Summary:

- Travel stocks have surged since the Tokyo Crash of August 2024, with the CRUZ ETF outperforming the S&P 500, driven by high travel demand.

- Carnival Corporation is a buy due to strong earnings, record customer deposits, and positive growth prospects despite some valuation concerns and macro risks.

- CCL’s Q3 results showed a significant earnings beat, record adjusted EBITDA, and strong future bookings, with a high expected earnings swing for Q4.

- Technically, the Company is undervalued with potential upside to $31.50, supported by a rising 200-day moving average and positive momentum heading into earnings.

Joel Carillet

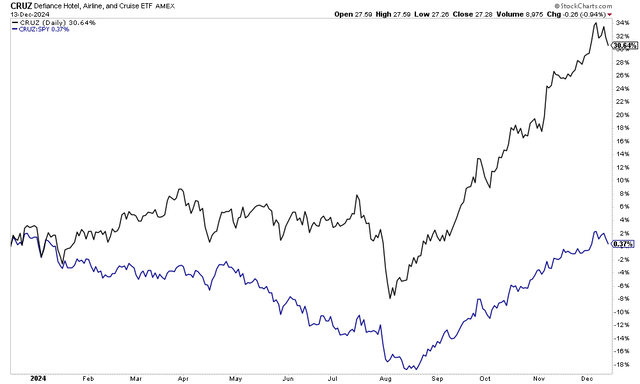

Travel stocks have taken off since the Tokyo Crash of August 5, 2024. I took a look at the Defiance Hotel, Airline, and Cruise ETF (CRUZ), which has significant exposure to all forms of travel. Of course, record TSA checkpoint data and high cross-border transaction volume, per the credit card companies, assert that Americans remain very pro-travel compared to goods spending.

CRUZ is now modestly outperforming the S&P 500 over the past year, with significant alpha garnered in the past four months. Momentum is indeed high across the travel industry, particularly in shares of one upcoming earnings reporter.

I have a buy rating on Carnival Corporation (NYSE:CCL). The options market is giddy about the stock, I see shares as reasonably valued given its growth prospects. I’ll also note a key upside target to monitor with the Q4 report due out on Friday morning.

CRUZ ETF Sports Relative Strength Since August

Back in September Carnival reported a very strong set of quarterly results. Q3 non-GAAP EPS of $1.27 topped the Wall Street consensus forecast of $1.15 while revenue of $7.9 billion, up more than 15% from the same period a year earlier, was a small $80 million beat.

CCL reported record adjusted EBITDA of $2.8 billion, which was a 25% year-on-year jump and above the company’s guidance from June. Despite lower capacity reported as of the end of August, its total customer deposit figure notched a record high of $6.8 billion.

Q4 2024 net yield guidance was a little soft compared to some buyside estimates, but it was above the firm’s previous outlook. This year was reported to be nearly fully booked across its ships, and 2025 is likely to feature record capacity and increased pricing, which bodes well for profitability trends.

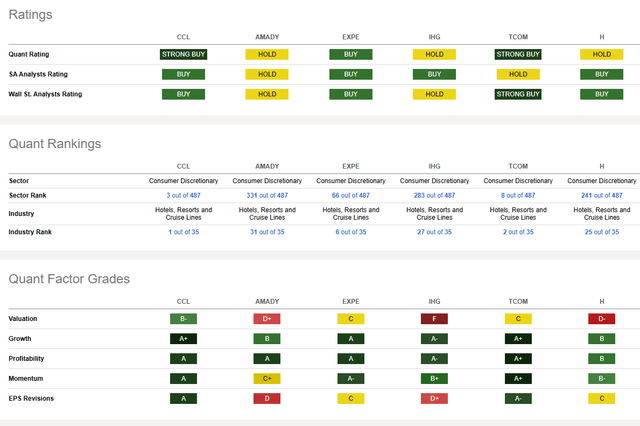

We’ll have to watch cost developments in the upcoming fiscal year, but macro inflation pressures appear to be easing, which is another boon. In all, CCL surged by almost 9% in the session that followed the Q3 report, helping to make Carnival now the No. 1 ranked stock in its industry.

As for the quarter about to be reported, the options market prices in a high 6.7% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after Friday’s report, according to data from Option Research & Technology Services (ORATS).

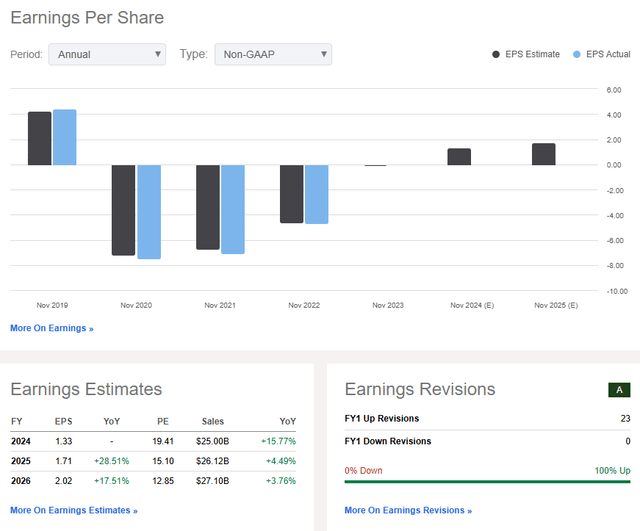

Seeking Alpha’s data reveal Carnival has topped EPS estimates in each quarter dating back to November 2022. Wall Street expects $0.07 in both GAAP and operating per-share earnings on revenue of $5.92 billion this go around.

On the earnings outlook, Carnival is expected to grow EPS by 29% in FY 2025 with another 18% rise in 2026. Revenue growth should then ease significantly, so there will be added attention paid to expense control and operating leverage.

Since the strong Q3 report three months ago, there have been a high 23 sellside EPS upgrades compared with zero downgrades. I also like that CCL has $0.90 of free cash flow over the past 12 months, resulting in a decent 4% free cash flow yield.

Carnival: Revenue & Earnings Forecasts, EPS Revision Trends

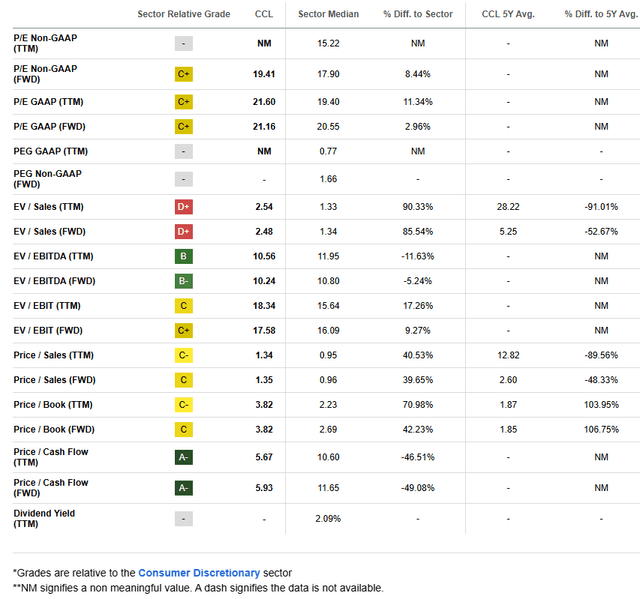

On valuation, we must keep in mind that Carnival is a highly cyclical company. So, being aware of the possibility that earnings growth could drop materially over a short period is key.

As it stands, if we assume $2.02 of peak earnings by 2026 and apply a modest 15x multiple, then shares should be near $30, making CCL undervalued today.

A market multiple and $1.71 of out-year EPS results in a higher valuation, but I urge CCL bulls to temper such sanguine forecasts given its price-to-sales ratio which is significantly above the sector median.

CCL: Mixed Valuation Indicators, But Strong Growth Warrants A Firm Current P/E

Key risks for Carnival include higher cost inflation and slower consumer demand – both of those factors are highly dependent on what happens at the macro level.

The company also carries a high amount of net debt, so a jump in interest rates could result in wrong-way risk – the combination of big interest expenses, a more strained consumer, and likely higher inflation. Geopolitical risk and global terrorism would be another negative catalyst.

Competitor Analysis

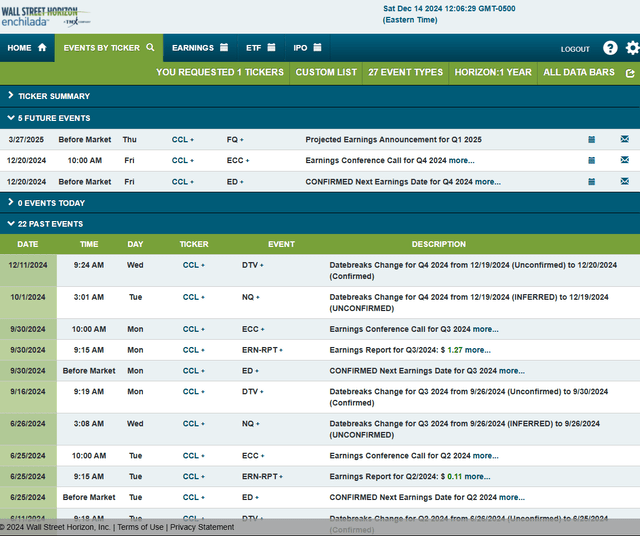

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2024 earnings date of Friday, December 20 BMO with a conference call later that morning. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

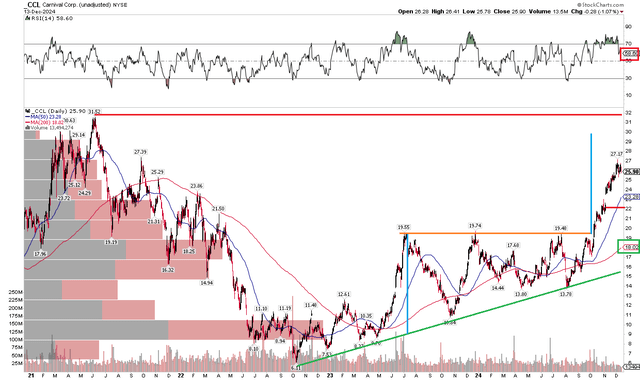

The Technical Take

With shares undervalued ahead of earnings, CCL’s technical situation appears strong. Notice in the chart below that shares have a multi-year high to contend with if we see a positive earnings reaction this week. The $31.52 mark will be eyed, but that will take a 30% jump from last week’s closing price.

On the downside, I spot a lingering price gap below the $23 mark which could get filled if there’s a bearish response to the Q4 report. For now, with a rising long-term 200-day moving average, the bulls control the primary trend.

But take a look at the RSI momentum gauge at the top of the graph – it has recently taken a dip while price holds near the highest level since late 2021. I’d like to see improved momentum heading into earnings. Moreover, there’s a measured move upside price objective to about $30 based on the height of a triangle pattern that began in Q3 2023.

Overall, the trend is up, and further technical strength up to $31.50 is in play over the ensuing months.

CCL: Momentum Into Earnings, $31.50 Resistance, Gap Fill Near $22

The Bottom Line

I have a buy rating on Carnival. I see shares of the $33 billion market cap Hotels, Resorts, and Cruise Lines industry company within the Consumer Discretionary sector as undervalued with technical strength heading into earnings on Friday.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.