Summary:

- Carnival is poised to benefit from strong 2025 cruise demand.

- The 2025 Wave Season is predicted to be robust, with industry bookings already 10-15% above historical levels, supporting continued free cash flow and debt reduction.

- The cruise line forecasts $3 billion in free cash flow for FY24, despite high capex, and targets $6 billion in adjusted EBITDA.

- The stock trades at a low 9x EV/EBITDA multiple, making it attractive given the strong bookings environment and potential for higher cash flows to further repay debt.

PM Images

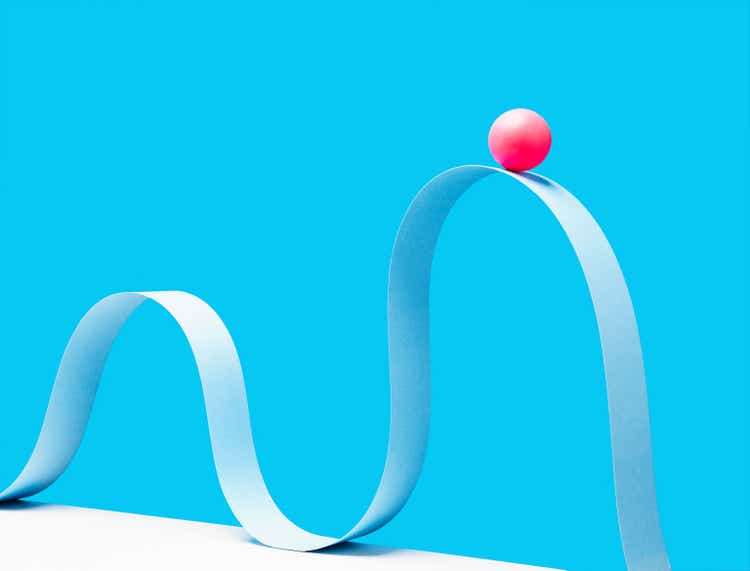

The cruise line sector has seen massive rebounds in business and some related stocks. Carnival Corporation (NYSE:CCL) finally saw the stock rally off lows that were actually closer to the COVID lows vs. all-time highs, like peers. My investment thesis is still bullish on the stock after the big rally over the last few months due to a strong demand picture for 2025.

Source: Finviz

Booming 2025

Carnival is set to complete a 2025 where revenue boom over 15% again to reach $25 billion. The company reported FQ4 results on Dec. 20 and the focus will on guidance for FY25 with current consensus estimates as follows:

- EPS estimates: $1.72, up 28.9%.

- Revenue estimates: $26.1 billion, up 4.5%.

The market is only forecasting minimal revenue growth of 4.5%, but cruise line demand remains very strong. The 2025 Wave Season stating in January should be strong, with some forecasts predicting 20% passenger growth next year to reach 30 million passengers. Truist estimated that 2025 voyages were already booked 10% to 15% above historical levels.

Bank of America has reported that monthly credit card spending shows no signs of demand slowing down. November cruise line spending was up 12% year-over-year and up an incredible 56% from the pre-pandemic year of 2019.

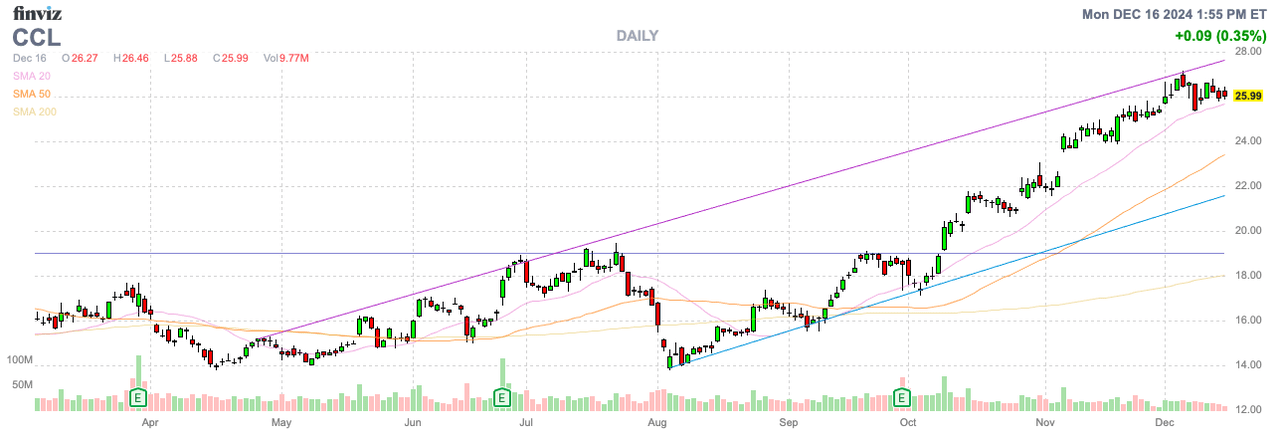

All of the data points out to Carnival continuing to produce the free cash flow to help drastically reduce the net debt issues. The cruise line ended FQ3 with a record high in customer deposits of $6.8 billion, up $1.9 billion from FQ3’19.

Source: Carnival FQ3’24 presentation

Another 20% boost in deposits would provide another leg up in positive cash flows to further reduce debt levels. The FY25 estimates appear far too low, especially with the company opening up the Celebration Key experience in July.

Cash Flow Machine Now

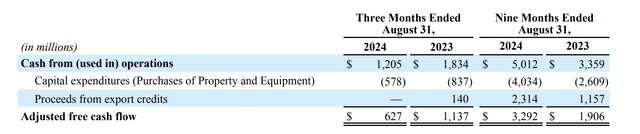

As expected, once cruise operations were restarted towards the end of 2021, Carnival quickly turned to a cash flow machine. The company is now forecasting $3.0 billion of free cash flow in FY24 when the business reports FQ4 earnings this week.

Carnival has already spent a solid $4.0 billion on capital expenditure this year and guided to another $0.6 billion for the November quarter. The cruise line operator will end up spending $4.6 billion on capex this FY and still produce $3.0 billion in free cash flow.

Source: Carnival FQ3’24 earnings release

The whole investment story changes, with the company producing around $7.6 billion in operating cash flows. Carnival can easily cut back on capex, or sell ships, to drastically push free cash flows higher.

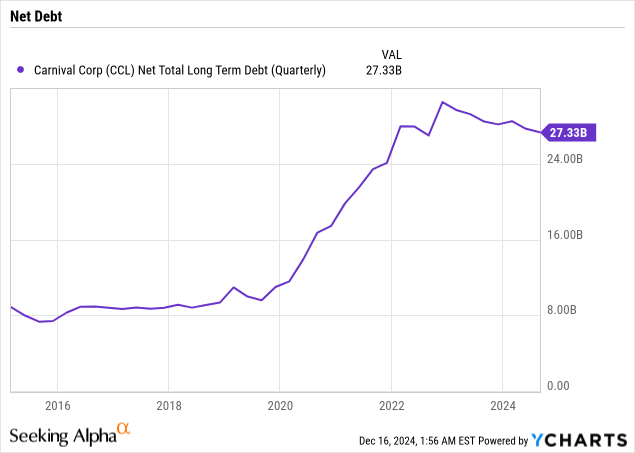

The company has already cut net debt to $27.3 billion while still spending strong on capex. Carnival is now at the point where lower debt reduces interest expenses and further boosts cash flows, not to mention the Fed has cut interest rates by 75 basis points this cycle already.

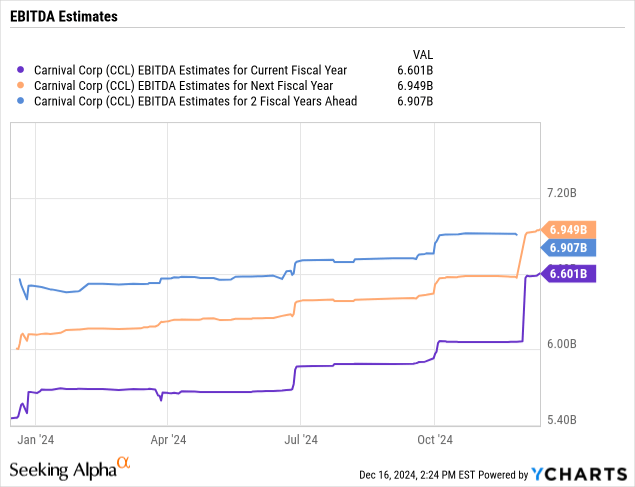

Carnival is targeting $6 billion in adjusted EBITDA for FY24, ending in November. At a 20% clip passenger growth clip, the company would far exceed the current guidance for adjusted EBITDA of $6.6 billion in FY25.

The adjusted EBITDA metric includes ~$2.5 billion worth of depreciation charges, along with interest expenses in the $1.8 billion range. The total costs excluded from net income equate to around $4.3 billion, leaving ~$2.3 billion for actual net income.

Carnival has 1.4 billion shares outstanding, so the EPS can quickly jump on any big adjusted EBITDA beat that flows directly to the bottom line and contributes to further lowing interest expenses. The stock only trades at 15x FY25 EPS targets of $1.72. In addition, the stock has an EV of ~$60 billion, pushing the EV/EBITDA multiple to only 9x.

The strong bookings environment will boost revenue and growth cash flows. The end result is growing EPS via higher operating income and lower interest expenses.

Takeaway

The key investor takeaway is that the 2025 Wave season ahead appears far too strong to dump the stock here, despite the big gains off what was still close to the COVID lows. Carnival is cheap at 9x EV/EBITDA targets and the industry numbers appear to support the cruise line, guiding FY25 numbers above the consensus estimates.

Investors should continue riding the stock higher in 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.