Summary:

- Carnival Corporation’s unmoving stock price over the past quarter is hardly surprising going by its market multiples. But can things change with the Q2 2024 results due soon?

- The company’s expected to continue making progress, to be sure. Revenue growth, improved EBITDA margins and possibly even an adjusted net income are expected.

- The company’s upgraded guidance for 2024 is encouraging, too. If its results turn out better than anticipated, guidance can improve again, which can be good for the stock.

- But as of now, the forward P/E compared to its peers still doesn’t make a case for Carnival Corporation.

alzay

Since the last time I wrote about the cruise company Carnival Corporation (NYSE:CCL) (NYSE:CUK) (OTCPK:CUKPF) a quarter ago, its price has barely moved. This is actually a better than expected outcome.

I had downgraded the stock exactly because it was hard to see further price gains for it. My estimates indicated that a 15-20% correction is possible. And it did happen. By mid-April, the stock was down by some 16% before picking up in fits and starts from there.

But something else happened as well. Its first quarter (Q1 2024) results, which might not have made the stock a certain buy, but they did give enough encouragement. With the company’s second quarter results due in a few days, the question now is whether the stock can break its essentially flat trend over the foreseeable future?

The recent past

Let’s first take a quick look at where Carnival has been recently. In March, the upside on the Carnival stock appeared to be exhausted, essentially on account of its market multiples. Its forward non-GAAP price-to-earnings (P/E) ratio was higher not only than just the consumer discretionary sector but also its cruise peers like Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Cruises (RCL).

This in no way implied any need for diffidence about the company’s prospects, though. Its revenues had grown at a fast clip in revenues in 2023, the adjusted EBITDA had grown faster than guidance showed, it had even managed a positive adjusted net income figure for the year and debt was also coming off.

The positive trend continued in Q1 2024, with revenue growth of 22% year-on-year (YoY) despite an unfavourable base. The company had seen an over doubling in revenues in Q1 2023, reflecting the continuing post-pandemic normalisation in cruise travel and also improved prices. Travel normalisation continues, to be sure, just at a slower pace. As Carnival says in relation to its Q1 2024 figures, “booking volumes hit an all-time high with prices considerably higher year over year.”.

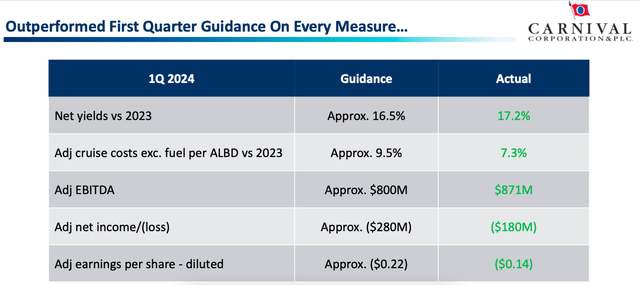

It also exceeded its adjusted EBITDA guidance significantly (see chart above) and the margin rose to 16.1% from 8.6% in Q1 2023. While the company continued to clock a net loss, the extent of loss was also lesser than forecast.

What to expect from Q2 2024 results

The positive trend is expected to continue into Q2 2024. Owing to a base effect and the company’s related projections, there can be a further softening in revenue growth, though, even as the adjusted EBITDA margin improves. Below are the details.

Healthy revenue growth expected

Carnival has provided a guidance for the net yields for Q2 2024, where the term is defined as the adjusted gross profit per average lower berth deck [ALBD]. ALBD is a measure of passenger capacity. This yield is expected to increase, at both constant currency and market exchange rates, by 10.5% YoY.

Additionally, it expects the ALBD to be at 23.5 million during the quarter. This gives us the figure for the adjusted gross profit, which is expected to increase by 16.5% to USD 4.3 billion. Assuming that the adjusted gross margin remains at the Q1 2024 levels of ~75%, this results in a revenue increase of 17.3%.

Adjusted EBITDA margin to expand further

Further, the company expects adjusted EBITDA to come in at USD 1.05 billion, a 54% YoY increase. This would also an uptick in the margin to 18.2%. Going by the fact that the adjusted EBITDA figure was 9% higher than expected in Q1 2024, if the same were to repeat, the margin would be even higher. However, it can’t be said for certain if Carnival will turn adjusted net income positive in Q2 2024 after reporting a loss in Q1 2024, though it does expect to become so for the full year, as discussed next.

Improved full-year outlook

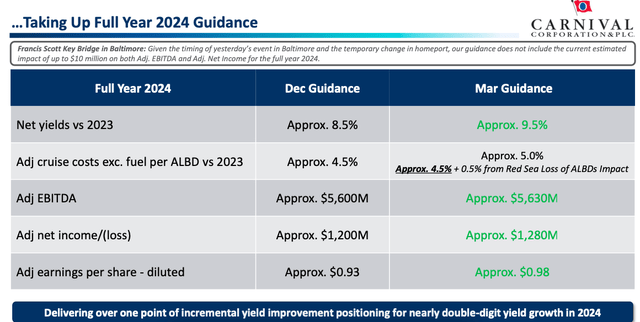

The company also improved its full-year outlook recently, with net yields now expected to be 9.5% higher than last year. Its earlier forecast was of an 8.5% increase. This, along with an ALBD guidance of 95.4 million for 2024 and the continued assumption of a 75% adjusted gross margin, results in a full-year revenue growth of 14.4%. Prior to the revision in the net yields forecast, the revenue growth figure would have been a percentage point lower at 13.4%.

Carnival has also upgraded the forecast for adjusted EBITDA and adjusted diluted EPS for the full year 2024 (see chart below). The indicates that the full-year margin will be notably higher at 21.7% compared to both Q1 2024 and the forecast for Q2 2024. It’s also higher than the 19.6% seen in 2023. But perhaps the most noteworthy aspect of the outlook is the improvement in the adjusted earnings per share [EPS], especially considering that so far it has clocked a net loss.

Market multiples are still high

The upgraded adjusted diluted EPS forecast yields a non-GAAP forward P/E of 16.4x, which is a come-off from the 16.9x when I last checked. However, compared with both the consumer discretionary sector and its peers, the relative trends stay the same as the last time.

The median forward P/E for the consumer discretionary sector is at 15.8x. Its gap has narrowed with CCL, but it still remains. Similarly, NCLH is at 12.1x and RCL is at 13.7x, which are both far lower than CCL.

What next?

The big picture for the Carnival stock then remains unchanged. The company continues to strengthen and might even show positive adjusted net income. Its improved forecast is encouraging too. Especially as it concerns the EPS figure.

Yet, despite this and the stock’s own unmoving price in the past quarter, it’s still not attractive from the standpoint of market multiples. Not when compared with either the consumer discretionary sector or its own peers.

This can change, though. If the company’s results continue to be better than expected, its guidance may well be increased again, which in turn can improve the prospects for the stock for the remainder of the year. We don’t know that yet, though. I’m retaining a Hold on Carnival Corporation for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—