Summary:

- Since 2019, Carnival Corporation debt ballooned by 3x and interest expense by 10x, due to a double whammy hit from Covid followed by rate hikes.

- Deleveraging plans shared by CCL management is poised to drive recovery in EPS to $2.2 by 2026, via strategic paydown of debt, leading to significant savings in interest payments.

- The deleveraging playbook can be comfortably executed with current cash flows at record highs over pre-Covid levels, and from lowered CAPEX due to lesser new ship deliveries.

- Applying a historical P/E of about 14 to forecasted 2026 EPS of $2.2 derives an intrinsic value of $30, a potential two-bagger from the current share price of $16.5.

Editor’s note: Seeking Alpha is proud to welcome Edpha Investor as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

kynny

A Deleveraging Play

Carnival Corporation (NYSE:CCL) is poised for significant earnings recovery from material interest payment savings, via executing its deleveraging playbook. In my opinion, the investment thesis can be comfortably executed by management, presenting a compelling opportunity to potentially materialize substantial alpha from its current share price of $16.5.

The cruise industry went through a torrid time, with Covid halting almost all cruise operations throughout 2020-2021. Cruise lines had to issue shares and/or take on more debt to keep the companies afloat. As cruise operations began recovering in 2022, an inflationary environment triggered rate hikes, leading to a huge interest payment burden on high debt cruise lines.

Compared to Royal Caribbean (RCL) and Norwegian Cruise (NCLH), CCL capital structure and profit took the most hit due to its much larger fleet, more than twice its peers by number of ships. CCL’s long-term debt rose by more than 3x from $9.7b (Q4 2019) to a high of $32.5b (Q2 2023) while annual interest payment spiked 10x from $205m (2019) to $2.1b (2023).

At Inflection Point

I believe a major recovery cycle for CCL earnings is underway as the world moved past the pandemic and await for rate cuts. What differentiates CCL from its peers is the magnitude of the potential interest payment savings from deleveraging, which can drive huge upside in Earnings per share (EPS) followed by share price.

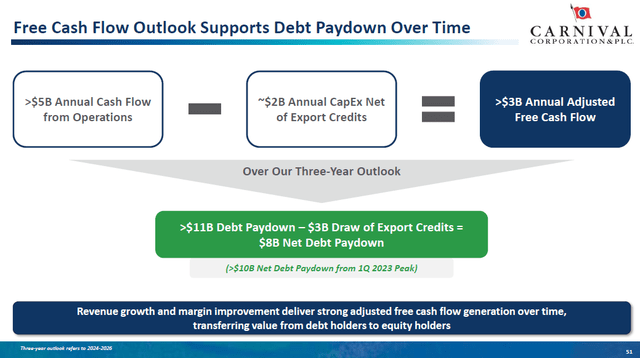

The plan to deleverage and transfer value from debt to equity holders was communicated by CCL management at its June 2023 Investor Day, with a commitment to cut net debt by more than $10b come 2026 to uplift EPS via lower interest payment.

Free Cash Flow drives debt pay down (Carnival Investor Day June 2023)

The path to deleveraging and EPS recovery is clear and achievable based on the 3 strategic levers that I identified. Foremost, CCL can strategically pre-pay or refinance its high-interest rate (~7-10%) debt taken during distress. Secondly, CCL operating cash flow has recovered past pre-Covid high, has lowered capital expenditure with lesser new ship deliveries, and halted dividends, which means all cash flows can be used to pay off debt. Also, CCL has leveraged on record-high client deposits, which are pre-book, mostly non-refundable and at a record high price for 2025 sail, as ‘free loans’ to reduce debt. The continued improvement in capital structure would enhance CCL credit rating and lower the cost of debt.

In my view, the high probability of management successfully executing its playbook is yet to be recognised by the market due to multiple reasons. Investors could be extra cautious of high debt companies after being spooked by the recent high rate cycle. Recessionary fears may also keep investors away from consumer discretionary stocks like cruise lines.

Most importantly, there is probably a lack of focus on CCL’s unique debt schedule, which means the market would have missed the 3 strategic levers and underestimated the impact of deleveraging on the company’s earnings. Hence, I will next quantify and illustrate how the levers enable CCL to reduce its debt, provide interest rate savings and materially drive EPS.

Committed Debt Reduction Is Achievable

I forecasted free cash flows (FCF) of $1.2b in 2024, $3.5b in 2025 and $3.7b in 2026, which can comfortably meet management commitment to reduce debt by $12b, from the peak of $32.5b in Q1 2023 to $20.7b in 2026.

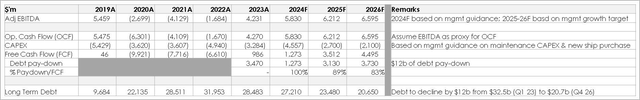

Actual (A) and forecasted (F) financials (Carnival Annual and Quarterly Reports)

Next, I will dive into the details of how I derived my forecast of Earnings before interest tax, depreciation & amortization (EBITDA), Operating Cash Flow (OCF), Capital Expenditure (CAPEX) followed by FCF. Do note, I have proxied OCF with EBITDA as both were historically close approximates.

- Forecast of EBITDA and OCF

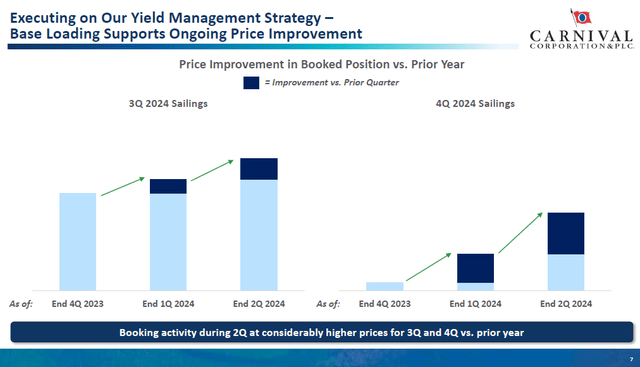

Management guided for 2024 EBITDA to increase to $5.8b. The guidance is plausible after observing a record-breaking Q2 in revenue, operating profit, booking levels and customer deposits. For example, pricing for Q3-4 2024 sail were booked in Q2 at considerably higher prices over prior year, as shown on Pg 7 of Q2 2024 CCL Earning Presentation:

Price increase booked in Q2 for future Q3 and Q4 2024 Sail (Carnival Earnings Q2 2024 Presentation deck)

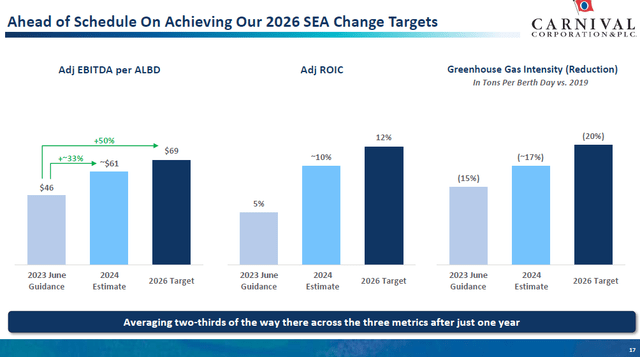

2026 EBITDA was forecasted at $6.6b, an increase of 13% over 2024. I relied on management guidance of 13% growth in EBITDA per available lower berth day (ABLD – a standard measure of passenger capacity), as shown on Pg 7 of Q2 2024 CCL Earning Presentation:

2026 Target in EBIDTA per ALBD, ROIC and Green Gas Intensity (Carnival Earnings Q2 2024 Presentation deck)

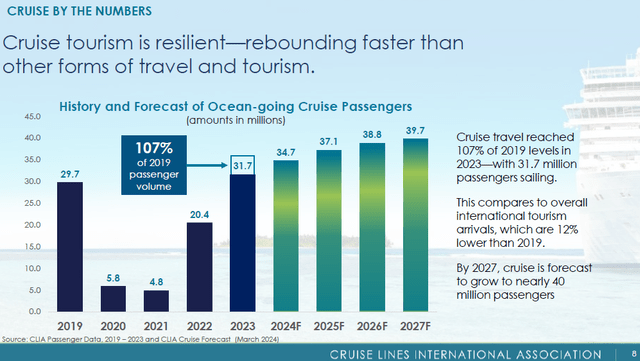

Cross-checking against industry data, a forecast of 13% EBITDA growth from 2024-2026 is aligned to the projected increase in the number of cruise passengers of 12% from 34.7m to 38.8m, as shown on Pg 8 in the State of The Cruise Industry Report May 2024.

Cruise Passenger Count (Cruise Lines International Association)

Having established a 2-year EBITDA growth of 13%, I assumed a liner increase of 6+% in EBITDA from 2024 to 2025 followed by 2025 to 2026.

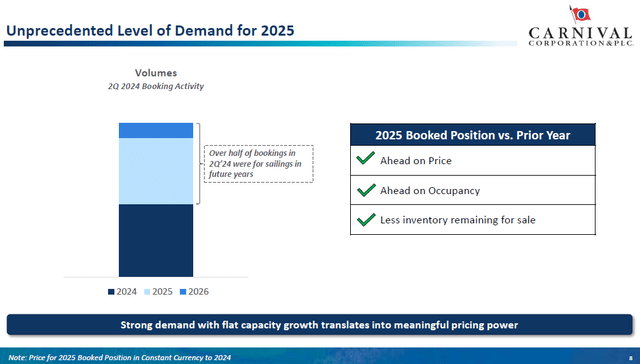

Hence, 2025 EBITDA is forecasted at $6.2b and assumed to be driven by higher price and occupancy booked till date for 2025 sail, as shown on Pg 8 of Q2 2024 CCL Earning Presentation:

Booking in Q2 2024 for future sail in 2024-2026 (Carnival Earnings Q2 2024 Presentation deck)

Similarly, 2026 EBITDA is forecasted at $6.6b and assumed growth is from the ramping of the new private island Celebration Key (CK) to be launched in 2H 2025. Incremental financials from CK are likened by management to a few new ships, mainly from higher price, more spending on the island and fuel savings due to proximity of CK to port as compared to the usual ship routes.

- Forecast of CAPEX

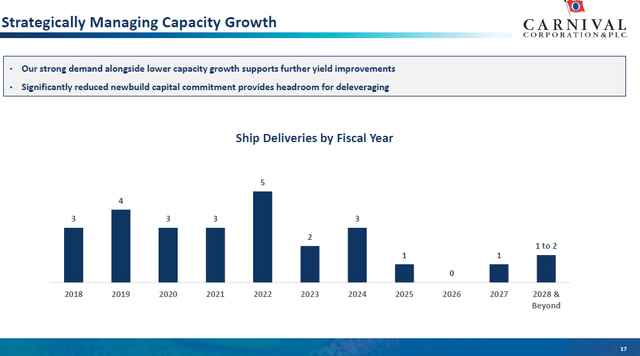

Looking into CAPEX, management has guided for a cut in spending by reducing the number of new ship deliveries, as shown on Pg 17 of Q1 2024 CCL Earning Presentation:

Number of new ship deliveries (Carnival Earnings Q1 2024 Presentation deck)

2024 CAPEX is forecasted by management to be $4.6b, largely due to 3 new ships delivered in North America and Europe during 1H 2024 to tap on high demand. 2025 CAPEX is guided to reduce significantly YoY to $2.7b, due to only 1 new ship delivery of $1b and usual maintenance CAPEX of $1.8b. 2026 CAPEX is expected to further decrease to $2.1b due to maintenance CAPEX only with no new ship delivery for the year.

- Forecast of FCF and Debt Reduction

Combining the actual and forecasted EBITDA (or OCF) and CAPEX, I derived FCF of $9.3b which can pay down debt by $8.1b aggregated across 2024-2026, excess cash left to shore up CCL balance sheet and improve its credit rating. Combined with $3.5b of debt already paid off in 2023, CCL can comfortably deleverage by $12b from 2023-2026.

EPS To Be Driven By Interest Savings

I forecasted interest savings from debt pay-down of $12b to lift EPS from losses across 2020-2022, to $1.2 in 2024, $1.6 in 2025 and $2.2 in 2026. A significant driver to EPS recovery is from the halving of annual interest payment from a high of $2.1m in 2023 to $1.1m in 2026, coupled with growth in EBITDA as explained in the previous section.

Actual (A) and forecasted (F) financials (Carnival Annual and Quarterly Reports)

Next, I will elaborate on how the annual interest payments are forecasted.

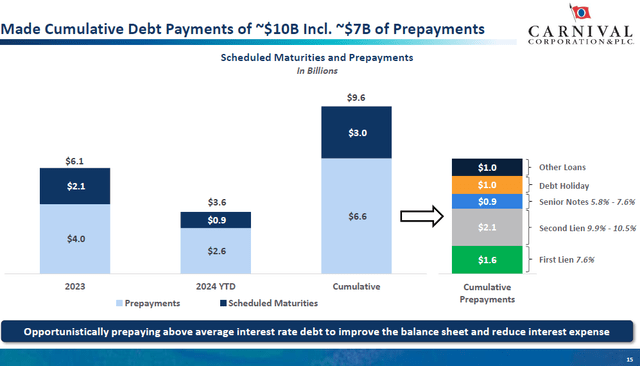

2024 interest payment was guided by management to be $1.7b, down significantly YoY due to strong debt prepayment momentum as shown on Pg 15 of Q2 2024 CCL Earning Presentation:

Debt payment from 2023-YTD 2024 Q2 (Carnival Earnings Q2 2024 Presentation deck)

The key to forecasting interest savings in 2025-2026 lies in analyzing the CCL debt schedule listed in the Notes to Consolidated Financial Statements (Note 3), found in the Q2 2024 10Q filings. The debt schedule provides critical information such as interest rates, period of maturity, loan quantum, fixed or floating terms and currency.

Using this information, I forecasted YoY interest saving of $170m in 2025 and $443m in 2026 by assuming CCL strategically pays off the highest interest rate debt first. To be conservative, I also assumed interest savings for half a year during the year of debt pay-down, and a full-year benefit to be derived from subsequent years.

My forecast of debt pay down and interest saving based on Debt Schedule (Carnival Debt schedule – Carnival 10Q Q2 2024)

This would result in the halving of annual interest payment from $2.1m in 2023 to $1.1m in 2026, and contributing to EPS of $2.2 in the same year.

Attractive Risk-to-reward

Referencing to past trends, CCL P/E ratio traded between 12-15 between 2011-2019, during normalized periods excluding Covid. If I apply a reasonable P/E ratio of 14 and forecasted 2026 EPS of $2.2, the intrinsic value would be about $30 per share, almost a two-bagger from the current share price.

In addition, several potential catalysts were not accounted for in my forecasts. Firstly, current margins are growing at double-digits and may continue at this pace, while I assumed a lower EBITDA growth of 6+% in 2025 and 2026. Secondly, I only forecasted for interest savings from debt pay down. Further savings can come from variable-rate loans benefitting from a decline in benchmark interest, and refinancing of debt at lower rates, e.g. CCL redeemed 7.6% unsecured notes and priced new offerings at 5.75% in April 2024. Thirdly, improved sentiment from reduction in debt and global interest rates may provide valuation upside. Also, a faster than expected recovery in capital structure may open room to resume dividend.

Thus, CCL presents a compelling risk-to-reward opportunity.

Major Risk Factors

However, it’s critical to be mindful of the potential risks that can derail my investment thesis. Pandemic is clearly a major risk to cruise operations, and the spread of Mpox warrants concerns. Notably, the World Health Organization has recently declared Mpox to be a public health emergency.

Also, softening of the consumer market may cause headwind to CCL earnings. The impact to CCL may be substantial given that it serves the mass market whose spending is more sensitive to economic fundamentals. The basis of my thesis is to rely on improved cash flows to pay off debt, which means adverse impact by the economy on CCL revenue or earnings directly reduces the company’s ability to generate the forecasted interest savings.

Conclusion

In summary, the deleveraging playbook is unique to CCL, and can be comfortably executed off conservative assumptions. It’s also a special situation where CCL was consecutively hit with the double whammy of Covid followed by rate hikes. Thus, CCL is a highly attractive and timely investment, with potential near to doubling in share price from the current $16.5 to $30 by 2026.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

I am sharing this idea for educational purpose only, and not as investment advice. I do own the stock and may be biased in my view. Information in this article may also be inaccurate or out-dated. Readers are to exercise caution and conduct own due diligence before making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.