Summary:

- Carnival Corporation’s shares have risen 120% since January.

- Customer deposits have increased from $5 billion to $7.1 billion over the past six months, indicating strong demand, and the company’s liquidity stands at $7.3 billion.

- However, Carnival’s high debt and share count have increased its enterprise value, which could limit its investment potential moving forward.

alphaspirit/iStock via Getty Images

Shares of recovering cruise liner Carnival Corporation (NYSE:CCL) are up 120% since January, which some may stick in their cap as a feather, a successful pandemic recovery stock idea.

But it could depend on when you bought the stock. Shares are down 35% since I last covered the stock in 2021, and while Carnival’s business has picked up, there is more to consider regarding this company.

I’ll detail and update my concerns below and show that a business surviving, maybe even thriving, doesn’t make it an excellent long-term investment.

Carnival is back to near-full capacity

The cruise liner is back to packing its ships after a rough couple of pandemic years. Carnival’s ships operated at 98% capacity in Q2 of 2023, a massive leap from just 69% the prior year.

It looks like things are only getting better too. Customer deposits have swelled from $5 billion to $7.1 billion over the past six months, indicating strong demand.

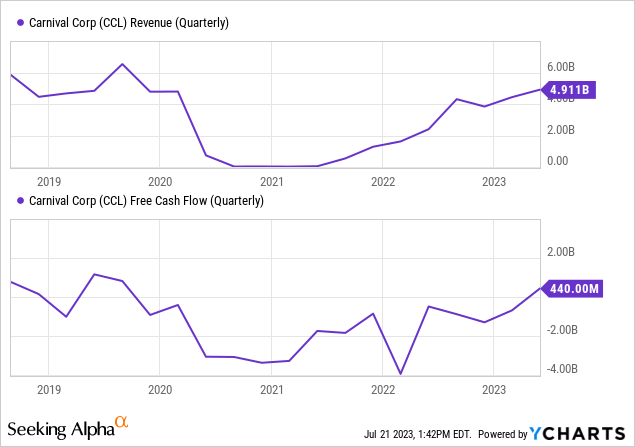

The chart above shows that quarterly revenue and free cash flow are closing in on pre-pandemic levels. While the company has $33.7 billion in debt, Carnival’s hefty $7.3 billion in liquidity (total cash and available credit lines) indicates that the company will stay afloat.

Has the stock already recovered?

A five-year price chart will show that Carnival’s stock remains well off its pre-pandemic highs of $67 per share. It’s understandable to look at the company’s improving operating performance and price chart and piece together the expectation that shares will continue chugging higher.

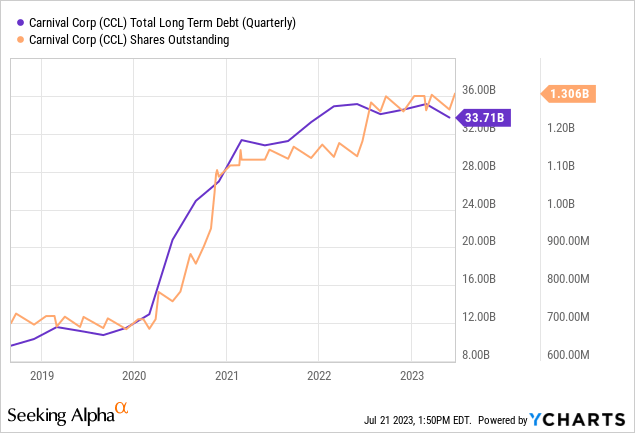

Maybe it will… but there is evidence that Carnival is approaching its near-term peak. Remember that Carnival had to pull out all the stops to survive the pandemic. That includes borrowing the billions of dollars it did and issuing a ton of equity to raise money.

Carnival’s debt and share count have grown since I wrote about the stock.

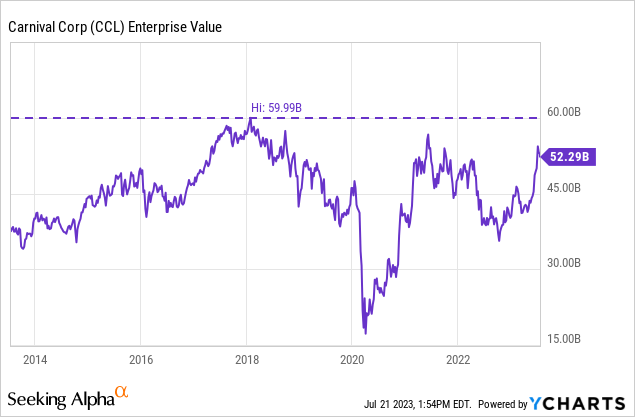

The problem here is that this has ballooned Carnival’s enterprise value. Carnival’s increasing debt and share count have offset most share price losses. You can see below that Carnival’s all-time highest enterprise value is $60 billion, just 15% over where it is today.

Next, one should consider whether Carnival should trade at such a high valuation. Carnival today has multitudes more debt than it had in the past, which will create interest expenses that sap its free cash flow.

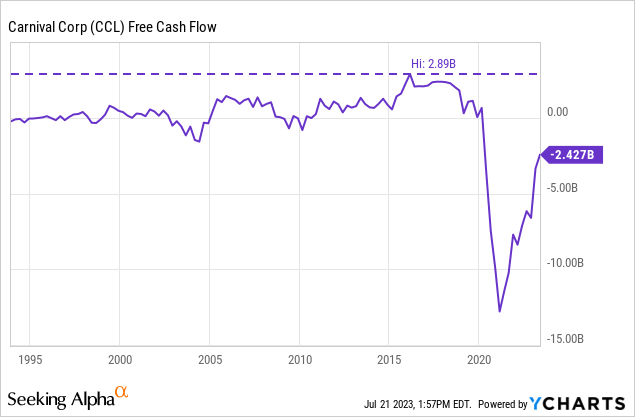

Additionally, Carnival’s best four-quarter stretch ever saw the business generate $2.89 billion in free cash flow. It would take over a decade to pay down its debt load if it repeatedly hit this record and applied every dollar to its balance sheet.

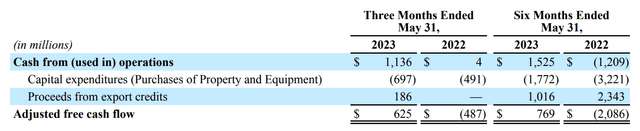

Carnival Corporation Q2 Cash Flow (Carnival Corporation)

Carnival operated at 98% capacity in the second quarter, generating $625 million in cash flow, which would be $2.5 billion annualized. That could increase depending on pricing and future capital spending, but investors will want to see the business produce more cash.

Risks to look out for

Cruises fall heavily into the consumer discretionary category, so the economy poses the biggest risk to Carnival and its shareholders. The company is just now hitting its stride, so the last thing it needs is a recession putting a damper on consumers’ spending.

Despite many whispers of an expected recession, labor data in the United States has remained resilient. Investors should keep an eye on economic data and trace that to how Carnival’s customer deposits respond. A decline in Carnival’s business would create additional stress on its financials.

Conclusion

Despite Carnival just now getting on its feet, the stock is marching towards its highest enterprise value ever. That’s not a firm prediction of a share price top, but an acknowledgment that there’s seemingly more downside risk than upside here.

It could be a good idea to lock in gains if you’ve enjoyed the rally in 2023. Carnival may need to demonstrate that it can grow cash flow to new heights before investors should feel too confident that the stock is on solid fundamental footing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.