Summary:

- Carnival Cruise Lines is facing both strong demand and a burdening debt load.

- Concerns are arising regarding a potential slowdown in cruising demand due to declining consumer health and discretionary spending.

- However, major cruise companies forecast continued strong growth and older generations, who make up the key demographic, are likely to be resistant to weakening consumer financial health.

Joel Carillet

Introduction

Carnival Cruise Lines (NYSE:CCL) is in a precarious position. The company is facing both a strong headwind and tailwind: the continually elevated demand environment and extremely leveraged balance sheet. In my previous two articles (previous 1, 2), I have argued that the company was a buy because of the strong travel demand despite a concerning debt burden as the continually elevated demand will likely allow the company to start the deleveraging process. I continue to stand by this argument despite some concerns arising regarding the potential slowdown of the cruising demand. Major cruise line companies including Carnival Cruise have guided for robust bookings for the rest of 2023 and 2024, and despite weakening consumer financial health, I believe this is sustainable as cruising demand is unique due to the customer demographic. Key customers are the older age demographic who are leading consumer spending and hold the majority of the wealth. Therefore, although I am slightly more cautious, I continue to be bullish on Carnival and the cruising industry.

Risk to Thesis and Counterargument

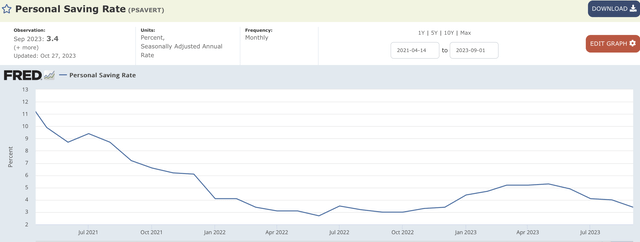

I’m going to address concerns and risks regarding Carnival and the cruising industry. As the picture below shows, consumer health has been in decline in recent quarters. The personal savings rate in the United States has declined to 3.4. Further, credit card balances are continuing to rewrite the previous highs each quarter even as the delinquency rates are increasing. Thus, it is reasonable to argue that the travel demand in the coming quarters could be bleak as consumers tend to cut discretionary spending as times get tougher, which could create headwinds for Carnival Cruise Lines.

The macroeconomic risks surrounding the entire cruise line industry is not the only problem that is facing Carnival Cruise Lines. The company also has a burdening debt load. Looking at the 2023Q3 earnings report, the company’s long-term debt load stood at about $29.5 billion with a quarterly interest expense of about $518 million. This level of debt is burdening as the company’s net income for the quarter was about $1 billion with a revenue of about $6.85 billion. As such, the high debt load poses a serious risk to the company if the current elevated travel demand starts to deteriorate or even moderate.

Despite these conditions, I am cautiously bullish for two major reasons.

One, multiple major cruise companies including Carnival and Royal Caribbean (RCL) are all forecasting continued strong growth throughout 2023 and into 2024.

Two, cruise customers’ key demographic of older generations will likely be resistant to concerns of weakening consumer financial health. The current strong consumer growth has been led by these age demographics, and as these age demographics hold a significant portion of the wealth, cruising demand could be resistant going forward.

Therefore, as it is potentially possible for the demand to continue to stay elevated, Carnival could continue its current outperformance and deleverage the company’s balance sheet.

Industry Outlook

Starting with the industry outlook, both Carnival and Royal Caribbean’s management team have hinted toward a continued strong demand throughout 2023 and into 2024 during the 2023Q3 earnings call.

During Carnival’s earnings call, the management team said “The outperformance [during the quarter] was driven by strength in demand” reflecting the strong demand for the third quarter. For the rest of 2023 and into 2024, the management team said that the company “see[s] no signs of demand slowing for our brands,” and “booking volumes for 2024 will recede as we simply run out of inventory to sell.” Finally, regarding the concerns surrounding demand, the company “just haven’t seen it in our bookings or our results, and we believe consumers are continuing to prioritize spending on experiences over material goods.” Therefore, I believe it is clear that Carnival will continue to see an elevated demand environment for the foreseeable future.

During Royal Caribbean’s earnings call, the company’s management team said that “on a macro level, some of the economic indicators continue to provide some conflicting signals. However, when we look closer at these trends, and indicators related to our customers, and their related behaviors and strong propensity to cruise, we see that many of these macro indicators are less relevant to our business.”

Overall, it is clear that both Royal Caribbean and Carnival’s management team sees continued elevated demand for the foreseeable future despite macroeconomic concerns some investors point out.

Why It Could Continue: Age Demographic

Although I believe it is reasonable to argue that demand concerns due to macroeconomic conditions are irrelevant looking at Carnival and Royal Caribbean’s outlook, one may argue that the current demand environment could start to deteriorate in the near future and these companies have just failed to see it. If this is the case, I believe this argument could also be wrong due to the unique age demographic of the cruise industry customers.

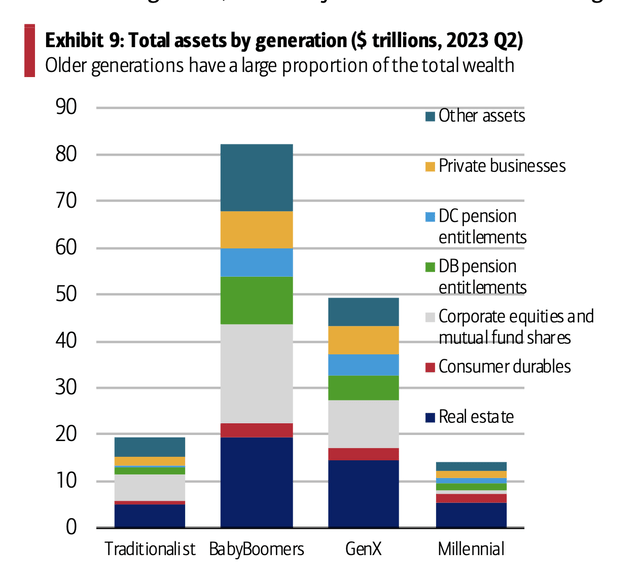

The average age of cruise customers is fairly high at about 47 as this data includes young children traveling with their parents, and as Bank of America (BAC) data shows, the “older generations are the only ones increasing consumer spending YoY terms” leading the consumer spending. Thus, the current trend of older generation increasing spending is likely benefiting Carnival Cruise Lines especially as the expectation is that the current older generation spending growth is unlikely to rewind in 2024. Further, this is a reasonable argument as the majority of the wealth, as shown below, is held by this age demographic, which is the average age of cruise customers.

Overall, consumer spending continues to be strong for older generations with a reasonable expectation for this to continue due to their wealth despite some economic turbulence. As such, I believe it is reasonable to argue that the cruising demand could prove to be more resistant than expected due to the average age of cruise customers being 47, the demographic that is growing their spending.

Valuation

Carnival’s current valuation, in my opinion, is reasonable and has room for an upside. Carnival is currently trading 13.74 times 2024 forward price to earnings, and when considering that the company valuation multiple fluctuated between about 9 to 26 from 2010 to 2020, I believe there is upside potential assuming that my bullish thesis stands.

However, investors must note the risks I laid out for the company toward the beginning of the article. Although the cruise companies are seeing the impact, macroeconomic conditions are worsening while Carnival has an extremely leveraged balance sheet. Thus, the continuation of the elevated travel demand will likely be more important than the risks or potential from the company’s valuation multiple.

Summary

The cruise industry is still booming. Despite some concerns regarding the balance sheet and the macroeconomic conditions, there are no clear signs of the current situation impacting Carnival Cruise Lines. The company’s management team is hinting at a continued strong demand, which is supported by Royal Caribbean’s view, an industry peer. Further, the continuation of the strong demand could be reasonable considering that the main cruise customers reside within the older demographic who hold the majority of the wealth. Therefore, considering these factors, I believe Carnival Cruise Lines is still a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.