Summary:

- Carnival Corporation & plc is expected to report a strong quarter with a forecasted large profit after years of massive losses.

- Carnival is focused on reducing its debt, with plans to repay $8 billion in the next 3 years based on strong cash flows.

- The stock is cheap at 10x EV/EBITDA targets and with expectations for EPS to regain $2+ in the next few years.

Lorraine Boogich

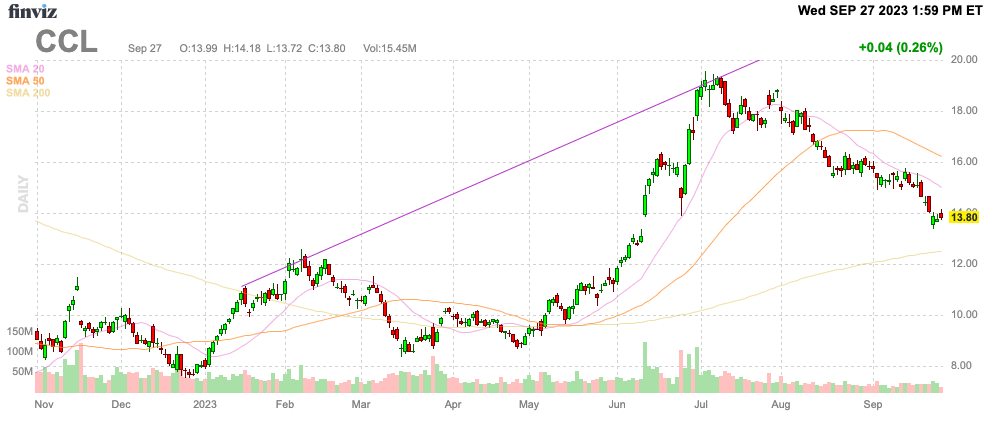

The cruise ship stocks have fallen the last couple of months, but Carnival Corporation & plc (NYSE:CCL) is set to report a blockbuster quarter on Friday. The market will quickly focus towards the level of positive cash flows in future years. My investment thesis is ultra Bullish on the stock following the dip in the stock price back below $14.

Source: Finviz

Big Quarter

Carnival is forecast to report a $0.74 EPS for FQ3 when the company reports before the market opens on Friday. The cruise line is different from the others in having a fiscal year ending in November versus a more traditional calendar year ending in December.

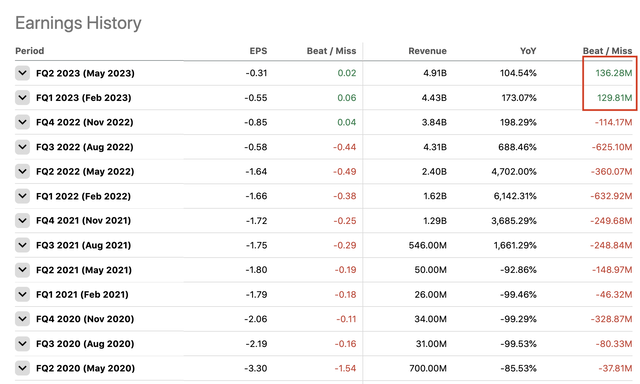

Due to the reporting shift, Carnival captures the prime Summer months of June, July and August all in the same quarter. The cruise line still reported a loss of $0.31 per share for the May quarter and is forecast to report a much smaller $0.09 loss for FQ4.

Other cruise lines are generally forecast to remain profitable during these other quarters due to the calendar shift with the big June month captured in the FQ2, but also other cruise lines don’t have the same debt issue.

Since Carnival is struggling to just turn profitable on an annual basis, a lot of the focus will clearly be on the forward guidance. Carnival can’t afford any setback due to a U.S. or global recession since the business isn’t even profitable on an annual basis yet.

Per research from Truist a week ago, industry forward-looking booking trends were supporting massive gains for the cruise line sector. Analyst C. Patrick Scholes suggests the 2025 bookings are on a pace to increase by 100% over 2019 levels.

Carnival is forecast to report peak season revenues of $6.7 billion, up just slightly from FQ3’19 when revenues were $6.5 billion. The cruise line is forecast to report solid revenues growth in the next couple of years, but the FQ3’25 revenue forecast is only $7.8 billion.

The big cruise line has beaten consensus revenue estimates by ~$130 million on average the last 2 quarters after big misses since the start of Covid. The suggestion is that analyst estimates appear too low based on the bookings trends providing upside to estimates.

Debt Is The Key

Carnival has forecast the 2023 ending total debt at $33.0 billion versus the $33.7 billion at the end of May. The number isn’t completely helpful because what investors care about is the net debt when excluding cash, such as the $4.5 billion cash balance on hand going into FQ3.

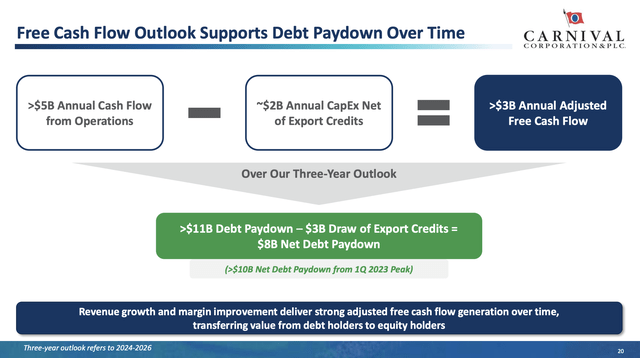

What is key though is Carnival forecasting repaying $8 billion worth of debt in the next 3 years based on at least $3 billion in annual adjusted free cash flows. The current $29.2 billion in net debt will approach just $20.0 billion by the end of FY26 with a big focus on the cash flow results during the big FQ3 earnings period.

Source: Carnival FQ2’23 presentation

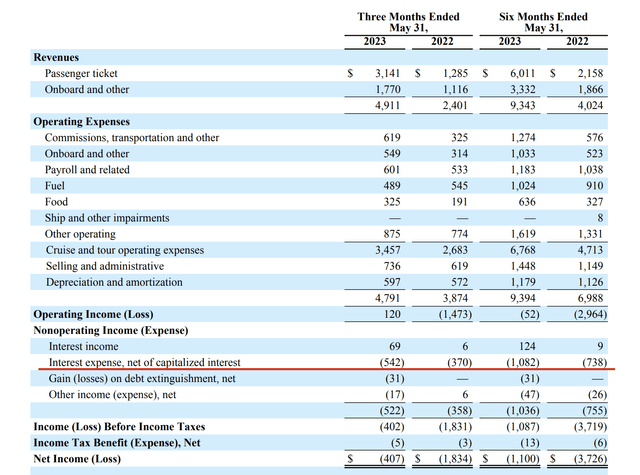

A prime reason the net debt levels are a huge part of the story is highlighted via the FQ2 results. Carnival actually reported positive operating income in the quarter at $120 million, but the loss before income taxes were $402 million. The company is now paying $542 million in quarterly interest expenses, up from only $370 million last FQ2.

Source: Carnival FQ2’23 earnings release

In essence, the cruise line could repay ~30% of outstanding debt during the next 3 years. Based on FQ2 levels, Carnival would add nearly $150 million in quarterly net income based on just lowering interest expenses.

The $600 million in annual interest expense reductions adds nearly $0.50 in EPS annually. All while Carnival forecasts the ability to grow adjusted EBITDA per ALBD by 50% compared to the June 2023 guidance.

The stock trades at about 10x EV/EBITDA targets for 2023 in a sign of the valuation. In the years ahead, adjusted EBITDA will only grow while net debt levels will quickly fall leading to a $2+ EPS guidance in the years ahead for a $14 stock.

Takeaway

The key investor takeaway is that Carnival Corporation & plc probably isn’t the best cruise line investment, but the stock is again exceptionally cheap for the opportunity ahead. Investors should buy the stock on weakness heading into what should be a strong FQ3 report with expectations for another guidance hike.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.