Summary:

- Caterpillar Inc.’s most recent financial results surpassed estimates. However, key variables suggest that demand-side concerns have emerged.

- Machinery, resources, and construction segments saw lower unit sales in Q2. Although energy and transportation sales have increased, the general systematic environment seems challenging.

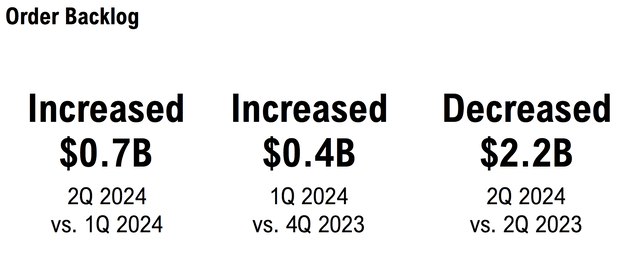

- A lower year-over-year backlog paired with stagnant cash conversion metrics are noteworthy considerations.

- I don’t see enough in Caterpillar’s peer-based multiples and dividend attributes to suggest that the stock is undervalued.

AttaBoyLuther/E+ via Getty Images

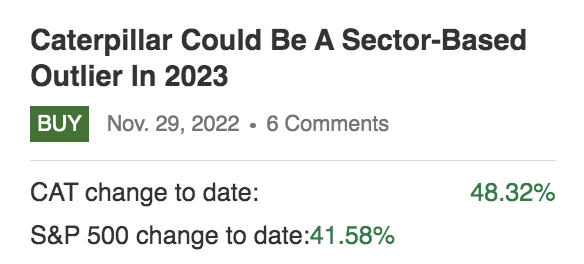

Caterpillar Inc.’s (NYSE:CAT) (NEOE:CATR:CA) stock is emphasized today as we revisit the industrial juggernaut’s prospects amid a changing economic environment. We last covered the stock in November 2022, stating it would be an outlier in the industrial sector. Although our analysis correctly predicted Caterpillar’s subsequent results, I have decided to update our thesis amid a shift in the company’s material aspects.

Pearl Gray’s Previous Rating (Seeking Alpha)

Without further delay, here are my latest thoughts about Caterpillar’s stock.

An Update On Material Events: Top-Down Analysis

Recent Earnings

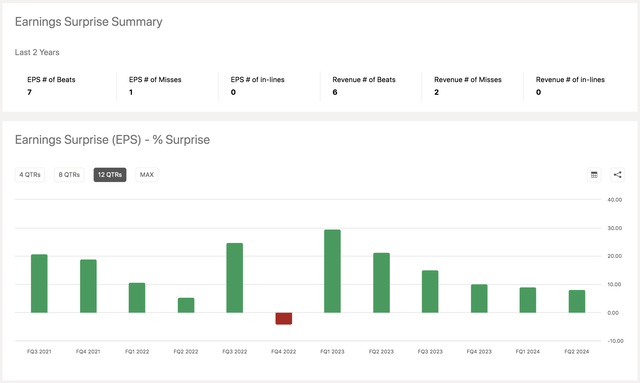

Caterpillar released its second-quarter earnings results on August 6th. The company reported $16.69 billion in quarterly revenue, surpassing estimates by $20 million. Moreover, Caterpillar reported $5.99 in earnings-per-share, beating forecasts by 45 cents.

The following diagram illustrates that Caterpillar has consistently surpassed its earnings-per-share estimates (since our latest coverage), likely contributing to its stock’s solid returns.

EPS Surprises (Seeking Alpha)

Despite surpassing its second-quarter targets, Caterpillar’s quarterly revenue tapered by 3.5% year-over-year, suggesting demand-side woes have emerged.

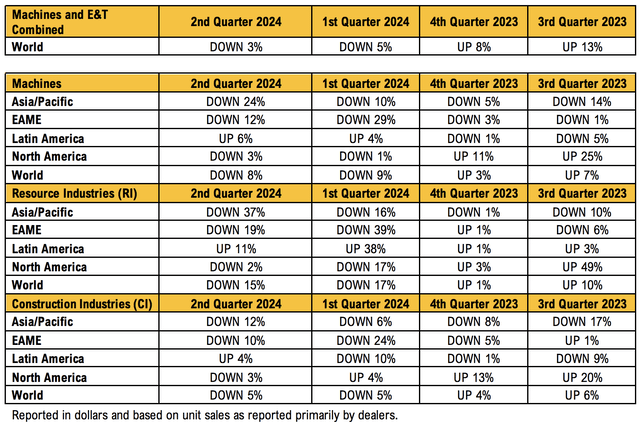

Caterpillar’s sales report delineates its demand-side woes. For example, the company’s machinery, resources, and construction segments experienced lower unit sales in the past two quarters.

Change In Retail Sales (Caterpillar)

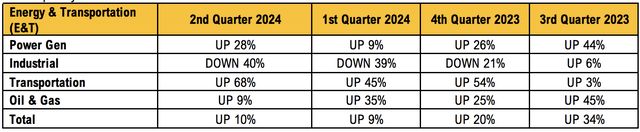

On a lighter note, Caterpillar’s energy and transportation segment’s sales increased in the last four quarters, providing the firm with some relief. However, as an exception, industrial sales have experienced substantial drawdowns in the previous three quarters.

Change In Retail Sales (Caterpillar)

I embedded a chart below to contextualize the company’s segmental performance in nominal value terms.

| Segment | $ Sales (bn) | $ Profit (bn) |

| Construction | $6.7 (-6.9%) | $1.741 (+3.6%) |

| Resources | $3.2 (-11%) | $0.72 (-2.97%) |

| Energy and Transport | $7.3 (+1.4%) | $1.525 (+20%) |

| Financial Products | $1.004 (+8.8%) | $0.227 (-5.4%) |

Source: Caterpillar (Q2 Results Rounded In $Billion and year-over-year % change)

Given the company’s latest results, the question beckons: Will Caterpillar’s Operating Results Find New Momentum, or Will They Stagnate?

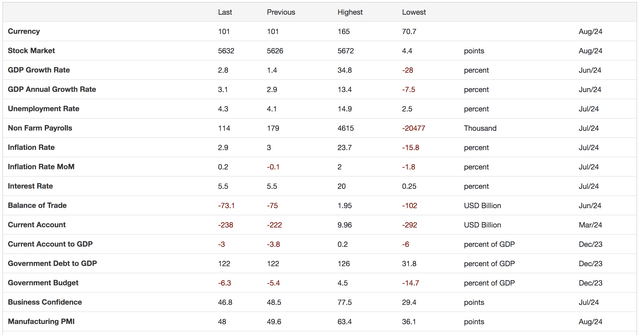

I don’t think the systematic environment allows Caterpillar to rebound in late 2024 and early 2025. Many believe lower interest rates will lead to concurrent economic growth. However, that might be a false assumption, especially as inflation has dropped from a level outside of its normal bounds (2% to 3% for the U.S.).

What am I trying to get at here? I believe that factors like higher unemployment, disinflation, and lower business confidence will dent the industrial cycle. Therefore, lower interest rates are expected. Although lower interest rates might eventually lead to a cyclical rebound, a linear occurrence is unlikely. In fact, real economic variables require a boost from the fiscus (in addition to central banking policy) before we see restored business and consumer confidence.

U.S. Economic Indicators (Trading Economics)

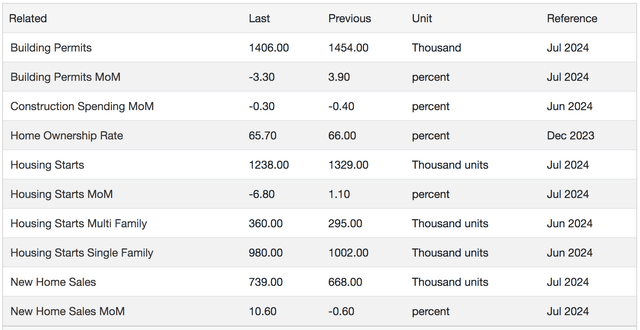

Considering the systematic environment, we might see declining demand for construction products. On a micro-level, building permits and new starts have already waned. As such, I think Caterpillar’s stagnant construction product sales growth will resume. Moreover, I see interlinkages with the firm’s machines and resource segments and expect them to follow a similar trajectory.

U.S. Construction Data (Trading Economics)

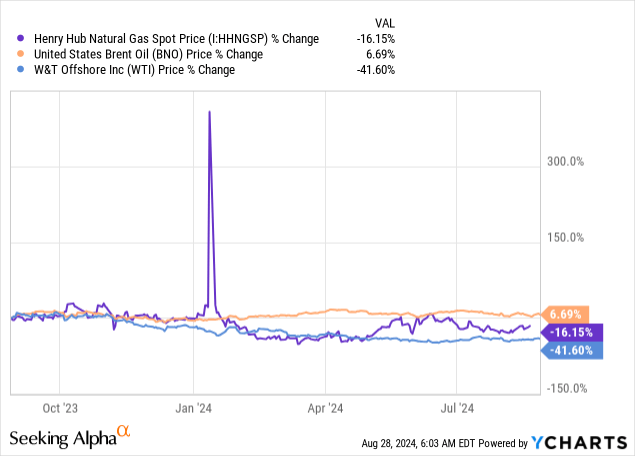

Furthermore, Caterpillar’s energy and transportation segment will likely face headwinds in late 2024 and 2025. What is my basis? Uncertain economic growth paired with a correction in the supply of fossil fuels has led to lower oil and gas prices. In turn, lower capital expenditure budgets are likely.

Another aspect to consider is Caterpillar’s financial products segment. The segment provides retail and wholesale financing solutions. However, lower sales and receding interest rates might reduce the segment’s interim viability.

Key Operating Metrics

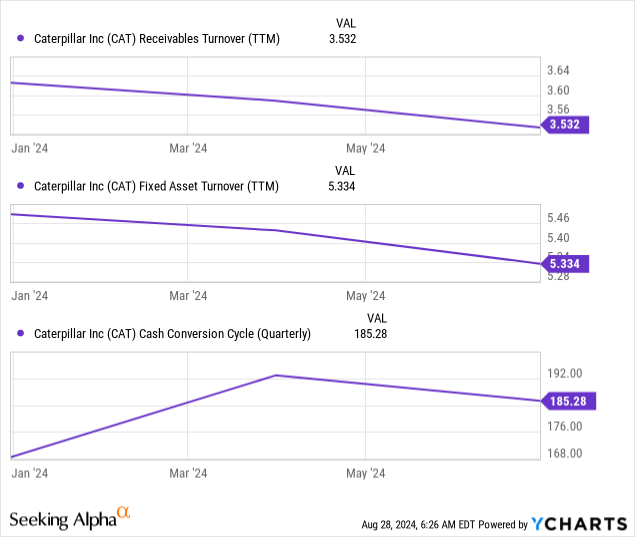

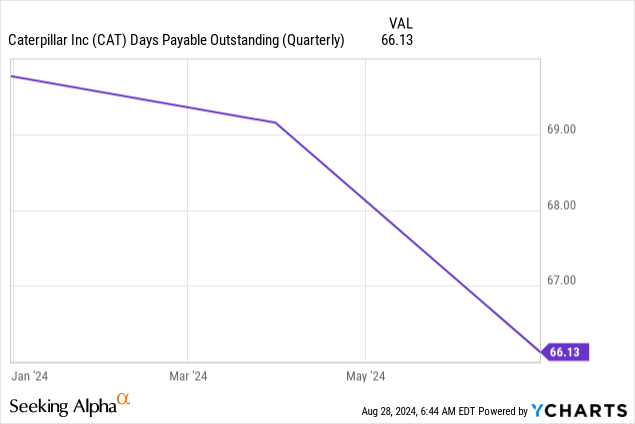

A look at Caterpillar’s key operating metrics conveys telling information. Although the company’s cash conversion cycle has improved quarter-over-quarter, it has risen since the turn of the year.

Furthermore, a look at Caterpillar’s turnover ratios shows that Caterpillar’s sales-to-receivables (receivables turnover ratio) and sales-to-fixed assets (asset turnover ratio) have compressed since the start of the year.

On the plus side, Caterpillar’s sales-to-accounts payable (days payable ratio) has improved since the start of the year. Although an isolated observation, this likely counteracts some of the abovementioned concerns.

I don’t think an extended cash conversion cycle is worrisome. Sure, Caterpillar’s backlog has decreased year-over-year, and, as previously discussed, the systematic environment is challenging. Nonetheless, I think the possibility of extending payables and receivables is unlikely.

Order Backlog (Caterpillar)

Valuation

Multiples

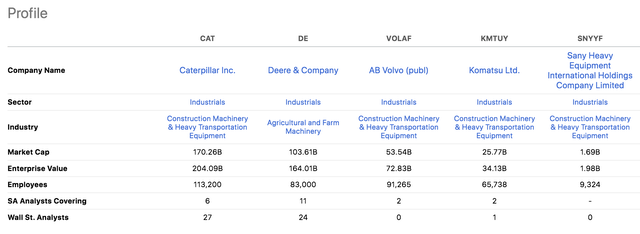

I decided to use a peer analysis to judge Caterpillar’s valuation outlook, whereby I compared the stock’s valuation multiples to those of Deere & Company (DE), AB Volvo (OTCPK:VOLAF), Komatsu (OTCPK:KMTUY), and Sany Heavy Equipment (OTCPK:SNYYF).

Peers (Seeking Alpha)

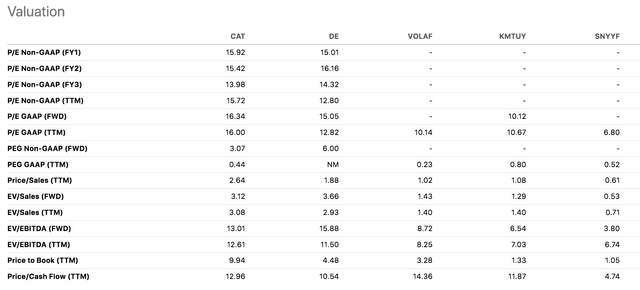

Caterpillar’s GAAP-adjusted price-to-earnings ratio illustrates that it is trading at a premium to its peers (on that basis alone). Moreover, the firm’s EV/EBITDA and price-to-book multiples are at premiums.

Caterpillar’s solid brand name and distinctive differences might explain its peer-based premium. Nonetheless, I don’t see enough in its premiums to deem the stock undervalued.

Peers (Seeking Alpha)

Dividends

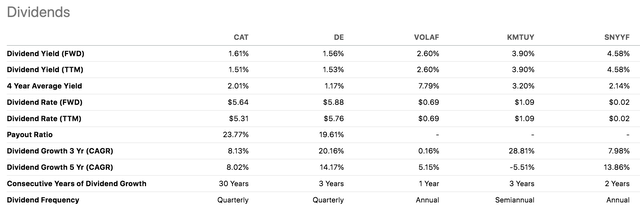

Caterpillar’s dividend metrics show that its trailing, forward, and four-year average dividend yields are lower than most of its peers. Although its dividend has grown for a longer period than its peers’, I think better dividend opportunities exist within the industrial sector.

Peers (Seeking Alpha)

Limitations Of The Analysis

My analysis is merely an opinion. A company’s stock price is a random variable; therefore, I might’ve overlooked some of Caterpillar’s influencing variables.

Furthermore, I assumed that an economic downturn is in motion. However, an economic outlook usually has a degree of subjectivity, especially when the parameters supporting the economy are volatile.

Lastly, Caterpillar has a robust brand and diversified operations. As such, my assumption about its cyclicality can be questioned.

Concluding Thoughts

Although I think Caterpillar is a high-quality company, its core operations might have reached a cyclical peak, meaning its stock price could reach a resistance level.

The company’s second-quarter report communicated slower broad-based sales, which is concerning as the line item coincides with a questionable outlook for the industrial cycle.

Furthermore, lower financial services revenue might surface due to the possibility of lower interest rates and the segment’s reliance on the firm’s core product sales.

In addition to the company’s fundamental aspects, I see little value in Caterpillar’s price multiples. Therefore, I decided to downgrade my outlook to market neutral.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Kindly note that our content on Seeking Alpha and other platforms doesn't constitute financial advice. Instead, we set the tone for a discussion panel among subscribers. As such, we encourage you to consult a registered financial advisor before committing capital to financial instruments.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.