Summary:

- Centene Corporation is a successful company in the government-sponsored healthcare sector, experiencing revenue and profit growth.

- The company’s Medicaid segment generates the most revenue, followed by Medicare and the Commercial segment.

- While some parts of the business have seen declines, the growth aspects of the company have robust profit margins and show promising growth potential.

FatCamera/E+ via Getty Images

In many respects, health care in this country is broken. It is not only overly costly, it also is terribly complex, with many different types of coverage. In this chaos, a number of companies have found ways to make a great deal of money. And one of the most successful firms in this space is Centene Corporation (NYSE:CNC), a business that is primarily focused on providing government sponsored health care to its clients. While this may not seem like all that exciting a space to be in, largely because of the lack of innovation that many might perceive to exist, the fact of the matter is that Centene is going through a rather interesting transformation at this point in time.

Revenue, profits, and cash flows, are all rising nicely. But when you dig deeper, you see that certain parts of the company are shrinking, while others are growing at a rapid pace. The parts of the business that have seen declines are the parts that generate the smallest profit margins for shareholders. Meanwhile, the growth aspects of the company generate rather robust margins that continue to grow year after year. Add on top of this how cheap shares are, not only on an absolute basis, but also relative to similar enterprises, and it is difficult not to like what I see. At the end of the day, I have decided to rate this business a solid ‘buy’. And frankly, it wouldn’t take much for me to upgrade it further to a ‘strong buy’.

A transforming enterprise

Author – SEC EDGAR Data

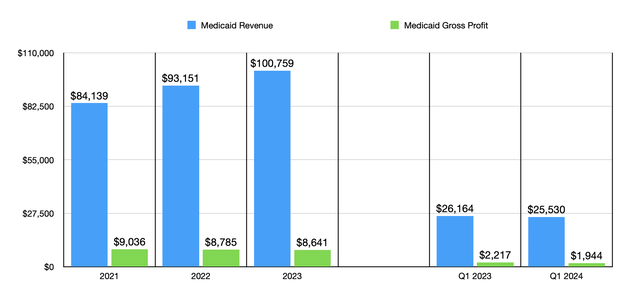

With a market capitalization as of this writing of $38.20 billion, Centene is a giant in the healthcare market. It’s a far cry from some of the other firms out there in terms of size. But it is large enough to dwarf most other firms. Operationally speaking, the company has three primary lines of business. Its largest segment is the Medicaid segment. As its name suggests, this is the part of the company responsible for providing all sorts of Medicaid plans to its customers. Using data from 2023, this part of the company was responsible for $100.76 billion in revenue. That’s up soundly from the $84.14 billion generated one year earlier.

Author – SEC EDGAR Data

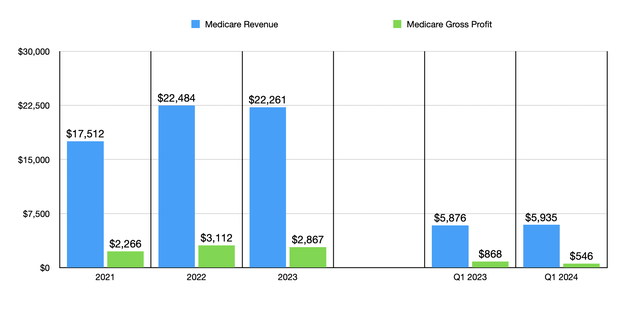

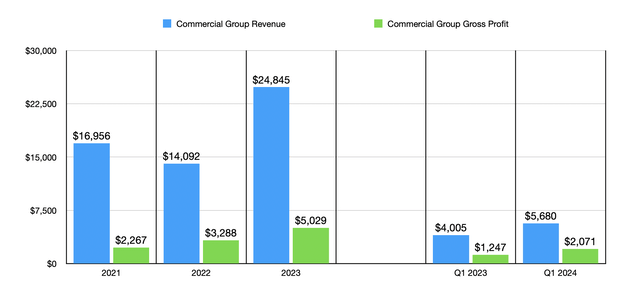

Next in line, we have the Medicare segment. This includes various initiatives such as Medicare Advantage, Medicare Supplement, Dual Eligible Special Needs Plans, and Medicare Prescription Drug Plans. Using data from the 2023 fiscal year, this part of the business was responsible for $22.26 billion worth of revenue. That’s up from the $17.51 billion generated in 2021. We also have the Commercial segment. This is the part of the company that includes its Health Insurance Marketplace products, as well as individual, small group, and large group commercial health insurance plans. This part of the company was responsible for $24.85 billion of sales last year. That’s an increase of 46.5% compared to the $16.96 billion generated one year earlier. There is a fourth segment just known as ‘Other’ that includes the company’s pharmacy operations, vision and dental services, clinical healthcare, and a wide variety of other lines of business. But this was responsible for only about 4% of the firm’s revenue in 2023. So for all intents and purposes, we won’t really be focused on this part of the firm.

Author – SEC EDGAR Data

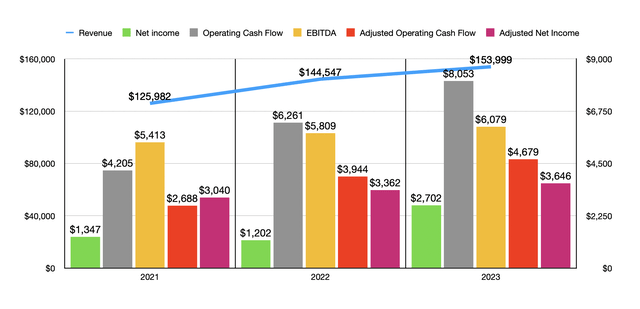

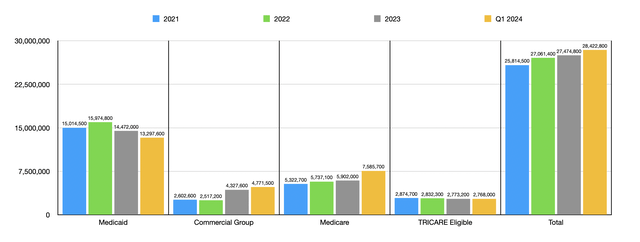

As a whole, revenue for the company has been on the rise in recent years. From 2021 to 2023, revenue grew by 22.2%, or 10.6% per annum, from $125.98 billion to $154 billion. This increase was driven by a couple of factors and came in spite of certain asset sales that the company completed. For starters, it ended 2023 with 27.47 million members on its books. This is up 6.4% from the 25.81 million that the company had just two years earlier. In addition to this, the amount that the firm is able to charge for its services also grew. Management cited higher Medicaid premium tax revenue, net rate increases, the launch of new plans in some states, and other initiatives, as key reasons behind this side of growth.

Author – SEC EDGAR Data

While revenue for all three core segments grew during this window of time, there was a decline in some parts of the firm. For instance, in 2022, the number of Medicaid members on the company’s roster peaked at 15.97 million. By the end of 2023, this number had fallen to 14.47 million. And as of the end of the first quarter of 2024, there was a further decline to 13.30 million. To be clear, this was not part of some strategy that the company implemented. The fact of the matter is that, due to the COVID-19 pandemic, a public health emergency was declared. With the declaration of this ending, as well as the subsequent expiration of what management calls eligibility determination waivers, management expects a decline in the number of Medicaid recipients.

Author – SEC EDGAR Data

This is not the only weak spot that the company has seen. Its TRICARE eligible members, which includes not only active duty service members in the US armed forces and their families, but also members of the National Guard/Reserve, and retired service members and their families, have been declining in recent years. The company went from having 2.87 million such members at the end of 2021 to having 2.77 million members by the first quarter of 2024. As painful as this is to see, there has been some really impressive growth elsewhere. The Medicare side of the business has exploded. After growing from 5.32 million members in 2021 to 5.90 million members last year, there was a further increase to 7.59 million in the first quarter of 2024.

According to management, this surge was driven at least in part by a strong bid position for the company that helped to push its Medicare Prescription Drug Plan membership up by roughly 44% year over year. Although not as impressive, the Commercial segment for the company has also been on the rise. Membership initially fell from 2.60 million in 2021 to 2.52 million in 2022. But in 2023, it soared by 71.9% to 4.33 million. And in the first quarter of 2024, there was a further increase of 10.3% to 4.77 million. An expanded footprint that includes 29 states for the Health Insurance Marketplace, as well as what management describes as ‘strong product positioning’ can be attributed for a good portion of this growth.

Author – SEC EDGAR Data

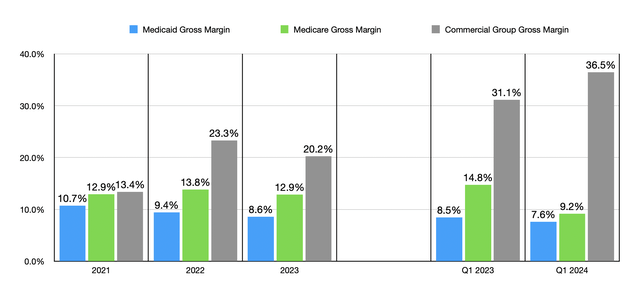

As I mentioned already, revenue for all parts of the company continues to grow. But not all growth is the same. In 2023, for instance, the gross profit margin associated with Medicaid was only 8.6%. This was actually down from 10.7% back in 2021. Over that same window of time, Medicare gross margin remained more or less flat at about 12.9%. However, for the Commercial segment, the gross profit margin was a hefty 20.2% last year. But what’s really impressive is how margins for that segment have grown so far this year. In the first quarter of 2024, the gross profit margin for the Commercial segment came in at 36.5%. That’s well above the 31.1% reported the same time one year earlier. If we accept management’s explanation, this rise can be chalked up to not only a 41% surge in membership growth for the Health Insurance Marketplace, but also to improved product design and execution strategies.

Author – SEC EDGAR Data

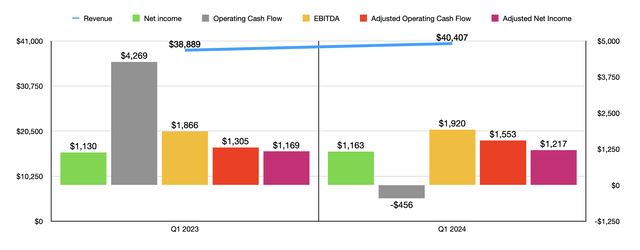

With revenue growing, profits and cash flows for the company have also been on the rise. Over the past three years, net profits have gone from $1.35 billion to $2.70 billion. Even on an adjusted basis, we have seen a rise from $3.04 billion to $3.65 billion. Operating cash flow has nearly doubled from $4.21 billion to $8.05 billion. But on an adjusted basis, it expanded from $2.69 billion to $4.68 billion. Meanwhile, EBITDA has moved up only slightly from $5.41 billion to $6.08 billion. As the chart above illustrates, results for the first quarter of 2024 also came in largely better than with the company experienced in the first quarter of the 2023 fiscal year. Although operating cash flow worsened during this window of time, all other profitability metrics showed growth.

This kind of top line and bottom line expansion, particularly in such a competitive and developed market, is great to see. You would expect a company like this to trade at lofty multiples. But that’s not the case. For the 2024 fiscal year, management anticipates revenue of between $147.5 billion and $150.5 billion. Even at the high end, that would be down from the $154 billion generated last year. However, they expect earnings per share greater than $5.94 and adjusted earnings per share greater than $6.80. If we go just one cent higher for both of these, this would translate to net profits of $3.12 billion and adjusted profits of $3.57 billion. Although net profits are higher than the $2.70 billion reported last year, adjusted profits are down slightly from the $3.65 billion reported. On the other hand, if we annualize growth seen in the first quarter of this year, we would expect adjusted operating cash flow of about $5.57 billion and EBITDA totaling $6.26 billion.

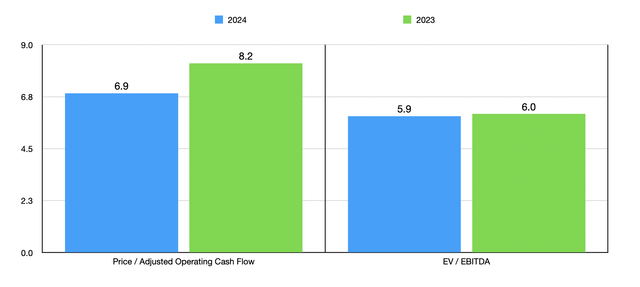

Author – SEC EDGAR Data

With these figures, we can value the company as shown in the chart above. I also priced the company using data from 2023. In two out of three ways, shares do get cheaper on a forward basis. I then took the price to operating cash flow approach and the EV to EBITDA approach for the company and compared it to five similar firms. This can be seen in the table below. Even using the 2023 figures where shares of Centene are more expensive than if we use the forward estimates, it ended up being cheaper than any of the five firms using each of the two valuation metrics.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Centene Corporation | 8.2 | 6.0 |

| Humana (HUM) | 10.8 | 6.9 |

| Molina Healthcare (MOH) | 18.8 | 6.8 |

| UnitedHealth Group (UNH) | 33.3 | 17.4 |

| Progyny (PGNY) | 14.5 | 32.2 |

| The Cigna Group (CI) | 8.6 | 11.3 |

Takeaway

Fundamentally speaking, Centene strikes me as an interesting company. There happen to be some weak spots for the firm, but the good overwhelmingly exceeds the bad. Cash flows look robust and shares are trading at very attractive levels. Obviously, there is always political risk. Cuts to Medicare or Medicaid, for instance, could hurt shareholders, potentially to a significant degree. But as things stand, I would argue that the company makes for a compelling opportunity and that shares definitely warrant a solid ‘buy’ rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!