Summary:

- Carnival stock has outperformed the market, as its recent earnings justified the market’s optimism.

- CCL posts sector-leading profitability grades, underpinning its ability to reduce debt further.

- Carnival is riding the cruise industry’s secular growth drivers amid an upcycle of travel.

- I explain why CCL’s valuation bifurcation suggests the stock can continue rallying further, debunking undue debt fears.

NANCY PAUWELS/iStock Editorial via Getty Images

Carnival: Market Outperformance Isn’t A Fluke

Carnival Corporation (NYSE:CCL) investors have continued to ride its recovery, even as CCL delivered an outlook that was below Wall Street’s estimates. While it led to post-earnings downside volatility, it outperformed the S&P 500 (SPX) (SPY) since my previous update, corroborating its resilience.

In my previous bullish CCL article in August 2024, I emphasized why I wasn’t concerned with its pullback then. I observed a robust bottoming process in early August, as CCL and its cruise industry peers have continued to deliver strong operating performances.

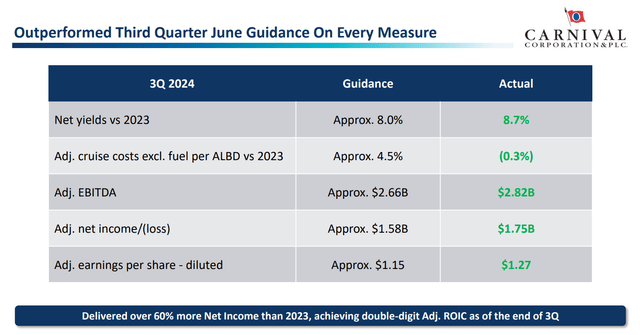

Carnival’s FQ3 outperformance (Carnival filings)

My bullish conviction is justified, as Carnival notched another solid performance. In CCL’s third-fiscal quarter earnings release, management underscored the cruise operator’s solid outperformance on “every measure.” As seen above, Carnival recorded a broad-based beat over its internal guidance on its core metrics, justifying its stock’s outperformance.

As a result, Wall Street estimates on CCL have also been lifted, notwithstanding the recent pullback observed in travel stocks. As a result, it corroborates the bullish proposition of the leading cruise operators, as they are expected to continue gaining more share over their land-based peers.

Carnival’s Ability To Reduce Debt Is Crucial

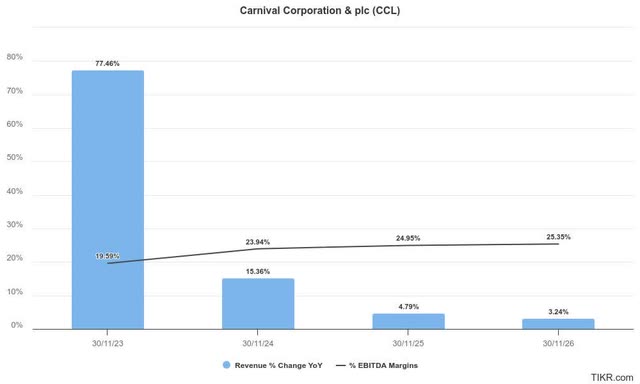

Notwithstanding my optimism, Carnival’s forward guidance suggests it’s still expected to undergo a growth normalization phase through FY2026. As seen above, investors should anticipate a deceleration in its revenue growth rates over the next two fiscal years.

Despite that, the robust recovery in CCL’s cruise operations and the industry’s healthy outlook suggest it can continue to improve its underlying profitability. Carnival’s sector-leading “A” profitability grade should bolster its valuation re-rating potential if it executes well over the next two FYs.

I assess its outlook as reasonable, as Carnival is expected to be more cautious in its new builds through 2028. Accordingly, management telegraphed a more controlled delivery cadence of three ships over the next four years in its order book. In addition, its robust bookings outlook through FY2026 should underpin advantageous pricing levers, helping to provide more clarity over its net yields growth.

Carnival seeks to demonstrate its ability to further focus on de-risking its balance sheet, building on its recent progress. Accordingly, the recent upgrades by S&P and Moody’s have validated its improved financial profile. Hence, it has likely increased the market’s confidence in CCL’s ability to move closer to its targeted adjusted EBITDA leverage ratio of 4.5x by the end of 2024.

Coupled with a more dovish Fed through 2025, it has likely lowered Carnival’s interest rate risks on future refinancing opportunities. Therefore, it should afford more clarity over CCL’s earnings outlook, lowering its execution risks further.

CCL Stock: Valuation Remains Favorable

CCL Quant Grades (Seeking Alpha)

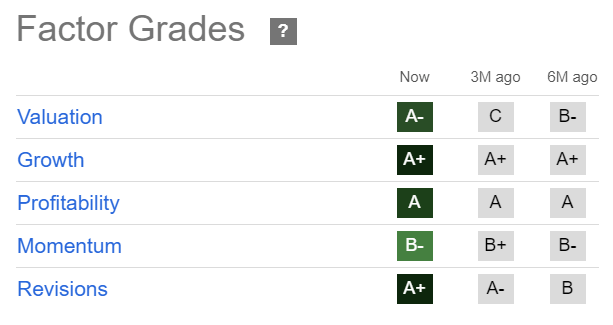

CCL boasts four “A” range factor grades, supporting its bullish thesis. The valuation bifurcation is notable, notwithstanding the possibility of a growth normalization phase over the next two FYs.

CCL’s forward adjusted EBITDA multiple of 8.7x is more than 15% below its sector median. It’s also markedly below the 10x median multiple posted by its industry peers (according to S&P Cap IQ data). Hence, I assess that the market remains relatively concerned over the company’s ability to improve its financial profile. Furthermore, Fed Chair Jerome Powell’s cautious commentary about anticipating similar 50 bps interest rate reductions could damper CCL’s valuation re-rating opportunities.

Notwithstanding my optimism, I assess that the company must manage its pricing strategy carefully to drive net yields growth. As its growth profile is expected to slow, CCL’s ability to optimize its pricing strategy to capitalize on its strong bookings visibility is critical.

In addition, recent geopolitical events in the Middle East could dampen consumer sentiments. However, given CCL’s robust booking visibility, I assess that it shouldn’t have a material impact in the near term. Despite that, the cyclical profile of travel spending behooves caution on external factors that could affect the forward outlook as consumers potentially pull back.

CCL’s price action is also increasingly constructive, as its buying momentum (“B-” momentum grade) has remained resilient. As a result, I assess maintaining a bullish thesis as still appropriate, bolstered by its sector-leading profitability marks and a below-median valuation profile (already reflected pessimism).

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!