Summary:

- Northrop Grumman is poised to benefit from rising global defense spending, driven by geopolitical instability and increased military budgets in NATO countries.

- NOC’s strong Q2 results, including a 7% revenue increase and 80% growth in free cash flow, highlight its robust financial performance.

- The company’s expanding order book and potential strategic acquisitions in cybersecurity and space position it for sustained revenue and profit growth.

- Despite potential risks, NOC’s financial strength and diverse product portfolio make it a compelling investment with a projected 13% CAGR over 40 months.

viper-zero/iStock Editorial via Getty Images

Introduction

Germany, Poland, the US, and the UK—what do these countries have in common? If you guessed rising defense spending, you’d be correct.

With 110 conflicts currently ongoing across the world according to Geneva Academy and NATO powers either directly involved or providing support, there has been a surge in government orders for new weapons. As geopolitical instability grows, and ongoing conflicts in regions like Eastern Europe and the Asia-Pacific, NATO members are significantly increasing investments in advanced weaponry and military infrastructure to bolster their defense capabilities. As a result, defense contractors are seeing a sharp rise in demand for advanced weaponry, ammunition to replenish stockpiles, and other military technologies.

One company set to benefit from this surge in defense spending is Northrop Grumman (NYSE:NOC), the manufacturer of advance aerospace and defense technologies, including unmanned systems, missile defense solutions, and next-generation stealth aircraft. Over the past 5 years, the shares have risen 42.23%.

NOC recently released a great set of quarterly results, confirming the benefit it is seeing from the upswing in defense demand. With solid revenue and earnings growth, guidance hiked, and free cash flow growth set to accelerate, let’s look further into the reasons I believe Northrop Grumman shares are a buy.

Rising Demand and Growing Free Cash Flow

Global military expenditure is rising across the world, growing 6.8% globally in 2023 to reach a record high. With growing tensions around the world, and, after decades of military cuts in Europe, the need for increased military spending has risen up the political agenda. In the U.S. military expenditures rose 2.3% in 2023, while in Europe defense spending growth surged, reaching 75% growth in Poland, 9% in Germany, and 8% in the UK. At the latest NATO summit, leaders pledged to boost weapon production further, both to help Ukraine and also strengthen their own defense capability. In the U.S. alone, recent aid packages for Ukraine, Taiwan, and Israel have allocated nearly an additional $13 billion for weapons production.

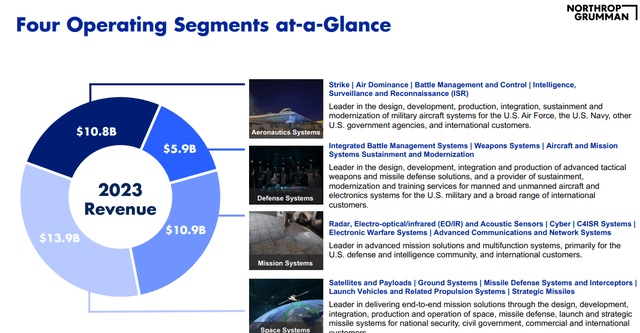

This rise in defense spending has significantly benefitted defense contractors, in particular North American firms, given the large orders from the US government and growing export demand. Among these companies, Northrop Grumman is reaping the rewards of this spending. With a wide range of capabilities including uncrewed aircraft, advanced weapons, command and control systems, and a space division, Northrop offers a wide range of advanced products critical for maintaining a modern military. The company operates two key future programs for the Department of Defense: the next-gen land-based intercontinental ballistic missile, Sentinel, and the B-21 strategic bomber. Among its other key products are building fuselages for the F-35 and the Triton UAV, both of which have picked up export orders to Europe and are key for supporting Northrop in the future.

Northrop Grumman Investor Presentation

This influx of government contracts has led to the order book reaching near-record highs, setting the company up for significant rises in revenue and free cash flows over the coming years. This increase in cash flows will aid the company in making strategic acquisitions in high-growth areas such as cybersecurity, and space, to complement and enhance its current product portfolio. For shareholders, rising cash flow is especially good news, enabling NOC to boost returns and continue its history of shareholder returns. Over the past 5 years, the company has repurchased over 11% of its shares and grown its dividend every year for over two decades.

With rising defense spending and growing free cash flow, Northrop Grumman looks set to continue growing revenues and profits, delivering strong returns to shareholders over the coming years.

Q2 Results

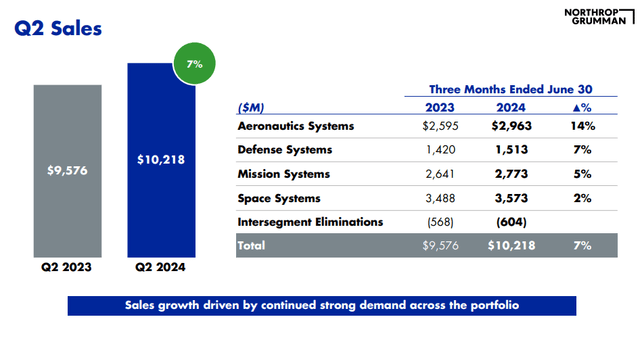

On July 25th Northrop Grumman released its results for the second quarter. This was a great quarter for NOC, with strong financial performance across multiple segments. The company reported revenues of $10.22 billion, a 7% rise year-over-year and beating analyst expectations by $200 million. This was driven by strong demand across all four of its major segments, particularly Aeronautics Systems, that saw a 14% increase in sales driven by higher volumes on the MC-4C Triton UAV and the F-35 program.

Northrop Grumman Q2 2024 Results Presentation

Total operating income came in at $1.09 billion, growing 13% on the previous year. This was a result of higher operating income across multiple segments and cost efficiencies at the corporate level. With this growth came significant growth in earnings per share, coming in at $6.36, up 19% year-on-year and beating expectations by $0.45. Free cash flow generated soared 80% in the quarter to reach $1.105 billion.

I highlighted earlier how rising military spending is set to boost defense companies like NOC. In the quarter, the order book grew by $15.1 billion, 50% higher than revenues. The total order book now stands at $83.1 billion. Although revenue only grew 7%, this growth in orders sets NOC up for strong future growth, with revenue only being recognized on delivery of the order.

In light of these strong results, Northrop Grumman raised its full-year 2024 guidance. Sales are now expected in the range of $41.0 billion to $41.4 billion, and earnings per share guidance has risen from $24.90 to $25.30, reflecting the company’s confidence in maintaining its strong performance.

Overall, these latest results highlight the strong performance of Northrop Grumman and how it is set up for strong future performance.

Valuation

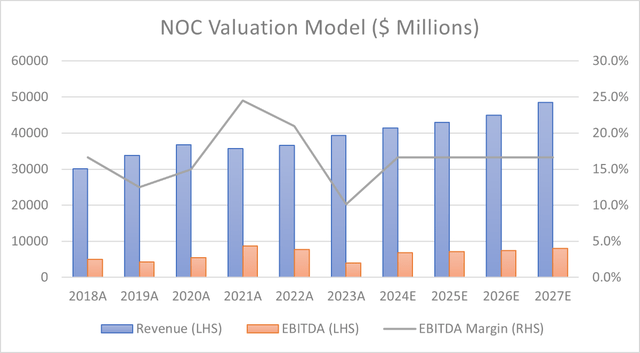

To value Northrop Grumman, I employed an EV/EBITDA methodology for the period to 2027. For future revenue, I used analyst expectations on Seeking Alpha, given their comprehensive industry insight and knowledge of market trends. For purposes of simplicity, I assumed debt and cash levels would remain constant. Based on the company’s EBITDA margin over the past 5 years, I predicted it would remain stable at around 16.5%.

Created and calculated by the author based on Northrop Grumman’s Financial Data found on Seeking Alpha and the author’s projections

I assumed the company would continue to reduce its share count from its current 146.2 million to 135 million in 2027. This is a decrease of 2.5% per year which is largely in line with the previous 5-year average. Although this may be higher in the future due to the significant free cash flows the company is producing, I am more conservative in my valuation.

To determine an exit multiple, I chose an EV/EBITDA multiple of 15. Although this is higher than the 5-year average of 14.58, I believe NOC deserves a slightly higher multiple due to the strength of the order book and free cash flow generation. This multiple is also broadly in line with the average that competitors General Dynamics (GD), BAE Systems (OTCPK:BAESY), and RTX (RTX) trade on.

Performing the calculations indicates a market cap of $105.8 billion at the end of 2027. With an estimated 135 million shares outstanding, this translates to a price target of $784, an upside of 50% from the current share price, for a CAGR of 13% over the next 40 months excluding dividends.

Risks

As with any company, there are several key risks I believe it is important to consider when determining whether to invest in Northrop Grumman.

Firstly, supply chain reconfiguration presents a challenge. With the global defense supply chains undergoing changes due to geopolitical tensions and the need for more secure and localized production, the ability to source critical components is only getting harder. These changes could disrupt Northrop Grumman’s ability to deliver on time and may result in increased cost. The fact that large defense companies rely on a network of smaller suppliers means any disruption can affect production and profitability. Take gallium as an example. A critical metal for a variety of defense applications including radar kit, electronic warfare, and communications kits, its supply has become dominated by China where 98% of primary low-grade gallium is produced. Last year China introduced export controls on this key metal resulting in a doubling of prices and constraining access to this key material. Although gallium is relatively plentiful, it will take time to get alternative supply chains online.

Another risk is financing issues. Although large defense companies like Northrop Grumman are in a strong financial position with adequate access to finance, the smaller suppliers they rely on are not. Banks are increasingly cautious about lending to the sector due to concerns over long-term contracts, regulatory requirements, and the reputational risks associated with defense related financing. This reluctance to lend could hinder Northrop Grumman’s ability to expand or maintain its supply chain, especially if its smaller suppliers struggle to access the necessary capital.

Finally, defense budget uncertainty. While defense budgets are currently on the rise due to global tensions, future budget allocations are inherently uncertain. Changes in governments, their priorities, and economic downturns could all lead to changes in defense budgets. Northrop Grumman’s revenues are heavily reliant on defense contracts and the size of defense budgets, so if budgets reduce so will its revenues and profits.

Conclusion

Northrop Grumman offers a compelling investment opportunity in the coming years. With an expanding order book and anticipated increases in defense spending, the company is well positioned to capitalize on the growing demand for weapons and equipment. With strong free cash flow, the potential for increased shareholder returns in the form of buybacks and dividend is high. As a key player in the defense space, the company’s portfolio of weapons and financial strength ensure it will continue to be a key player in the defense space for the foreseeable future. I therefore rank the shares a buy with a predicted CAGR of 13% over the next 40 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.