Summary:

- CAT has a new life at recent highs. China’s stimulus news is part of the story, but my analysis sees beyond that one factor.

- The stock isn’t currently in my 40-stock portfolio or 75-stock watchlist. But I did recently buy a call option for a lower-risk opportunity.

- Despite not being in my portfolio, I closely monitor it as part of the Dow 30.

- The stock might become a candidate again, hence it’s always on my screen for potential opportunities.

pabradyphoto

While a lot of social media has been focused on a “cat-related issue” in the U.S. Midwest, the stock market’s big cat, Caterpillar Inc. (NYSE:CAT) has been pretty active in its own right. It led the Dow Jones Industrial Average higher on Tuesday, and is now up more than 30% in 2024. And at least in part, the reason for the latest surge in this CAT was due to something happening in a different part of the world, where Caterpillar does a lot of business. News of fresh economic stimulus out of China re-focused investors on companies that do a lot of business there.

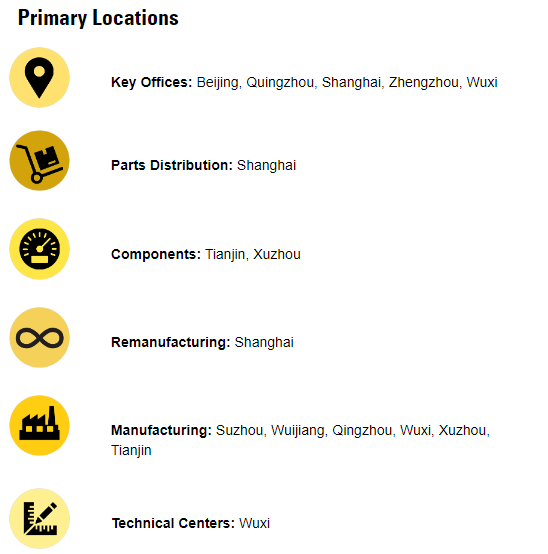

CAT has been operating in China for more than four decades, and currently is quite entrenched there, as shown in this graphic from the company’s website:

Caterpillar.com

More broadly/globally, Caterpillar is the world’s largest manufacturer of heavy equipment. The company is comprised of four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its global dealer network contains 2,700 branches maintained by 160 dealers. Cat Financial is a retail financing connection for its customers, and offers wholesale financing for dealers. That one-stop-shop is an inherent advantage for sales generation.

CAT has been and will continue to be a leader in the business of supplying heavy machinery to a range of industries. Infrastructure is an investment theme that is hard to imagine not growing long-term. Particularly in the United States, not upgrading bridges, tunnels, roads and providing enough housing to narrow the demand-supply gap would be catastrophic (no pun intended).

100-year companies mean a bit more to me

I tend to add extra “points” in my quality scoring system for companies that have been around for a very long time. CAT scores highly there, as the company will turn 100 years old this coming April. CAT has gained the trust level associated with some of the most sustainably competitive businesses, which is why it is a long-standing member of the Dow Jones Industrial Average, which aims to represent the landscape of the broad US economy. Reliability, quality and efficiency are the hallmarks that have made CAT a business I don’t seriously question as a candidate for my portfolio.

However, duration and industry leadership are not enough. Valuation matters, as does dividend, as my YARP stock portfolio keys off the dividend yield. As I’ll show below, the yield is just too low and too “overvalued” by my YARP factor measure to consider this stock in my main portfolio for now. I neither have CAT as a holding in my 40-stock YARP portfolio, nor the supplemental list of 35 stocks I follow as the “next man up” list for that live money portfolio that is the main driver of my semi-retirement asset management work.

However, that doesn’t mean I don’t track it. I do. Because I am a big fan of the Dow Industrials, and often use the lower and no-yield components of that index as swing trading and options positions. Specifically, on Tuesday I bought a “token” call option position (1 month out, $400 strike) so I am “invested” here, to the extent I am willing to for a low-yield stock. And if the stock’s current run continues, I will consider adding to that option position or even converting it into shares. But more likely, my current interest in seeing a strong momentum stock “hockey stick” higher, as the broad market appears in some spots to be offering that potential More on that below.

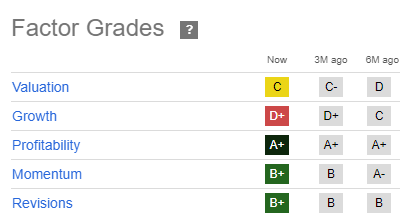

Factor grade analysis

Profitability is the Seeking Alpha factor I focus on the most, by a wide margin. As a longtime technician, the momentum grade of B+ is about the closet proxy to what I see in the charts, though I tend to be more conservative with stocks that have run up as much as CAT has. That also explains why the dividend yield is so low. A sustained period of high price returns will do that. CAT is one of a set of stocks that in my case, has lived up the old Wall Street adage, “strong stocks don’t give you a chance to get in.”

Seeking Alpha

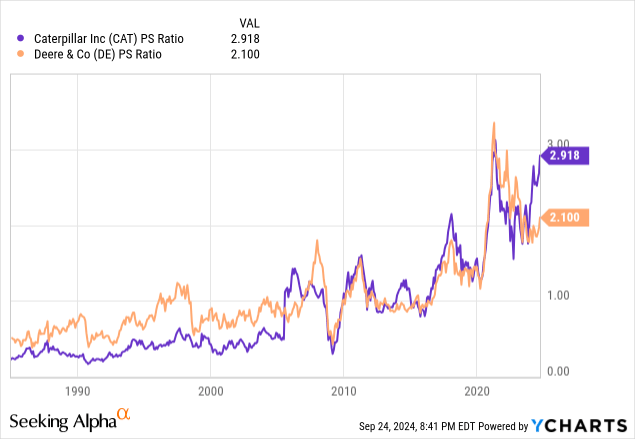

Valuation is not, to re-use a term from earlier, catastrophic. And it has risen to C from a D grade 6 months ago. But as we see below, CAT is selling at its higher Price to Sales Ratio in decades. And, versus a familiar peer, Deere & Co. (DE), whereas CAT traditionally sold at a P/S discount, it now trades at a 35% premium to DE. These are not “game changers” to a technician like me, but they are issues that factor into why, as a risk manager, I assign a higher risk of major loss to a stock like CAT, given the heights it has reached.

Seeking Alpha/YCharts

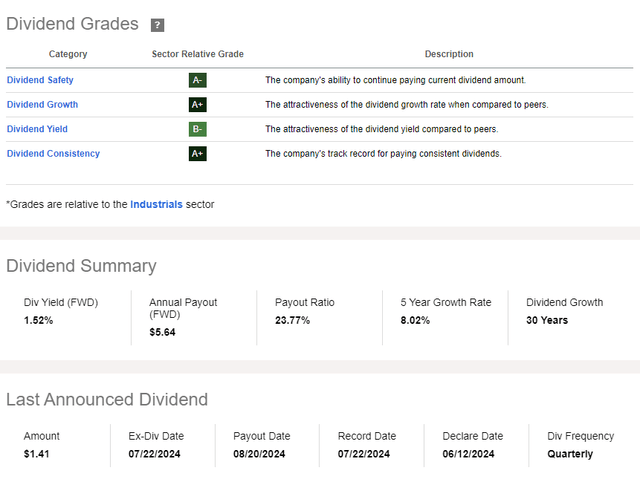

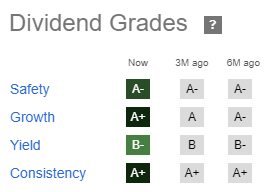

Dividend analysis

Seeking Alpha’s dividend grades show a solid safety level, which is no surprise with a wide moat type of stock like CAT. The dividend is growing, and solid as a rock, but the price is growing faster. And while the yield gets a respectable B-, that’s because SA quant ratings are measured within a sector. My own grades are absolute. In other words, if there were no viable industrial stocks yielding, say 1% or more over the S&P 500 (so about 2.2% today), I likely would not own any industrials in my 40-stock YARP portfolio. Or I’d find an alternate way to own them, perhaps selling options. But this is not a current matter, and I’ve yet to have to resort to that.

Seeking Alpha

I can’t predict future company policy, but I can say that CAT would look a lot more attractive to me if management were to lift the dividend by more than the current growth rate. Yes, this is a somewhat cyclical business, but the company within that business is less cyclical, given its size and strength. So with a payout ratio under 25%, there would appear to be room. But that’s me, the YARP dividend factor guy talking!

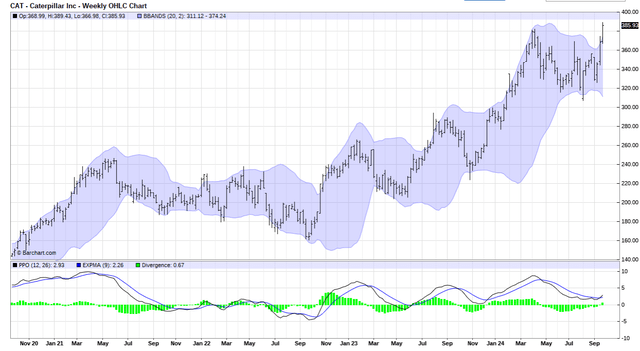

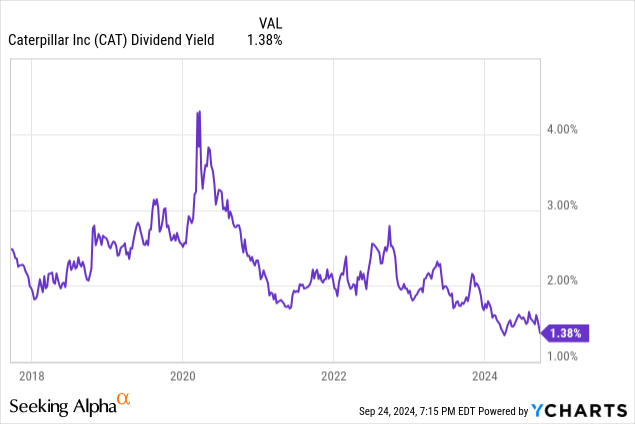

YARP factor dividend history analysis

At its most basic, YARP is a formula I created and have a pending registered trademark on (three weeks from now, officially). I look at the past seven years dividend yield, and measure where on that spectrum the current 12-month trailing yield sits.

Obviously looking at the chart below, CAT is at the bottom of that range, at or near its lowest yield in the past seven years. That’s not a reason for me to urgently sell a current holding, but as noted above, CAT is not something I owned as a main portfolio stock position. I did own it a couple of times in the past, and looking at the chart here, the approximate YARP-driven attraction points were back in spring of 2020 (with virtually every stock in the Dow and in the industrial sector of the S&P 500 index), in mid-2022 and marginally again in late 2023. The idea is that when the yield has potentially started to decline from a seven-year range peak, that’s when a stock starts to get my interest as a new buy.

During much of this time, I was doing more ETF work than stock work, and so I did benefit from owning ETFs that held CAT, such as DIA which tracks the Dow Industrials. But as for the stock, I clearly missed out for this cycle.

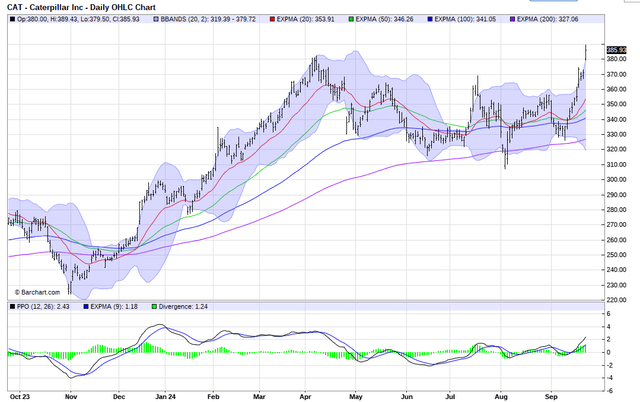

Technical analysis of CAT

Finally, here’s why I still have strong hopes (based on analysis, not wishing and dreaming) that I can still get some profit out of CAT through my newly-purchased call option position. This daily price chart below shows a potential breakout from a trading range back to April of this year. We are in a market climate where in stock-specific cases, particularly in iconic brand names like CAT, the stocks appear to have “liftoff” potential, at least for a period of several weeks or months. We’ll see. That’s why I am most comfortable not chasing stocks with sub-2% dividend yields as core holdings, but am very willing to “take big shots with small amounts of money” via the call option route.

That breakout is a close call for now, but another little burst higher, if it lasts even a couple of weeks, could put CAT in new high ground that can at least provide enough for a call position to pay off handsomely. In particular, the lower part of this chart shows my favorite momentum indicator, the PPO, just having crossed over to the upside. Translation for non-chartists: this is a very good sign, as it was in May of 2023 and again in November of 2023.

Those similar-looking patterns produced gains of 40% and 70% respectively, in relatively short time frames. And to be clear, while I participated in the DIA ETF’s surge in part thanks to that type of move in CAT and elsewhere in the Dow Industrials, I am truly kicking myself for not returning to more individual stock work sooner. More on that as I continue to relate the rationale, process and recent strong history of my YARP dividend stock portfolio work.

Rating? Hold. Explanation for rating? Required reading.

I’m assigning a hold rating to CAT for two reasons. First, as my regular readers know, I am no great fan of ratings that don’t have position sizing commentary attached. So while technically I bought a call option which could be used to ultimately possess shares of CAT within the next month or so, that is not the same thing as a buy. I have a fraction of the capital at risk.

It also isn’t a sell rating, since I do see a strong chance CAT can rise from here. If I had been smart enough to own it sooner, I probably would have been reducing my position, even if just for rebalancing purposes. But I would not have been selling it out completely. Thus, I split the difference and rate it hold. But hopefully that adds more color to the official “rating” here.

GO CAT GO!

I am a big fan of the NHL’s Florida Panthers, my local team who I brought my now adult son up on. As a young boy, he insisted I read him the Panthers media guide as a bedtime story. So when they won the coveted Stanley Cup for the first time, after 20 years of general mediocrity and near-misses, we celebrated as any fans would. Our rallying cry at the games: “GO CATS GO.”

So it seems fitting I close this article on Caterpillar, with call option position in hand, with a similar sentiment: GO CAT GO.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As noted through the article, I own call options on CAT

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.