Summary:

- Although consumers are searching for vacation experiences rather than destinations only, Carnival Corporation & plc. (CCL) has struggled to provide value for investors over the last decade.

- Carnival Corporation & plc. (CCL) is significantly overvalued and poses a risk for investment due to high debt levels and struggling fundamentals post-pandemic.

- CCL’s key fundamentals, such as ROIC, WACC, ROE, and ROA, indicate a weak financial position compared to peers like RCL.

- Based on a discounted cash flow model, fair value for CCL is estimated to be significantly lower than the current share price.

Joel Carillet

Investment Thesis

I recently discussed a fundamental analysis on a competitor in the same sector of Carnival Corporation & plc (NYSE:CCL), Royal Caribbean Cruises Ltd. (RCL). When I evaluated RCL, in the article titled: Royal Caribbean Cruises: Estimated Earnings Already Priced In, it seemed that the company was fairly valued and showed promise as an investment given the fundamental rebound from pandemic lows. I rated RCL as a hold because it is still turning around in those key fundamentals. Carnival Corporation & plc. is another international cruise line that has a diverse portfolio of leisure assets such as their cruise line, ports, private islands, and hotels/lodges. I conducted a fundamental analysis which included a discounted cash flow model based on their earnings and I believe that CCL is significantly overvalued, posing a risk for investment capital with their significant debt levels. They have struggled to return to their 2019 business fundamentals after being impacted from the pandemic, and this is unlike some of their better performing peers. Given the fundamental analysis and valuation presented, I am designating CCL as a sell, meaning that I would not buy this company today and that there are safer places for an investment with a higher potential for better returns.

Company Description

Founded in 1972, Carnival Corporation & plc (CCL) is another international cruise line that operates through numerous brands such as their Princess and Carnival Cruises. Like their peer RCL, CCL is in the consumer discretionary sector and also categorized in the hotels, resorts, and cruise lines industry. Macro-economic pressures should be a focus to investors if consumers are struggling, CCL’s revenues may be impacted. However, the opposite is also true that if the economy is booming, CCL will likely benefit. In CCL’s earnings call, management described that they had a record book position with a high level of new guests. For now, the economic environment for leisure seems to be strong, and this is also evident in the geographic region breakdown of revenue.

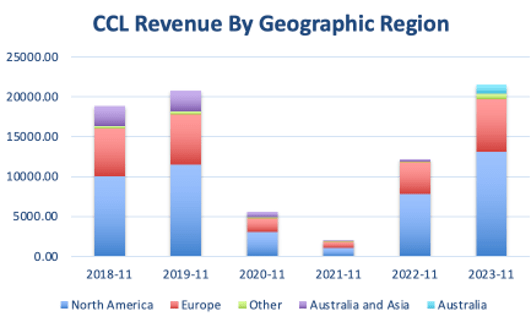

Revenue By Geographic Region

As you can see in the chart below, CCL’s revenue over the last few years is primarily made up of sales in the United States. Luckily, the consumer remains strong with their discussion about record bookings in their recent earnings call, however, revenue growth has been modest. Compared to 2019, CCL’s revenue from the United States is only 14% higher in 2023. This is only a slight rebound overall after the pandemic lows seen in 2020 and 2021. Moreover, in 2023, CCL adjusted their reported revenues from Australia and Asia to solely Australia given the growth they’ve had in this geographic region. This growth was described in their recent earnings call where they stated that CCL is responsible for over 60% of patrons in the Australian market.

CCL: Revenue by geographic regions (North America, Europe, Asia, and Australia) since 2018. (GuruFocus)

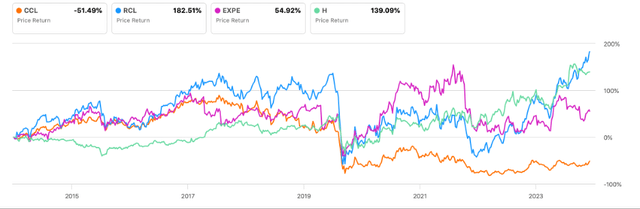

Industry Comparison and Outline

Like their peer RCL, CCL was significantly impacted from the pandemic during 2020 and 2021 with significant decline in all key fundamentals. This lead to the company taking on massive amounts of debt and issuing more shares to raise cash. However, unlike their peer, CCL has not been able to rebound from the lows of 2020 as nicely and is still struggling to provide value for investors. Over the last decade, RCL has returned 182% compared to CCL’s return of -51.49%. Moreover, CCL has lagged behind other peers in this sector such as Expedia Group, Inc. (EXPE) and Hyatt Hotels Corporation (H) which indicates to me that this is not a sector/industry specific decline but failure of the company to provide value for investors. Now, let’s take a look at key fundamentals that will continue to indicate the risk of investing in this company.

Comparison of price return over the last decade for CCL and industry peers. (Seeking Alpha)

Fundamental Analysis

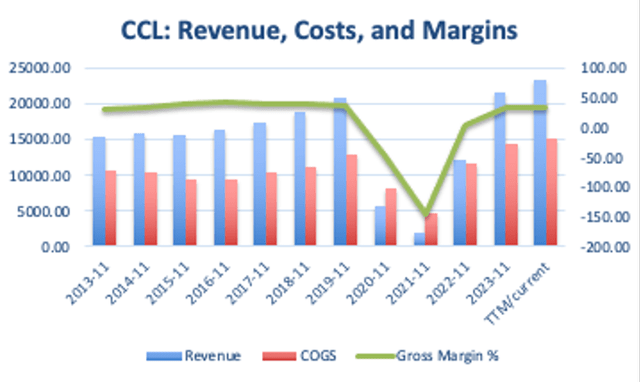

(CCL), which is currently priced at $18.37 per share as of the close on June 27th, is trading at a forward non-GAAP PE of 16.22 and trailing twelve-month GAAP PE of 25.17. They are trading at a sales to price ratio of 0.96 over the trailing twelve months and a forward price to sales ratio of 0.91. This is just slightly lower than the sector median, but significantly lower than their 5-year average. Additionally, this company is trading at a trailing twelve-month EV/EBITDA ratio of 9.78 and forward ratio of 8.95 which are both slightly lower than the industry. For context, their peer RCL, which has performed well, trades at an EV/EBITDA ratio of 12.83 over the trailing twelve months and 10.87 on a forward basis. CCL is valued slightly lower now than the out-performer in this sector, but the stock price has not reflected that as earnings and revenue have not significantly rebounded since the pandemic. Compared to 2019, total revenue has only increased by 13% while costs have grown by 17%.

CCL: Revenue, costs of goods sold (COGS), and gross margins since 2013 with dollars per million on the left and percentage of margins on the right. (GuruFocus)

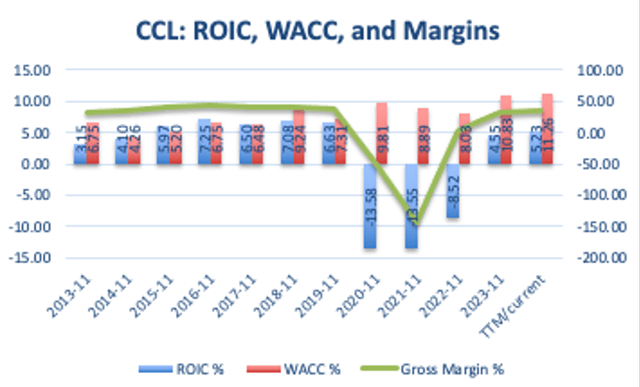

As costs are increasing while the company is struggling to grow their revenue at a significant rate, let’s look at the return on invested capital (ROIC) and weighted cost of capital (WACC). Currently, CCL has a WACC that is more than double that of ROIC, which is a significantly negative ratio (ROIC-WACC). This is concerning given that the last time ROIC was greater than WACC, as you would see in a great company, was 2017. This is an indication that the company was starting to struggle prior to the pandemic. However, CCL is still attempting to make their footprint in the travel and leisure industry and may be growing with their increased revenue in the Australian market over recent years.

CCL: Return on invested capital (ROIC), weighted cost of capital (WACC), and gross margins since 2013 shown in percentages. (GuruFocus)

CCL: Return on Assets and Equity

As you can see in the chart below, CCL demonstrates a low return on equity (ROE), low return on capital employed (ROCE), and almost non-existent return on assets (ROA). This further indicates that management has continued to not make smart decisions with their investments to provide value for investors, and the company is struggling. Compared to the year 2019, which is prior to the pandemic, ROE has only increased by 13%, ROCE has decreased by 22%, and ROA has decreased by 74%. If the company continues with these lower returns and declines, they may struggle to pay back or restructure their outstanding debt, even with record bookings. However, as ROE is recently positive, this metric is a similar characteristic of RCL where ROE is far outpacing ROCE and ROA and this may be indicative of the start to a turn around for CCL.

CCL: Return on equity, return on capital employed, and return on assets, since 2013. (GuruFocus)

Per Share Declines

Carnival Corporation & plc. at one point over the last decade had growing earnings per share, growing book value, and modest debt levels. Currently, debt levels per share have far exceeded book value, cash per share, and earnings per share. Since 2019, debt has increased by 43% while earnings have declined by 85%. The earnings decline per share is somewhat intensified from the massive amount of shareholder equity loss due to the issuance of more shares in starting in 2020 with a share buyback ratio of about -59%, and continual negative buyback ratio since then. Similarly, over the last decade, book value has declined by 16.4% on an annualized basis. Comparing to their peer RCL, CCL continues to struggle and the company may be at risk of further declines.

CCL: Per share data for earnings, cash, book value, and debt since 2013. (GuruFocus)

Fair Value

Following a discounted cash flow model (DCF) with the assumptions of a 10% growth rate over the next 10 years, and 5% growth rate for the following 10 years, CCL is significantly overvalued. As you can see in the table below, I calculated fair value for CCL to be around $11.59 per share based on their current diluted trailing twelve month EPS of $0.65 and assuming a 10% discount rate for a margin of safety. This valuation represents a significant decline from the current share price. However, if we assume CCL will hit their EPS estimates of $1.13/share at the end of 2024, then fair value would be closer to $20.13 per share. This would mean over a 100% growth in their earnings which the company has yet to show a sustained positive turn around in the key fundamentals outlined above. Investors should consider the current valuation versus the estimated valuation along with the macroeconomic environment when considering a position in CCL as these are all factors that would impact investor sentiment and thus returns on investment capital.

Fair value calculation based on a DCF model using earnings per share instead of free cash flow. (Author’s Calculations)

Limitations to Investment thesis

In the above discounted cash flow model, the assumptions made are conservative in nature, assuming a 10% discount rate to provide a margin of safety. This margin of safety is attempting to account for the uncertainties in the consumer discretionary space over a short period of time, and provide a cushion for my growth estimates over the next 10-20 years. Additionally, as we have seen with their peer RCL, CCL may continue this turnaround trend over the next few quarters and surpass their earnings expectations, which would impact this discounted cash flow valuation model and the assumptions I made. If the company can successfully provide higher returns on investments and higher earnings for investors, the share price would likely increase.

Furthermore, as this fundamental analysis is primarily looking at the last 10 years of data, we are limited in the fact that past performance does not always guarantee future returns, or in this case, future expected declines. As this DCF model is based on assumptions I made about the business expected growth and industry concerns, and the fundamental analysis is based on past performance over the last decade including the pandemic years, the dynamic nature of business and the economy pose risk to this thesis. If the United States economy continues to remain strong, and CCL continues with their record bookings due to a strong consumer, this would impact earnings positively and pose risk to the calculations in the DCF model above, thus changing the fair value price target.

Concerns About Investing in CCL

My concerns based on fundamental analysis for CCL are that key fundamentals currently do not represent the company as a buying opportunity such as ROIC, ROE, and ROA. Additionally, although the company recently described in their earnings call that they are paying down and restructuring debt, they are still taking on more debt levels and investing into assets that will not be in commission for a few more years. Given that they have had record bookings and are still struggling to provide a return for investors makes me wonder if they are overpaying for some of their assets that are not yet in commission or are attempting to grow too quickly to compete with other cruise lines. Either way, if there is a decline in foot traffic, this company may be at significant risk depending on their outstanding liabilities. Debt level are of paramount concern for a company that is attempting to turn things around.

Conclusion

Based on the fundamental analysis above, I am designating CCL as a sell because I believe the key fundamentals indicate a severe overvaluation and high risk to invested capital in this company that peers in the sector like RCL, EXPE, and H are not displaying. CCL displays a high level of debt, declining book value, and very negative ROIC-WACC which are all factors of a weak financial position. Moreover, as the company has continued to struggle since the pandemic lows, direct competitors like RCL have provided a monstrous return to investors and have a brighter outlook. If you are looking for an investment into the consumer discretionary sector and looking to capitalize on the excess in leisure spending and travel, I would consider other investments before CCL given the outlined risks. Regardless, as a conservative investor I miss out on companies that do not meet my strict fundamental investing criteria and given that businesses are dynamic, small changes in these fundamentals may lead to stock appreciation. I believe there are better opportunities in the current environment than an investment in a turnaround play like CCL, however, given my strict criteria I will miss some more speculative investment opportunities. Investors should perform their own analysis and collect their own research before making any investment decisions, as this analysis includes my opinions about the company and own research.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.