Summary:

- In 3Q24, CCL generated $7.89 billion and $1.7 billion in revenues and net income respectively, representing a year-on-year growth of 15.20% and 61.55% respectively.

- Multiple indicators suggest that overall demand in the cruise industry remains strong and will continue to serve as tailwinds for the company.

- Paying down debt is CCL’s utmost priority; it is an achievable but challenging task. CCL must manage its liquidity tactically. Fortunately, customer deposits stand at a high of $6.4 billion.

- Valuation analysis suggests that upside potential is limited as the company’s bottom line is significantly affected by interest payment.

ocuric

Introduction

Carnival Cruise Lines (NYSE:CCL) is a cruise operator headquartered in Miami, Florida. Currently, the company has 104 full-time employees with approximately 92 ships. Additionally, CCL has a diverse portfolio of cruise lines; some of these brands are Carnival Cruise Lines, Princess Cruises, Holland America Line, Costa Cruises, AIDA Cruises, and Cunard.

Since CCL’s share price plunge after Covid-19, we have yet to see the company’s share price recovering. As of today, CCL’s share price still remains around 50% of its pre-Covid levels. Ostensibly, it seems that the company has immense value at this price.

However, based on my analysis, upside potential for CCL remains muted at the current share price of $24. Although demand remains strong and the company has the capacity to pay down debt; interest payments will continue to plague the company’s financials in the next few years, affecting CCL’s bottom line. In this report, I will demonstrate why investors should not be misled by the current share price and should exercise patience for a better entry point.

Latest Developments

In 3Q24, CCL generated $7.89 billion and $1.7 billion in revenues and net income respectively, representing a revenue growth of 15.20% year-on-year and net income growth of 61.55%. During this period margins have improved primarily driven by lower cost of goods and SG&A. Gross margin improved to 58.12% from 56.35% while operating margin improved to 48.45% from 45.94%.

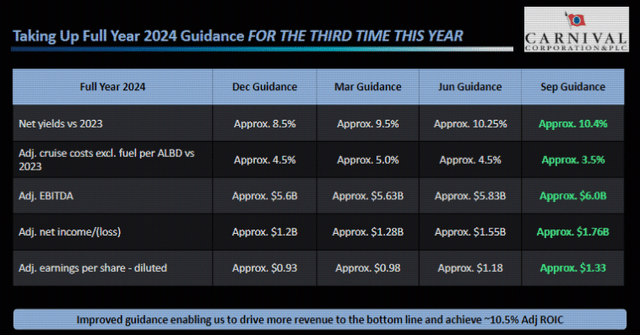

CCL’s FY2024 Guidance (Earnings Presentation)

As a result of strong demand, CCL raised its guidance again. CCL expects total net yields to improve 10.4% year-on-year. Cruise costs to improve to 3.5% from previous guidance of 4.5%. Adjusted net income and EPS to be $1.76 billion and $1.33m increasing by 13.54% and 12.71% respectively.

Multiple Indicators Suggest That Overall Demand Remains Strong And Will Continue to Serve as Tailwinds

Between 2020 and 2021, due to Covid-19, CCL’s financial performance has been affected due to global lockdowns and furloughs in the cruising industry. Since then, the company’s has effectively turned its ship around. Revenues which plunged from 4.7 billion in 1Q20 to 30 million in 3Q20 has already surpassed pre-Covid levels. Currently, CCL generates revenues of $7.89 billion, representing 1.7x of pre-Covid revenues.

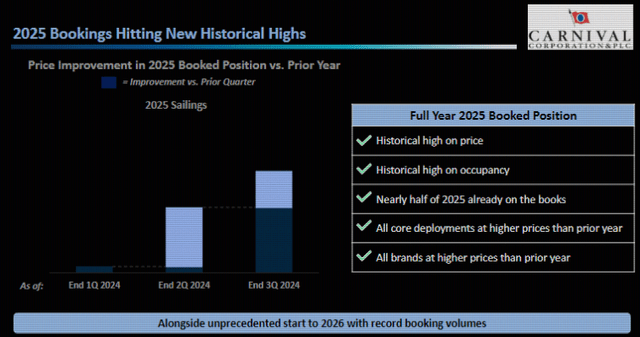

CCL’s 2025 Bookings (Earnings Presentation)

More importantly, demand remains robust despite a macroeconomic environment plagued with poor consumer sentiment. According to CCL about 2/3 of 2025’s sailings are already on the books; moreover, prices are booked at higher prices as compared to the previous year. Onboard revenue per diem surged by 6% year-on-year, increasing by 300 bps as compared to the previous quarter; pre-cruise onboard revenues surged from 37% to 42%.

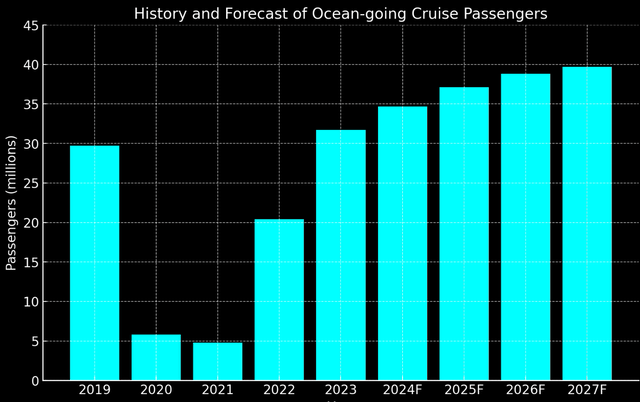

Forecast of Cruise Passengers (CLIA)

Apart from the demand seen in CCL, overall outlook for cruise remains strong. According to CLIA, total cruise passengers for FY2024 is likely to increase to 34.7 million by another 3 million passengers, representing a year-on-year growth of 9.4%. For FY2025, CLIA expects an increase of approximately 7% to 37.1 million passengers. All of these suggest that overall demand remains strong and will continue to serve as a strong tailwind for CCL.

Paying Down Debt Maturities Is An Achievable But Challenging Task

Ever since the CCL’s operations were affected by Covid-19, the company took up a huge amount of debt to ensure that the company survives. As compared to November 2019, CCL’s debt has increased by 2.56x. Currently, CCL has a debt of $28.85 billion. Debt/Equity remains elevated at 3.36x as compared to 0.44x in November 2019. That being said, Debt to EBIT improved to 1.89x from 2.71x in November 2019, suggesting that if CCL is able to continue to pay down its debt, the company will emerge as a stronger entity.

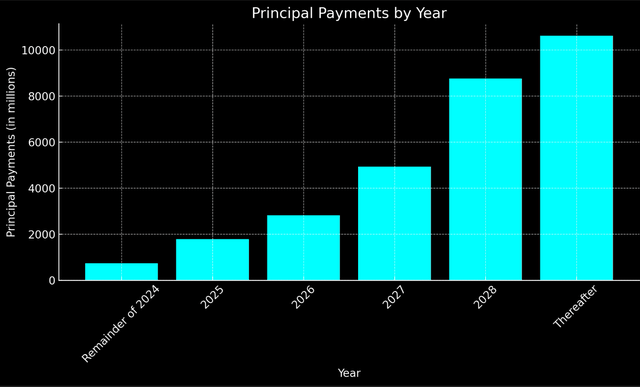

Principal Payments (Company Filings, Author’s Illustration)

It is important to note that although CCL has prepaid more than $7 billion in debt since 2019 and is working on an investment grade profile by 2026, the ability and capacity to pay down debt remains the biggest challenge for the company.

As a reference, in the past four quarters, CCL generated about $5.9 billion in cashflow from operations and incurred a capex of approximately $4.7 billion; CCL generated a free cashflow of about $800 million per year. Fortunately, CCL has a cash reserve of about $1.5 billion and customer deposits of $6.4 billion. Pre-bookings will be an important factor in CCL’s success to navigate its way out of its debt.

Overall, it is likely that CCL is able to continue to service its debt and pay the necessary interests; however, CCL will need to be able to manage its liquidity tactically. As long as the company can continue to pay down its debt, we will see meaningful expansion in its net margin that will be ultimately be beneficial to the valuation of the company. Currently, CCL’s trailing-twelve-months margin stands at 6.39% as compared to 14.35% in 2019.

Valuation Analysis Suggests Upside Potential Is Limited

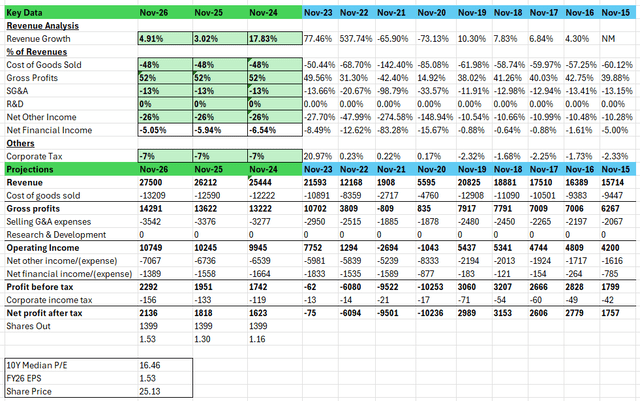

Valuation Analysis (Author’s Projections)

Unfortunately, because of CCL’s debt and relatively higher annual interest payments, my projection suggests that there is little to no upside potential for CCL. Based on the following assumptions: (1) CCL’s revenue to surge 17.83% and normalize its growth to 3.02% and 4.91% in FY2025 and FY2026 due to limited capacity expansion, (2) CCL maintains its trailing-twelve-months margins (which are relatively optimized as compared to pre-Covid), (3) interest payment to decline from $1.8 billion in FY2023 to $1.45 billion in FY2026 and (4) diluted shares outstanding of 1.38 billion, we should expect EPS for FY2026 to come in around 1.53. Utilizing CCL’s long-term median P/E of 16.46x, the company’s share price should be around $25.13, suggesting that upside potential is limited and CCL is currently fairly valued.

Closing Remarks

Overall, CCL has successfully turned around the company; in fact, in terms of sales and margin optimization, CCL’s financial performance has surpassed 2019 levels significantly. Unfortunately, the company’s debt was its savior and now its biggest burden. In 2019, the company’s net financial expense was only $183 million; however, as of the past four quarters, CCL has paid $1.69 billion. In other words, net financial expense has surged close to 9x.

We should continue to monitor CCL’s ability to accelerate its debt repayment and reduce its interest expenses effectively; if CCL does so, it will not be too late to start accumulating shares of CCL. Otherwise, given that current estimates suggest little to no upside, I will urge investors to stay cautious and not be misled by the current share price.

t

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CCL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.