Summary:

- CCL is likely to continue reporting robust performance metrics ahead, thanks to the raised FY2024 guidance and promising FY2025 commentary.

- The same has been observed in its travel/cruising peers and the Cruise Lines International Association, with the ocean-going cruise passengers to grow at a CAGR of +5.59% through 2028.

- Thanks to the 50 basis point rate cut, a lower borrowing cost is likely to trigger the improvement in market and consumer sentiments/ spending trends.

- Even so, readers may also want to temper their near-term expectations, since the reinstatement of CCL’s dividend is likely to occur only by 2026.

whyframestudio/iStock via Getty Images

The Cruise Investment Thesis Remains Compelling, As The Fed Pivot (Likely) Brings About Improved Consumer Confidence

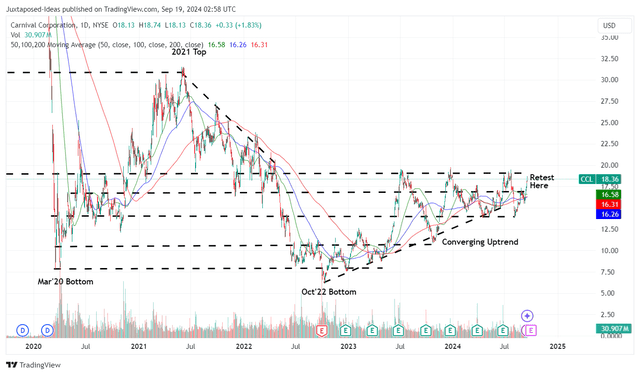

We previously covered Carnival Corporation & plc (NYSE:CCL) in November 2023, discussing its converging uptrend since early 2024, as buying momentum decelerated and the high inflationary/ elevated interest rate environment continued.

With the company unlikely to offer any dividends any time soon, we believed that the stock was likely to trade sideways in the near-term, resulting in our reiterated Hold (Neutral) rating then.

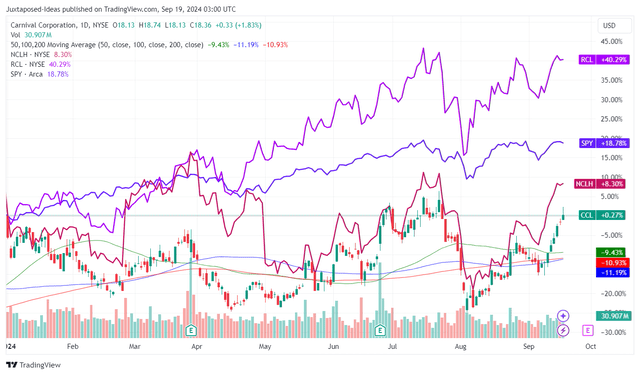

CCL YTD Stock Price

Since then, CCL has had a painful -11% correction in July 2024 attributed to the market wide rotation, with the stock charting an impressive recovery by +28.6% afterwards, compared to the wider market at -5.4%/ +8.8%, respectively.

Part of the tailwinds are naturally attributed to the cooling inflation and the relatively healthy labor market, with these developments already contributing to the cruise liner’s record high customer deposit at $8.3B (+18.5% QoQ/ +15.2% YoY) along with the robust booking trends for FY2025, with it being “even higher than 2024 in both price (in constant currency) and occupancy.”

These developments have also led to CCL’s robust YTD adj EBITDA generation of $2.06B (+94.3% YoY), YTD adj Free Cash Flow of $2.66B (+246.4% YoY), and moderating FQ2’24 long-term debts of $27.15B (-4.8% QoQ/ -14.9% YoY).

This is on top of the raised FY2024 adj EBITDA guidance of $5.83B (+37.8% YoY), which may trigger an estimated end-of-year net-debt-to-EBITDA ratio of 4.65x, drastically lower from FY2023 levels of 6.51x while still elevated from FY2019 levels of 2.02x.

With the management already expecting “substantial free cash flow driven by our ongoing operational execution and the lowest new build order book in decades to deliver continued improvements in our leverage metrics and balance sheet,” we believe that CCL is finally a Buy at these levels.

With the cruise liner set to announce their FQ3’24 earnings call on September 30, 2024, readers may want to focus on these performance metrics indeed, since they are highly indicative of the durability of consumer cruising trends along with the health of its balance sheet – one that was previously devastated by the COVID-19 pandemic.

Even so, market trends continue to point to the robust consumer travel trends, as similarly reported by Booking Holdings (BKNG), Norwegian Cruise Line (NCLH), and Royal Caribbean (RCL) in their latest earnings call.

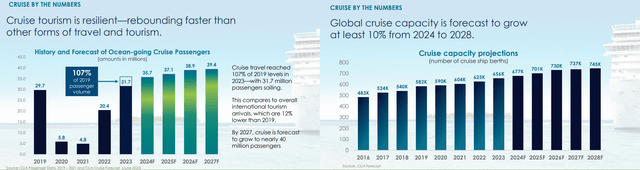

If anything, the cruise industry is expected to remain resilient despite the near-term noise surrounding the Fed’s pivot in the September 2024 FOMC meeting, as projected by the Cruise Lines International Association [CLIA].

Projected Cruise Trends

The CLIA already expects the ocean going cruise passengers to grow from 31.7M in 2023 to 39.4M in 2027, expanding at a CAGR of +5.59% – as the global cruise capacity also grows by “at least +10% from 2024 to 2028.”

Part of the tailwinds are attributed to the relative stable age of cruisers at 46 years old by 2023, compared to the 46.8 observed in 2019, with it implying the growing popularity and expanding target demographics of cruise travelers in general.

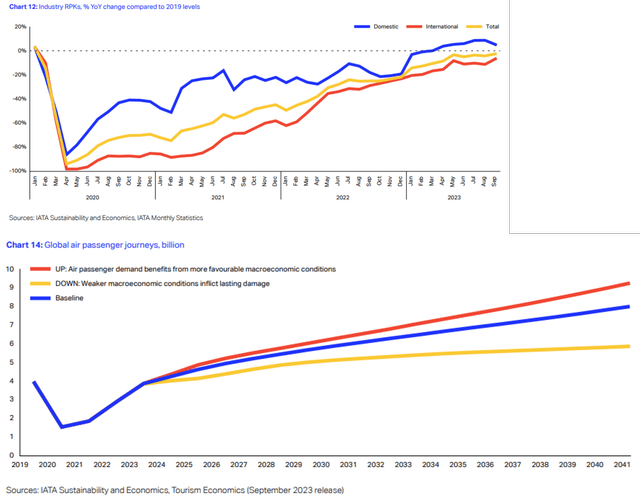

Global Air Travel Trends & Projections

If anything, global air travel has also recovered near to pre-pandemic averages by the end of 2023, with things to further grow over the next few years as the “global commercial aviation fleet also expands by +33% to more than 36,000 aircraft by 2033, according to an Oliver Wyman analysis.”

These developments further underscore the continuity of travel and consumer spending trends, with CCL likely to report another beat and raise performance in the upcoming FQ3’24 earnings call.

Thanks to the 50 basis point rate cut, we believe that a lower borrowing cost is likely to trigger the improvement in market and consumer sentiments, with it potentially contributing to the stock’s further price recovery and improved consumer booking trends, respectively.

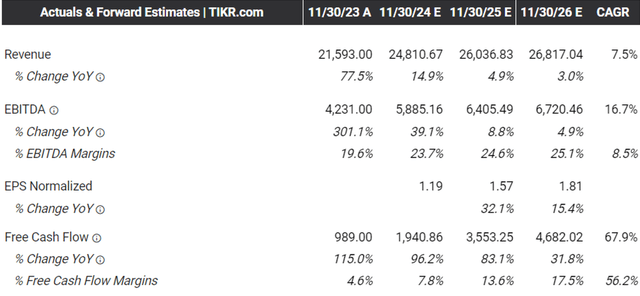

The Consensus Forward Estimates

As a result of these developments, we can understand why the consensus forward estimates appear to be very promising, with CCL expected to generate an accelerated top/ bottom-line expansion at a CAGR of +7.5%/ +23.5% through FY2026.

This is compared to the previous estimates of +3.3%/ +22% and the historical growth at +8.3%/ +8.4% between FY2016 and FY2019, respectively.

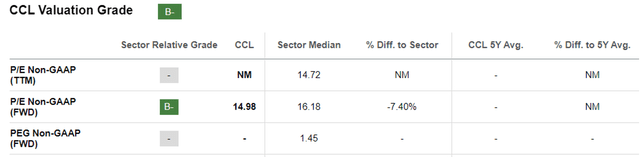

CCL Valuations

As a result, we believe that CCL is not expensive at FWD P/E non-GAAP valuations of 14.98x, compared to its 1Y mean of 15.56x and 3Y pre-pandemic mean of 13.65x.

This is attributed to the estimated FWD PEG non-GAAP ratio of 0.63x, based on the projected expansion in its adj EPS at a CAGR of +23.5% through FY2026.

While elevated compared to CCL’s cruise peers, such as RCL at 0.46x and NCLH at 0.24x, the former’s valuation is still lower than the sector median PEG non-GAAP ratio of 0.92x observed during the pre-pandemic levels.

As a result, we believe CCL continues to trade reasonably at current levels, offering interested investors with the decent margin of safety.

So, Is CCL Stock A Buy, Sell, or Hold?

CCL 5Y Stock Price

For now, CCL has already broken out of its converging uptrend since the October 2022 bottom, partly attributed to the recent July 2024 market rotation.

Even so, based on the pre-pandemic P/E mean of 13.65x and the consensus FY2026 adj EPS estimates of $1.81, the correction has triggered an excellent upside potential of +34.5% to our long-term price target of $24.70.

As a result of its improving performance metrics and the promising industry trends, we are cautiously upgrading the CCL stock to a Buy.

Risk Warning

Part of CCL’s stock recovery after the July 2024 market rotation is undeniably attributed to the Fed’s pivot in the September 2024 FOMC meeting.

However, it remains to be seen when the CPI may return to the Fed’s target rate of 2%, with the process of macroeconomic normalization likely to bring forth some uncertainty regarding the soft/ hard landings along with the labor market health.

While CCL has reported a robust consumer deposit growth and offered an optimistic FY2025 commentary, readers may want to closely monitor the developing situation, since a prolonged normalization process may trigger a softening in booking metrics, worsened by the tougher YoY comparison from FY2025 onwards.

At the same time, readers may also want to temper their near-term expectations, since the management has guided a return to investment-grade leverage metrics by 2026 – implying that the reinstatement in dividend payouts is unlikely to occur over the next one and a half years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.