Summary:

- Carnival Corporation investors were likely hurt by CCL’s recent decline. But they shouldn’t fear.

- CCL dip buyers returned in August, helping the stock form a bottom.

- Carnival and its leading cruise industry peers are expected to gain market share against its land-based competitors.

- Carnival’s solid execution, record bookings and debt reduction strategy support optimism for a profitability growth inflection.

- I argue why recent pessimism on CCL is misplaced as it’s making an incredible comeback against all odds. Read on to find out why.

SeregaSibTravel

Carnival Isn’t Immune To Travel Industry Headwinds

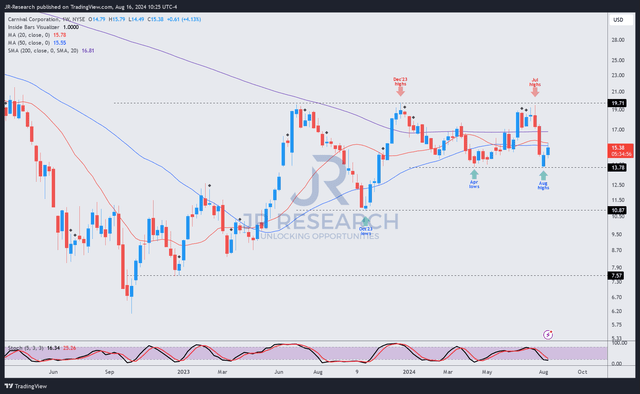

Carnival Corporation (NYSE:CCL) investors were likely stunned as the stock fell into a bear market after failing to clear the resistance level under the $20 zone in July 2024. However, dip buyers returned in August, helping the stock bottom out just above the $14 zone, underpinning CCL’s April 2024 lows. As a result, investors are likely assessing whether its recent recovery represents a significant turnaround after its August plunge as the travel industry faces intensified headwinds.

In Carnival’s FQ2 earnings release in June, CCL surpassed Wall Street’s estimates, underscoring the market’s confidence in the leading cruise operators. Solid results by Norwegian Cruise (NCLH) corroborated the industry’s tailwinds. However, fears of a growth slowdown in Royal Caribbean’s (RCL) prospects dimmed buying sentiment. As a result, I assess that hotels, resorts, and cruise lines investors likely de-rated the industry as a whole as they reassess increasingly worrying consumer spending headwinds.

There’s little doubt that Carnival operates in a highly cyclical consumer discretionary sector. However, Carnival and its peers are assessed to be in the nascent stages of gaining market share against their land-based peers. JPMorgan Research projects that cruise operators could gain significant market share through 2028. Despite that, they’re expected to account for just about “3.8% of the $1.9T global vacation market by 2028.” Other estimates suggest that an 11.5% revenue CAGR for cruise operators between 2023 and 2030, corroborating its secular growth tailwinds.

Carnival’s Execution Remains Solid

Given CCL’s solid performance in Q2, bolstered by solid forward bookings trends, I assess significant visibility on its earnings profile. Several critical drivers are expected to power Carnival’s earnings growth beyond 2025/2026. The cruise leader reported a yield increase of more than 12% in FQ2. While North America’s performance was robust, the recovery in its European business was more spectacular as yields surged more than 20%. As a result, Carnival benefits from a global recovery momentum that should help diversify its North American business (almost 70% of its total revenue base). Lowering concentration risks should help underpin a more resilient earnings growth visibility even if US travel spending weakens further.

In addition, Carnival also posted “record customer deposits and bookings” in FQ2, which is expected to translate into higher pricing power. Unforeseen consumer spending weakness could still permeate the cruise industry from its land-based vacation peers. However, management’s confidence in its limited inventory and robust occupancy levels (104% in FQ2) should undergird revenue visibility. Moreover, cruises are increasingly being viewed as more value-for-money options. Consequently, it should help bolster Carnival’s leading position in attracting travelers, particularly among new-to-cruise (up 10% in FQ2) and Gen Z travelers.

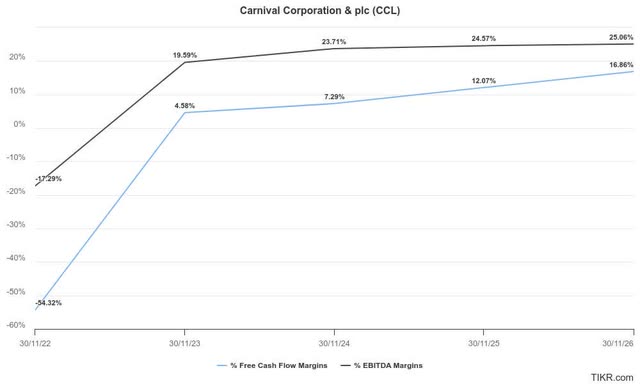

Carnival profitability estimates (TIKR)

As a result, I think optimism on Carnival’s profitability growth inflection seems reasonable. Wall Street’s estimates on CCL have also been upgraded, corroborating its positive outlook. In addition, Carnival’s ability to gain operating leverage while improving its free cash flow conversion through 2026 is expected to support buying sentiments.

Watch Carnival’s Debt Reduction Carefully

The company’s execution prowess has also been validated as it inches closer to its 2026 SEA Change targets. Accordingly, management highlighted the company is “two thirds of the way to achieving these targets after just one year.” Hence, it should also provide more confidence for investors while they await more clarity from CCL’s debt reduction strategy.

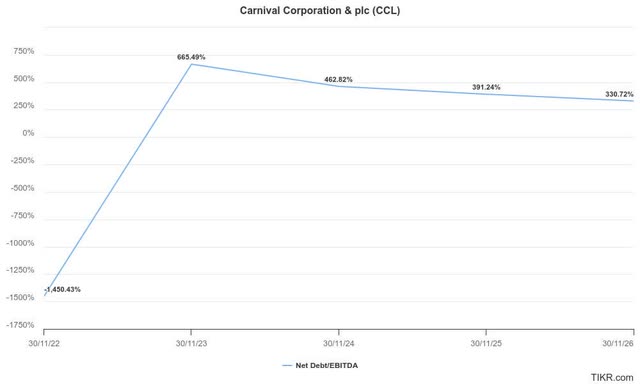

Carnival adjusted EBITDA leverage (TIKR)

Accordingly, Carnival’s adjusted EBITDA leverage ratio is anticipated to continue trending downward (3.3x by FY2026) but still well above its pre-COVID highs (FY2019: 2x). Therefore, some investors could still be concerned about Carnival’s relatively high leverage ratio, which could hamper a more robust FCF margins accretion.

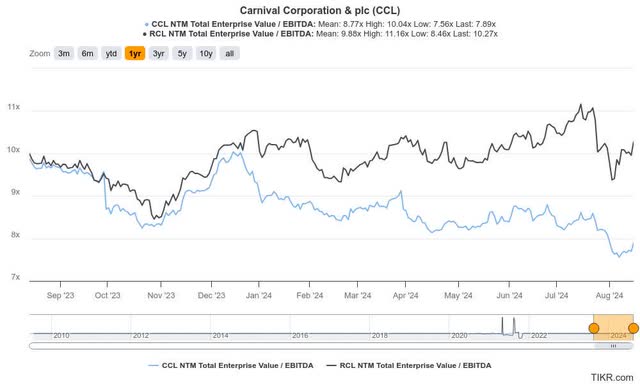

In addition, Carnival’s decision not to reinstate its dividend could send income investors toward RCL, as Royal Caribbean reinstated its dividend in late July 2024. Despite that, bullish CCL investors could also argue that Carnival is still projected to be FCF profitable (while tracking its 2026 SEA Change targets). Furthermore, the valuation bifurcation between CCL and RCL has likely reflected Carnival’s relatively high debt load.

CCL Stock: Valuation Is Relatively Attractive

CCL Vs. RCL valuation metrics (TIKR)

As seen above, CCL’s forward adjusted EBITDA multiple of 7.9x is markedly below RCL’s multiple of 10.3x. Hence, the market is assessed to have accorded substantially higher risks for Carnival stock, suggesting its debt burden could hinder a more aggressive valuation re-rating.

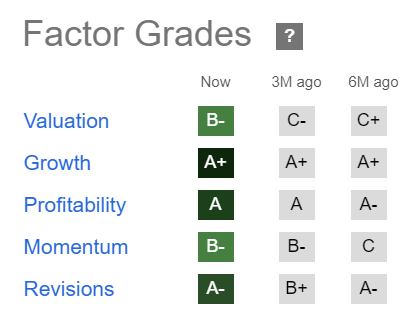

CCL Quant Grades (Seeking Alpha)

Despite that, it hasn’t significantly impacted CCL’s buying sentiments (“B-” momentum grade). Carnival’s robust execution (“A-” earnings revisions grade) accentuates the market’s focus on its ability to deliver earnings accretion as it looks to recover its investment-grade credit rating.

Coupled with its best-in-class “A+” growth grade, CCL’s “B+” valuation grade suggests a marked improvement from its “C” grade three months ago. Its forward adjusted earnings multiple of 13.3x is also almost more than 15% below its sector peers, implying relative undervaluation. Hence, I assess a potential dip-buying opportunity as timely.

Is CCL Stock A Buy, Sell, Or Hold?

CCL price chart (weekly, medium-term) (TradingView)

CCL’s price action suggests a bear trap (false downside break) could have occurred just above its $13.5 level. I assessed a bullish reversal over the past two weeks, although it suffered a bear market decline.

Moreover, its solid momentum grade underpins my conviction that buying accumulation is expected to undergird its recovery, predicated on its solid fundamental thesis.

However, investors must not throw caution to the wind, as Carnival’s debt overhang could still impact the market’s confidence. RCL’s reinstatement of its dividend could also stretch the valuation bifurcation, putting further pressure on CCL. In addition, the travel industry headwinds afflicting its land-based peers could persist and broaden if the US economy slows down more than anticipated. Investors must consider that even the leading cruise operators aren’t immune to a hard landing, impacting CCL’s recent recovery.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!