Summary:

- Carnival’s FQ1’23 performance has brought its revenue closer to its pre-pandemic levels.

- Despite a commendable effort to bounce back, its heavy debt burden looms large over Carnival’s balance sheet, hindering its earnings recovery.

- Carnival could be several years away (and that’s a big if) from seeing its earnings recover to pre-pandemic levels.

- Despite the possibility of a speculative play, caution is encouraged when considering a position in CCL, as its current valuation does not offer sufficient justification for such a risk.

courtneyk/E+ via Getty Images

Carnival Corporation (NYSE:CCL) reported its FQ1’23 earnings on March 27, demonstrating that its bookings recovery has remained robust.

The company posted revenue of $4.43B, up 15.4% YoY, corroborating the underlying strength in its WAVE season, as Carnival delivered the “highest booking volumes for any quarter in its history.” As such, customer deposits reached $5.7B, exceeding its pre-pandemic FQ1’19 metric of $4.9B by 16%.

However, moving past the highly optimistic commentary, Carnival still posted an adjusted EPS of -$0.55 compared to FQ1’19’s adjusted EPS of $0.49.

Hence, even as its top line shows signs of recovering to its pre-pandemic levels, the company is being hampered by its significant debt burden. As such, we believe investors need to be wary about the company’s turnaround of its negative EPS profitability in the near term.

Accordingly, Carnival posted an interest expense of just $55M (1.1% of revenue) back in FQ1’19. However, in FQ1’23, the company posted $539M in interest expense, representing 12.2% of revenue.

Analyst estimates suggest the company’s net debt-to-EBITDA ratio is expected to be 7x for FY23, well above FY19’s 2x. Management highlighted in its earnings call that it’s committed to “generate free cash flow, pay down debt, and get back to 3.5x debt-to-EBITDA to be better positioned to make new build decisions in the future.”

But by when? Analysts project a net debt-to-EBITDA ratio of 4.9x by FY25. Hence, Carnival’s debt burden will likely continue hampering its ability to deliver more new builds over the next three years.

Accordingly, Carnival’s new order book has been curtailed significantly to just “one to two ships per year.” It’s well below its previous cadence of “between three to five ships per year.”

As such, despite posting a first quarter yield just 8.5% below FQ1’19, it will likely take much longer, suggesting significant execution risks.

Carnival’s FQ2 outlook suggests flat net yields. However, the company expects a 1% to 2% net yield improvement in FY23 over FY19. Hence, the premise is a more robust H2 recovery of “mid-single-digit growth over pre-pandemic levels.”

Given its order book and net yield uplift, the company is confident about its forward visibility. However, we aren’t sure it could return its adjusted EPS to 2019 levels over the next three to four years.

As such, there’s a significant level of execution risks that investors looking to buy at the current levels need to account for.

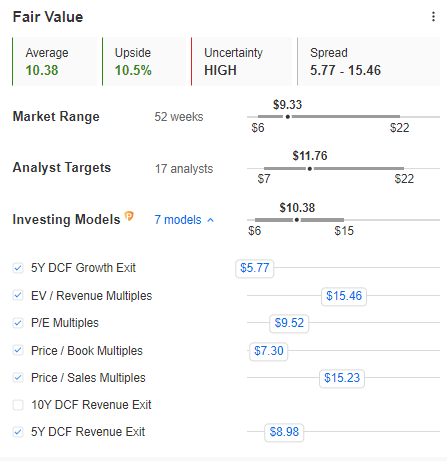

CCL blended fair value estimates (InvestingPro)

CCL’s blended fair value estimate of $10.40 implies a potential 10% upside to fair value. In addition, its NTM EBITDA multiple of 9.2x is slightly lower than its peers’ median of 10.1x (according to S&P Cap IQ data).

Hence, we assessed there isn’t an obvious dislocation in its valuation, suggesting that investors don’t need to ramp up their purchases.

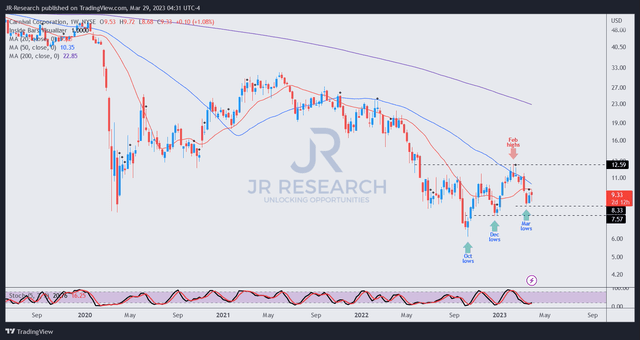

CCL price chart (weekly) (TradingView)

CCL remains in a medium-term downtrend, with an astute bull trap or false upside breakout in February sending it to its recent March lows.

Therefore, there isn’t an optimal price action trigger suggesting a lower-risk entry point. However, despite that, the reward/risk does seem to be leaning toward upside risks than downside risks, suggesting speculative investors could still consider an opportunity.

However, we believe that CCL’s February bull trap level of $12.50 should remain a critical impediment against a further advance.

Takeaway

Carnival has more constructive tailwinds bolstering its recovery in H2. However, it’s still hampered by a significant debt burden affecting the recovery of its profitability.

Moreover, we have not observed a steep undervaluation at the current levels. Also, its price action doesn’t suggest an optimal entry point, even though it’s leaning toward an upward mean-reversion opportunity.

As such, we believe CCL’s reward/risk is pretty balanced at the current levels.

Rating: Hold.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Spot a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment and let us know why, and help everyone to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!