Summary:

- Carnival Corporation is recovering from pandemic debt but expects to achieve positive cash flow for the rest of the year.

- Carnival’s management is forecasting an adjusted EPS in the range of $.7 and $.77. According to my calculations, CCL could even exceed this.

- Risks include massive debt, competition from other cruise lines, and potential fluctuations in oil prices and foreign currency values.

Ruth Peterkin/iStock Editorial via Getty Images

Carnival Corporation & plc (NYSE:CCL) is still recovering from the massive debt it piled up during the pandemic to keep its ship afloat, but its management has outlined a plan for tackling its debt load and expects to return to profitability in Q3.

Tailwinds from the summer season and record bookings in Q1 and Q2 have pushed CCL stock up 113% since May, but I see long-term risks for the stock as the company faces tough competition from other recovering cruise lines. Despite this, I believe Carnival is a buy due to the positive outlook for the year and its potential to report a Q3 EPS nearly double management’s expectations.

Seasonal Catalyst

Historically, summer is Carnival’s best season.

Last year, Carnival’s revenues almost doubled from Q2 to Q3, jumping from $2.4 billion to $4.3 billion. At its latest earnings, Carnival reported $4.9 billion in revenue and I expect Carnival will see a similar QoQ increase in Q3 – since Q2 2023 revenues were in line with its Q2 2019 revenues. With that in mind, Carnival expects to return to profitability in Q3 with an expected adjusted EPS in the range of $.7 and $.77.

Q3 is typically CCL’s peak season, and its management currently expects to return to profitability in Q3 for the first time since 2019. While this is an important catalyst for the stock, it does not guarantee smooth sailing for the company.

Q3 EPS Estimates

Carnival’s management is forecasting an adjusted EPS in the range of $.7 and $.77. I believe the company’s expectations are feasible as my calculations show that Carnival is capable of nearly doubling management’s forecast.

Considering Carnival’s record bookings in Q1 and Q2 in addition to increased ticket prices, Q3 could be its most successful quarter ever in terms of revenues. Thanks to an all-time high of $7.2 billion in customer deposits, representing unearned revenues by the company, CCL could beat expectations for Q3.

Given that Q3 ticket revenues represent on average 81.8% of Q2 customer deposits at pre-pandemic capacity, we can expect Carnival to post $5.88 billion in ticket revenue in Q3 2023.

|

Year |

Q2 Customer Deposits |

Q3 Ticket Revenues |

Q3 Revenue % from Q2 Customer Deposits |

|

2017 |

$4.7 Billion |

$4.1 Billion |

86.6% |

|

2018 |

$5.3 Billion |

$4.3 Billion |

82% |

|

2019 |

$5.8 Billion |

$4.4 Billion |

76.9% |

|

2023 |

$7.2 Billion |

*$5.88 Billion |

*81.8% |

*Projected numbers based on pre-pandemic performance

At the same time, onboard and other revenues represent an average of 37.3% of ticket revenues which could be a little conservative given that Carnival’s onboard spending is at record levels. Based on this information, we can forecast Carnival’s Q3 revenues to come in at $8.07 billion – a new record for the cruise line.

|

Year |

Q3 Ticket Revenues |

Q3 Onboard & Other Revenues |

Q3 Total Revenues |

% Of Onboard & Other Revenues From Ticket Revenues |

|

2017 |

$4.1 Billion |

$1.3 Billion |

$5.5 Billion |

33.2% |

|

2018 |

$4.3 Billion |

$1.4 Billion |

$5.8 Billion |

34% |

|

2019 |

$4.4 Billion |

$2 Billion |

$6.5 Billion |

45.9% |

|

2023 |

*$5.88 Billion |

*$2.19 Billion |

*$8.07 Billion |

*37.3% |

This indicates that Carnival has a solid chance to beat its own EPS estimates since the revenue growth in Q3 would be significantly higher than the expected increase in costs due to Carnival’s industry-leading cost structure.

|

Year |

Q3 Operating Costs |

Q3 Ticket Revenue |

% Change |

|

2017 |

$4.1 Billion |

$4.1 Billion |

100% |

|

2018 |

$4 Billion |

$4.3 Billion |

93% |

|

2019 |

$4.6 Billion |

$4.4 Billion |

104% |

|

2023 |

*$5.82 Billion |

*$5.88 Billion |

*99% |

Normally, these numbers would make Carnival an extremely profitable company, however, the elephant in the room is Carnival’s interest payments which are adding pressure to the company’s bottom line.

In Q3 2019, Carnival’s interest expense was $52 million and this number will increase exponentially in Q3 2023 as the company reported $542 million in interest expense in Q2 2023 and $539 million in Q1 2023. Based on this, Carnival’s interest expense in Q3 would be in the region of $540 million.

As for taxes, Carnival reported $5 million in Q2 2023 and $7 million in Q1 2023 which could indicate that Carnival’s tax payments for Q3 would be in the region of $6 million.

Adding all of this up, Carnival would report a net income of $1.7 billion which would equate to an EPS of $1.34 – much higher than the management’s guidance.

|

(in billions except EPS) |

|

|

Revenues |

$8.07 |

|

Operating Costs |

$5.82 |

|

Interest Expense |

$0.540 |

|

Tax |

$0.006 |

|

Net Income |

$1.704 |

|

Outstanding Shares |

1.27 |

|

EPS |

$1.342 |

Debt Repayment

Carnival has $35 billion in debt as of Q1 2023, of which it is expected to pay off $2 billion of near-term debt by the end of the year. Carnival has made significant progress this year, achieving positive operating income for the first time since the start of the pandemic as well as positive cash from operations and adjusted free cash flow in Q2. As is, it expects to achieve positive cash flow for the rest of the year.

Carnival expects to generate an average of $5 billion in free cash flow for the next 3 years and will allocate around $3 billion a year for debt repayment – driving its debt down by $8 billion through 2026. Since around 80% of Carnival’s debt has a fixed interest rate, it will not be affected by any further interest rate hikes.

Despite this, the company’s current ratio is .64 indicating that it is not as well positioned to cover its current or short-term liabilities as investors would normally like. The interest coverage ratio of -1.72 also shows that its interest expenses are burdening the company. In Q2 2023, interest expenses totaled $542 million while its net loss was $407 million.

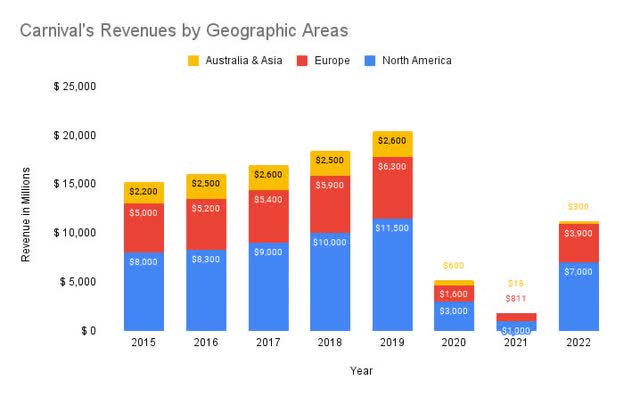

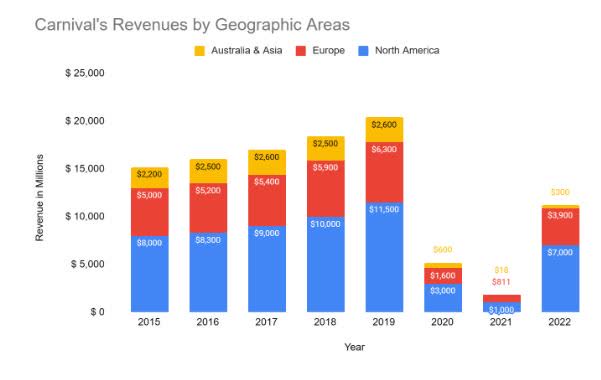

Asian Market

As per the company’s Q1 earnings call, Carnival has resumed its operations in Japan and Taiwan. Back in 2019 Asia and Australia made up 15% of Carnival’s revenue, with China alone accounting for almost 50% of the revenue coming out of the Asian and Australian markets. So it’s not an understatement to say that the loss of the Chinese market over the last 3 years has been one of the heaviest blows to Carnival.

Meanwhile, this market has continued to grow and once CCL is able to resume full operations there, I believe it will be a catalyst for the stock. It appears CCL is preparing to resume at least part of its operations in China after CSSC Carnival announced that it would start cruises in Q4 2023. CCL owns 40% of this joint venture, and its operations will give Carnival a jump on Royal Caribbean Cruises Ltd. (RCL) which is preparing to resume cruises in April 2024.

But now that Chinese authorities shared their plans in March for cruise companies to resume services, I expect to see a rush among cruise lines to access this market. As China fully normalizes this year, pent-up demand could drive ticket sales and onboard spending for cruise lines.

Despite this, Carnival has shared that it has no intention of moving its Costa brand back to China after redistributing its assets to manage China’s closure. CEO Weinstein shared that “[…] the fact is, we’re going to be probably on the sidelines of that for a few years because our assets are right where we want them to be. And we can always relook at that.”

Carnival has already moved its Costa Venezia ship and integrated it into its North American brand and expects its sister ship – Costa Firenze – to complete the transition by next year. In this way, Carnival is adding an additional capacity of nearly 8400 guests to its existing operations.

I find it surprising that CCL does not want to get ahead of China’s potential revenge travel season, especially since China accounted for more than 7% of Carnival’s revenue in 2019.

While Weinstein did mention the possibility of redistributing its assets if it believes that is the best allocation of its resources, at this time CCL does not see itself re-entering China for at least the next 3 years.

Growing Competition

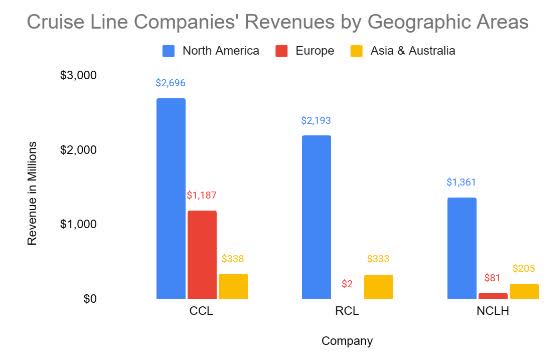

Carnival also faces stiff competition from Royal Caribbean Cruises and NCLH, both trumping Carnival when it comes to their cabin and suite offerings.

While Carnival is dominating the European market, both Royal Caribbean Cruises and Norwegian Cruise Line are seeing growth in the North American market and have already exceeded their 2019 quarterly revenues in the region.

This could be concerning considering that CCL derives the majority of its revenue from North America. Additionally, Royal Caribbean is expected to return to China in 2024, and CCL’s absence in the region could cause it to lose out to its competitors.

Company Filings

Risks

Fuel prices have a significant impact on CCL’s operations because increases in the global price of fuel would increase the cost of its operations. These costs would not only be passed on to customers but could also deter some customers from cruising since the cost of airfare would also increase with rising fuel prices.

Higher interest rates are another risk to CCL since the increasing interest rates impact the discretionary spending of its customers. As many experts predict a US recession in late 2023 or early 2024, an economic downturn could impact both ticket sales and onboard spending for CCL’s clientele.

As the Russia-Ukraine war has shown, conflicts around the world can divert the ordinary operations of any cruise line. If a conflict were to emerge, CCL may be forced to divert its cruise lines at the cost of its customers and revenue.

These macro-level risks would in turn impact Carnival’s debt situation which is the company’s biggest risk at present. The company’s current strategy for paying down its debt depends on achieving high occupancy levels with competitive cruise pricing. If for any of these reasons, the company was unable to generate the cash necessary to service its debt or operations the company would face significant risk.

It’s also important to note the forex risk that Carnival faces since it has historically generated 40–47% of its revenue outside of the United States. This exposes it to fluctuations in the value of foreign currencies against the strong USD.

Company Filings

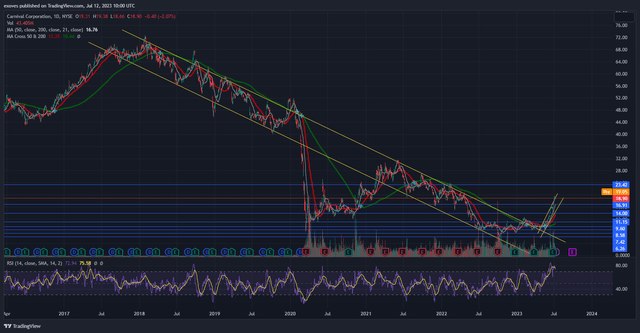

Technical Analysis

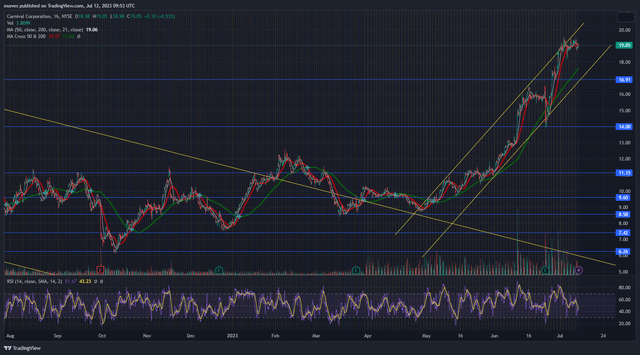

Looking at the daily timeframe, CCL has just broken out of a huge 5-year+ downward channel. This is a very bullish sign, but I expect a retest of the upper trendline given that it just broke out and the RSI is at 73, indicating it is overbought.

This could provide an opportunity for investors to take a position following this run-up on the retest or when the RSI cools off.

We get more confirmations looking at the one-hour timeframe, which shows the trend is bullish with CCL stock trading above the 200 MA and slightly below the 50 and 21 MAs.

Considering that CCL stock is already up 113% since May and is significantly overbought on the daily timeframe, I recommend investors wait for a pullback and retest of the 50 MA on the daily timeframe before taking a position. Investors can take profit at resistance levels or hold for a swing in anticipation of its next earnings on September 28th.

Conclusion

Carnival has shown many signs of improvement and I believe that overall the company is on track to steady the ship. Carnival achieved positive cash flow in Q1 2023 and expects to achieve positive cash flow for the rest of the year. The company is also close to achieving positive operating income and expects a return to profitability in Q3.

In fact, according to my calculations, Carnival may double its management’s expectations for EPS. For these reasons, I am bullish on Carnival and I am giving it a buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.