Summary:

- Caterpillar stock is a top pick on my watch list, but I haven’t purchased it yet.

- Many of Caterpillar’s peers are painting a picture concerning investors.

- Caterpillar’s Q2 report is delicate and could lead to high volatility if the company fails to meet high expectations.

Avalon_Studio

Caterpillar Inc. (NYSE:CAT). This name has resounded in many ears since childhood, thanks to the yellow excavators and earth diggers that fascinate kids around the globe. With its stock, however, I have not been fortunate so far. I haven’t lost any money, but neither have I made some. The reason is simple: I have never bought it. And yet, it is among my first picks on my watch list. But this stock taught me an interesting investing lesson because when I was convinced it was in buy territory, I did not have the cash ready at hand. Since then, I always hold 5% to 10% of my portfolio parked in short-term bonds or high-yield saving accounts that I can quickly deploy if an opportunity appears.

I consider Caterpillar one of the best machinery manufacturers in the world, together – perhaps – with PACCAR Inc (PCAR). The reason is simple. Caterpillar has a revenue mix that addresses the issue of cyclicality. In fact, over a third of its revenue comes from services – mainly spare parts and maintenance. Thanks to this carefully planned and well-executed strategy, Caterpillar offers revenue stability and profitability that are rarely found among equipment manufacturers.

As Caterpillar’s earnings report is about to be released, I think investors should have in mind the whole macroeconomic picture to have reasonable expectations and a clear long-term strategy. Let’s say it right away: we will likely see Caterpillar decelerate and come in lower compared to last year’s Q2. The softness Caterpillar will probably report, however, should not be viewed as an internal flaw of the company, but rather, as the consequence of the macroeconomic environment. While Caterpillar’s shares may indeed trade down, an opportunity could open up for investors willing to grab a few shares for their portfolios.

Construction Equipment: Demand Is Decreasing, Use Is not

Caterpillar has been transparent since its Q1 2024 earnings call: Q2 sales are going to be lower YoY.

In its earnings presentation, it also added that, combined with lower sales, we should see operating profits at the same prior-year level, thanks to favorable pricing.

Since then, however, it seems the environment has deteriorated a bit and I doubt Caterpillar won’t have given up a bit on pricing to keep volumes up. After all, the leitmotif this year is “volume, volume, volume” and those companies that have shifted towards a “value over volume” strategy have taken the strongest hit.

Now, some of Caterpillar’s peers have already reported, and this helps us paint a better picture of what we could be seeing in Caterpillar’s report.

Terex Corporation, for example, (TEX) fell 5.6% in extended trading after it lowered its sales outlook for the year.

Even closer construction equipment peers such as The Volvo Group and CNH Industrial have updated their guidance lowering their outlook.

AB Volvo (publ) (OTCPK:VOLAF, OTCPK:VLVLY) reported a 10% decrease in construction equipment deliveries and lowered its expectations for North America and Europe, which are seen down 0-10% and 15-25% respectively. Only South America, led by Brazil, sees growing demand.

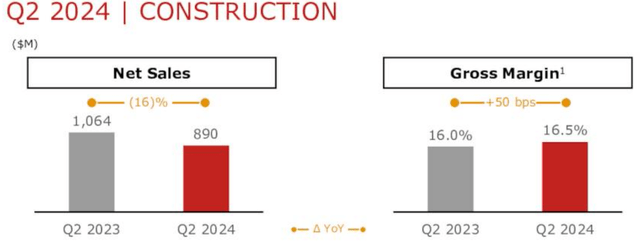

CNH Industrial N.V. (CNH) is mainly known for its agriculture business (it is the second-largest player after John Deere), but 20% of its sales come from construction equipment. Well, here is what happened during Q2: sales were down 16%, and gross margin increased by 50 bps only because the company had taken quick restructuring actions.

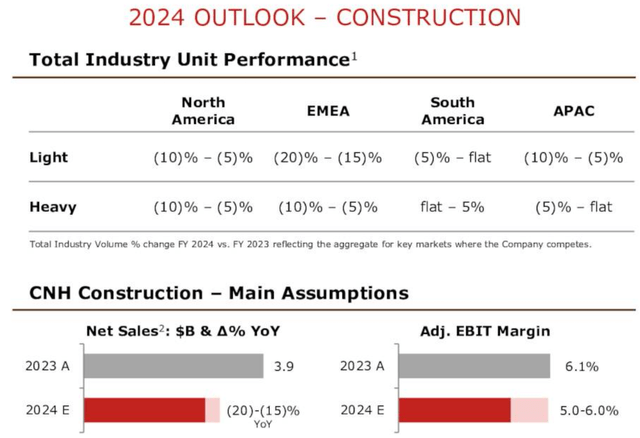

But what is even more important can be seen below. Before Q2, CNH guided for construction to be down -7% to – 11% YoY. Now this has been revised downwards, and the segment should have net sales down between 15% to 20%. That is a major downward revision in just 3 months.

CNH Q2 2024 Earnings Presentation

What is happening? Didn’t we see governments all around the world spend billions on infrastructure? Of course, we know that the U.S. Congress has passed several laws that funded this (Inflation Reduction Act, Infrastructure Bill, etc.). Right now, most of the new equipment needed has been already purchased and is now being used. So, while there is a lot of ongoing activity in construction, demand for new machinery has somewhat naturally softened. To this, we need to add the high-rate environment and the expectations everyone has of lower rates down the road. This creates a push-forward effect, that may benefit Caterpillar and the whole industry in late 2025 and 2026. At the same time, the high level of usage of construction equipment bodes well for Caterpillar because its service business will likely perform well.

Caterpillar’s Q2 Earnings Preview

Oddly, Caterpillar’s analysts are still bullish and have released 11 EPS up revisions in the last 3 months, with only 2 EPS down revisions. However, we have 5 revenue down revisions vs. only 1 up. So, expectations on the bottom line are better than the top line for two reasons. Caterpillar’s efficiency is excellent, and its services contribute to higher margins compared to its sales. We can also factor in buybacks, and we have a picture that may actually be favorable for the company’s EPS.

But, as we have always done when calculating a reasonable estimate of the upcoming results, let’s do some rough calculations.

One reminder: Caterpillar has three main business lines: construction industries, resource industries (mining equipment), and energy and transportation. The largest is usually the first one, with the third one right behind and sometimes able to surpass it (as in Q2 2023). Resource industries address the mining equipment market and are seeing the strongest tailwinds. However, it makes up a smaller portion of total revenues and profits.

Last year, Caterpillar reported $7.2 billion in construction revenue, over $3.6 billion from resources, and $7.2 billion from energy and transportation.

I expect Caterpillar to report a 10% decrease in construction sales. Equipment sales are probably down more, but this could be a bit balanced by increasing services revenue. So this makes me expect $6.4 billion from this segment.

Resource should be down in the high-single-digits. Let’s say around 8.5%. This means it could make $3.3 billion in revenue.

Regarding energy and transportation, Caterpillar said in the last earnings call that it was expecting flat results. Considering the environment deteriorated a bit quicker than anticipated, I expect this segment to be down around 3%. This means potential revenue of $7 billion.

So, we could see industrial revenues around $16.7 billion, which would be above the $16.5 reported last year.

Considering the impact of other revenues, of corporate items and eliminations (usually reported in Q2 as a negative number), and of the financial branch (thanks to higher rates it should probably report a YoY revenue increase), I see Caterpillar’s Q2 revenue around $16 billion. This is a 7.6% decrease in total sales and revenues. The current consensus is more optimistic and expects $16.67 billion for the quarter. Honestly, I would deem it a good quarter if Caterpillar can pull off a decline in the single digits.

Moving towards the bottom line, in Q2 2023 Caterpillar reported the following operating profit metrics:

| in USD billions | OP | OP margin |

| Construction | 1.80 | 25.2% |

| Resource | 0.74 | 20.8% |

| Energy & Transportation | 1.27 | 17.6% |

Caterpillar won’t probably report a price cut, but we won’t see aggressive price increases either. So, lower volumes mainly mean lower margins, given the nature of the industry.

Last year, the net income margin was 16.9%. In fact, Caterpillar has low interest expenses and thus its net income is usually close to the operating profit.

So, the estimate of the operating profit is way more important than the net income margin.

Last year, the overall profit margin was 21.1%. This year, the COGS should not be higher, but SG&A should be because of wage increases. R&D should be slightly up, too. The result is that I see a 20% profit margin as an important threshold. If Caterpillar is above that, its quarter will probably be welcomed happily by investors. As for me, given what I am seeing in the industry, I think we could have Caterpillar come above 19% but below 20%. So, I will use the middle point as my estimate. The result is that my operating profit forecast is $3.12 billion. Net income could then be close to 14%, or $2.24 billion. Considering Caterpillar had 489 million common shares outstanding at the end of Q1 and that its buyback program is strong and able to repurchase 10 to 20 million shares per year, we could have the Q2 share count around 485 million. This gives us a Q2 EPS estimate of $4.61 versus the $5.54 current estimate.

What does this make me think? I believe current expectations are still too bullish and this may lead to a strong disappointment as Caterpillar fails to meet them. The only possibility for the company would be a very strong performance in services, but it is no easy endeavor to offset the decline in equipment sales completely by this business line.

Perhaps I am being too conservative, but after three months of seeing every company in the industry report lower-than-expected results and revising downward their outlook, my view of Caterpillar’s earnings is the one I have described.

What does this lead me to? As said, I consider Caterpillar a great company and I would like to grab some shares and hold it for a long time. However, its valuation has often been an obstacle for me. The company still trades at a fwd P/E of 16, and a fwd P/FCF of 13.4. These are high multiples for an industrial company manufacturing machinery and equipment. As said, it is partly justified by its strong services business, which offers high margins and recurring revenue. But in a deteriorated environment, chances are that these multiples are higher because looking forward I expect a year or two of lower sales.

So, my rating is double-faceted. Short-term, I see Caterpillar declining. This is why I consider it a sell-into-earnings. But this doesn’t mean I am shorting it. It is just the suggestion to lock in profits if one is trying to exit the position and move the money outside. However, long-term investors should eye Caterpillar closely because it seems to be moving back to $300, which brings us below a 14 fwd P/E ratio considering CAT’s 2025 EPS to be around $22. This begins to be an interesting valuation that would turn into a strong buy below $250 (Forward 2025 P/E of 11.4).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.