Summary:

- Capital One’s proposed acquisition of Discover Financial currently offers a 15.2% merger arbitrage premium (plus dividends) in DFS shares for investors willing to wait for the deal to close.

- Merger arbitrage allows investors to profit from the price difference between the announcement of a deal and its closing.

- With higher rates and a healthy amount of M&A activity, some solid merger arb opportunities currently exist in the market for investors willing to bear antitrust risk.

- High-profile investors like Warren Buffett have quietly practiced merger arbitrage for decades.

Joe Raedle/Getty Images News

“Give a man a fish and you feed him for a day. Teach him how to arbitrage and you feed him forever.”

-Warren Buffett, 1988 annual letter to shareholders.

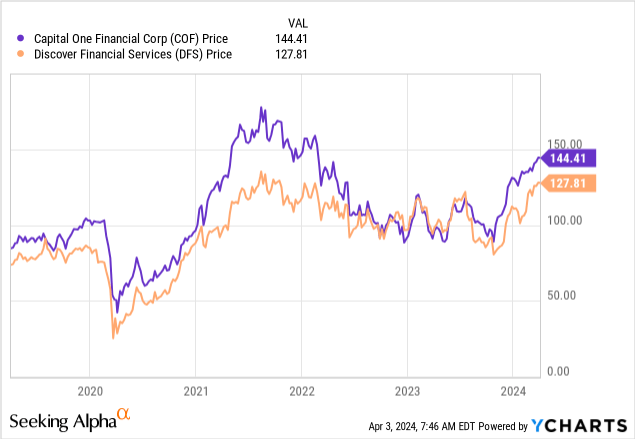

Capital One (NYSE:COF) made headlines this year after announcing a ~$35 billion acquisition of Discover Financial (NYSE:DFS). So far, the proposed merger is the largest of 2024 and the deal immediately made waves in the financial media. Capital One is set to acquire Discover in an all-stock deal for 1.0192 COF shares per DFS share. As such, the deal values DFS at about $147, or a 15.2% premium. Throw in three to four quarters of dividends between now and the deal’s closing, and those willing to buy DFS at today’s prices stand to earn an expected return of roughly 17% in 9-12 months.

Merger Arbitrage 101

The trade belongs to a style of investments known as “merger arbitrage.” When a company decides to acquire another company, it announces a deal price. However, deals take time to close, and there’s always some risk involved that the deal doesn’t go through. This is where patient investors can step in and buy stock in the company being acquired, collecting a nice profit when the deal goes through.

When interest rates are higher, merger spreads tend to be larger to compensate for the time value of money. This means you can make more money. By itself, this isn’t a groundbreaking revelation. To this point, the 0% interest rates in the 2010s caused niche strategies like merger arbitrage to be flooded with capital. With interest rates now being much higher, opportunities are starting to pop up again. Less competition equals more profit.

A key advantage of merger arbitrage is that the future price of the deal is known. This means you can track the merger spreads with software or by hand to see what kind of compensation you’re being offered at any given price and decide to invest or not invest. When investors get impatient, you can step in and earn larger a deal spread. Another nifty bonus on merger arbitrage is that the strategy can have tax advantages, at least in the US. Dividends you earn in the target company are subject to a lower tax rate than ordinary income would be, and you often can benefit from long-term capital gains taxation as well (this is easy to do in all-stock deals, as well as in cash deals that drag out longer than 12 months).

Of course, it’s up to you to determine whether moves in the target company’s stock are noise or a signal that the deal won’t close. From my experience, they’re mostly noise as long as the deal isn’t hostile. There has been loads of academic research over the years on identifying deals likely to close and avoiding deals that won’t close. Some of it relies on simple rules of thumb, like avoiding hostile takeovers. 94% of announced mergers eventually close, with a few percent seeing a higher bid than the first announced bid. Other research focuses on using options pricing to identify deals likely to fail. Warren Buffett was for decades a frequent merger arbitrageur through Berkshire Hathaway (BRK.B), writing this in his 1988 annual letter:

In past reports we have told you that our insurance subsidiaries sometimes engage in arbitrage as an alternative to holding short-term cash equivalents. We prefer, of course, to make major long-term commitments, but we often have more cash than good ideas. At such times, arbitrage sometimes promises much greater returns than Treasury Bills and, equally important, cools any temptation we may have to relax our standards for long-term investments. (Charlie’s sign off after we’ve talked about an arbitrage commitment is usually: “Okay, at least it will keep you out of bars.”)

Buffett’s sentiment in 1988 sums things up quite nicely. Stock prices were high, and there was a big asset bubble in Japan at the time. As such, Buffett placed some merger arbitrage bets that he expected to beat the return on Treasuries while waiting for the broader stock market to correct back to reality. There are currently plenty of deals to choose from. Exxon (XOM) is buying Pioneer (PXD), Chevron (CVX) is buying Hess (HES), Alaska Airlines (ALK) is buying Hawaiian Airlines (HA). The US Steel (X) deal is super messy and political so I wouldn’t get involved there without a lot of due diligence, but that’s going on as well.

There are risks to merger arbitrage. For one, the Biden administration has rightly or wrongly made it a policy to try to block as many big mergers as possible. Sometimes they’ve won and sometimes they’ve lost. Most notably, they won against Spirit Airlines (SAVE), which is now going to have some serious issues trying to stay in business after a failed takeover by JetBlue (JBLU). Spirit now trades for an all-time low of under $5 per share.

Deal Specifics On Discover/Capital One

The first step in evaluating a merger arbitrage is to figure out how much you’ll make if the deal is successful. We know what our return for buying DFS stock will be. The deal price is simply 1.0192 COF shares per DFS share, or about $147. DFS is under $128, so that’s a premium of about $19 per share, plus dividends. In stock deals, the acquiring company must be solid – otherwise, you end up with the price risk of the acquirer. It’s possible to hedge this out with options or by shorting, but that’s more for Wall Street pros who need to have a certain mandate.

The second step is to evaluate the risks to the deal. Capital One does have its hands full here with various regulators. The Federal Reserve needs to sign off, as does the OCC. The Justice Department also will have the opportunity to challenge the deal under antitrust grounds. On cue, Sen. Elizabeth Warren is not a fan of the COF/DFS deal. The populist right also is against the deal, with Sen. Josh Hawley also signaling opposition to the merger. However, one key to understanding politics is that opposition often is just the start of a negotiation. By one measure, $361 billion in M&A deals were challenged by regulators in 2022 and 2023, while $255 billion eventually closed, often with tweaks to satisfy regulators that consumers would not be harmed. Microsoft’s (MSFT) acquisition of Activision Blizzard was an excellent example of this. The deal ultimately went through after negotiations with regulators across the globe. Notably, Buffett/Berkshire bought stock in ATVI as a merger arbitrage play.

I can’t say with certainty whether this deal will close. Based on what I’ve read, I feel that it will. Regulators are likely to ask Capital One to do something about its subprime business (perhaps by selling it to a competitor). But I don’t think this will derail the deal, and the market spread pricing indicates to me that the deal is likely to be successful. There are other ways you can make money in Capital One – the company has a couple of preferred stock issues worth taking a look at, such as the J shares (COF.PR.J) or the I shares (COF.PR.I). Both of these have safe dividend yields of over 6%.

Another objection that bears are likely to have with this deal is the risk of recession to COF and DFS. I previously did a lot of research on this, and credit card loans are much safer in a recession than you’d think (even a severe one, like 2008). Even in 2008-2009, interest earned exceeded charge-offs, while this spread can be close to 20% annually in good times. Despite the TV narrative, it wasn’t the subprime credit card loans with 30% interest that killed the banks in 2008, it was the mortgages to supposedly safe upper-middle-class households with preferential rates that crushed them. To this point, the absolute level of charge-offs in the financial industry is far less important than whether the interest assessed exceeds the charge-offs. Here, I’m not particularly worried about the macro risk to Capital One or Discover. As long as you’re managing market risk well at your portfolio level, you’re likely to avoid running into too many problems.

Bottom Line

I’ve become increasingly interested in merger arbitrage plays after a ferocious market rally that I feel is unfounded by fundamentals. There are some nice opportunities currently in the merger arbitrage space, and Discover Financial is a solid medium-risk, medium-reward opportunity for anyone willing to make a small bet. What do you think? Share your thoughts in the comments below!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DFS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.