Summary:

- Carnival Corporation emerged in the post-pandemic world with a levered balance sheet and low occupancy rates.

- As the company changes course, management is focused on fixing its capital structure first and foremost, in order to lower interest payments.

- Simultaneously to the adjustment in the balance sheet, the company currently enjoys positive momentum as an aging population and a younger generation increase its demand for cruise vacations globally.

- I argue why the market, at current prices, is still pessimistic about CCL’s prospects.

NANCY PAUWELS

Company & Business Overview

Carnival Corporation (NYSE:CCL) is one of the largest leisure travel companies in the world, owning a portfolio of world-class cruise lines: Aida Cruises, Carnival Cruise Line, Costa Cruises, Cunard, Holland America Line, P&O Cruises (Australia), P&O Cruises (UK), Princess Cruises and Seabourn.

There are three classifications for cruise brands: contemporary, premium and luxury.

Contemporary brands are the broadest segment of the cruise vacation industry, appealing mostly to families with children of all ages, with a focus on features to please all customers. Cruises tend to last 7 days or less.

The premium brands focus on quality, comfort and often have more destination-focused itineraries. Cruises in this category tend to last between 7 and 14 days.

The luxury experience might have the same duration as the premium brands, but they come with the highest standards of accommodation and service, along with smaller vessel size and often exotic itineraries (being smaller, they can acess ports that bigger ships cannot).

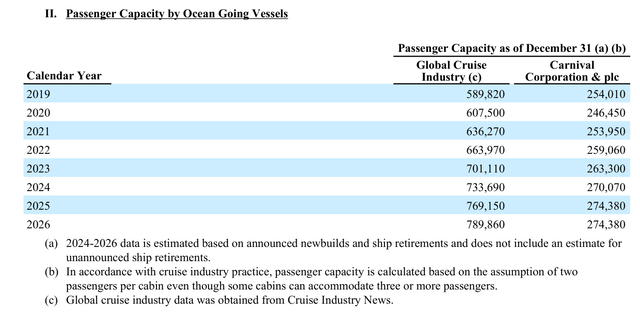

Passengers capacity by ocean going vessels (Carnival Corporation 2023 10-K)

The industry is dominated by a few big players: Carnival Corporation, Royal Caribbean Group, Norwegian Cruise Line Holdings and MSC Cruises. Together, these represent approximately 80% of global cruise industry supply.

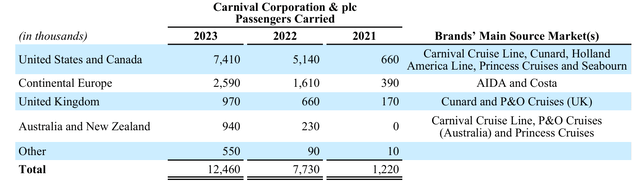

Carnival Corporation, along with its peers, was extremely impacted by the pandemic, as the industry saw its business disappear during the peak of the lockdowns. The volume of passengers started normalizing only in 2023.

Passengers carried (Carnival Corporation 2023 10-K)

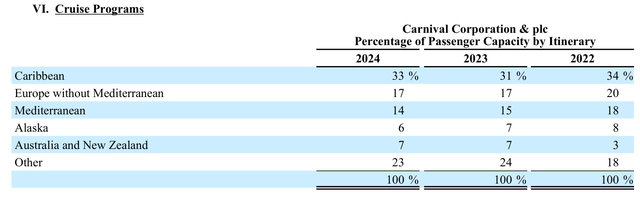

Cruise programs (Carnival Corporation 2023 10-K)

Bookings in the industry are often made several months in advance of the departure date. The ticket price usually includes accommodations, meals, access to amenities (swimming pools, water slides, etc.), childcare, entertainment (i.e. theatrical shows) and visits to the destinations. Additionally, it’s common for value-added packages to be bundled with the tickets. These may include items such as internet, photo packages, specialty restaurants, shore excursions, and more.

Seasonality is a major factor in the industry as demand for cruises peak in the third quarter (roughly May-September), resulting in higher ticket prices and occupancy levels. Strategically, companies will often schedule maintenances in the first and second quarters, to ensure that most of the ships will be available for the peak season.

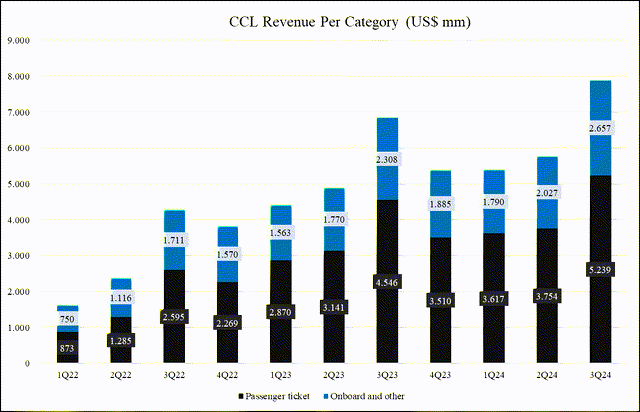

Roughly ~30% of the revenue comes from onboard activities, which customers pay for separately (not included in the regular ticket, unless specifically bought in a bundle package). Most of these are offered by independent concessionaires, which pay a percentage fee to Carnival Corporation. These can be exclusive beverages, casinos, full-service spas, art sales, laundry and dry-cleaning services, among other services.

Financial Analysis

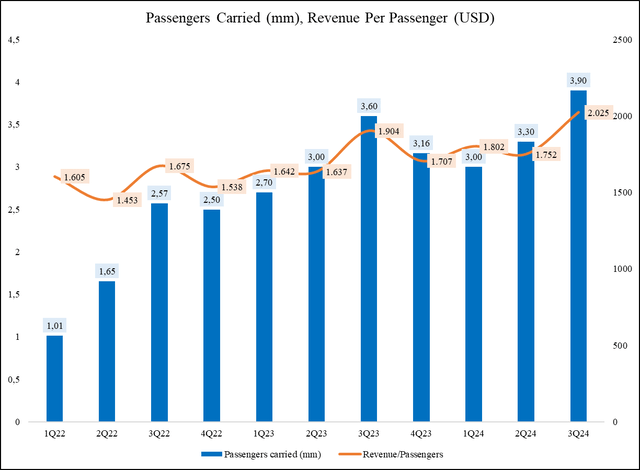

The two primary drivers of CCL’s revenue are number of passengers carried and revenue per passenger. The chart below shows both, on a quarterly basis.

Passengers Carried (mm), Revenue Per Passenger (USD) (Company Filings, Author)

As you can see, passengers carried have grown over 3x from early 2022’s numbers, while revenue per passenger has been steadily rising as well.

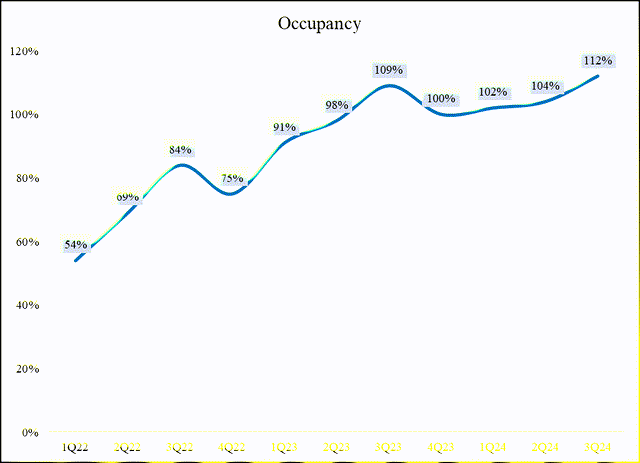

Another important number to keep track of is occupancy, which you can see in the chart below. Occupancy numbers are calculated in accordance with industry best practices, which assume two passengers per room. This is the reason the number can go above 100% since, in reality, some rooms accommodate more than two passengers.

Occupancy in CCL’s cruises (Company Filings, Author)

Demand is strong and the company believes it will continue forward, as nearly half of 2025 is already booked. From the 3Q24 call transcript:

In fact, in the last three months, our 2025 booked positions price advantage versus last year has actually widened for the full year and for each quarter individually. And with nearly half of 2025 already booked, we feel confident in maintaining our trajectory.

Consequently, revenues have sharply increased. TTM revenue is currently at US$ 24.4B.

CCL Revenue Per Category (US$ mm) (Company Filings, Author)

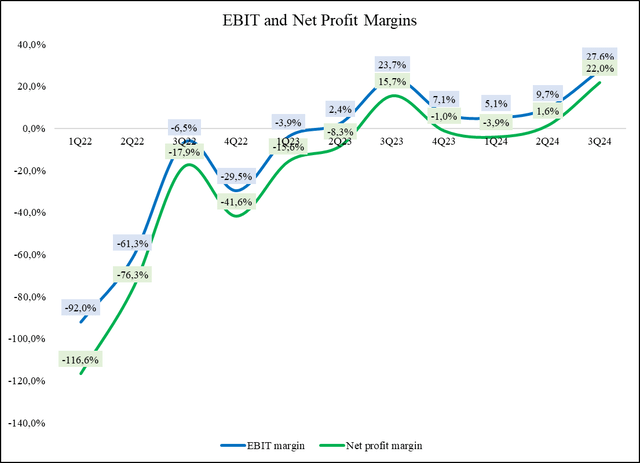

Consequently, the company’s margins have risen as well. You can see it clearly in the EBIT and Net Profit margins, as they have turned positive again. This is because the company was losing money operating under capacity.

EBIT and Net Profit Margins (Company Filings, Author)

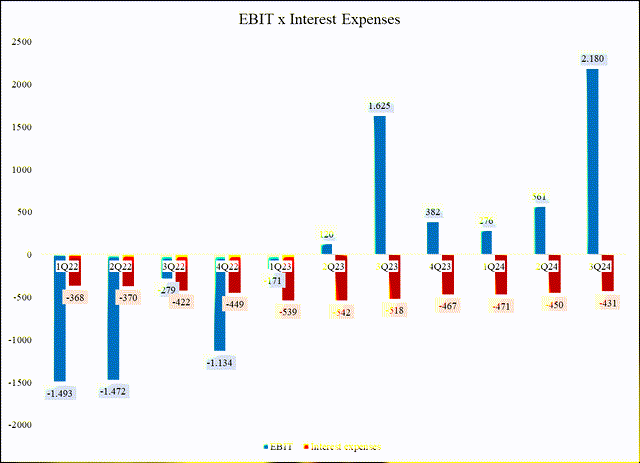

One of the company’s biggest issues is interest expenses. Notice that it was only in 2Q24 that the company was able to have more EBIT than interest expenses in a non-3Q-quarter (i.e. not peak season).

EBIT, Interest Expenses (Company Filings, Author)

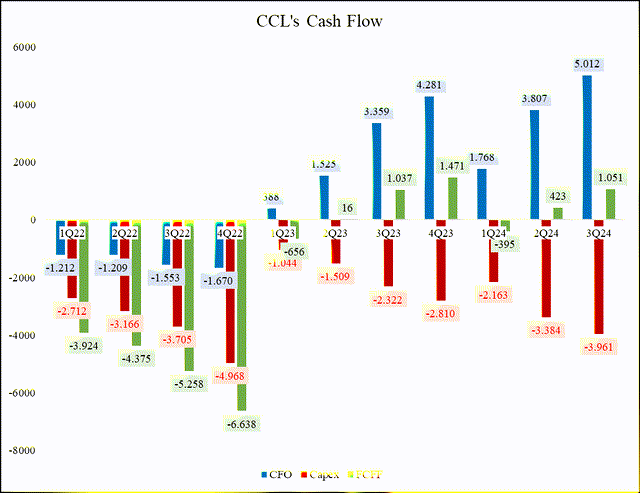

Most importantly, the company has returned to being Free Cash Flow positive since 2Q23.

CCL’s Cash Flow (Company Filings, Author)

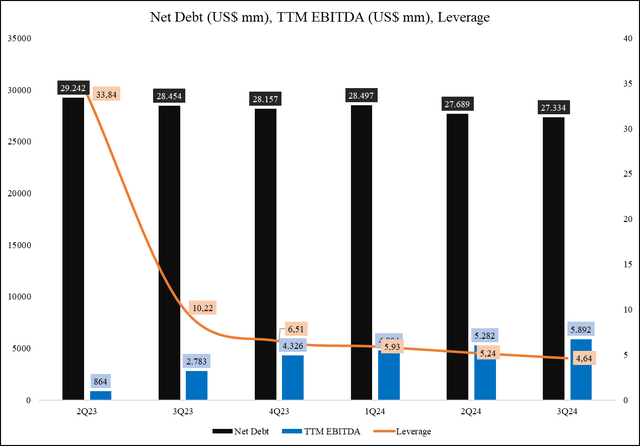

The company’s debt profile got considerably worse during the post-pandemic years as EBITDA was crushed, massively increasing CCL’s leverage. However, as operations normalize, leverage is getting back under control.

Net Debt (US$ mm), TTM EBITDA (US$ mm), Leverage (Company Filings, Author)

Notice how not only is EBITDA rising, but Net Debt is slowly decreasing as well as a consequence of the company being Free Cash Flow positive. The focus on improving its debt profile is the number one priority for management. From the 3Q24 transcript:

Now, turning to our balance sheet. We expect to continue on our path towards investment grade and have a clear line of sight for further debt paydown, having recently finalized our order book through 2028.

And:

So basically, our priority one, two and three is debt reduction, where you have the goal of becoming investment grade, and we do expect to see both the reduction in our debt levels as well as the improvement in our EBITDA, achieve investment-grade metrics as part of our SEA Change program towards the end of 2026. And so we’ve got plenty of time to think about other alternatives beyond that.

Macro-wise, there are two important tailwinds that caught my eye when studying the industry. The first one is relatively well known—the aging of the global population, particularly in developed countries, which has a positive impact on the cruise industry. For the US in particular, the baby boomer generation makes for an attractive customer base.

The second one, however, really surprised me: younger people are starting to frequent cruises more than previous generations. You can read more about that here and here, but a good summary would be (from the second link):

“There is definitely a move away from the old world of cruising to a more contemporary and casual environment focused on experiences, culture and culinary adventure. This has perhaps changed the opinion of the younger traveller who may have, in the past, been put off by the perceived ‘stuffiness’ of cruising and is now attracted by the more modern, immersive and, let’s face it, very ‘Instagrammable’ experiences offered.”

Personally, I think the reason is that cruises make for very popular content on social media such as TikTok and Instagram. So, I believe digital influencers are more likely to pick those trips in order to gather more views, and naturally the viewers become more inclined to take them as well.

Path Forward, Peers & Valuation

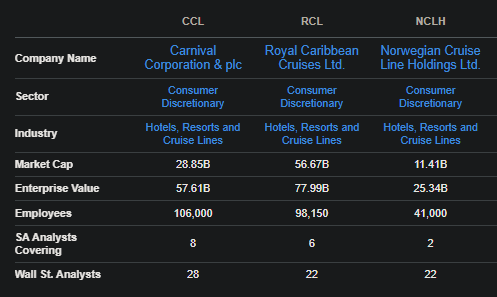

These are the three listed companies I consider to be CCL’s peers.

CCL listed peers (Seeking Alpha, Author)

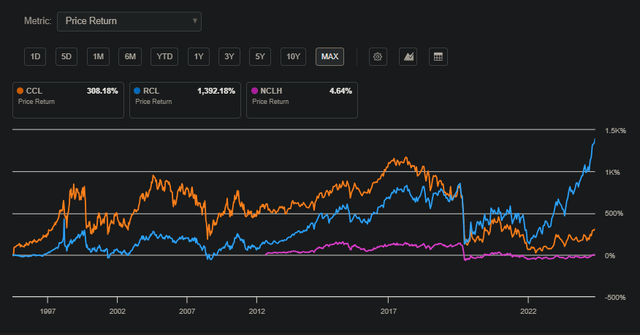

The price action is very interesting, as we can clearly see the impact the pandemic had. And since then, all three have recovered, but RCL has had by far the most extreme price rise.

Cruise Companies Returns (Seeking Alpha, Author)

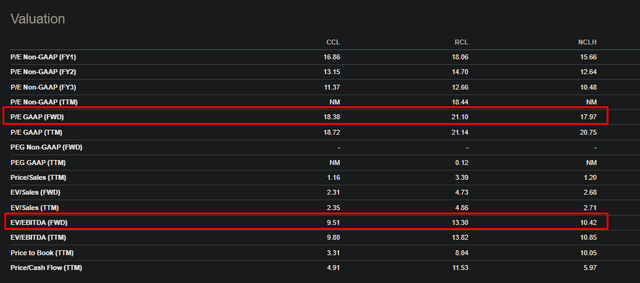

Naturally, given the price action you can see in the chart above, RCL trades at premium valuation, while CCL and NCLH trade at similar levels.

Cruise Companies Valuation (Seeking Alpha, Author)

I think CCL’s biggest opportunity comes from its cost of debt reduction. Currently, interest expenses eat up most of its EBIT.

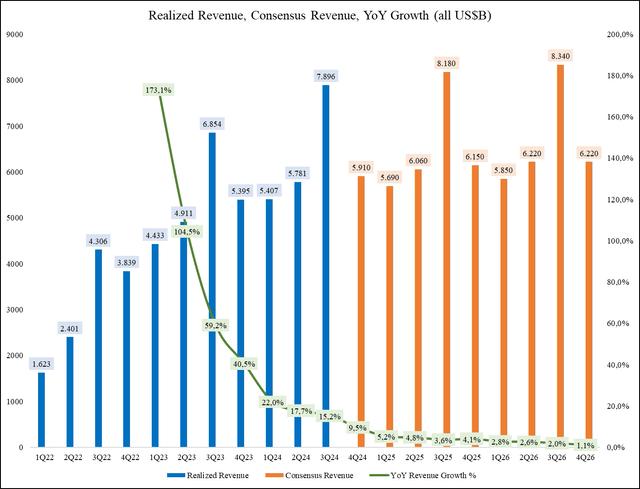

Let’s take a look at consensus numbers, which are the basis for the multiples above. First, consensus revenue. Notice how much growth is cut down in the next few quarters.

Realized Revenue, Consensus Revenue, YoY Growth (all US$B) (Company Filings, Author, Consensus)

I think that’s being too pessimistic. Naturally, growth won’t be explosive—most of it was just the company getting its occupancy levels back up. However, besides the points already mentioned in this article, there are more than a few triggers for future growth. Management is very explicit about this in last quarter’s call.

1 – Higher prices. “Every brand in our portfolio is well booked at higher pricing in 2025.”

2 – Higher revenue-per-customer. “Our year-over-year improvement in onboard per diems actually accelerated from the prior quarter.”

3 – New ships. “Premier of the highly successful Sun Princess in just a few weeks. This will be followed by the introduction of her sister ship, Star Princess, the second next-generation Princess ship coming online in a year.”

4 – New destinations. “… introduction of our game-changing Bahamian destination Celebration Key. It’s five portals built for fun were opened in July 2025, but it really ramps up in 2026 when Celebration Key serves as a premium call for 19 Carnival Cruise Line Ships…”

5 – Lower costs. “In 2026, there’s also the midyear introduction of a two-berth pier at Half Moon Cay, are naturally beautiful and pristine Beach consistently rated among the top private islands in the Caribbean. These two destinations will be available to even our largest ships, further reducing fuel costs and our environmental footprint at the same time.”

Modelling all this with high accuracy is difficult, but I think the combination of impacts, even if not all of them occur, should result in higher growth than what its currently priced in.

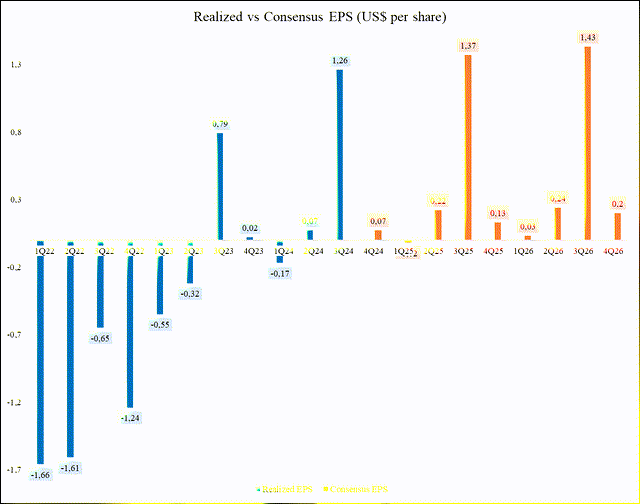

Here’s current EPS consensus:

Realized vs Consensus EPS (US$ per share) (Company Filings, Author, Consensus)

I think that growth in EPS looks remarkably small, particularly if we factor in the reduction in cost of debt, both as the company is able to refinance its debt at lower rates, and prepaying it with its positive free cash flow generation.

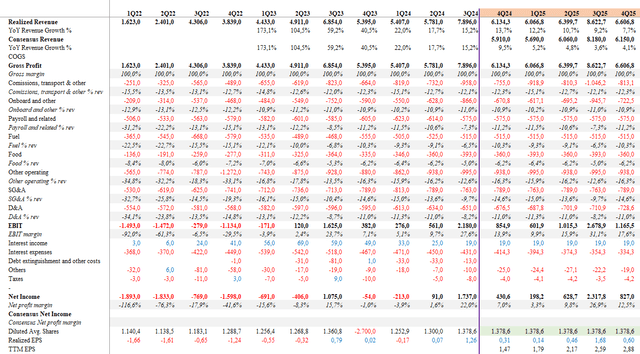

Here’s what my model looks like:

CCL Author’s model (Author)

A few premises are used:

1. Growth slows down, but it’s still relevant throughout most of 2025. Consensus has growth essentially stalling as of the next two quarters.

2. Operational margins are roughly the same (there could be potential further gains of scale, but I’m assuming not). Also, implicitly, I’m assuming fuel costs won’t skyrocket.

3. I decrease the effective interest rate by 20 basis point each quarter until it reaches 5,31%, which was the cost back in 2Q22 already, so it’s not too dramatic.

4. I assume a US$ 200 mm FCFF generation per quarter (the average from the past four quarters). This decreases net debt in about US$ 800 mm.

Based on these premises, I arrive at earnings of US$ 2.59 per share for the next four quarters, implying that at current prices of US$ 24.00, the stock is trading at about 9x forward earnings. At current multiples of ~18x, this means that I would consider the stock to be fairly priced at around $46.00.

Risks & Final Considerations

There are quite a few risks to this thesis:

1. Another global pandemic. The last one almost bankrupted the company. While I think this is unlikely, its important to point out that I don’t believe CCL can survive another period of lockdowns.

2. Rising fuel costs. War in the Middle East being the most likely, but not the only, factor that could lead to a rise in oil prices and subsequently fuel costs. This could severly impact CCL’s margins.

3. Skyrocketing interest rates. Despite its aggressive deleveraging plan, CCL currently carries a lot of debt, and higher interest rates might make it harder for the company to refinance at lower rates.

Despite this considerations, I think CCL offers an attractive risk/reward at current levels, with a healthy margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.