Summary:

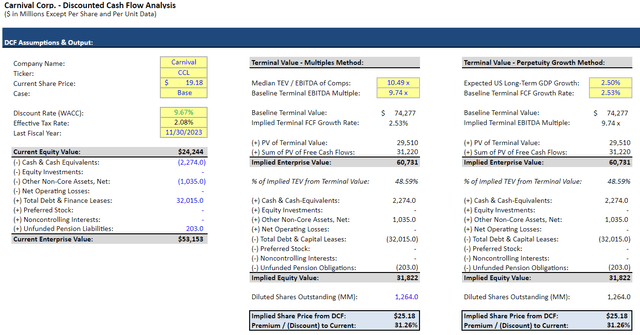

- Like most tourism-oriented companies, Carnival stock has performed well since 2023; however, it is still undervalued in the market, with a target price of $25.18.

- Carnival is in an unrivaled position within the cruise industry, and recent announcements show that management only expects this to continue.

- The main risks to Carnival surround its bottom line, but these have clear mitigants, and the company should be able to operate with this strength for the foreseeable future.

Editor’s note: Seeking Alpha is proud to welcome Vincent Phan as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

kynny/iStock via Getty Images

Investment Thesis

In the first half of 2024, the broader travel industry continued its post-pandemic recovery from 2023, and many companies performed well in the market as countries slowly opened their borders. That being said, Carnival Corporation (NYSE:CCL) is uniquely positioned in the market due to its continued resilience and relative discount compared to its competitors. Despite a 130% increase in share price last year, Carnival stock remains far below pre-pandemic levels, and Wall Street seems to think that a heavy debt burden and diminished cruise demand will keep the share price down. However, the market has missed recent announcements and developments showing that these statements will soon become obsolete. My base case valuation for CCL is $25.18 per share, showing a 30% upside potential – this is a significant opportunity for investors given the current price.

Industry Overview

At its core, the cruise industry is centered on the ship and the destination, with ample room for differentiation in both. Ships can vary based on the line – mass-market cruises have the largest boats with the most amenities, while premium and luxury cruises are more private and personalized. Additionally, cruises have been including more exotic destinations on their itineraries in recent years, especially ones in colder climates. These activities aim to capture a broader market as demand for different cruise experiences increases – cruise companies are simply being proactive. It is also a common industry practice to separate different cruise experiences into distinct brands, as it is easier to target certain markets, separate ship classes, and select destinations specifically for said markets.

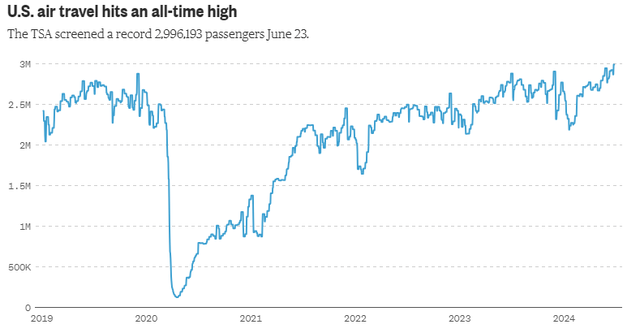

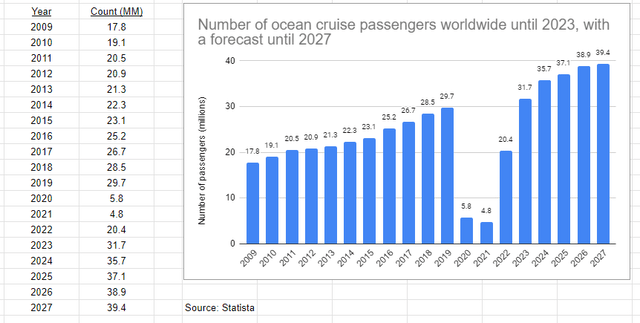

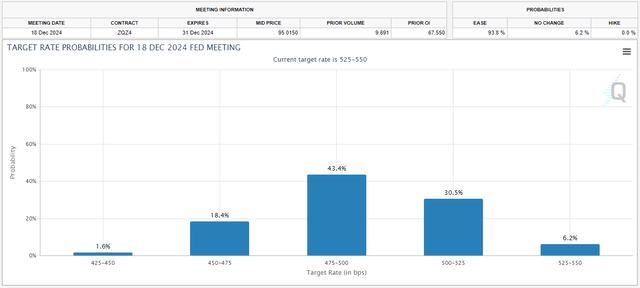

By every measure, the broader tourism industry has seen a remarkable recovery after the pandemic, and this applies to the cruise industry by extension. Although it was 2023 that saw the most “rebounding,” the trend has nevertheless continued into 2024. TSA screenings have remained higher – including an all-time high set on June 23 – and this year is projected to see the highest cruise passenger count on record, a trend extending into 2027 per Statista. Furthermore, the market has currently priced in a 94% chance of at least one rate cut this year – this will only increase broader tourism and cruise demand further.

TSA screenings per day since 2019 (NBC News) Global cruise passenger count since 2009 per Statista (Author)

Target rate probabilities for end of 2024 (CME Group)

Company Overview

Carnival Corporation was founded in 1972 and is currently headquartered in Miami, Florida, USA. The company became dual-listed in 2003 after acquiring the British P&O Princess Cruises plc, which renamed itself to Carnival plc. The two companies function as one entity, as they jointly own the nine cruise line brands under the Carnival group. With over 90 vessels in their fleets, these cruise brands control 40% of the global cruise market per Cruise Market Watch, which is the most out of any company. Carnival uses its position as the market leader to stand out compared to the other companies, as it is easier for them to market to customers and set prices.

As the tourism industry continues to recover, Carnival is uniquely positioned in the market to continue the trend upwards in a stronger fashion than its peers. This is due to Carnival’s relative market strength and proactive decision-making, the Street overestimation of its debt burden in a rebounding economy, and ample upside potential due to the pandemic-era price decline.

Key Drivers/Investment Catalysts

Firstly, Carnival is demonstrating significant strength even when compared to the rest of the travel industry. Carnival is in a much better position following the pandemic, which is best evidenced by recent data. Carnival has beaten Street EPS estimates for the past seven quarters. Furthermore, per the Q2 2024 earnings report, Carnival’s cumulative booked position for 2024 is the highest on record for both price and occupancy. Carnival management is already touting that the 2025 numbers are even higher in both respects, despite it being early in the booking season. It is then unsurprising that Carnival’s customer deposits number hit an all-time high of $8.3 billion in Q2 2024, beating the previous record (Q2 2023) by $1.1 billion. It is easy to write off these facts because many tourism companies are also in a period of ample growth, but these all-time highs are unique in the industry and highlight Carnival’s strength beyond the de facto market growth. It is also important to highlight that Carnival can assert this immense strength into 2025, showing that the 2024 numbers were not a lucky occurrence and that this is instead the start of a longer trend.

Furthermore, Carnival is making decisions indicating that management expects this strength to continue over the next few years, which is a mindset that few other companies have. For example, the Adora Cruises ship “Adora Magic City” set sail for the first time on January 1 this year. Adora is Carnival’s China -oriented cruise line, as it is a joint venture between Carnival and the China State Shipbuilding Corporation. This ship was the first to be built on Chinese soil, and Adora is the first cruise line to be majority-owned by China and based within China itself, while other lines merely offer cruises to China instead. This has allowed Carnival to gain access to the Chinese market well before the other Western cruise companies, since Adora Cruises will specifically target this market.

Carnival also recently ordered two new Excellence-class ships to be completed in 2027 and 2028, which is the largest class in Carnival’s fleet. (As a bonus, the two ships will also be powered by LNG rather than diesel, which will help on the sustainability front.) Carnival management clearly believes strongly in the cruise market’s potential, having launched one and ordered two more ships this year, an investment that few companies have made even in the current economic conditions.

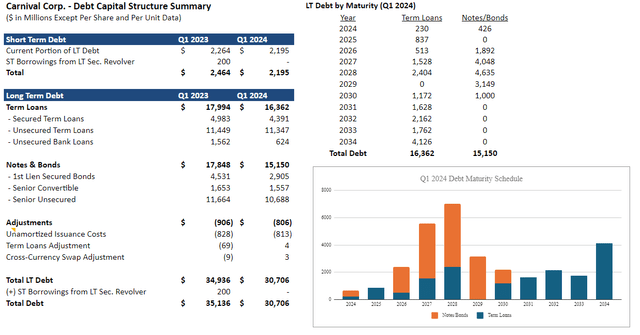

Second, the Street is underestimating the ability of Carnival to shed its debt burden. The company was forced to take on ample debt during the pandemic, and management has demonstrated a two-part goal of paying it down quickly. This can be seen in an analysis of Carnival’s debt capital structure. Carnival paid $4.4 billion of its debt between Q1 2023 and 2024, which represents 20% of its revenue over the same period and showing a clear focus on the debt burden by management. Since the company’s revenue is only expected to grow from here, Carnival will continue to pay down debt at an even faster rate.

There are some that will see the 2027 and 2028 maturity walls of $5.6 and $7.0 billion respectively as a point of concern. However, the company is already taking steps to limit this burden as well. In April this year, the company repriced a $1.3 billion term loan for 2027 and a $2.2 billion loan for 2028, while also using $800 million in balance sheet cash to partially prepay the loans and making the maturity walls less “tall.” It is evident that company management is fully aware of this situation and is also more than ready to address it.

It should also be noted that Carnival management is also working on refinancing their loans, showing initiative to reduce its debt payment down the line. On the same day as the above-described repricing, the company refinanced a 500-million-euro 5.75% senior unsecured notes offering to reduce the interest expense on this debt by 2%. The company issued this offering due 2030 to pay off another offering of the same principal, but at a 7.625% rate due 2026, thereby lowering its interest on the debt by $50 million annualized. Furthermore, with the current federal funds rate at 5.25%, it can be argued that this refinancing event will just be the first of many. As mentioned, the market is currently pricing in a 94% chance of at least one rate cut by the end of the year. Thus, Carnival management will be able to lower its interest expense even further in the future.

All these factors combined show that Carnival has a straightforward path to paying off its debt burden, and that it will only be easier for management to do so as time goes on.

Lastly, even as the industry is doing well, Carnival is unique in that the pandemic-era discount of its stock has left it with extreme upside potential. As mentioned previously, this is partly due to Street overestimation of Carnival’s debt burden. At Q1 2023, Carnival’s total debt was $35.1 billion, but the company posted a $6.1 billion loss in the 2022 fiscal year. As such, Carnival stock remained at extremely low prices – in the single digits – before the massive 130% increase in 2023, followed by modest gains to the $18 per share territory it sits in today.

However, even though Carnival has had a great 2023, Carnival shares remain at a substantial discount compared to pre-pandemic levels. In 2019, Carnival shares were trading in the $40 range before the pandemic sent them sliding to 10-dollar territory, something that also happened to Carnival’s competitors. Despite Carnival’s clear recovery regarding revenue, Carnival shares have remained in the $10 range, which are similar prices to those from the middle of the pandemic. Some will say that even though the underlying business is going strongly once more, Carnival is so straddled with debt that the share price will remain depressed anyway. However, I would quickly point out that as discussed, the debt burden is quickly being alleviated, and there is little reason to continue depressing the share price – at least at the peak-pandemic level it is at right now.

Valuation

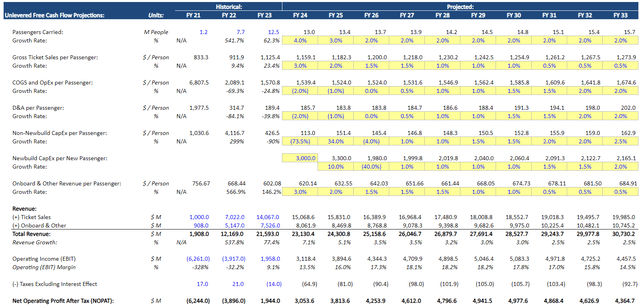

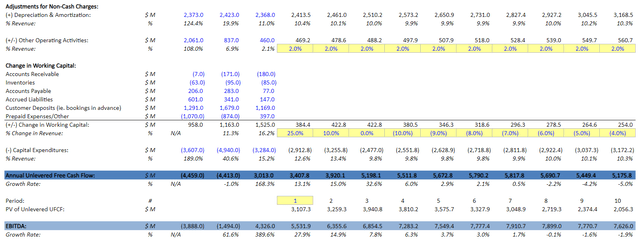

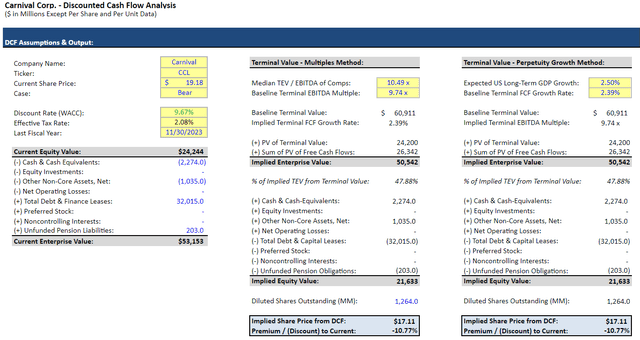

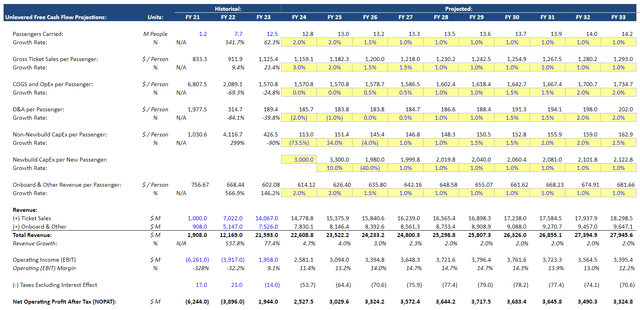

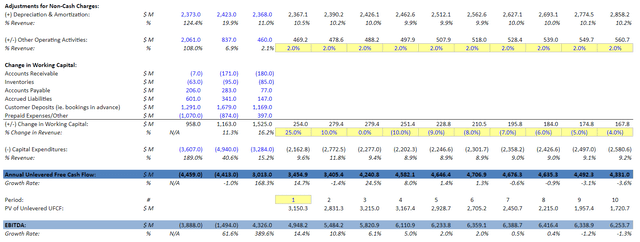

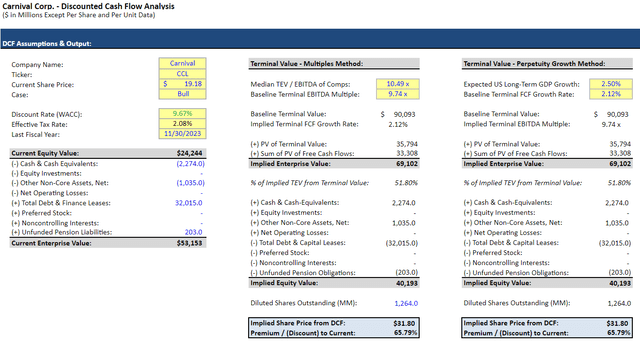

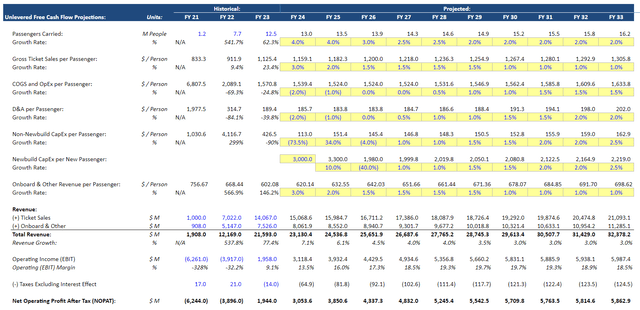

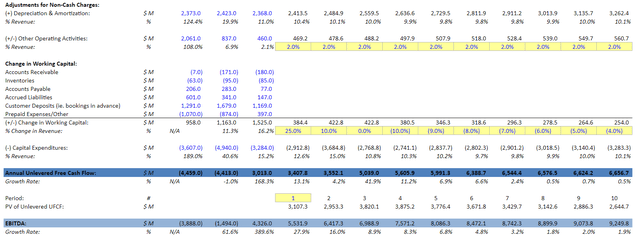

It is logical to discuss my base case model first. Total revenue is derived through multiplying the total passenger count by the ticket sales and onboard revenue for each passenger, with expenses done in a comparable manner. Assumptions for growth rates and such are matched to those from the Q2 earnings report and then taken slightly lower to use as a conservative estimate. For example, the sharper upticks for 2024 and 2025 revenue and passenger counts are justified by Carnival earnings reports headlining their strong price and occupancy positions to a similar degree. Carnival saw 6.3 million passengers in the first half of 2024 versus 5.7 million passengers for 2023 – which is a 10% increase year-over-year – so it is reasonable to assume at least a 4% passenger count uptick given that most 2024 reservations have already been made. Other values, particularly those for capital expenditures and working capital, are taken directly from the expectations in the Q2 earnings report. For instance, Carnival is expecting 1.5B in non-newbuild capital expenditures for 2024 (0.5B already and 1B for the remainder of the year), and my model assumptions closely match this expectation. This sort of process applies for all the cases that I will discuss.

Author’s Calculation Author’s Calculation Author’s Calculation Author’s Calculation

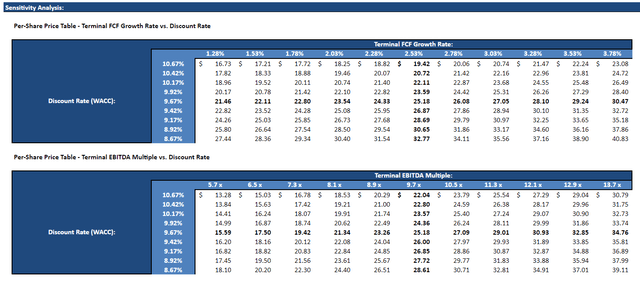

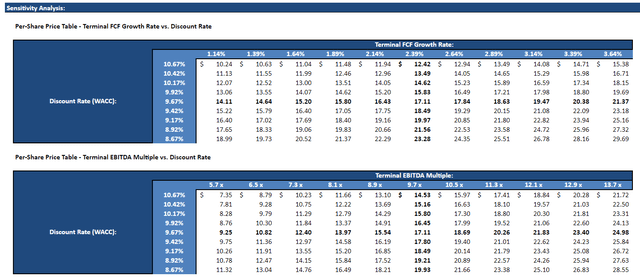

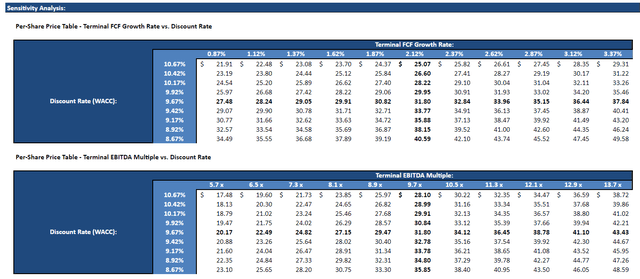

Given a discount rate of 9.67%, I have estimated the fair value for Carnival shares to be $25.18, implying a 30% upside from the current price. In this scenario, the 2024 and 2025 record bookings play out as company management expects, with costs and other forecast items also aligning with expectations and historical tendencies – additionally, past 2029, passenger counts and revenues taper off to a near-zero growth percentage, while costs continue to increase as Carnival reaches a sort of steady-state.

One point of note is that I have elected to assume that Carnival will not send out any more ships beyond 2028, as these ships have not yet been announced by management. This is done partly to avoid speculation on the number of ships or growth capital expenditure numbers, but mostly to remain conservative with Carnival’s far-future growth numbers. In addition to this, I have already underestimated the increase in passenger count and revenue streams compared to management expectations; as such, I am comfortable with this valuation as a conservative base.

Author’s Calculation Author’s Calculation Author’s Calculation Author’s Calculation

Next, let’s discuss a bear case – a sort of worst-case scenario. In this model, inflation continues to remain high and the price of oil increases, driving up operating costs and COGS and causing booking prices to increase. As a result, some bookings are cancelled, and Carnival is unable to meaningfully increase its passenger count – the newbuilds are sent to port but cannot reach full capacity. Furthermore, existing customers are unwilling to shell more out of pocket, while on the cruise itself, for fear of taking on too much consumer debt. Carnival’s top and bottom line are both heavily impacted as a result.

In this scenario, I have estimated the intrinsic value of CCL shares to be $17.11 at a 9.67% discount rate, implying a 10% loss. However, this is roughly where CCL has been trading in the past few weeks at the time of writing – even as the stock price has seen its typical gains and losses a few dollars up and down, it has remained mostly within the $17 to $19 range. As such, given that this is a worst-case scenario, this investment opportunity is still very attractive.

Author’s Calculation Author’s Calculation Author’s Calculation Author’s Calculation

The last case to mention is a plausible bull case. In this scenario, Carnival can keep prices high as consumers splurge on tickets and onboard the cruise itself, inflation quickly flattens to 2%, and bookings continue to be high as newbuilds are sent to ports around the world. Demand drives prices up, but in this model they continue to stay higher for longer, as the company is still able to fill their ships without issues. Simultaneously, costs have remained at the same levels, partly due to inflation, but also due to elections and lax global policies on oil allowing prices to decrease, thereby offsetting the slight increases in input prices as a natural effect of inflation. Importantly, Carnival maintains a positive year-over-year EBITDA growth through FY 2033 in this bull case, something that does not apply for the base case. The intrinsic value of CCL shares in this scenario is $31.80 at a 9.67% discount rate, implying a 70% upside. Although this is certainly a high upside percentage, I do think that this is attainable for the company given current economic and market conditions and the strength of its drivers.

Risks and Mitigants

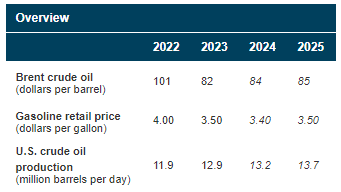

Oil price instability. One risk of note is the prospect of large oil price fluctuations due to geopolitical conflicts, OPEC controls, and so on, which could hurt Carnival’s bottom line and make it harder to pay down its debt. However, the June 11th US EIA short-term energy outlook (latest report at the time of writing) has Brent spot prices at $84 for 2024 and $85 for 2025, off the back of an increase in US crude oil production and an OPEC announcement detailing voluntary cut relaxing in Q4 this year. These forecasts are exactly in line with today’s prices – in fact, the Brent continuous contract closed in the $85 range at the time of writing. As such, I expect Carnival to continue the oil status quo, at least until 2025.

Future climate change policies. Another risk is that of climate policies hurting Carnival’s emissions numbers and restricting its ability to run certain types of ships, or simply not as many ships as management might want, thereby limiting its future growth. However, the US is quite lax on these policies, as President Biden’s Inflation Reduction Act – billed as climate legislation – largely ignored cruise emissions. Of the 119 programs in the IRA, none of them directly impact cruise emissions despite some of their names (for example, the Diesel Emissions Reductions program only targets emissions from “goods movement facilities” and vehicles serving them), and only a few have slant impacts on Carnival, such as a program targeting air pollution in ports. In the US, the phrase “clean energy” usually refers to EVs or renewables, and cruise emissions are just not prioritized as highly. On the global side, the only climate tax named in Carnival documents – an EU cap-and-trade emissions program – does not take effect until 2027, and I quite simply see the stock reaching my $25 target before then, as discussed above.

Continued higher-than-expected inflation curbing demand. Finally, the general economy has been showing signs that the “soft landing” coveted by the Fed may not be happening as inflation stubbornly remains above 2%, and there are concerns that travel demand will decrease as prices of food, housing, and the like continue to increase. However, as mentioned, the travel industry has indicators that show the industry is not currently suffering demand contractions, and Carnival itself is in a great position for 2025. The only way that Carnival could see a demand decrease beyond 2025 is if the current economic situation worsens, and there is data showing that this is highly unlikely to happen – May CPI data came in at 3.3%, just under the Street forecast of 3.4%; PPI declined 0.2% over May when it was forecasted to increase 0.1%; and Fed funds futures are pricing a 0% chance of a hike by the end of the year, as shown previously. (All of this data was the latest at the time of writing.) Even if the economy remains as is – for example, if we do not see any rate cuts this year – the travel industry has been so strong that it is hard for me to expect a substantial enough decrease in demand to significantly hurt Carnival’s passenger count.

From the EIA June forecast (US Energy Information Administration)

Conclusion

In summary, I am recommending a buy on Carnival stock, with a target of $25.31 being reached within the 18 months or so. Carnival is currently displaying robust booking numbers and high initiative on paying down its debt burden, while its share prices are still sitting in pandemic-era territory. Despite risks regarding oil prices, climate change, and broader demand in the industry, Carnival’s unparalleled position in the cruise industry makes it a distinct investment opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.