Summary:

- Caterpillar Inc.’s Q3 results were mixed, with a miss on the top and bottom line, but an overall optimistic outlook for the whole fiscal year.

- However, the current valuation appears stretched, and long-term investors should pay close attention to changes in price realization.

- Ongoing trends in the Energy & Transportation segment are likely to provide a short-term tailwind for the share price, but problems a brewing in the company’s other two segments.

Pickone

Caterpillar Inc. (NYSE:CAT) just reported its third quarter results for FY 2024 and the stock is down by roughly 4% in the early trading hours.

On the surface, this share price reaction makes sense given the earnings and sales miss during the quarter.

Seeking Alpha

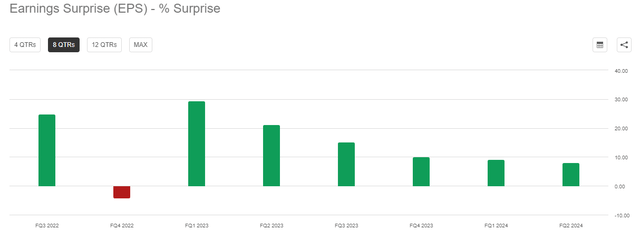

Following the lower-than-expected Non-GAAP EPS figure, this quarter puts an end to the recent trend of positive earnings surprises, and this is likely to cause some concern among sell-side analysts and short-term oriented investors.

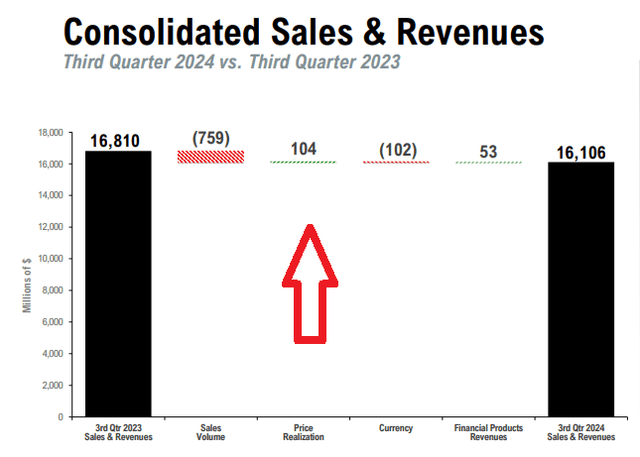

During the previous earnings release, CAT’s management was expecting revenues in Q3 to be slightly lower compared to Q3 2023 and adjusted operating profit margin to be similar to the same period of last year.

With that in mind, sales did fall on a year-on-year basis by roughly 4%, which could pass for a slight decrease. Adjusted operating profit margin, however, has fallen by almost 1% which was unexpected.

Adjusted operating profit margin was 20.0% for the third quarter of 2024, compared with 20.8% for the third quarter of 2023.

Source: Caterpillar Earnings Release.

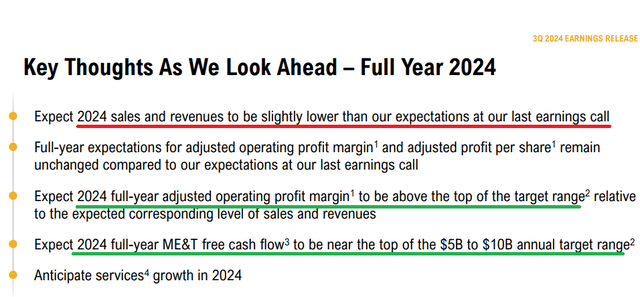

While this could be considered a major negative, the current guidance for the full fiscal year 2024 dispelled any fears regarding the company’s profitability. Sales are expected to be lower than previously expected, but adjusted operating margin and free cash flow for the full fiscal year are now expected to be near or above the top range of the previously provided guidance.

Caterpillar Investor Presentation

Based on all that, it is not surprising why the initial share price reaction was negative. At the same time, we should keep in mind that Q3 results and the guidance for the full fiscal year do not signal any major issues. In my view, this could result in CAT’s share price rebounding in the following days and remaining on its recent uptrend.

Looking beyond the near-term, however, this quarter highlights some important areas of concern for long-term shareholders. To understand what these are, we need to zoom out a bit.

Focus On What Matters

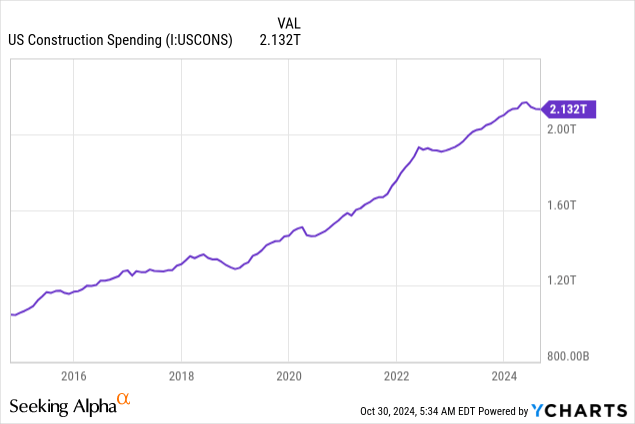

As a starting point, the recent uptrend in construction spending and net farm income, have been a major tailwind for Caterpillar recently.

As we could see on the graph below, U.S. construction spending has been running above-trend since 2022 and this has allowed many of CAT’s customers to spend more construction equipment and other valued added services.

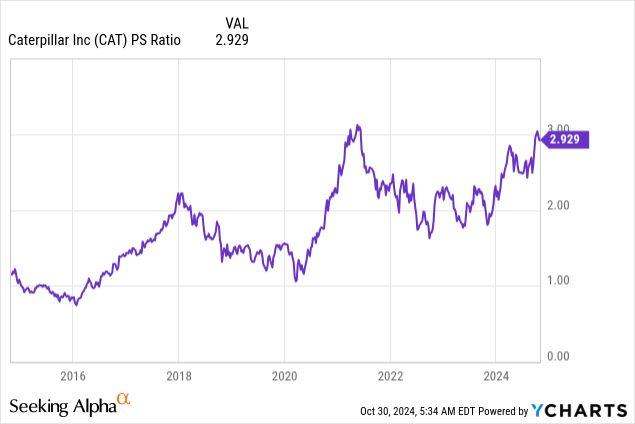

That is why, it is not surprising that CAT is now trading at a sales multiple that well-above the historical average, even though forward revenue growth stands at only 4%.

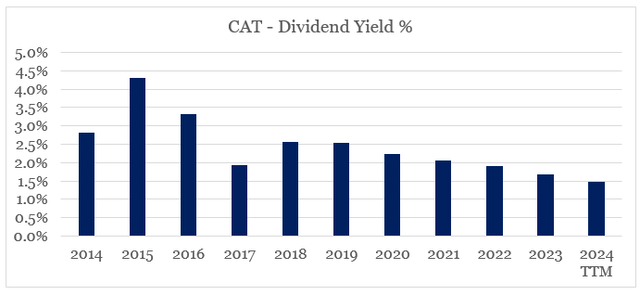

The dividend is also pointing towards CAT being priced at nose-bleed levels, with the current yield standing at multi-year lows at only 1.5%.

prepared by the author, using data from Seeking Alpha and SEC Filings

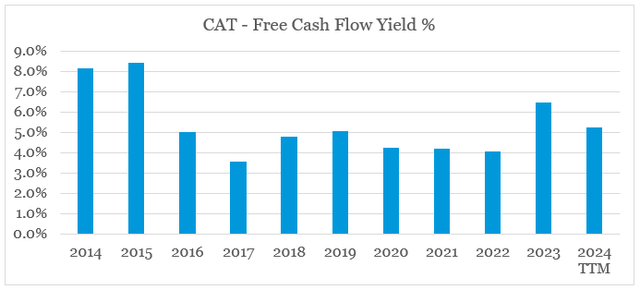

But investors are more interested in the company’s earnings and free cash flow, which are far more important metrics on the overall condition of the business. In that regard, CAT actually trades at very attractive levels on a historical basis. The recent increases in free cash flow result in the stock now trading at a free cash flow yield of above 5%, which is above the historical average.

prepared by the author, using data from Seeking Alpha and SEC Filings

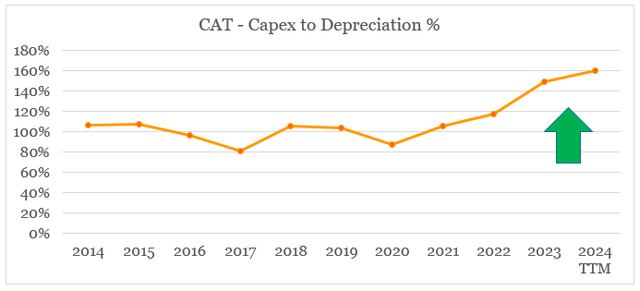

Moreover, it appears that the current free cash flow could improve even further once the current level of capital expenditures normalizes.

For context, CAT’s current capex to depreciation & amortization ratio stands at 160%. This is a clear indication that the company continues to invest in future growth and that eventually, capex should return to historical norms and provide yet another tailwind for the company’s free cash flow.

prepared by the author, using data from Seeking Alpha and SEC Filings

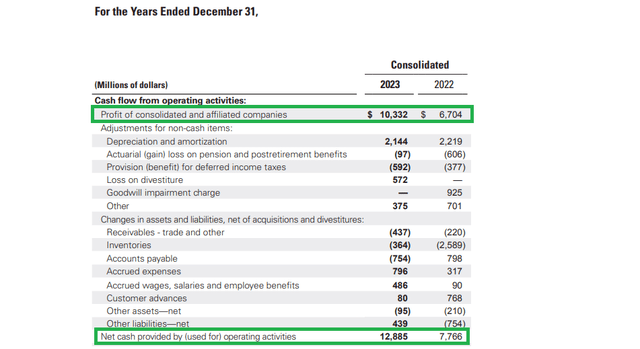

As optimistic as this might look like, we should clearly understand the key driver behind CAT’s recent increase in free cash flow and how sustainable this is. As we could see in the extract below, the cash flow from operations improvement in FY 2023 was net income, which suggests that it was margin improvements behind the recent increase in free cash flow.

Although sales increased significantly in 2023, selling, general and administrative expenses to sales ratio also increased from 7% in 2022 to 8% in the following year. This shows that economies of scale as a result of higher sales were not the driving factor behind CAT’s higher margin in 2023.

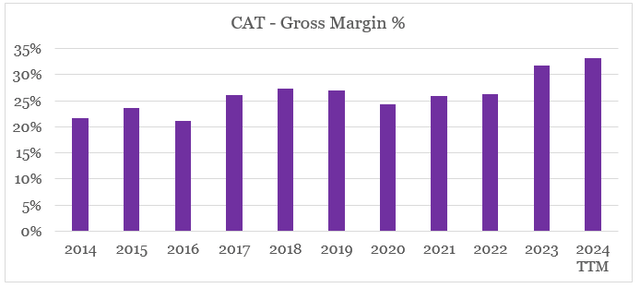

What drove that increase was gross margin, which is now at record highs and well-above the company’s historical average.

prepared by the author, using data from Seeking Alpha and SEC Filings

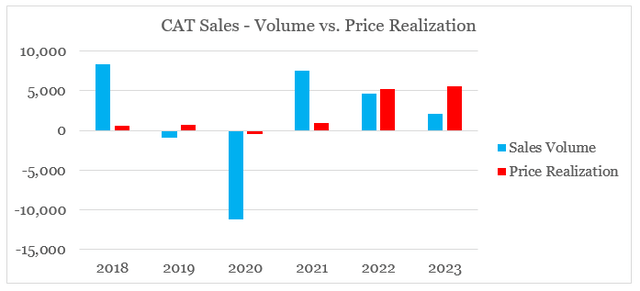

An unprecedented increase in the company’s price realization in 2022 and then in 2023 was the key driving factor behind CAT’s record high gross profitability. As we could see on the graph below, such large increases are very unusual for the company, with sales volume being on a downtrend recently.

prepared by the author, using data from SEC Filings

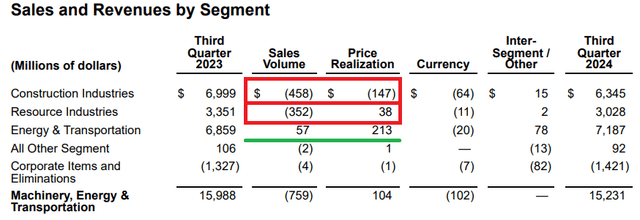

This makes price realization a key development for CAT that shareholders should keep a close eye on. In Q1 and Q2 of this year, the trend in pricing remained strong, with positive price realization impact of $578m in the second quarter of 2024 and $575m in the first quarter. In the third quarter, however, this has fallen to only $104m, with lower volumes having a significant negative impact.

Caterpillar Investor Presentation

On a segmented basis, the construction industries unit is no longer the largest one for CAT, as price realization has turned negative and volumes are falling. The situation in resource industries is not very good either, which leaves energy and transportation the only area of the business that is experiencing volume growth and a positive price realization.

Given all these developments, it is not a surprise that the first question during the earnings call was related to the current above-trend margins of CAT and their sustainability, how sustainable they are. The answer given by CAT’s management was quite generic and did not provide any evidence of where price realization trends are headed.

All that highlights the ongoing risks for CAT shareholders if the deterioration of business fundamentals in Construction Industries continues. On the positive side of things, there has been a notable increase in backlog within Energy & Transportation, 75% of which is expected to be sold within the next 12-month period. This is likely to be a much-needed short-term offset to the other two business segments, and it could keep CAT share price afloat.

Conclusion

The daily decline of CAT share price is justified by the somehow mixed results and guidance for the whole fiscal year of 2024. However, there were several critical developments during the quarter, which, if sustained, could derail a recovery in CAT’s share price. With that in mind, I would expect CAT to trade sideways over the coming months, provided that there are no major macroeconomic developments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the industrials space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.