Summary:

- Carnival Corporation stock’s recent surge may not be sustainable due to the company’s heavy debt load and weakened economic moat.

- Carnival is expected to post negative returns on invested capital until 2027, making it unattractive for investors to hold on to their bets.

- While CCL has outperformed the market, its recent momentum spike should be capitalized as an opportunity to take profit and cut exposure.

JHVEPhoto/iStock Editorial via Getty Images

Carnival Corporation (NYSE:CCL) has defied skeptics as CCL continued its remarkable recent outperformance since it bottomed out in early May. I gleaned that short-sellers also rushed to cover their positions as CCL breached a critical resistance zone.

Yesterday’s (June 12) upgrade by JPMorgan (JPM) analysts could also have sent more bearish investors fleeing. The analysts indicated they were impressed with the management’s optimism, indicating “no signs of momentum slowing.”

Notably, CCL accelerated its 2023 recovery as it bottomed out decisively in October 2022. Even though I rated CCL as a Hold in March, I highlighted that “the reward/risk does seem to be leaning toward upside risks than downside risks.” I also suggested “speculative investors could still consider an opportunity.”

After such a massive battering in 2022, as sellers forced CCL holders into submission, as it re-tested its 2020 COVID lows, a mean-reversion thesis has always been on the cards.

However, with the recent surge taking out CCL’s February highs, should investors who missed buying into its lows earlier in the year jump on board now?

Seeking Alpha Quant rated CCL with a “C-” valuation grade. As such, its valuation is likely still fairly balanced from this perspective. However, Carnival’s fundamental challenges remain, including its heavy debt load. Accordingly, Carnival’s trailing twelve months or TTM interest expense rose to $1.78B last quarter, putting further pressure on the company’s ability to recover its medium-term profitability.

The revised analysts’ estimates suggest that Carnival’s adjusted EPS is expected to continue its recovery through 2025. Accordingly, Carnival is projected to post an adjusted EPS of -$0.26 this FY but is expected to improve to $1.21 by FY25. However, it’s still well below FY19’s $4.4.

In addition, Morningstar highlighted that Carnival’s “returns on invested capital, including goodwill, are expected to remain below the cost of capital until 2027.” With a forecasted FY25 net debt-to-adjusted EBITDA ratio of 4.7x, I assessed that investors should not expect momentum buyers to return to Carnival anytime soon.

With that in mind, I also believe it’s challenging to convince long-term investors to return to the fold, as Carnival’s economic moat has weakened significantly by the throes of the pandemic. The extent of the balance sheet damage should not be taken lightly. With the company unlikely to restart share repurchases and dividends until they deleverage much further, income investors are also unlikely to return.

Moreover, with Carnival expected to post negative ROIC through 2027, value investors are unlikely to return strongly to help support its recovery. Hence, I urge investors to ask critical questions about who would bolster CCL’s continued march toward its previous highs if the challenges are expected to persist, and CCL is not a growth stock per se.

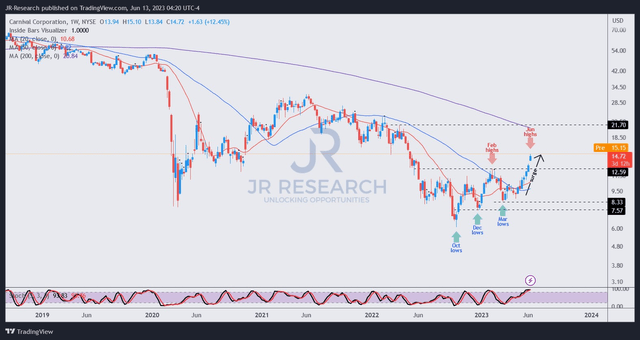

CCL price chart (weekly) (TradingView)

CCL’s price action indicates a significant surge over the past four weeks, as investors anticipated a breakout against its February critical resistance zone.

It’s important for investors not to dismiss that zone, as it helped sellers hinder CCL’s buying momentum from being sustained previously. However, as dip buyers returned to form higher lows over time, the buying pressure built up and likely forced bearish investors to cover quickly, intensifying the recent surge.

Despite that, given its balance sheet woes, I don’t expect CCL to close the gap toward the $21 level. While CCL’s medium-term downtrend has likely reversed, I see an opportunity for investors who bought into CCL’s dips to take profit/cut exposure.

Rating: Sell (Revised from Hold). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!