Summary:

- Caterpillar’s revenue growth is expected to recover next year due to strength in the Energy & Transportation business and a rebound in the Construction business.

- The company’s E&T business is experiencing strong demand for reciprocating engines, particularly from data centers, which is driving revenue growth.

- Despite concerns about high dealer inventories, the situation is manageable, and the stock is trading at a discount, making it a good buying opportunity.

Avalon_Studio

Investment Thesis

I last covered Caterpillar (NYSE:CAT) stock in February last year with a buy rating, and the stock is up a solid 42% since then. While Caterpillar Inc. faces near-term revenue growth challenges in 2024, its revenue growth is poised to recover next year due to continued strength in the Energy & Transportation (E&T) business and a rebound in the Construction business in FY25, which should offset any weakness in the Resources business. The company’s E&T business is seeing strong demand for reciprocating engines, especially from data centers, and the company is making multiyear capital investments to cater to this demand, which bodes well for revenue growth. Further, secular demand tailwinds like the recent reshoring trend and IIJA funding are supporting the non-residential construction business. Additionally, the residential construction business, which is experiencing a slowdown, should also see a rebound with a potential reversal in the global interest rate cycle in the coming years. While the investors are concerned about the high dealer inventories, I believe this situation is manageable if we account for $300 mn in E&T project related inventory that is backed by firm customer orders.

On the margin front, the company should benefit from favorable price/cost and improved productivity. In the medium to long term, the margin should see gains from operating leverage as sales recover and mix benefits from increased high-margin services revenues. The stock is trading at a discount compared to its historical averages, which makes it a good buying opportunity for medium to long-term investors who can wait for the fundamentals to bottom and the stock to re-rate once the company returns to growth. So, I have a buy rating on the stock.

Revenue Analysis and Outlook

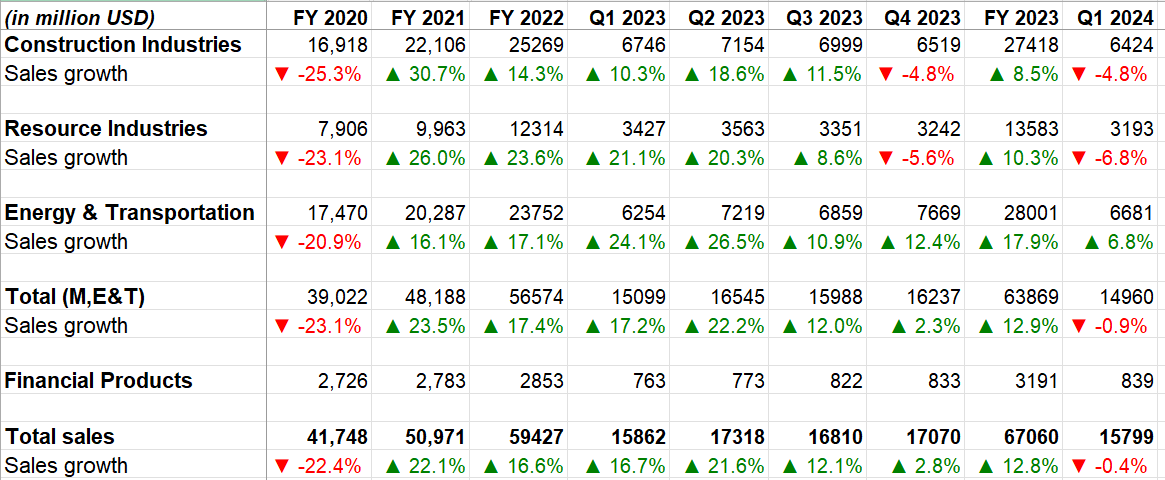

After seeing double-digit growth in FY21, FY22 and early FY23 driven by strong end-market demand, CAT revenue growth slowed and turned negative in the last quarter. In the first quarter of 2024, the company’s sales declined by 0.4% Y/Y to $15.79 billion, with the Machinery and Energy & Transportation (ME&T) declining 0.9% Y/Y. Sales to end users declined by 5% Y/Y in the quarter.

In the Construction Industries segment, sales decreased by 4.8% Y/Y as favorable price realization was more than offset by lower equipment sales to end users. Sales in North America increased by 6% driven by healthy demand for both non-residential and residential construction. However, in EAME (Europe, Africa, the Middle East, and Eurasia), sales fell by 25% primarily due to weakness in European residential construction and economic conditions. The sales declined by 14% in Asia Pacific due to the impact of changes in dealer inventories, while the Latin America sales were flat Y/Y.

The Resource Industries segment’s sales decreased by 6.8% Y/Y due to reduced sales to end users in the mining, heavy construction, and quarry and aggregates market as a result of softness in off-highway and articulated trucks.

Meanwhile, in the Energy & Transportation (E&T) segment, sales increased by 6.8% Y/Y attributed to sales growth in oil and gas, power generation, and transportation applications. Sales were up 26% Y/Y in power generation, 19% Y/Y for oil and gas, and 9% Y/Y in transportation, while sales were down 21% in industrial.

CAT’s Historical Revenue Growth (Company Data, GS Analytics Research)

While FY24 will likely be a tough year for the company, this is already built up in investor expectations. In fact, I believe investors are overly conservative about the company’s prospects, given the way stock sold off last quarter despite the EPS beat. One thing in particular which is worrying investors is the inventory build-up at the dealers, which the company reported at the time of last quarter’s earnings. Usually, dealers stock up inventory in the first quarter to cater to the spring selling season. Typically, the company sees a $700 mn to $800 mn sequential increase in inventory from Q4 to Q1. However, this year, dealer inventory increased by $1.4 bn, causing investor concerns. I believe the market overreacted to the inventory numbers. Out of this $1.4 bn increase in inventory, $1.1 bn is related to machines, while $300 mn is related to E&T customer projects. The majority of E&T dealer inventory is backed by firm customer orders. So, I am not too worried about this inventory. The remaining $300 mn to $400 mn of excess inventory in machines compared to $66 bn in annual sales is around half a percentage point of total sales and is manageable in my opinion.

Segment-wise, the company is seeing a strong demand in the E&T end market. One particular business line which stands out in this end market is the company’s reciprocating engines in power generation. These reciprocating generator sets are seeing a good demand from data centers. Unlike normal non-residential buildings, data centers require significantly higher generator backup capacity, and Caterpillar is benefiting from this demand. The company is also making multiyear capital investments in its large reciprocating generators division to cater to this secular demand trend, which bodes well for long-term growth.

There are also multiyear drivers in the construction business like the recent reshoring trend which is helping U.S. non-residential construction as well as IIJA which is helping infrastructure construction demand. While the U.S. residential markets and some European geographies remain soft, I believe we should see a global interest rate cycle reversal in the coming years which should catalyze these markets as well. Overall, I believe we are likely to see the construction market bottom this year and then eventual recovery from FY25 onwards.

The Resources segment is relatively trickier, but the company is doing a good job in terms of increasing its services business there. Further, this segment is relatively smaller compared to the other two, and recovery in construction combined with continued strength in the E&T segment should more than offset any weakness here.

So, I believe the company will return to growth starting next year onwards.

Margin Analysis and Outlook

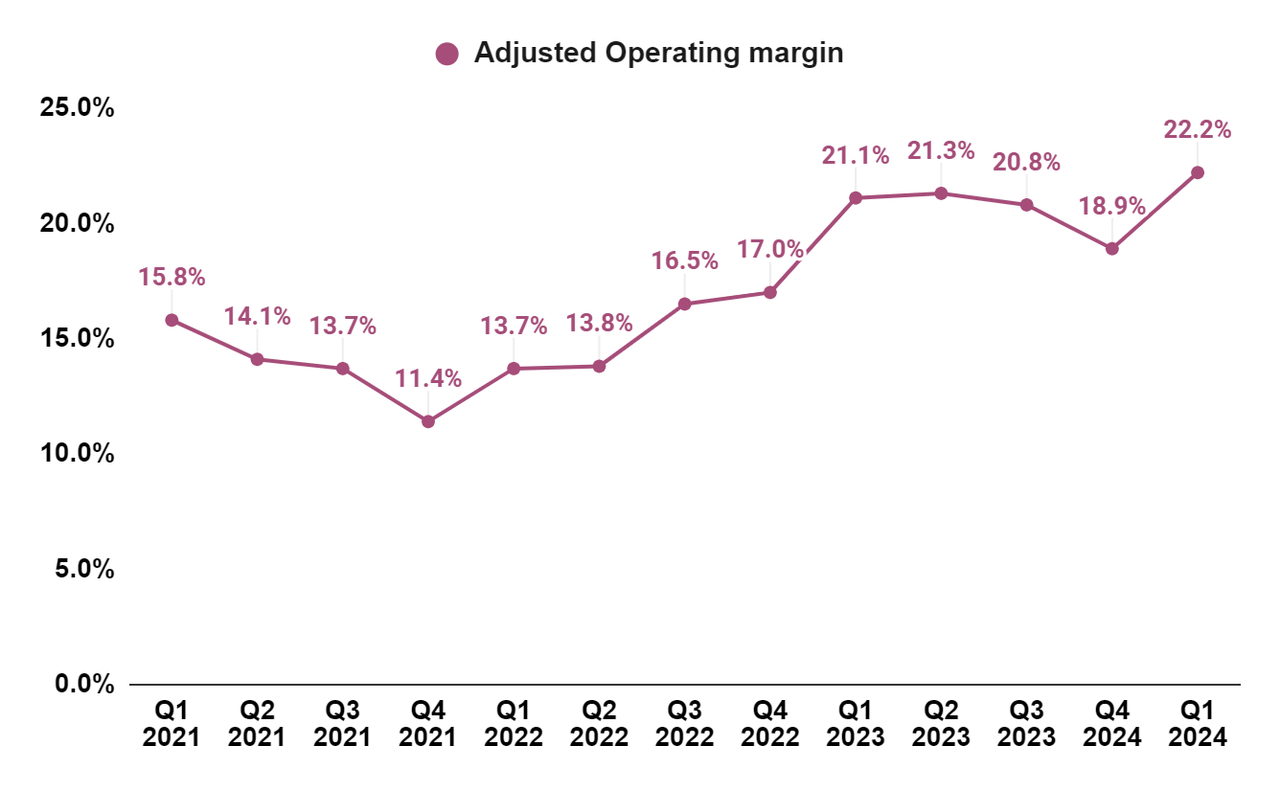

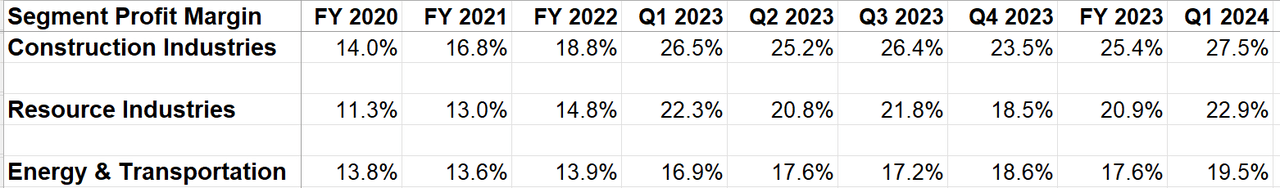

In Q1 2024, the company’s margins benefited from favorable price realization and lower manufacturing costs from reduced freight expenses. As a result, despite a decline in sales, the total adjusted operating margin expanded by 110 bps Y/Y to 22.2%.

On a segment basis, the segment profit margin increased by 260 bps Y/Y in the Energy & Transportation, 100 bps Y/Y in the Construction Industries, and 60 bps Y/Y in the Resource Industries segments.

CAT’s Adjusted Operating Margin (Company Data, GS Analytics Research) CAT’s Segment Proft Margin (Company Data, GS Analytics Research)

Looking forward, the company’s margin outlook looks positive. On its last earnings call, management indicated that price realization should be slightly higher than manufacturing costs for the full year. So, price/cost should benefit margins. The company is also doing a good job in terms of improving productivity and unit profitability, and this should continue moving forward.

In the medium to long term, once the revenue starts recovering next year, the company should see benefit from operating leverage. Further, the company’s E&T segment is currently in an investment phase and management is focusing on increasing capacity. Once this phase is over, this segment’s margins should also improve. The company is also focusing on growing higher margin services revenue, which should improve the mix in the long term.

Valuation

CAT is trading at 16.49x FY24 consensus EPS estimate of $21.60 and 15.78x FY25 EPS estimate of $22.58. Over the last five years, the stock has traded at an average forward P/E of 18.18x.

I believe investors are overly worried about near-term headwinds, resulting in a discounted valuation. The dealer inventory situation is manageable and less concerning than it appears when accounting for the $300 million E&T inventory likely backed by firm customer orders. Although the reversal in the interest rate cycle has been delayed by a few quarters, I believe it will eventually occur in the coming years, allowing the company’s P/E multiple to re-rate to historical averages. Meanwhile, the company is executing well and controlling what it can, as evidenced by its strong margin performance. Medium to long-term investors who can wait a few more quarters for the company’s revenues to bottom and the stock to re-rate as growth resumes can consider buying the stock at current levels.

As fears around dealer inventory situation subside and the company’s revenue growth turns positive again in the next year, I believe the stock’s P/E multiple will re-rate higher. Assuming the company’s multiple re-rate to the five-year average of 18.18x and using FY25 consensus EPS estimates of $22.58, we get a target price of ~$410 or ~15% upside from the current levels.

Therefore, I have a buy rating on the stock.

Risks

If interest rates remain high for longer, it could adversely impact residential construction activity and could result in the recovery in the residential construction business being slower than my expectations.

While I find the current dealer inventory situation manageable, prolonged high inventories or additional inventory buildup could further impact investor sentiment as well as the stock price.

Takeaway

While there are near-term concerns, the company’s medium to long-term revenue growth prospects remain attractive. The company’s revenue should benefit from strength in the E&T segment, driven by strong demand for its reciprocating engines and the company’s focus on capital investments to cater to this demand. Additionally, multiyear tailwinds such as the reshoring trend and IIJA funding in the non-residential construction business, along with a likely recovery in the residential construction with interest rate cycle reversal should contribute to revenue growth. While the investors worried about high dealer inventory levels, this situation appears manageable considering the $300 million in E&T projects backed by firm customer orders. The margins should expand with the help of price/cost benefits, productivity gains, operating leverage, and an improved mix from high-margin services revenues. This, coupled with a discounted valuation, makes CAT stock a good buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Gayatri S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.