Summary:

- Caterpillar has beat consensus EPS forecasts in 15 of the last 16 quarters.

- We detail the fundamental drivers for why we expect the pace of beats and analyst upgrades to continue.

- The current macro environment is bullish for Caterpillar as well.

- We conclude CAT stock has 30-50% upside from current levels.

narawon/E+ via Getty Images

Investment Thesis

Caterpillar Inc. (NYSE:CAT) has beat consensus EPS forecasts in 15 of the last 16 quarters. We detail below the fundamental and macro drivers for why we expect that trend to continue, and why, we believe, it will drive a re-rating in the shares. We see a potential upside of as much as ~45%. We recommend a Buy on CAT stock.

What does Caterpillar do?

Founded in 1925, Caterpillar sells bulldozers, excavators, etc. to the construction and infrastructure markets, sells large trucks, hydraulic shovels, and drills to the mining industry and engines and turbines to the oil and gas, marine, rail, and power generation markets.

The company generates revenue not only from original equipment sales but also from parts and services in addition to long-term maintenance contracts, financing, and insurance products they offer their customers.

The broad mix of equipment sales, services, and financing, across different end markets and geographies, means CAT offers a diversified and robust revenue profile.

Caterpillar’s structural advantages

Companies with “economic moats” that enable them to outcompete their peers will tend to deliver sustained EPS growth and outperform the market. Caterpillar has two primary sources of advantage, which are its strong brand and global scale.

World-Class reputation: Decades of great products and service have earned CAT a strong brand identity that drives customer loyalty and repeat business. Their equipment is renowned for its durability and robust construction that withstands harsh working conditions. This reliability is a significant selling point for their customers who require their machinery to be capable of handling long working hours in tough environments.

Caterpillar also has developed a reputation for their advanced technologies like automation and data analytics that improve the efficiency and uptime of its products. The company’s commitment to fuel efficiency, lower emissions, and renewable materials are increasingly important to their clients who must adhere to global ESG standards.

Global Scale: Caterpillar’s scale is a major advantage as well.

The company’s massive manufacturing footprint and efficient processes mean they can also produce at a more competitive cost, which gives them room to compete on price vs their peers and also grow their margins.

Caterpillar’s scale allows them to spread fixed costs and investments across a larger number of units sold which reduces the per-unit cost, which again is a positive P&L driver. The overall efficiency gives CAT leverage when negotiating with customers and suppliers.

The company’s global footprint is also a benefit as they can serve large global clients across a diverse range of industries including construction, mining, energy, and transportation. The company’s extensive worldwide network means they can respond quickly to the local needs of their customers, providing excellent customer support, including maintenance, repair services and training resources to help their customers maximize the use of their equipment. The diversity across various end markets creates a natural hedge and delivers a smoother, more reliable P&L profile.

Finally, CAT’s financial heft enables the company to invest strategically in new technologies and growth markets. We cover this positive earnings driver in more detail below.

Caterpillar has an incredible track record of beating consensus

The structural moats that CAT has around its business go a long way to explain its stellar earnings track record.

CAT’s 2023 full-year results were the best in the company’s 98-year history, with record sales and revenues, record adjusted profit margin, record adjusted profit per share, and record free cash flow. Total revenues hit $67.1 billion, up 13% from the previous year. Adjusted profit per share in 2023 was $21.21, a 53% increase compared to 2022. Free cash flow of $3.7 billion was a 58% increase.

Their most recent Q1 2024 EPS beat consensus by 9%, which marked the 15th quarterly result in the past 16 quarters to beat expectations.

| EPS | Beat / Miss | Rolling 4 Qtr Beat | Average Beat | Historic P/E | |

|

EPS FQ1 2024 (Mar 2024) |

5.6 |

0.47 |

1.68 | 1.98 | 16.3 |

|

EPS FQ4 2023 (Dec 2023) |

5.23 |

0.48 |

3.3 | 14.6 | |

|

EPS FQ3 2023 (Sep 2023) |

5.52 |

0.73 |

2.65 | 15.3 | |

|

EPS FQ2 2023 (Jun 2023) |

5.55 |

0.97 |

2.7 | 15.2 | |

|

EPS FQ1 2023 (Mar 2023) |

4.91 |

1.12 |

1.89 | 16.6 | |

|

EPS FQ4 2022 (Dec 2022) |

3.86 |

-0.17 |

1.05 | 18.6 | |

|

EPS FQ3 2022 (Sep 2022) |

3.95 |

0.78 |

1.65 | 11.8 | |

|

EPS FQ2 2022 (Jun 2022) |

3.18 |

0.16 |

1.33 | 14.1 | |

|

EPS FQ1 2022 (Mar 2022) |

2.88 |

0.28 |

1.36 | 18.4 | |

|

EPS FQ4 2021 (Dec 2021) |

2.69 |

0.43 |

2.01 | 17.2 | |

|

EPS FQ3 2021 (Sep 2021) |

2.66 |

0.46 |

2.21 | 20.4 | |

|

EPS FQ2 2021 (Jun 2021) |

2.6 |

0.19 |

1.91 | 27.1 | |

|

EPS FQ1 2021 (Mar 2021) |

2.87 |

0.93 |

2.03 | 36.8 | |

|

EPS FQ4 2020 (Dec 2020) |

2.12 |

0.63 |

33.0 | ||

|

EPS FQ3 2020 (Sep 2020) |

1.34 |

0.16 |

24.4 | ||

|

EPS FQ2 2020 (Jun 2020) |

1.03 |

0.31 |

16.5 |

Positive Drivers for Future Earnings Forecast Include the Following:

Looking forward, we see many reasons that the pace of beats should continue:

Strong Demand Trends: Caterpillar’s healthy demand across many of its key markets especially in North America also was evident in the Q1 2024 figures. In Power generation, sales in Q1 2024 surged by 26%, while sales to oil and gas were up 19%. The Energy & Transportation segment also saw a 9% increase in the quarter. This strong momentum bodes well for the coming quarters.

Healthy Backlog: CAT’s strong Q1 2024 backlog of $27.9 billion, up $400 million from Q4 2023 is a further sign of sustained demand for Caterpillar’s products that gives us confidence on future earnings.

Positive Pricing: Caterpillar also continued to deliver positive pricing in Q1 2024 which helped increase adjusted operating profit margin to 22.2% up from the full year 2023 margin of 20.5% which was also up a huge 510 basis points over 2022 and 80bps above the top end of the company’s target margin range. CAT’s ability to pass on higher costs to customers and grow margins is a further positive for future earnings growth.

Greater mix towards high margin services: CAT has emphasized expanding its services revenues, with a target for $28 billion by 2026. These value-added services benefit their customers while providing the company a high-margin recurring revenue stream. The results of the focus are already showing up in CAT’s figures, with the company reporting at their full year 2023 results that services increased by 5% to a record $23 billion, and rose again in Q1 2024. Their focus on growing the services segment is a powerful incremental driver to future earnings.

Thematic Exposures: The company is prioritizing investments in high-growth themes such as electrification, autonomy, alternative fuels, connectivity, and digital solutions and is looking to capture future growth opportunities in data centers and power generation.

Investments in accretive projects: Caterpillar is also proactively investing in positive return projects which should deliver profit growth. The company plans to invest between $2 billion and $2.5 billion annually in capex, which should deliver high returns, increased sales, and market share gains, all which should support sustained profitable growth moving forward.

For example, the company has a multi-year plan to double the production of large reciprocating engines from 2023 to 2027. These large engines play a critical role in power generation to address the AI surge in data centers that requires reliable and scalable power, the oil and gas industry needs the engines for gas compression et al, and aging fleets driving demand in the mining sector.

Caterpillar is investing in products like their Cat Hybrid Energy Storage Solution, which they launched in February to its oil and gas customers. The energy storage system can store excess power and discharge it when needed. It offers up to 85% cost savings vs fuel gas and substantially reduces emissions, cutting NO2 by up to 80% and carbon dioxide by 11% as compared with natural gas.

Caterpillar’s investment in future growth drivers like battery electric solutions for heavy machinery and autonomous and connected technologies will deliver real savings to their clients and allow them to capitalize on the growing demand for these environmentally conscious solutions.

Positive Macro Exposure: The current market environment is also positive for CAT

Global monetary policy remains accommodative, and credit markets are healthy, which means Caterpillar’s customers that are considering large capital investments or infrastructure products should be able to get easy access to funding for their projects.

At the same time, the fact that the economic leading indicators are also pointing to continued stable, healthy GDP growth makes these investment decisions more likely to get the green light.

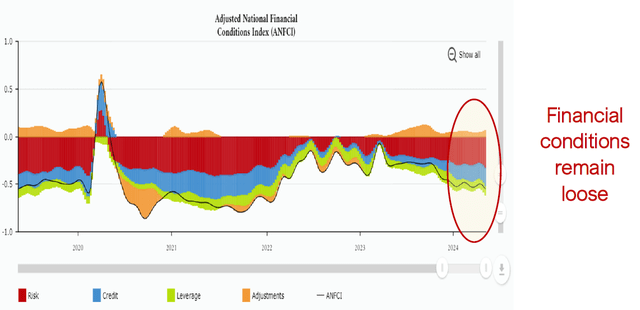

Liquidity Conditions

Global monetary policy is loose, which is a positive for Caterpillar and its Industrial sector, as easier access to credit helps support investment in new projects.

Adjusted National Financial Conditions Index (FRED)

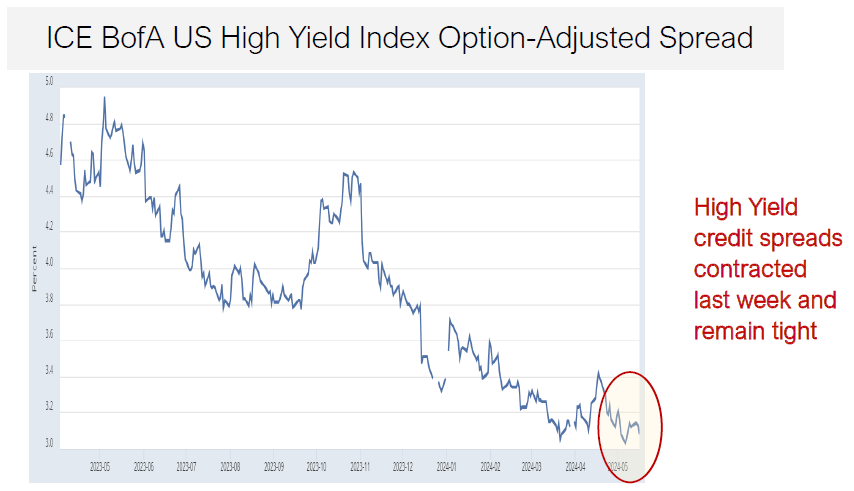

Credit Conditions

Credit conditions are healthy. Financial markets aren’t showing any signs of stress, which is historically a positive for the industrial sector. High-yield credit spreads remain tight, equity volatility is low, and mortgage rates are declining.

High Yield Credit Spreads (BofA / X)

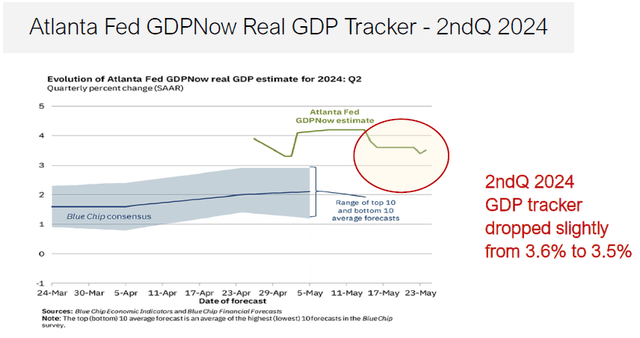

Economic Conditions

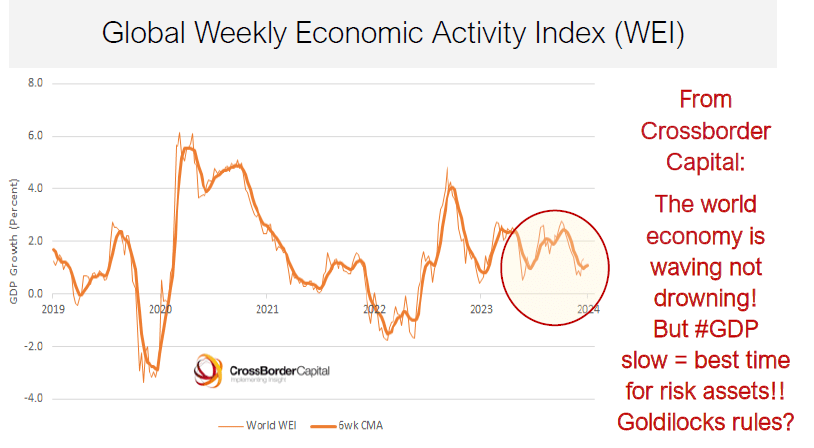

Economic indicators continue to show healthy GDP growth and slowing inflation, which is a positive for industrial spending.

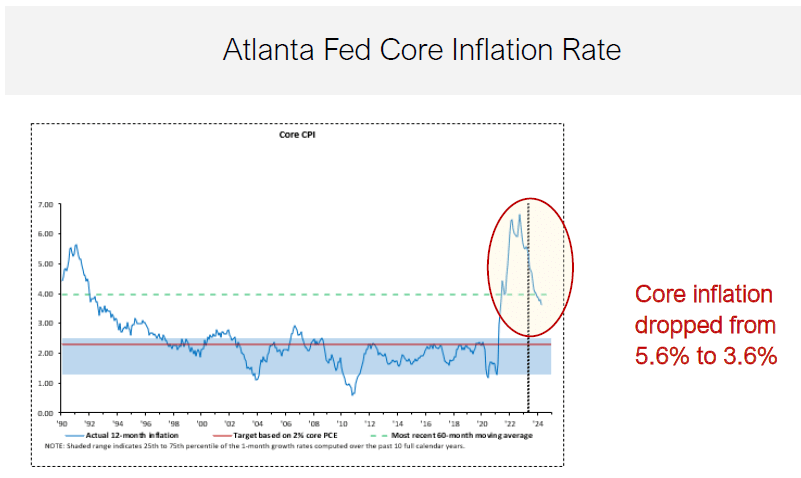

The Atlanta Fed GDP Now tracker forecast is for 3.5% growth in Q2 while core inflation has dropped from 5.6% to 3.6% and global economic growth continues to be very resilient. All of which are continued positives for industrial investment.

Atlanta Fed GDP Now Tracker (Blue Chip Economics / Atlanta Fed) Global Weekly Economic Activity Index (Crossborder Capital / X) Core Inflation Rate (Atlanta Fed)

Bullish Macro Conclusion for Caterpillar

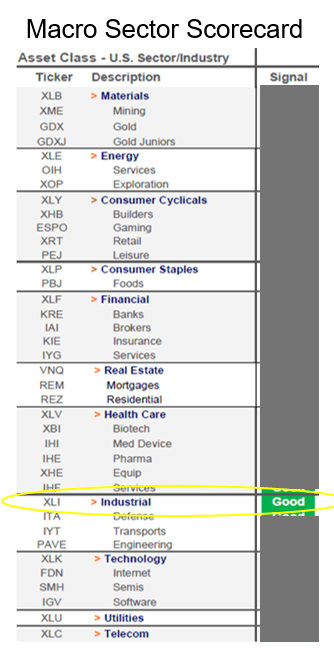

Our conclusion is that CAT and the Industrials sector should outperform in the current phase of the market cycle.

Sector Conclusion of Macro Analysis (Author’s Calculations)

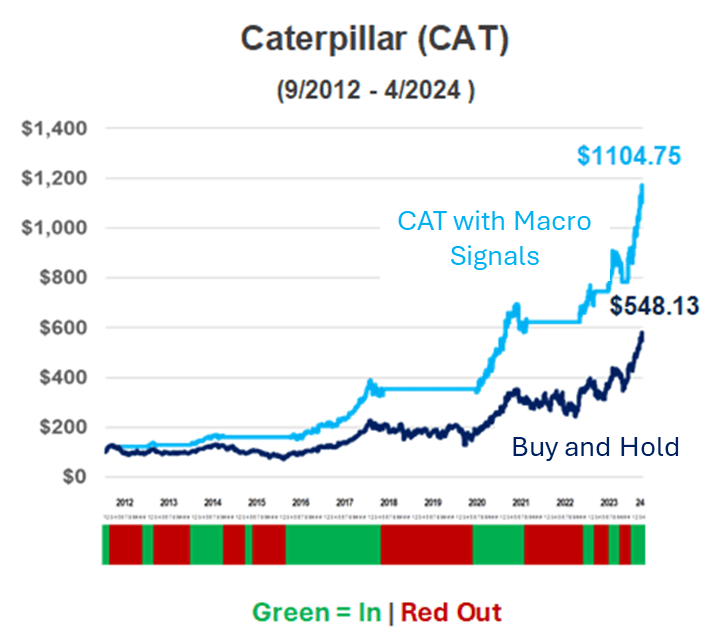

As the illustration below shows, investing in stocks where the Macro is also aligned helps minimize drawdowns and leads to superior returns versus a long-only strategy. CAT currently fits that criteria.

Example of Long Only versus using a macro overlay to mitigate drawdowns (Author’s calculations)

Seeking Alpha’s Factor Grades

CAT also screens well on Seeking Alpha’s quantitative Factor Grades which, as Seeking Alpha’s lead Quant strategist, Steve Cress, summarized in this article, are solid predictors of future share price performance.

Seeking Alpha gives Caterpillar an A+ Profitability Grade…

Seeking Alpha Profitability Grade (Seeking Alpha)

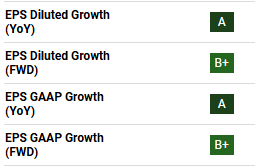

…and its EPS growth metrics are strong as well.

Seeking Alpha Earnings Growth Grades (Seeking Alpha)

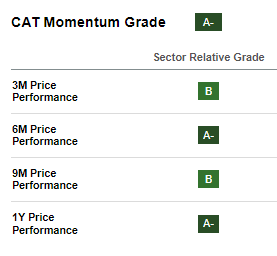

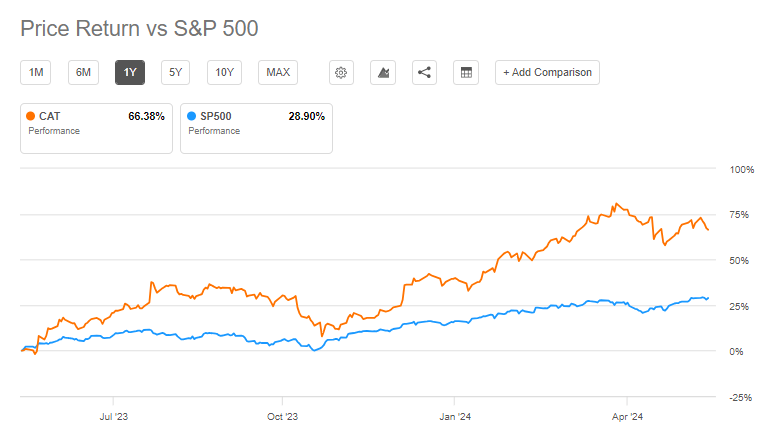

CAT’s long-term price momentum is strong, supported by the strong fundamentals outlined above, and is rated A- on Seeking Alpha’s Momentum Grade.

This is an additional positive factor that bolsters our view that the stock will outperform the market.

Caterpillar’s Price Momentum Grades (Seeking Alpha ) Caterpillar Share Price Relative to the SP500 (Seeking Alpha )

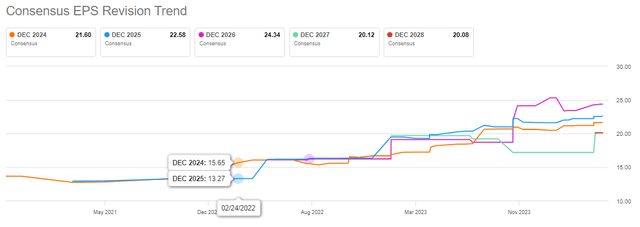

Positive Earnings Revisions

Caterpillar’s recent EPS beat vs consensus expectations explains why over the last 3 months there have been 20 positive analyst EPS revisions vs only 3 downward adjustments. This has earned CAT a respectable B+ rating on Seeking Alpha’s Revisions Grade.

Seeking Alpha Revisions Grade (Seeking Alpha) Caterpillar’s EPS Revisions Chart (Seeking Alpha )

Upside to Valuation

For the reasons cited at the top of this article, we expect the pattern of EPS beats and analyst upgrades to continue, which we suggest would justify a re-rating to higher P/E multiple.

Looking back at the past 16 quarters, Caterpillar, the average beat on a rolling 4-quarters basis has been $1.98 above consensus forecasts.

The current consensus for 2024 EPS is 21.60 per share. The high estimate is 22.80.

The current forward P/E ratio of 15x compares to CAT’s own historic P/E during the period above of 19.8x and the current US machinery Industry average forward P/E of 22x.

Assuming the company delivers the high end EPS forecast of $22.80 and Caterpillar re-rates to its historic P/E the stock has 32% upside. In a blue sky scenario where CAT re-rated to the industry average, the share price upside would be 47%.

| Current Price | $342.00 |

| Current 2024 EPS consensus Forecast | $21.60 |

| High-end 2024 EPS Forecast | $22.80 |

| Current Forward P/E Ratio | 15.8x |

| Historic Average P/E | 19.8x |

| Target Price Historic Avg P/E on High End EPS Forecast | $450.73 |

| Upside | 32% |

| US Machinery current Industry Average Forward P/E Ratio | 22.0x |

| Target Price Industry Avg on High End EPS Forecast | 501.6 |

| Upside | 47% |

Key Risks

While 2023 marked a record year, and Caterpillar’s robust business model is expected to drive superior performance in the medium term, the Q1 2024 report did show weaker sales. The company still achieved a non-GAAP EPS of $5.60, beating forecasts by $0.47. However, revenue posted a 0.6% year-over-year decline, falling short of expectations by $190 million, primarily due to lower volumes. Despite this, margins remained strong, pricing was effective, and cash generation was solid.

The principal concern moving forward is that this sales softness may herald further challenges. With growing economic uncertainty, particularly in key markets such as Europe and Asia, there is an increased risk that sales may not meet expectations.

We address the top-down above and are not currently concerned about an economic slowdown. While not our thesis, this scenario would certainly impact the company’s financial performance and share price, so we will monitor it closely.

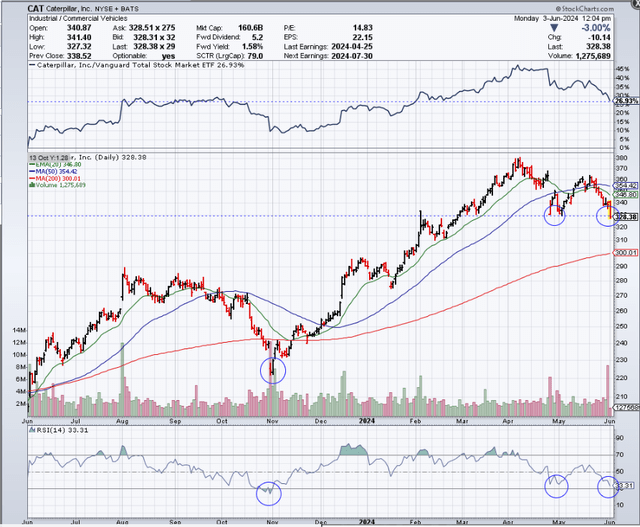

The stock is also at a key relative and absolute price support and is back to levels of oversold on 14-day RSI that previously led to the stock rallying. Should the support not hold, the downside risk is worth highlighting.

Caterpillar Stock Chart (StockCharts.com)

Conclusion: Buy Caterpillar

Caterpillar’s strong end markets, positive pricing, management’s continued focus on improving margins and investing in growth should see the company continue its track record of beating consensus. As analysts are forced to upgrade the stock, its P/E multiple should re-rate. Crucially, the stock also benefits from the tailwind of a supportive macro environment. We see a potential upside of as much as ~45% for the shares. Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.