Summary:

- Carnival Corporation & plc is forecast to report another large loss when reporting FQ1’23 results next week.

- The large cruise line should provide positive indications of a very profitable summer season.

- Carnival Corporation stock shouldn’t trade below $9 when travel sector stocks are already forecasting a return to record earnings equivalent to $4.40 per share for Carnival.

Lorraine Boogich

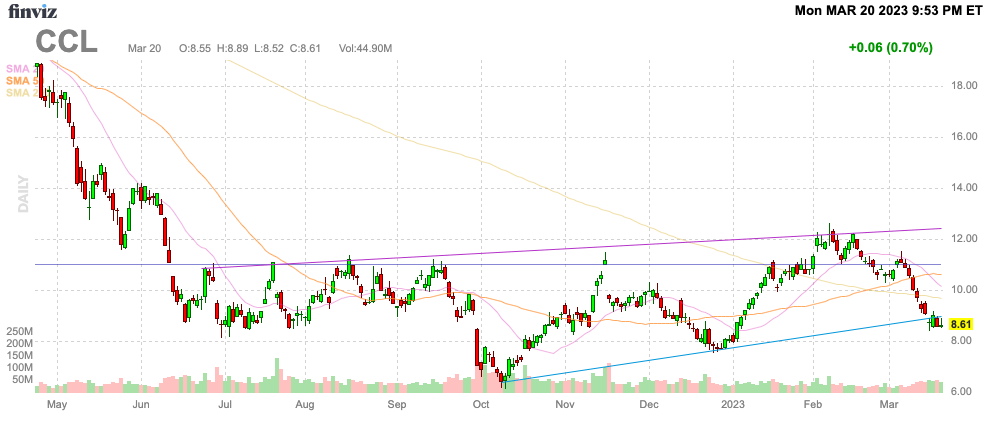

The cruise sector is only days away now from re-entering the market of profitable companies. Carnival Corporation & plc (NYSE:CCL) will report FQ1’23 earnings prior to the open on March 27 to provide an indication of the progress of the cruise sector heading out of the dark days of large losses. My investment thesis remains ultra Bullish on the cruise line, which is back trading near the lows due the unrelated banking crisis and irrational fears of a recession.

Source: Finviz

Last Big Loss

The key to the cruise line turnaround story is understanding the process back to reporting consistent profits. The travel industry is seasonally weak during the colder months and Carnival is about to report FQ1 results that ended in February.

Prior to covid, the large cruise line tended to report profits/revenues along the following seasonal trends:

- FQ1 ending Feb. – 11%

- FQ2 ending May – 15%

- FQ3 ending Aug. – 60%

- FQ4 ending Nov. – 14%.

In the past, Carnival was profitable during every quarter, but this isn’t forecast to be the case in the initial return to normal operations. The prime reason is that the cruise line has far more interest expense now and Carnival had limited profits outside of the prime sailing season of June, July and August all crammed into the same quarter, unlike other cruise lines.

The other major issue is that covid restrictions weren’t removed until the September time frame, reducing the ability of the cruise lines to fully sell winter cruises. The market wasn’t expected to return to more normal strong operations until the summer months after the full restart towards the end of 2022.

The combination leaves the cruise lines in the same general pattern as the airlines from the prior year. The first quarter of 2022 was highly impacted by covid before a full reopening led to massive profits over the last 3 quarters of the year. The cruise lines should see a similar scenario in 2023 with or without a global recession.

For these reasons, analysts are forecasting Carnival reports the following numbers for FQ1’23:

- Consensus EPS estimate – ($0.60)

- Consensus Revenue estimate – $4.31 billion.

The prime example of how FQ1 revenues didn’t return to normalized levels is that the consensus estimates for FQ1’24 is for growth of $1.0 billion to $5.3 billion. Analysts forecast the FQ2’23 loss to be cut in half to $0.27 in a sign of how last quarter was the last major loss.

Carnival forecast interest expenses of $2.0 billion for FY23, up $1.8 billion from the FY19 levels. The difference in the interest expenses on the higher debt levels accounts for the reasons the cruise line is now forecast to produce losses for quarters outside of the Summer quarter.

A big key to the quarterly report is whether Carnival can forecast an improvement to the FQ2 estimates above analyst estimates. One needs to not focus too much on these short-term numbers as the cruise lines return to normalized operations and return to focusing on improving efficiencies from restarting operations.

Focus On Terminal Results

As with the airlines, investors are focusing too much on the short-term volatile numbers in the rebound versus the forecasted end results of returning to record profits. Royal Caribbean Cruises Ltd. (RCL) has already forecast their EPS hitting record levels in a few years, with the market mostly dismissing the targets.

In a similar manner, United Airlines Holdings, Inc. (UAL) forecasts the airline will return towards record EPS levels this year with a midpoint target of $11. The market kept ignoring the forecasts and suddenly the record profits are already here, but of course those shares haven’t rallied, either.

Carnival is set up for the same scenario, where the larger cruise line over the next couple of years will absorb the higher debt levels and use positive cash flows to cut interest expenses. The end result is that profits will eventually approach the $4+ levels of FY19, yet the stock still trades below $9.

Back in FY19, Carnival paid ~$1.4 billion in annual dividends. The cruise line will use those future cash flows to repay debt as opposed to paying dividends for years into the future. Just lowering interest expenses to prior levels would add $1.50 per share to earnings.

Takeaway

The key investor takeaway is that Carnival Corporation & plc should provide some bullish commentary regarding the recovering cruise market during the FQ1’23 earnings report. Investors should focus on progress, not perfection.

Carnival Corporation & plc should quickly return towards profits in the quarters ahead. A global recession could definitely impact growth, but the cruise line sector should be back towards normal business cycles that generate strong profits and cash flows. Carnival Corporation & plc has to whittle down net debt and reduce interest expenses in order to generate those profits, but that is just a matter of time.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.