Summary:

- Cisco generates significant cash flow and has a net cash position on its balance sheet, allowing the company to invest in R&D, conduct M&A, and return cash to shareholders.

- The company’s dividend yield is the highest since the pandemic bear market and is supported by a conservative payout ratio of ~48%.

- Cisco is the market leader, and new entrants have a barrier to achieving scale.

- The stock is undervalued.

Justin Sullivan

Stocks are trending up again after a horrible September. But unlike the post-pandemic bull market, high-interest rates will likely favor companies with solid balance sheets. A company like cash-rich Cisco Systems (NASDAQ:CSCO) should do well. Cisco is generating enormous amounts of free cash flow [FCF], enough to reinvest in the business, conduct bolt-on acquisitions, and reward shareholders in a disciplined manner. That said, Cisco has difficulty generating revenue growth because it operates in a mature industry, networking. The rapid growth days are in the past. But Cisco has a comprehensive suite of products and a significant installed base and is a prolific acquirer of smaller companies that allow it to grow. Moreover, the company’s stock is yielding 3.6%+ and it has increased the dividend for the past 12 years. Hence, I think cash-rich Cisco is a buy.

Overview of Cisco

Cisco was founded in 1984 and had its IPO in 1990. The company has grown rapidly into the market leader for networking. The company sells Internet Protocol-based networking to IT and communications companies. Specifically, Cisco sells hardware, software, and services, including routers, switches, wireless access points, cybersecurity platforms, firewalls, collaboration software, etc. Total revenue was $51,577 million in the past twelve months and in the fiscal year 2022 (Cisco’s fiscal year goes through the end of July).

Revenue and Earnings Growth

Cisco’s revenue has been range bound for the past decade between ~$48 and $52 billion. The company operates in a mature market, and growth is challenging to come by. Customers are usually large enterprises, campuses, and data centers. However, despite tough competition, Cisco is the market leader in switching, routing, SD-WAN, and wireless. Also, the company has a strong position in security and collaboration software.

Cisco’s status as the market leader, combined with long-term relationships, makes it hard for new entrants to displace the company. Moreover, the firm’s ability to provide integrated solutions makes its product portfolio attractive.

Cisco spends roughly $6.5 billion annually on R&D to continuously bring updated products to the market. However, revenue has grown slowly at best. Also, Cisco is a serial acquirer of smaller companies. On its website, the company states,

“Cisco’s growth strategy is based on identifying and driving market transitions. Corporate Development focuses on acquisitions that help Cisco capture these market transitions. Cisco segments acquisitions into three categories: market acceleration, market expansion, and new market entry. The target companies might bring different types of assets to Cisco, including great talent and technology, mature products and solutions, or new go-to-market and business models. Cisco particularly seeks acquisitions with the potential to reach billion dollar markets.”

It acquired several companies in 2021, including IMImobile, Sedona Systems, Socio Labs, Kenna Security, Involvio, Epsagon, and replex. Also, Cisco acquired Opsani in early 2022. Most of these acquisitions are small, but Cisco did acquire Acacia Communications for $5 billion in 2021 for its optical interconnect technologies.

Now, Cisco has offered $20 billion for Splunk (SPLK), although it is possible private equity firm Hellman & Friedman could acquire Splunk.

Despite the slow revenue growth, adjusted earnings per share have consistently grown in the past decade. This is because Cisco has reduced its operating costs, contributing to EPS growth. However, the considerable reduction in share count each year has mainly driven EPS growth.

Risks for Cisco

Competition is fierce for Cisco. Arista Networks (ANET), Palo Alto Networks (PANW), Fortinet (FTNT), and many smaller players sell similar IP-based products. Next, Microsoft (MSFT) and Zoom Video Communications (ZM) are strong players in collaboration software. In addition, numerous companies sell security software. Consequently, Cisco must continuously invest in R&D and marketing and buy smaller companies to remain relevant. However, this activity seemingly has not resulted in significant top line growth.

Like many other companies, Cisco faces inflationary trends and labor shortages that could negatively impact sales. In addition, the semiconductor shortage is also a near-term concern for sales growth. The strong dollar could affect margins and thus profitability.

Dividend Analysis

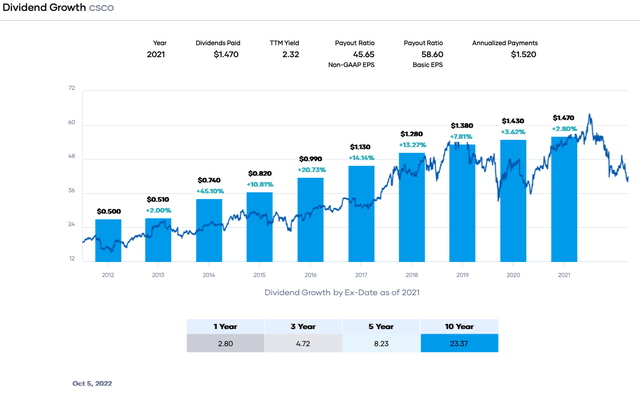

Cisco’s dividend yield is 3.63%, based on a forward dividend rate of $1.52. The yield is more than the 5-year average and the highest value since the pandemic bear market. The dividend yield is also twice the average yield of the S&P 500 Index. Moreover, Cisco has increased the dividend for 12 years since it initiated a dividend in 2011, making the stock a Dividend Contender.

Cisco has increased the dividend at an astounding 23.37% in the past decade and 8.23% in the trailing 5-years. The last quarterly dividend increase was $0.38 per share from $0.37 per share. Moreover, the relatively conservative payout ratio of ~46%, united with climbing earnings per share, means the dividend will likely be higher in the future.

Cisco has excellent dividend safety from the perspective of EPS, FCF, and the balance sheet.

Consensus estimates in fiscal 2023 for Cisco are $3.53 per share, and the dividend rate is $1.52 per share. These numbers result in a forward payout ratio of ~43%. Our payout ratio threshold is 65%, implying the dividend is safe with a solid cushion and space for growth.

Cisco had approximately $12,749 million in FCF in fiscal 2022. Therefore, the dividend needed about $6,224 million, giving a dividend-to-FCF ratio of ~49%. This value is very good and beneath our limit of 70%, signifying little risk to the dividend based on FCF.

Cisco has a net cash position on the balance sheet with $19,267 million in total cash and short-term investments versus $10,561 million in total debt. The firm has significantly reduced debt over the past several years. Interest coverage is ~39X. Cisco has an AA-/A1 high/upper-medium investment grade credit rating from S&P Global and Moody’s. Debt is not worrying in regards to dividend safety.

Valuation

Cisco’s stock price is down like the rest of the stock market in the calendar year 2022. The year-to-date total return is approximately (-33.5%), and the 1-year return is better at (-23.2%), worse than the S&P 500 Index, and nearly the same as the Nasdaq. However, the stock is valued at a price-to-earnings ratio of almost 11.9X, below its range in the trailing five years and decade.

The consensus analyst earnings estimates are now $3.53 per share for 2022. So next, we will use 14X as a reasonable value for earnings, multiple accounting for competition, supply chain constraints, inflation, and lack of revenue growth. Hence, our fair value estimate is $49.42. The current stock price is ~$41.99, suggesting that Cisco is undervalued based on consensus fiscal 2023 earnings.

Applying a sensitivity calculation using PE ratios between 13X and 15X, we obtain a fair value range from $45.89 to $52.95. Hence, the stock price is approximately 96% to 105% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

13 |

14 |

15 |

|

|

Estimated Value |

$45.89 |

$49.42 |

$52.95 |

|

% of Estimated Value at Current Stock Price |

92% |

85% |

79% |

Source: dividendpower.org Calculations

How does this result compare to other valuation models? An EV/EBITDA multiple analysis from finbox gives a fair value estimate of $53.77 per share. The model assumes a forward multiple of 10.1X. Portfolio Insight’s blended fair value model combining the P/E ratio and dividend yield gives a fair value of $49.27 per share. Finally, the Gordon Growth Model gives $50.67, assuming a 5% dividend growth rate and 8% desired rate of return.

The four-model average is ~$50.78, signifying Cisco is undervalued at the current price.

Final Thoughts

Cisco is a slow-growth stock that generates exceptional cash flow. The company is using cash flow to maintain its market leadership, although it is not growing rapidly. Furthermore, Cisco has a wide moat making it difficult for new entrants to gain scale. A growing dividend and a high level of stock buybacks are rewarding shareholders. A reasonable payout ratio supports the forward dividend yield of ~3.6%. The stock is undervalued at the current price, even with conservative assumptions. I view Cisco as a long-term buy.

Disclosure: I/we have a beneficial long position in the shares of CSCO, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.