Summary:

- Carnival stock’s surge is likely due to management’s confidence in raising ancillary service costs.

- The company’s ‘recovery program’ is proving immensely successful as its year-over-year revenue has surged by more than 1.98x.

- Despite its top-line recovery, Carnival remains far adrift from its midpoint profit margins and has a sizeable corporate bond to service.

- A residual income valuation model places a fair value of $9.91 on the stock, placing it in fair value territory.

Joel Carillet

Carnival (NYSE:CCL) stock surged after it was announced that it would increase costs pertaining to accommodation and add-ons. The company said it would increase gratuities by $1.5 per room and Wi-Fi charges by $1.7 per day (a near 10% increase).

Although resilient input costs played a role in its decision-making framework, Carnival’s new pricing mandate suggests that demand is robust, despite global recession fears. In my opinion, the financial markets interpreted Carnival’s price increases as a positive move, which could set the firm back on track toward profitability.

Is the market acting rationally, or are Carnival’s prospects gloomy? Let’s find out!

Operational Update & Key Metrics

Recovery Route

Carnival’s operations were dented during the past three years due to an array of pandemic lockdowns, which later translated into urgent balance sheet restructurings. However, the company’s recovery plan is clearly in full motion as its fourth-quarter earnings report revealed a 198.29% year-over-year revenue surge.

The cruise liner’s occupancy is back at 99% of its pre-pandemic level, and its earnings are 2% higher per passenger cruise day on a currency-neutral basis. Furthermore, Carnival’s resurgence has seen it rehire more than 100,000 crew members in the past 18 months, reactivate approximately 90 cruise liners, and add eight island destinations to its portfolio.

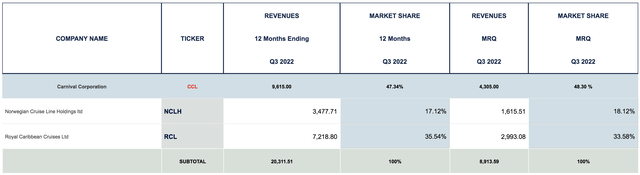

There’s little doubt that Carnival could be a breadwinner if pandemic re-openings are sustained, especially since it holds down a market share of nearly 48%, allowing it to exercise pricing power over its target market.

Carnival Market Share (CSI Market)

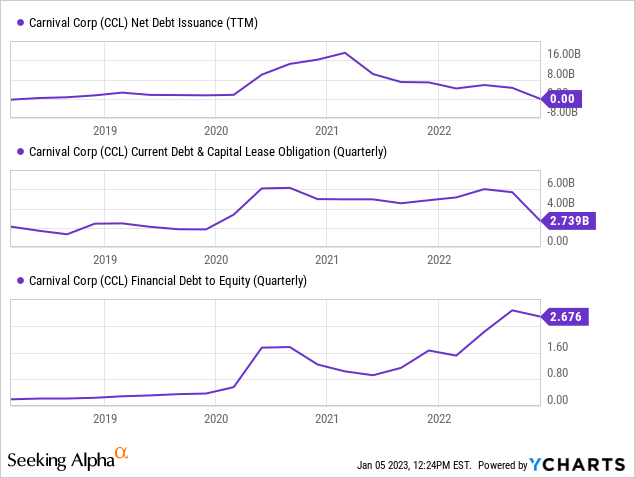

Debt Concerns

Much has been made of Carnival’s debt issuances in the past few years, but the company didn’t have much of a choice as it needed to operate an asset-heavy business with capacity restrictions. In October last year, the firm issued a $2 billion bond offering at a yield of 10.75%. The cruise liner secured the debt by creating a subsidiary, which collateralized 12 of its ships.

Of course, this debt offering presents an extraordinary risk, especially as the coupon is fixed at 10.375%. Personally, I would’ve rather looked at combining various sale-leasebacks in tandem with public debt. Nonetheless, here we stand with Carnival having to service high-yield debt in a potential recession.

However, there is hope. If Carnival can continue scaling, it will probably be able to recoup much of the debt or, alternatively, restructure in the event of a global interest rate pivot (assuming credit spreads retrace as well).

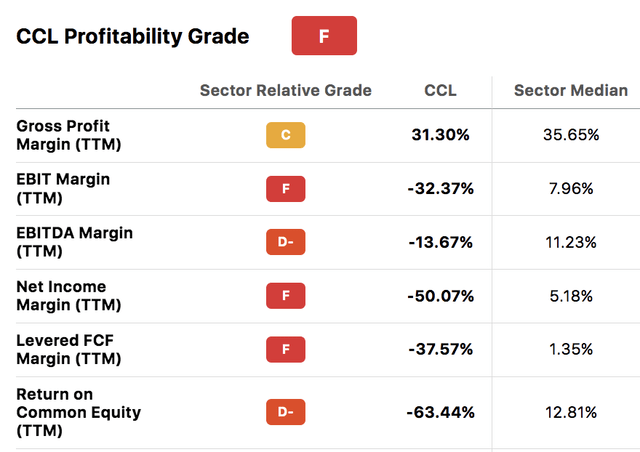

Margins, Margins, Margins!

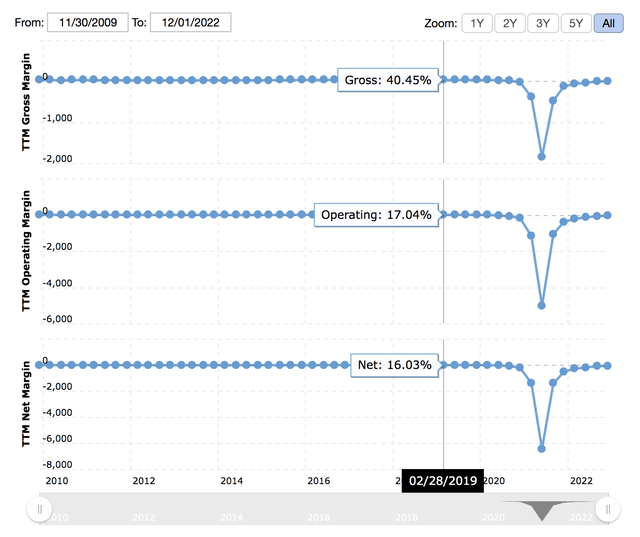

There’s no doubting the fact that Carnival’s operations are in recovery mode. However, its margins remain depleted, which is to be anticipated from an asset-heavy business that wasn’t able to operate at full capacity for an extended period. Also, keep in mind that Carnival sustained serious cost pressures in 2022 amid skyrocketing fuel costs.

It will probably take time for Carnival to reach its cyclical midpoint again. However, historically speaking, the company operates at sound margins. If re-established, the company would be able to repay its debt burden and pass along residual value to its equity investors.

Macroeconomic headwinds remain a concern, but the business’ industry stronghold could phase out much of the economy’s risks.

Valuation

Residual Income Model

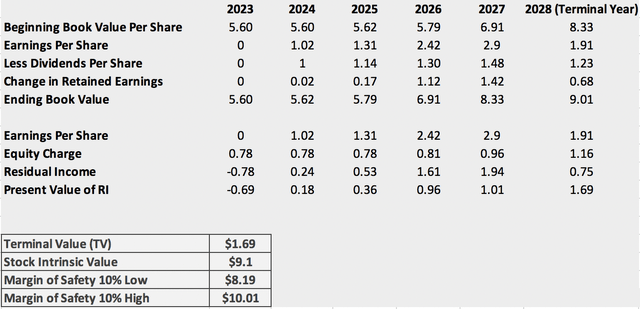

Output

I used a residual income model to value Carnival and discovered that the stock is fairly valued at $9.1. Including upper and lower-level bounds doesn’t deter the scenario and still deems the stock fairly valued with no noticeable intrinsic value that isn’t yet priced by the market.

- Note: The RI model is a mere indicator and doesn’t guarantee a target price.

Input Variables

I’m not going to run you through how the residual income model functions; if you’d like to learn more about the model itself, kindly visit one of our previous articles.

However, I am going to run you through my input variables.

- Book Value: I divided the company’s stock price by its price-to-book ratio to discover a benchmark beginning book value.

- EPS: Seeking Alpha’s database provides analysts’ earnings-per-share targets, which I plugged in from 2023 to 2027. The 2028 input is a normalized average.

- Dividends: I assumed Carnival would reinstate its dividend in 2024 (including a special dividend) and used the historical growth rates to interpolate the succeeding payouts. Once again, 2028’s value is a normalized average.

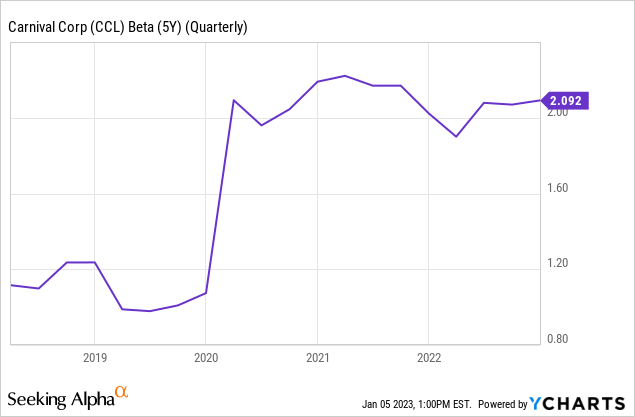

- Equity Charge & Persistence Factor: I used an equity charge of 13.96%, which I derived by leveraging a CAPM formula with a beta of 1.5 and the current U.S. market risk premiums. You’ll notice that I softened the stock’s beta coefficient to 1.5 from its current 2.092, as I believe it’s an appropriate midpoint between covid lockdowns, the company’s current recovery, and recession risk scenarios. Lastly, a persistence factor of 0.75 was assumed in the intrinsic value calculation to account for the company’s dominant market share.

Concluding Thoughts – Hold Rating Assigned

Carnival’s ancillary service price hikes signal confidence, which is a significant value-add to its impressive year-over-year earnings recovery. If re-openings persist, the company could rise to stardom. However, the firm has a challenging bond offering to contend with and remains a long way from its midpoint profit margins. Moreover, recession risk remains high, adding pressure to Carnival’s capital structure.

At face value, Carnival stock looks set to rebound. However, considering the residual income model and lingering challenges, it’s likely that the company’s recovery program is already priced in by the stock market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>