Summary:

- Thanks to Fed stimulus, the US construction sector thrived after the 2020 market crash.

- Caterpillar’s business model grants it a longer lag time from economic changes, as its independent dealers face an immediate risk of falling construction activity.

- With construction activity slipping, the manufacturing PMI low, and other recessionary signals, it seems likely that Caterpillar’s sales will decline faster than expected over the coming two years.

- Long-term US energy and infrastructure needs will benefit Caterpillar, but only over a long time horizon, and they are unlikely to offset its more immediate cyclical pressures.

- Although Caterpillar’s sales may fall, its profit margins may remain abnormally high due to a lack of direct competition and focused management, mitigating its apparent overvaluation.

Jarretera

The construction sector was among the top performers after the 2020 market crash. As the Federal Reserve lowered rates and pursued immense QE stimulus, a large wave of homebuilding and multifamily construction began. From homebuilders to construction equipment companies, their value surged.

After over a decade of lower construction activity (after 2008), the US has had a general lack of sufficient homes, large buildings, and critical energy infrastructure. To a large extent, the surge in building activity is closing some critical gaps, particularly in the single-family home market, which is among the more volatile. In most of the country, there is a shortage of rental units, but record numbers of office-to-residential conversions seem likely to close that gap as well. Even after the previous bill, the US still needs significant infrastructure investments; however, this trend appears very long-term and may not benefit construction companies significantly in the short term.

In my view, with employment stability levels and consumer retail spending declining, the US (and most developed countries) seems headed into a typical recession. Whether this will be large or small remains unclear. However, I expect that trend may reverse the positive activity in the housing construction market, particularly when considering the crash in home sales and building permits.

I expect this trend will impact companies like Caterpillar (CAT). CAT has seen a remarkable 142% return over the past five years, with a 33% gain YoY. Before the rally, it struggled with stagnation due to generally low construction levels. While that has changed dramatically since 2020, I expect that it will face some revenue declines over the coming year or two as some of its key segments see a slowdown. Considering that, it is an excellent time to reassess its valuation for a potentially heightened risk environment.

Caterpillar’s Exposure to Macroeconomics

In my experience, many investors and analysts habitually project historical revenue and earnings trends linearly when valuing a company. That may be reasonable within some sectors, but construction-related companies are inherently cyclical. Even if it seems the trend is positive, we must always account for some risk that there will be a cyclical turnover.

To an extent, we can separate cyclical factors from long-term “secular” trends. In the case of Caterpillar, many investors look to the generally aged US infrastructure and need significant related investments into the energy grid and mining sectors needed for EVs and to upgrade old infrastructure. While I agree with that need, I think many investors and analysts in Caterpillar overstate its likely impact.

For one, these efforts will likely be seen over the coming decades, and stocks are generally valued based on their earnings expectations over 1-5 years, driven by the economic credit cycle. Further, as I’ve explained regarding Southern Copper (SCCO) and Vale (VALE), the actual mining needs for these efforts are likely overestimated and are tremendously overshadowed by falling long-term metal needs from China due to its excessive infrastructure development.

I expect Caterpillar’s construction segment will remain its most important. This segment delivered $1.76B in operating profit last quarter at $6.4B in sales, both figures down YoY but offset by a slight margin improvement. Resources saw an OI of $730M at a sales of $3.2B, again with negative YoY trends. Its Energy and Transport segment (which makes engines and turbines), saw OI of $1.3B at $6.7B in sales. Its Energy and Transport segment saw strong YoY growth following lower demand during the years prior.

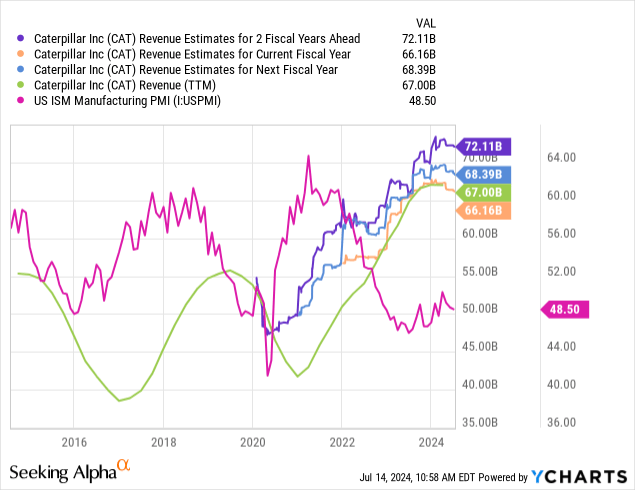

The company’s sales outlook has had significant growth in recent years, likely because it should see some benefit from efforts to improve US infrastructure. That said, with the manufacturing PMI being stuck at a “contracting” level, Caterpillar’s sales expectations over the coming years are stagnating, as well as its TTM sales. See below:

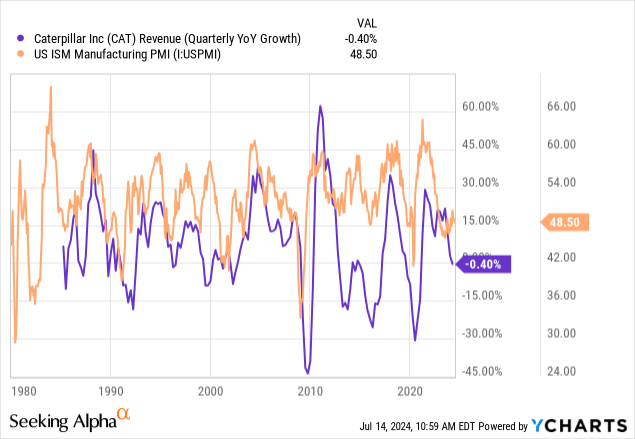

Caterpillar’s sales are highly cyclical. Its sales outlook is also well-correlated to its TTM sales, implying many analysts are watching the trend in its immediate sales but not necessarily projecting its sales based on the economic cycle. Indeed, the manufacturing PMI, a survey measure of industrial activity (a level above 50 indicating growth), is closely correlated to Caterpillar’s annual sales changes. See below:

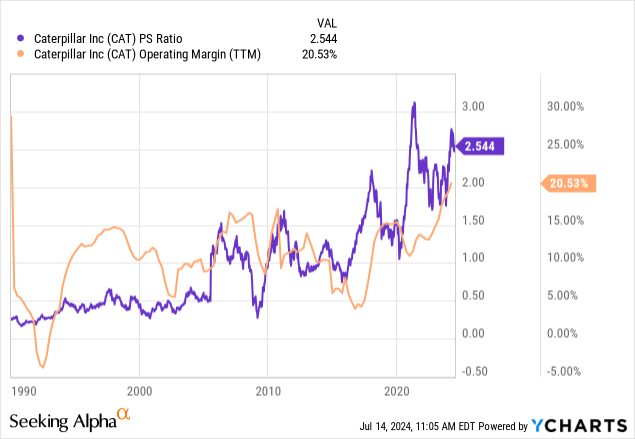

Today, the manufacturing PMI is signaling an ongoing decline in activity, and Caterpillar’s sales are also falling. No surprise there, but that has had almost no impact on its valuation. See below:

Caterpillar’s price-to-sales is exceptionally high today compared to its historically typical level. Of course, that is mainly due to its abnormally high operating profit margin, as its “EV/EBITDA” is generally within the range we’ve seen over the past two decades. Thus, the most significant risk to CAT’s valuation is likely a decline in sales and a reversal in its profit margin. The latter risk seems potentially underappreciated by the market.

Investors must understand that Caterpillar’s business model gives it an extended lag between economic changes and performance. Caterpillar dealers are independently owned, so its sales are sales to those dealers. Thus, should demand for construction equipment fall, we’ll see that impact in dealers before Caterpillar is impacted. That warns the company to reduce its manufacturing activity, but does not totally shield it. Its dealer inventory levels have risen, though not yet at a very concerning pace.

Overall, I think it is pretty clear that Caterpillar’s fundamental sales outlook is in a cyclical decline. Usually, a stock will rise or fall if it beats or misses expectations. Analysts expect Caterpillar to see around 3-4% in annualized sales growth over the next two years but with little growth this year and rapid growth in 2025-2026. In my view, that is very unlikely, given total US construction spending is now declining. Thus, I expect we’ll see higher dealer seasonally adjusted inventories over the coming quarters, likely hampering CAT’s stock performance.

That said, Caterpillar has a virtual monopoly in its sector. While I expect its segment to see a faster-than-expected reversal over the coming three years, I admit it is the only company with the capacity to supply the necessary equipment for a recovery in US infrastructure. Still, I feel we may not see growth related to that issue for some time, and it takes much longer than many expect. Decades of low infrastructure investment imply decades of recovery. Of course, if the economy is not strong and people, companies, and governments lack significant discretionary spending capacity, that may not occur.

The Bottom Line

There is significant uncertainty surrounding Caterpillar today. I believe the stock is overvalued, with a forward “P/E” of 15X, up from ~11X just over a year ago. In my view, it was more reasonably valued than when investors valued it according to the high probability of a slowdown related to tighter monetary conditions.

Undoubtedly, expectations surrounding Caterpillar are improving due to hopes that a Federal Reserve cut will cause a significant increase in construction machinery demand. To that end, I point to the fact that we’re only now seeing its sales slow due in part to higher interest rates, so any positive impact of rate cuts may not be seen for two years or more, while the adverse effects of rate hikes have yet to surface. Indeed, I’d argue Caterpillar’s performance over recent years is far more impacted by the highly stimulative impact of QE that gave many companies excess savings to deploy into capital investments.

In my view, we’re still seeing the positive effects of extreme monetary stimulus wear off, while the result of tightening has not been realized. Again, Caterpillar and the economy have a significant time lag because its dealers are an economic buffer.

While I am slightly bearish on CAT and believe it is overvalued, I am not nearly as bearish on it as on more exposed segments, such as homebuilders. I expect underperformance in CAT’s sales, but I see little reason to suggest its operating margins should crash. Further, Caterpillar could see income growth if its sales decline slightly while its margins improve. That is essentially what the analyst consensus suggests today. Still, even near-monopolies can see their margins slip if demand falters.

Again, CAT appears overvalued due to overestimation of its sales growth, but that is not sufficient reason to be excessively bearish or short the stock. Its dividend payout ratio is also low at 23% and has declined recently, indicating it may hike its dividend even if its income slips. I do not see that as a growth opportunity, but it may shield its share price from declines, even if its sales underperform as I expect.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.