual return off of the earnings yield. That’s dirt cheap, given that the company’s lending profile is not like other banks that can easily show losses in a recession. Capital One should still be able to profit nicely in a moderate recession, and even in a 2008-like scenario, its operating profit should still be positive. This is due to the nature of the company’s credit exposure which tends to bend but not break. COF yields about 2.3%, which is a nice kicker but likely not the reason that most people choose to buy the stock. Why is Capital One so cheap? I admit that I’m a bit puzzled. All of the major banks are trading at low valuations at the moment, but Capital One fundamentally has an even more profitable business model in credit card lending. While I think stocks like Bank of America (BAC), Truist (TFC), JPMorgan Chase (JPM), and Morgan Stanley (MS) are all good buys, Capital One is among the best. This gets down to the misperception that credit card lending is a high-risk business when it in fact isn’t. And these kinds of misperceptions are incredibly useful for value investors.

Bottom Line

Much of the selling in bank stocks is being driven by ETFs and mutual fund managers with a desire to swap boring, dangerous-looking banks for sexy tech stocks. Warren Buffett and Michael Burry might be looking to teach the market a lesson here, and you can too. Relatively few investors seem to understand how good COF’s business model is! Capital One common stock is a buy, and the preferreds (NYSE:COF.PJ), (NYSE:COF.PI) are worth a look too, yielding about 6.5% on a bank that is highly unlikely to lose money even in a repeat of the 2008 recession.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COF, MS, TFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.