Summary:

- Carnival Cruise rose dramatically during the year’s first month due to a potential short squeeze and a surge in “recovery” exuberance.

- Due to substantial dilutions and debt growth, Carnival’s “full recovery” EPS is likely around 70-75% below its 2019 level.

- Carnival’s enterprise value is also at its pre-pandemic level, suggesting the stock is priced as if a full operating income recovery is inevitable this year.

- While Carnival’s operating income may recover this year, household financial strain and rising costs (specifically crew wages) could easily upset the recovery.

- CCL appears overvalued today since it could lose most of its value if its operating income does not normalize quickly, as its low credit rating limits its financing capacity.

DLMcK/iStock Unreleased via Getty Images

The first month of 2023 saw big rebounds in many stocks that crumbled in 2022. Last year was difficult for many stocks as the sharp rise in interest rates combined with a slowdown in economic growth caused a sharp rise in investor uncertainty. While interest rates remain high and economic indicators appear weak, they are not worsening and have improved slightly, pointing toward a potential “recovery trade” among underperforming stocks.

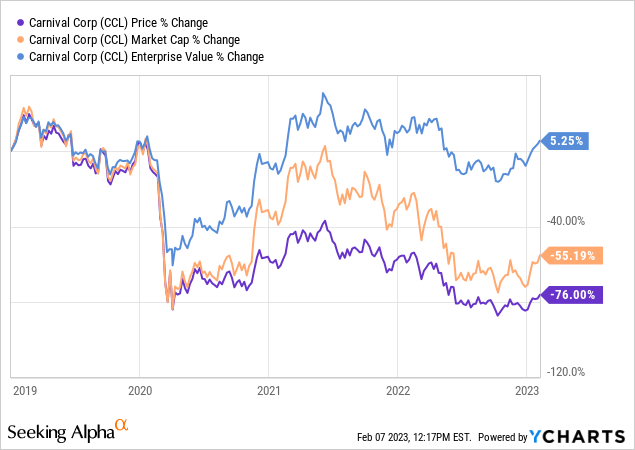

One major “fire sale” target has been the cruise line Carnival Corporation (NYSE:CCL). The stock has risen by a staggering ~48% over the past five weeks as deep-value speculators race to buy and short-sellers rush to close. Despite its strength, CCL still trades around 75% below its pre-COVID level. Of course, its outstanding shares have doubled since then, so adjusting for dilution, it is closer to 50% below its pre-COVID level. Taking it a step further, the company’s debt has roughly tripled since 2019. In fact, its enterprise value (the total value of the company – or net debt plus market capitalization) is higher than before COVID. By that metric, the company is nearly more valuable than before 2020. See below:

Investors in CCL may assume the stock is likely to eventually rise back to its pre-COVID level as the company’s revenue normalizes. In my view, that would be a very incorrect assumption since CCL has undergone massive dilution and debt leveraging since then. Indeed, as an enterprise, Carnival stock is now worth essentially the same or more than before the pandemic. Thus, to justify its price today, we must assume its revenue and operating income will rise above its pre-pandemic level. Though the company’s revenue and operating income have increased, they remain well-below pre-COVID levels, indicating the stock is likely overvalued today following its recent rally.

The “Recovery” Is Now Fully “Priced In”

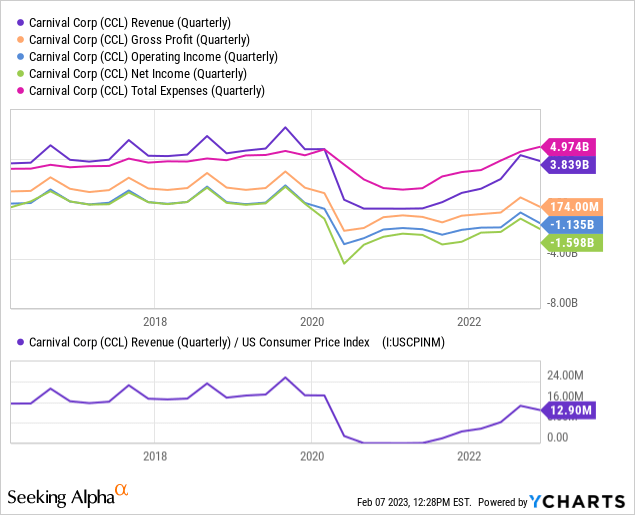

The pandemic, and the international government response to it, created massive negative headwinds for Carnival Corporation. The company’s revenue fell to essentially zero from mid-2020 to mid-2021. During that period, Carnival had to use tremendous financing from debt and equity sales to increase its liquidity sufficiently to offset negative cash flows. The company has seen a decent revenue recovery since, but they remain below the 2019 peak level, particularly after accounting for inflation. Inflationary forces have also caused Carnival’s costs to rise much faster than its revenue, making it significantly more difficult for the company’s operating income to return to 2018-2019 levels. See below:

The increase in leverage caused the firm’s quarterly interest costs to rise from below $50M to around $410M, or ~$1.65B per year. Before 2020, the company’s operating income was around $2.7-$3.3B per year, so even if its operating income returns to those levels, its net income will be at least 50% below pre-COVID levels. Combining that with the ~83% rise in its share outstanding since then, its “full recovery” net income per share can only be around 70-75% below its normal pre-COVID level. Thus, we see the same pattern in Carnival’s income outlook as its price vs. enterprise value.

Put simply, Carnival is valued nearly precisely as high as it was before the pandemic. In other words, assuming its operating income normalizes (to 2018-2019 levels) during the first half of 2023, its price-to-earnings and “EV/EBITDA” ratios today are essentially the same as in 2018-2019. Assuming CCL was fairly valued in 2018-2019, CCL can only be fairly valued today if its operating income is likely to return to the levels it was then quickly. Because CCL’s valuation is near the same as before the pandemic, it has effectively zero upside potential “from recovery” at its current price. CCL is only undervalued today if it was undervalued in 2018-2019, or its operating income is likely to rise above 2018-2019 levels this year (or both).

Around the pre-pandemic period, CCL’s “P/E” was around 11-14X, and its “EV/EBITDA” fluctuated around 7-9X. Most companies trade at “P/E” ratios around 15X in the long run, with growth stocks usually having higher valuations and “cyclical” stocks (like Carnival) having lower valuations. Thus, that valuation level seems roughly normal for a cyclical company like Carnival.

To compare, Royal Caribbean (RCL) had a “P/E” range of ~13-15X and an “EV/EBITDA” range of ~9-11X. Thus, CCL was trading for a discount of around 20% compared to RCL. Royal was growing its revenue per share considerably faster during that period, so it is unlikely that CCL was truly discounted to its peer.

Overall, I believe Carnival was fairly valued during the 2018-2019 timeframe. Considering its enterprise value (and estimated “full-recovery” EPS) is essentially the same today as it was then, CCL is not likely undervalued today unless its operating income outlook is superior to its pre-COVID level. Both companies were also expanding quickly throughout the 2015-2019 period and benefited from excessively low energy costs. Energy costs are higher today, limiting Carnival’s growth potential and making it more likely to be overvalued when compared to the “goldilocks” pre-COVID period.

Carnival Corporation Recovery Potential

CCL is arguably “priced for perfection” today. I believe the company must see its operating income return to pre-COVID levels for CCL to be fairly valued. While possible, I think that is generally unlikely, given the macroeconomic situation impacting demand and the microeconomic problem affecting its operating costs. Last quarter, Carnival’s revenue was nearly 20% below its seasonally average 2018-2019 level, while its total expenses were ~16% above typical seasonal levels. The company’s operating margins averaged around 20% before the pandemic but were -30% last quarter (or closer to -17% seasonally-adjusting). This is a considerable risk factor for the company because it continues to burn cash quickly despite a near recovery in sales. If this continues, the company must pursue more financing, directly lowering its fair value today.

Cruises require immense fuel, service workers, and food to operate. These costs have risen much faster than overall inflation and wages in the US and most of the developed world. Cruise lines are experiencing significant worker shortages since fewer people are willing to accept low-wage jobs, particularly after mass layoffs in 2020 and general fears associated with that experience. For Carnival’s operating income to normalize, its ticket costs will likely need to be well-above 2019 levels due to the sharp rise in operating expenses since then. Since this is difficult, Carnival has instead cut back on services, making the experience less appealing to customers.

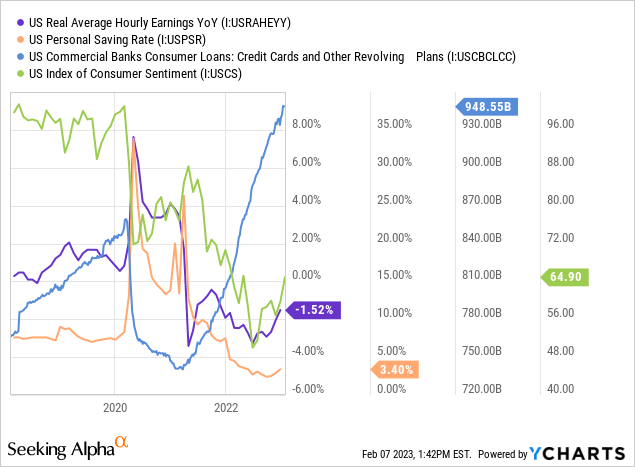

Additionally, macroeconomic data indicate that most US households must reduce spending this year. With living costs rising faster than wages, most households have seen a significant reduction in personal savings. Although consumer sentiment remains very low, consumer spending is generally high due to a substantial increase in credit card debt. See below:

Credit card debt growth is not a sustainable means of supporting consumer spending levels. The general decline in real hourly wages, savings, and confidence seems to be bottoming but will likely remain at concerning levels throughout this year. Soon, as credit card debt reaches unsustainable levels, I believe many households will have no choice but to reduce discretionary spending. One of the most obvious ways to do so will be to reduce vacation spending. Since cruises cost more and have fewer services, I believe the sector will almost certainly see a demand reduction this year from “normal” levels. Thus, even if cruise spending rises as all COVID-related patterns end, I believe that trend will likely be offset by a decline in demand due to elevated household financial strains.

The Bottom Line

Overall, I am bearish on CCL and believe it is a short opportunity today. The stock was a short-target last year and likely rallied as quickly as it has over the past five weeks due to a short squeeze. It is now significantly more expensive than it was at the end of 2020 and, with many shorts cleared, is less likely to squeeze further. Of course, that remains a critical risk, but I believe it is mitigated by the sharp rise in CCL’s valuation. Additionally, CCL’s option implied volatility is at a 14% percentile, so its put options may be very affordable today for those looking to bet against the stock with defined risk. Additionally, its short borrowing cost is back down to near-zero due to the squeeze, lowering the carry cost of betting against CCL.

CCL’s fair value depends on our assumptions. If we assume the economic situation negatively impacts household spending capacity ends and consumption growth returns, then Carnival may see a continued rise in sales this year. Further, for Carnival to be fairly valued today, it will also need cost-growth patterns to slow, slowing pressure on ticket costs and profit margins. Thus, if we make a “goldilocks” economic outlook, I believe CCL is worth, at best, $12 per share, given its enterprise value, income, and valuations would be around 2019 levels.

In my opinion, it is far more likely that Carnival will not experience these “goldilocks” economic benefits. Economic data indicates a need for consumer debt to slow amid the sharp decline in savings levels and rising living costs. Further, although some cost-push inflationary trends, such as fuel prices, are mitigated, wage pressures (and associated shortages) appear likely to hamper Carnival’s operating profit margins.

Under these scenarios, the downside is challenging to assess as I do not believe it is likely that Carnival will become profitable again until at least 2025-2026 – or after all economic pressures end. By then, Carnival’s already weak liquidity and solvency position could push it toward restructuring or massive equity dilution. Carnival has a very weak credit rating after suffering many downgrades, meaning it (essentially) cannot pursue more debt financing, making restructuring or substantial dilution the only likely alternative. In that case, CCL would likely lose most of its remaining value today.

The bottom line is that CCL’s future is likely a bit binary; its profits may fully recover, in which case its stock probably has little remaining upside, or economic pressures could upset the recovery, potentially causing its balance sheet risks to bankrupt to the firm (or force dilutions). Since its leverage is so high, there is relatively little middle ground. That said, if I assume there is a 40% chance of negative economic pressures causing an 80-100% decline in CCL’s value or a 60% probability of total income recovery, which I believe offers no further upside. Thus, my estimated “expected value” of CCL is 36% below its current price. That equates to essentially $7.5 per share, close to its price before the recent rally.

I am not predicting CCL will face bankruptcy or mass dilution, but discounting the stock according to that probability. My chief bearish argument is that Carnival is unlikely to rise any more than it already has from a recovery. If it is unlikely to grow further and could fall substantially if that recovery does not pan out, then it seems investors should avoid the stock at its current price. Of course, for short sellers, there is a material risk that CCL continues to rally on (seemingly) irrational exuberance or a short squeeze, so CCL could rise above its current price. However, in the long run, I believe it is generally unlikely to sustain its current price based on the company’s fundamentals and the economy at large.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in CCL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.