Summary:

- CCL has outperformed in 3Q24, aiming at even stronger results in guidance through this year and the next three.

- The stock spiked on earnings call indicating more to come based on management guidance conviction for balance of ’24 and ’25.

- CCL’s strength in the Millennial generations will power its growth ahead while maintaining its grip on the over 62 base customer.

Above: Targeting younger demos has paid off for CCL Jose Luis Pelaez Inc/DigitalVision via Getty Images

Premise: Carnival Cruise Lines (NYSE:CCL) in its September 30th, 3Q24 earnings release achieved one of the best post-Covid performances in the entire consumer leisure space. It broke the records of many of its pre-Covid metrics. In brief, it appears the company has now shed most of its Covid blues. Its strategy post-Covid bears a similar focus to that of Warner Brothers Discovery (WBD): FCF mainly aimed at rapid debt repayment.

Generating max FCF devoted to paying down massive debt as speedily as possible unfortunately doesn’t work for WBD stock, but it clearly has for CCL. Getting the balance sheet healthy, cutting operating costs and rebuilding the fortress of product and marketing expansion that propelled you to global leadership in the sector is the CCL pathway. Moodys, S&P and Fitch have all upgraded CCL’s credit ratings to BB. The balance sheet is getting healthier. Management says it’s committed to continue paydowns.

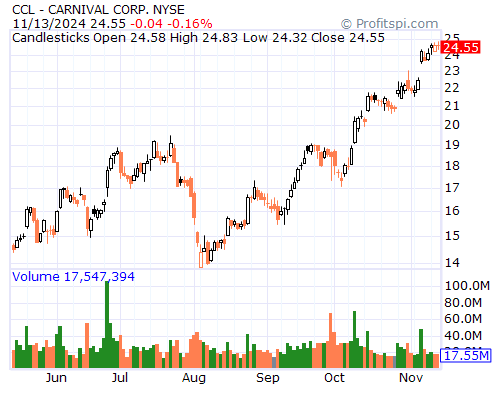

Just prior to the 3Q24 release CCL was ~$16 a share. Post-release it has now moved to $24.59 at writing. Analyst consensus is looking for a PT around $25/ $30, some in the high teens. We see a pathway ahead — free of black swans swimming into CCL’s ocean — to $56 by 2Q25. Our call is based on the beginning forward guidance of CCL that in our view foretells clear sailing ahead to more than doubling. In many ways, CCL is a unicorn in its sector. It dominates the sector in capacity and revenue base, the sector is benefitting from a strong demand from younger demographics. CCL’s leverage over the next five years will be coming down to a goal of $20B.

google

Above: The march to a much higher valuation has begun.

Let’s begin with a brief summary of a solid 3Q24 release:

- Net income $1.7b, up 60% YoY 2023. Outperformed guidance by $170m.

- 3Q24 revenue: $7.9b, up $1b YoY 2023.

- Operating income: $229m, up $554M YoY

- 3m guests in 2024 projected.

- ROIC: 10.5%

- Reasons for strong performance: Strong demand, relentless cost-cutting programs, record net yields up 5% YoY, AEBITDA: $1.14b up 20%, FCF $3B, Expecting 4Q24

- Debt ballooned to $36b in 2022 carrying Covid baggage loans and is now ~$30b. CCL guides a goal of reduction to $20b more in line with peers. Leverage ratio at 5.8x, not pretty but given the proven march north of FCF and debt reduction goals, CCL should have no problem financing if faced with underperforming quarters due to macro events.

- Expecting 4Q24 results with net yields up 5% YoY 2023, cost rises of 8%, AEBITDA $1.4b up 20%, FCF $3b.

2025/6 forecasts by management:

Bookings for 2025 are already 25% ahead of 2024 at same stage. However, there will be less inventory available so on a net basis margins will be stronger. Customer deposits are already at $8b. Expect: Net yields, per diems, the opening of Celebration Key fun island, the new Queen Anne ship, to the beating of baseline 2019 results on all key performance metrics. Capex for 2025 very low. No major headwinds ahead as far possible to bake in.

So the recovery cycle for CCL from Covid can reasonably be characterized as complete. What lies ahead, we believe, is a 5-year powerful surge of growth.

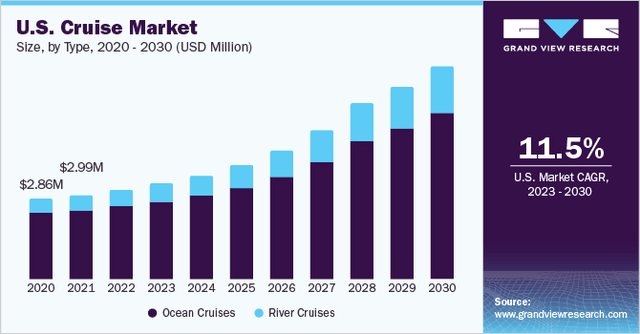

Above: Lay 11.5% CAGR against CCL market share as basis for value now.

What’s not in the grand plan?

What CCL management confirmed in response to 3Q analyst questions that they do not see the growing niche of river cruises in their priority list despite growth in that sector. Also, no dividends in sight until the debt load gets much lighter and the revenue arc as planned comes in as planned. Greece, a potential new but small market, is still in negotiations with local officials.

Overall CCL’s tight focus remains on: Mass consumer global value vs. other vacation options including land-based hotels. Maintaining its runaway revenue and global capacity leadership with its 100 ships, key brands and dominance of the strong North American market.

The demographic gold mine works for CLL better than peers:

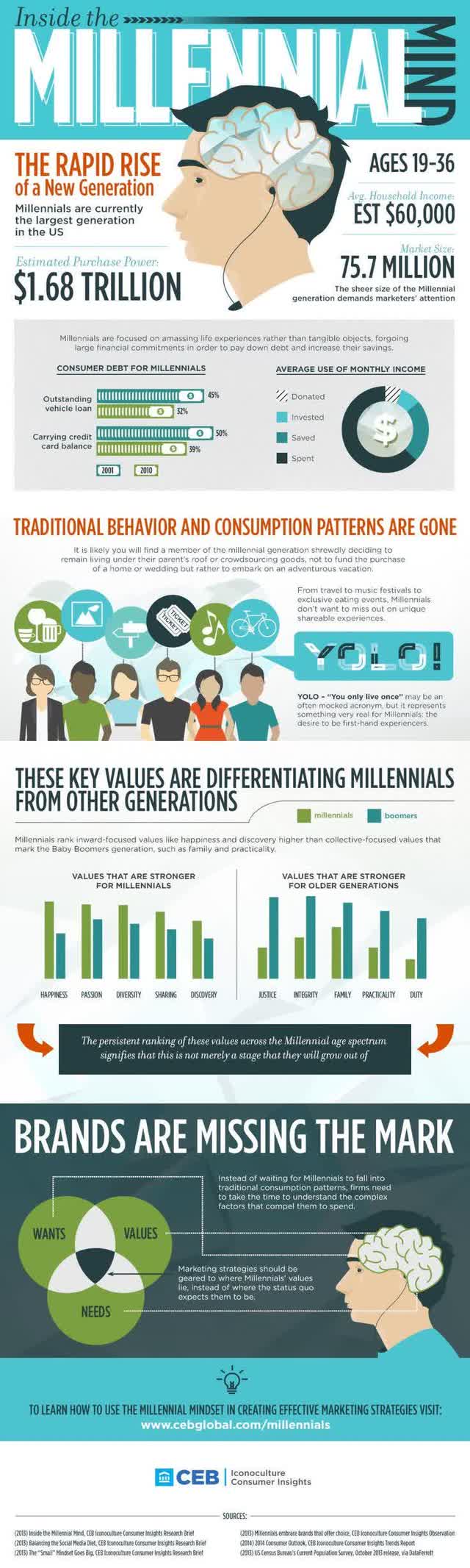

Over 73% of 95m US millennials surveyed by Pew Research answered ‘yes’ when asked if they would like to go on a cruise. The considerations: cost, short durations, and fun themes. Cruising has long appealed to older and retired generations — average age of cruisers being 62, comprising a large percent of passengers on longer distance and farther geography vacations. In brief, the runaway share leadership by CCL disproportionately benefits from the growth of these two demos. Baby boomers count of course but that cadre is starting to decline as a key segment for marketing.

The average age of cruise passengers has been falling and is now 47. That is remarkable given the hefting presence of elders in the mix.

Above: CCL’s business model targets this generation and is growing revenue.

CCL clocked revenue of $21.5b for FY 2023 meeting its pre-covid baseline 2019 record of $21B. The quick return of cruise passengers bears proof that the basic business model of CCL works. It will continue to gathering momentum as its short, theme cruises appealing to Millennial singles and families while holding older demos because it’s a real value deal vs. many other options available to these demos.

Aside from price, duration and experiences, we look a bit deeper. And that is where my more bullish PT is born.

Call it the YOLO factor. It is a particular change of attitude between younger demos and Boomers plus their older cadres. It has developed among younger people because, among others, several dramatic events have hit their consciousness in early life. The 2007-9 world financial crisis and its aftermath, the Covid disaster disrupting their lives. “Live life” scenarios among the young is the stuff in pop culture delivered with ever more invasive technology devices — in brief, the dominance of social media.

Y for You, O for Only, L for Live, O for Once — hence Yolo. Drilled somewhat down, Pew researchers found the generation less interesting in acquiring things. This includes cars, status jobs, upscaled living quarters, high fashion clothing, jewelry, and all manner of things prior generations strived for over decades. Instead, their value system’s foundation is experience. Food, restaurant dining, travel for exploring and expedition, smartphone babble, gatherings with friends, healthy lifestyles, pop culture. Neatly fit inside this youth bubble is the cruise. CCL is the biggest and best, catering to the mass of the younger generation with offerings that match their YOLO inclinations.

With their business model now a proven, if not powerful, survivor of all these macro crises, facing a consumer market targeting them dead center, it is hard for me to fall in with analyst PTs that have settled into an average range between $23 and $30 at last look.

I feel the premium here, is not always visible to investors. The excellent match of product and consumers that has such a lead in scale, that the PT we suggest here falls within a BUY signal that will strengthen over the next 3 quarters way beyond analyst PT consensus.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.