Summary:

- Despite current oil price pressure, Suncor’s integrated business model and cost efficiencies position it well for long-term success and substantial returns.

- Suncor is aggressively returning capital to shareholders through dividends and buybacks, supported by robust free cash flow and debt reduction.

- The company trades at an attractive valuation, offering a deep-value opportunity with significant upside potential as oil prices stabilize.

- Operational efficiencies, including advanced technologies and optimized production, enhance profitability, making Suncor a strong buy in the energy sector.

mysticenergy

All financial numbers in this article are in Canadian dollars unless noted otherwise. Oil and gas prices are always in US$.

Introduction

On Sept. 12, I wrote an article titled “Collapsing Oil Prices? Here Are My 3 Favorite High-Yield Oil Stocks To Buy.”

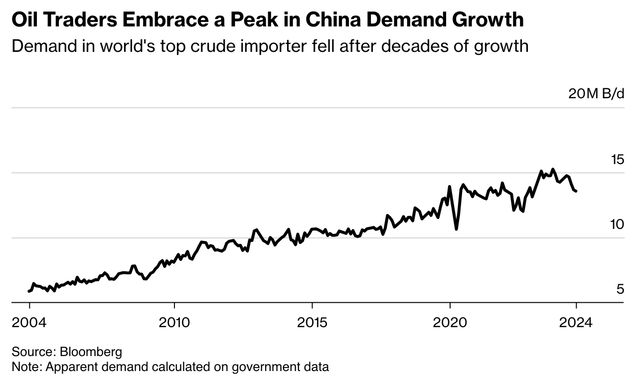

As the title suggests, this article was about pressure on oil prices which are suffering from demand fears and uncertainty regarding OPEC’s output decisions, among other factors.

It also does not help that supply is still strong (although growth is slowing).

And while much of the focus remains on demand – with slowing growth in China and concerns in the US – supply is really the issue.

Global oil output will hit a record this year, even with OPEC+ curbs in place. Production from outside the group is set to grow by 1.5 million barrels a day, and by the same amount again in 2025.

That deluge is why traders are so bearish right now, despite signs of tighter volumes in the near term. – Bloomberg

The chart below shows Chinese crude oil demand. Although we need to be careful, as this is based on government data (which is not always reliable in China), it makes sense that demand is down, pressured by weakening cyclical growth.

While the current oil price decline isn’t favorable, I’m a big fan of buying opportunities, which is why I quoted energy expert Eric Nuttall in the article I just mentioned:

Wrapping up Day 1 at the always great Peters & Co conference. A bit of shellshock amongst many watching oil down 4% on no news. Fundamentally, the contrast to when we were last at $65WTI is stark. Balance sheets are in amazing shape and sustaining capital + servicing dividend = ~$45-55WTI, company dependent. We need higher volumes but trading action starting to feel capitulative to me. Fundamentally, many stocks yielding 5%-8% sustainable down to COVID-era pricing. This is not COVID: Financial demand for oil may be at a record low yet August demand hit a seasonal all-time high. We firmly believe that oil is oversold and mispriced fundamentally. – Eric Nuttall (X @ericnuttall)

Not only is the long-term bull case still strong, but we’re also dealing with oil and gas companies that are in a much better spot compared to pre-pandemic years.

One of these companies is Suncor Energy Inc. (NYSE:SU), a company I called “One Of My Best Ideas In Energy” in the title of my most recent article, which was published on May 19.

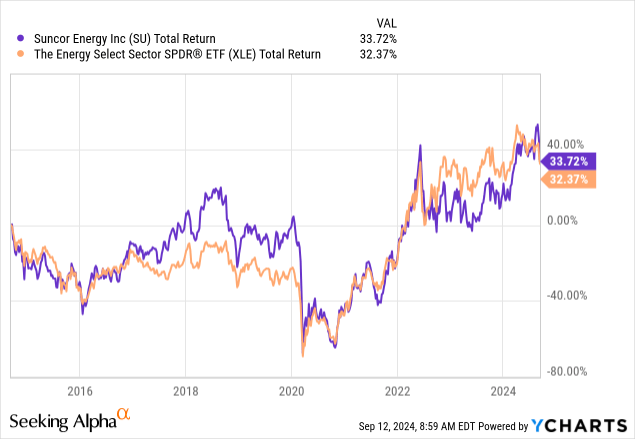

Although New York-listed Suncor shares have returned just 34% over the past 10 years (in line with the energy ETF (XLE)), the company is one of the oil producers that has significantly improved its business in recent years.

Suncor is lowering debt, improving upstream (oil and gas production) and downstream (refineries) assets, and preparing to return up to 100% of its free cash flow to shareholders in the not-too-distant future.

The only reason why the company was not included in my oil article is that I did not want to include two Canadian stocks in a three or four-ticker article.

In this article, I’ll update my thesis and explain why Suncor is still one of my favorite energy stocks.

A Canadian High-Yield Gem

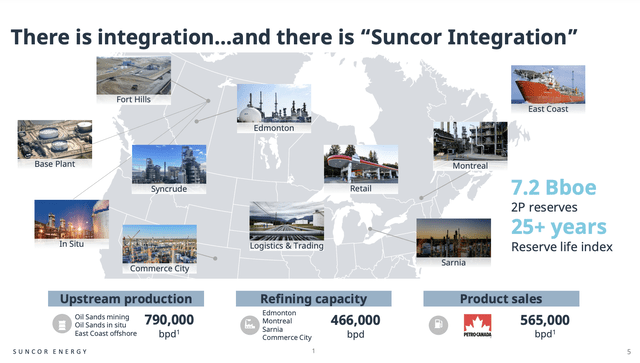

I own Canadian Natural Resources Limited (CNQ), which is Suncor’s bigger peer. The biggest difference between the two – their business models. Whereas Canadian Natural is an upstream-focused company, Suncor is one of North America’s largest integrated oil and gas companies, which includes refining assets.

This also applies to giants like Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX), which have oil and gas production, refining assets, and gas stations.

On top of producing close to 800 thousand barrels of oil per day, Suncor has the capacity to turn roughly 470 thousand barrels per day into value-added products. Its Petro-Canada whoselase marketing brand sells more than 560 thousand barrels per day to end-customers.

Additionally, one major thing that stands out is its operational footprint. I like Canadian oil and gas companies for two big reasons: They often come with deep reserves and low-cost operations.

Suncor, for example, has a reserve life of more than 7 billion barrels of oil. This translates to more than 25 years of production without any additional discoveries.

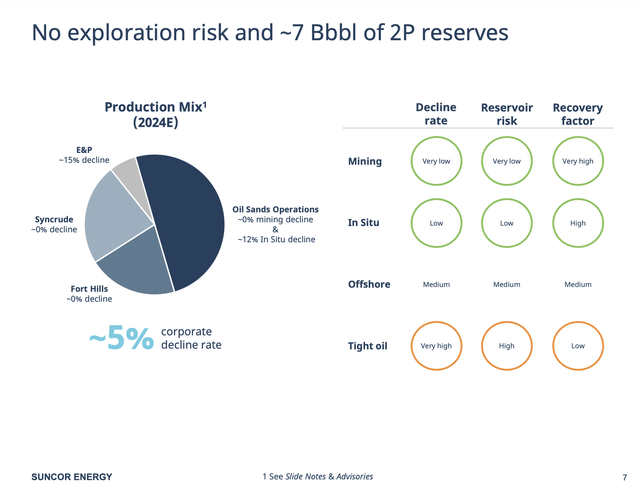

Even better, the majority of its production consists of mining and In Situ operations in the Western Canadian Sedimentary Basin, one of the biggest oil and gas formations in the world.

Although oil sand operations are worse for the environment than, i.e., U.S. onshore operations, they tend to be cheaper and have no decline rates.

Onshore producers in the United States are dealing with a rapid decline in output after initial drilling, but oil sand operations do not have that issue.

Hence, the company has a corporate decline rate of just 5%, with most of its operations having a 0% decline rate.

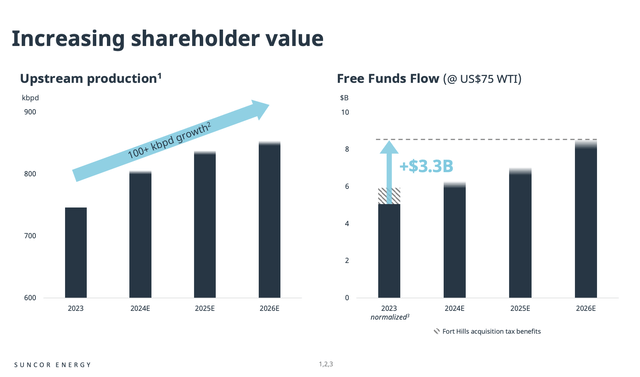

Thanks to these assets, the company is boosting its output, cutting costs, and increasing free cash flow.

In its 2Q24 earnings call, the company noted it aims to grow its free cash flow by more than $3 billion annually by 2026, fueled by a planned production increase of more than 100 thousand barrels per day.

In general, the company is on the right track when it comes to improving internal efficiencies, including boosting its refining utilization rate to 95%, which is up from 82% in the first half of 2023. This allowed it to refine 11% more products.

Even better, despite these improvements, the company spent 4% less on operating, selling, and general expenses, which is another impressive sign of higher operating efficiencies.

I also need to add that the company’s turnaround activities were completed on budget and 10% ahead of schedule. This added roughly 20 extra (unexpected) production days in the second quarter.

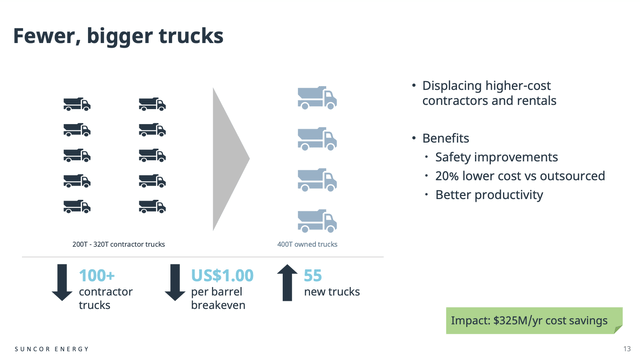

Meanwhile, in its mining operations, the company is reducing the number of trucks with a lower number of more efficient larger autonomous trucks. This is expected to result in $300 million in annual savings and reduce the breakeven price of its operations by roughly $1 American dollar per barrel.

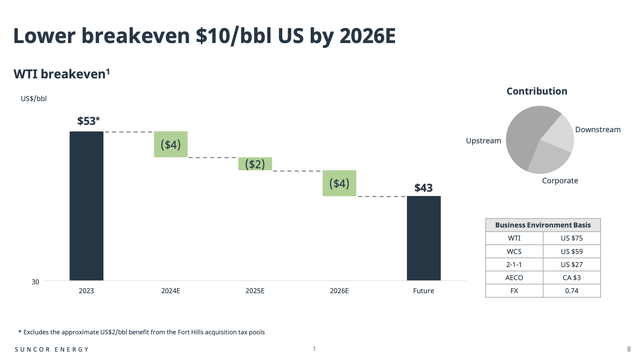

Although a saving of US$1 may not sound like a lot, it’s a big deal and one of the reasons why the company sees a path to roughly US$10 in per-barrel cost savings.

The big question is what this means for shareholders.

A Lot Of Shareholder Value

Suncor Energy has turned into a cash cow. In the second quarter, the company generated $3.4 billion in adjusted funds from operations. It turns this number into $1.4 billion in free cash flow.

It used this money to return $1.5 billion to shareholders through dividends and buybacks. Roughly $700 million of this consisted of dividends. In the first half of this year, it returned $2.5 billion to shareholders. This translates to an annualized return yield (dividends + buybacks) of 8%.

Another way to improve shareholder value is by lowering debt.

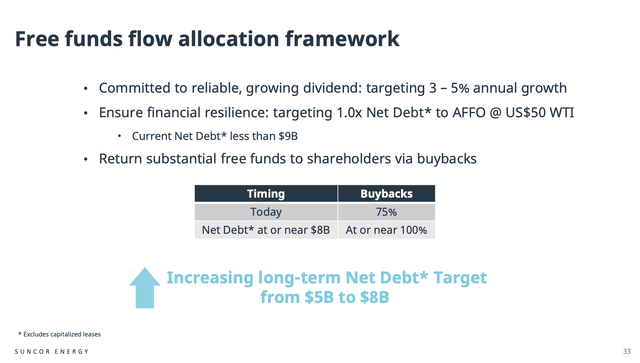

In the second quarter, Suncor lowered its net debt by $500 million to $9.1 billion. It’s now just $1.1 billion above its $8.0 billion target.

- This debt target will allow the company to maintain a 1.0x net leverage ratio at US$50 WTI.

- The company increased its long-term net debt target from $5 billion to $8 billion, which means it is more comfortable with debt. It also means it can reward investors more aggressively. However, when I wrote my prior article, the target was $9 billion, which means the goal post has been moved a bit in an unfavorable direction.

Currently yielding 4.5%, Suncor aims to grow its dividend by 3%-5% per year. It will distribute additional capital indirectly by using buybacks. In light of its current net debt situation, 75% of excess free cash flow is used for buybacks.

That number will rise to 100% the moment the company reaches its net debt target.

Analysts expect Suncor to end this year with $8.3 billion in net debt, which indicates the company could hit its target in the first half of 2025. Needless to say, oil price changes could slow or accelerate this process.

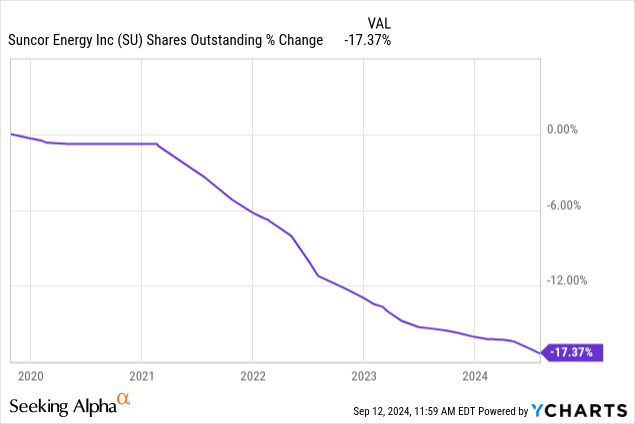

Over the past five years, SU has bought back 17% of its shares.

As the company is expected to generate more than $7 billion in free cash flow in both 2025 and 2026, we could be dealing with a free cash flow yield of 11%.

This bodes very well for its total return in the years ahead – especially if oil and gas prices recover.

In general, SU shares are extremely attractive.

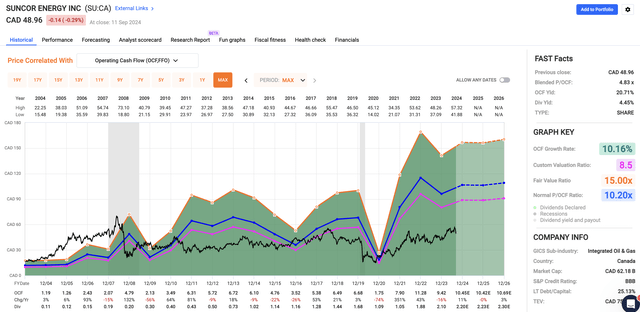

Using the FactSet data in the chart below, Suncor trades at a blended P/OCF (operating cash flow) ratio of 4.8x, which is frankly ridiculous, as the company trades at the valuation of a beaten-down coal producer.

Even in this challenging environment, the company is expected to grow its per-share OCF to $10.69 in 2026. Applying a conservative 8.5x multiple gives us a fair stock price of roughly $91, $2 above the target I gave in my prior article. This would also imply roughly 90% upside potential. The same applies to New York-listed shares.

Although it may take some time for oil to recover and investors to discover just how aggressive SU’s buybacks (on top of consistent dividend growth) can become, I believe Suncor is one of the best value plays in the entire oil and gas industry.

I stick to a Strong Buy rating.

Takeaway

Despite current oil price pressures, Suncor’s integrated business model, deep reserves, and focus on cost efficiencies position it well for long-term success.

The company is seeing significant improvements in reducing debt, optimizing operations, and returning value to shareholders through dividends and aggressive buybacks.

With its robust cash flow and attractive valuation, Suncor is a terrific value stock in the energy sector.

As oil and gas prices stabilize, I expect Suncor to deliver substantial returns, making it a strong buy in my book with a realistic potential to double in the years ahead.

Pros and Cons

Pros:

- Strong Financial Position: Suncor is generating substantial free cash flow and aggressively returning capital to shareholders through dividends and buybacks.

- Operational Efficiency: The company is cutting costs, optimizing production, and utilizing advanced technologies (like autonomous trucks) to improve profitability.

- Deep-Value Opportunity: Suncor trades at a very attractive multiple, which paves the way for potentially elevated returns.

- Integrated Business Model: With upstream, downstream, and retail operations, Suncor is well-diversified and successfully improving margins across the board.

Cons:

- Oil Price Volatility: Suncor’s performance is closely tied to oil prices, which remain under pressure from global supply-demand imbalances and economic uncertainty.

- Environmental Concerns: Oil sands operations are rather “dirty,” which could come with regulatory and reputational risks – although I expect no major headwinds as Canadian oil production is too critical.

- Debt Levels: While Suncor is reducing its debt, unexpected free cash flow headwinds could cause the company to adjust its net debt target.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.