Summary:

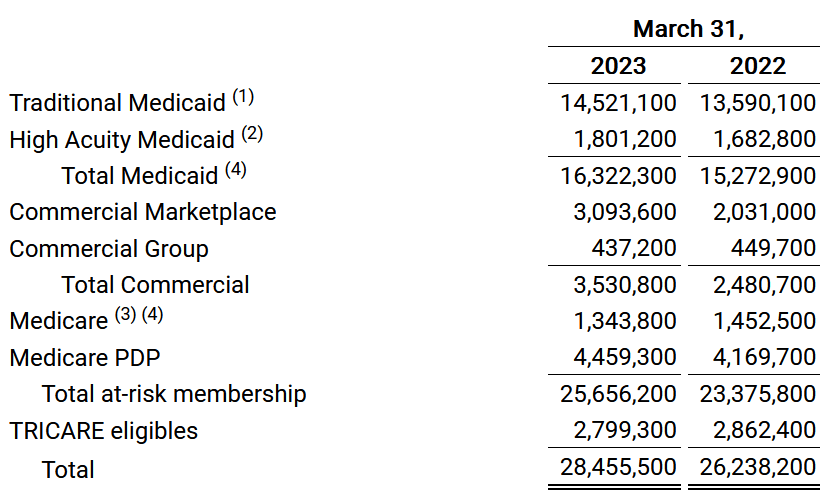

- Centene Corporation’s share price has been declining, but with a p/e of 10, there seems to be a limited downside. The company has grown its memberships by 7% YoY, reaching 28.4 million in total.

- The company recently completed the divestiture of Apixio, aiming for a leaner company structure. The Q2 FY2023 report is expected to show an EPS of $2.03 per share, a 14.6% YoY growth.

- Centene has over $15 billion in cash and is expected to authorize significant buybacks.

Chaay_Tee

Investment Outline

The healthcare sector in the US has had a volatile 2023 with a lot of negative sentiment as a result of the talks regarding the debt ceiling worried markets. The worries brought from that dragged down the whole sector as the impact of lacking government distributions where evaluated. The share price of Centene Corporation (NYSE:CNC) has been in a constant decline for the last 12 months and with a p/e of just 10 there seems to be limited downside from here on out.

The last report from CNC just showed them growing memberships by around 7% YoY reaching 28.4 million in total. This result helped grow the outlook for 2023 and the guidance was raised. The adjusted EPS for 2023 is now predicted to be at least $6.4. That together with a fantastic balance sheet makes CNC look like it’s at a great entry price now. To further underscore the financial health of the business, they have over $15 billion in cash, representing nearly half the market cap. The likelihood of significant buybacks in the coming quarters seems strong, which supports a buy case further.

Company Overview

Centene has been in operation for some time now and focuses on the healthcare sector. Here the company provides various programs and services to primarily underinsured or uninsured families. Operations span across the US and this has resulted in CNC netting a broad set of customers over the years.

The company has two segments, Managed Care and Specialty Services. The first one focuses mostly on health plan coverage for individuals. The second segment offers behavioral and health assistance plans with focus areas such as clinical health care and primary care. What drives earnings growth for the company comes mostly from a growing customer base and more efficient operational performances.

Recent Developments

On June 13 CNC announced that they had completed the divesture of Apixio. This is a leading AI platform that aims to enable better value-based care for patients. The divestitures are moving Apixio to New Mountain Capital instead and mark that CNC is aiming to create a leaner company structure that is flexible and adjustable to market trends.

The CEO of Centene, Sarah M. London had some comments to share on this, “The close of this transaction and our ongoing partnership with Apixio are a reflection of our continued execution against our long-term strategy and value creation efforts”.

As for the impact of the divestiture on the result of 2023, there is no indication that it will have negative results because of it. The transaction is to be neutral on the 2023 adjusted EPS.

Apart from this, we aren’t that far off until we have the next earnings report from CNC. On July 27 the Q2 FY2023 report is set to be released. Estimates are for an EPS of $2.03 per share, representing a 14.6% YoY growth. That type of growth should come with a higher multiple in my view, which CNC doesn’t have now and that is what makes it such an appealing investment now, especially for the medium term.

Memberships (Earnings Report)

On April 24, 2023, we got the Q1 results from CNC. With solid growth in the membership base of the business, the same momentum will hopefully carry through into Q2, which is something I will be watching out for. Besides this, the health benefits ratio for Q1 came in at 87%, if we see Q2 somewhere around 85% driven by a more efficient allocation of capital and strict operational expenses then a far higher multiple than 10 should be applied.

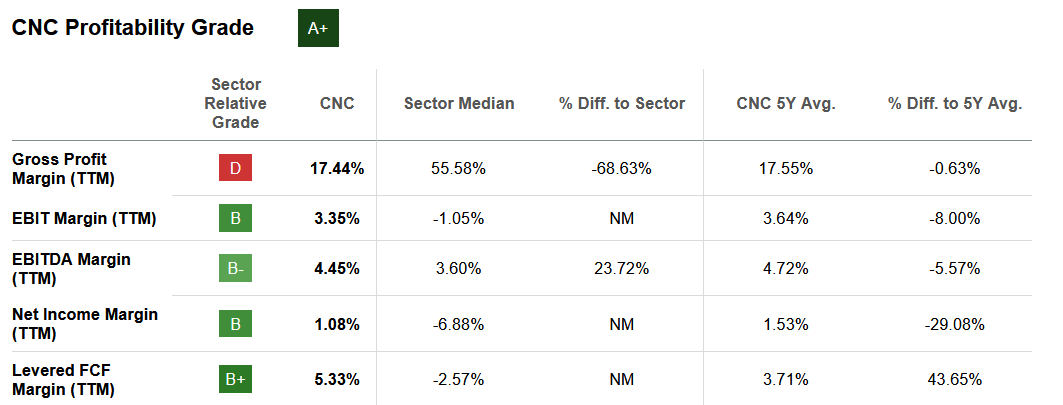

Margins

Margin Profile (Seeking Alpha)

The margin profile of CNC is a reason for the lower multiple I have to admit. But CNC is at some of its 5-year highs, and the FCF margin is the highest it has ever been at 5.33%. As I mentioned previously, if Q2 shows a lower health benefits ratio then higher margins are to come as well. That would indicate that CNC is heading towards stronger earnings results and that will take the share price with it.

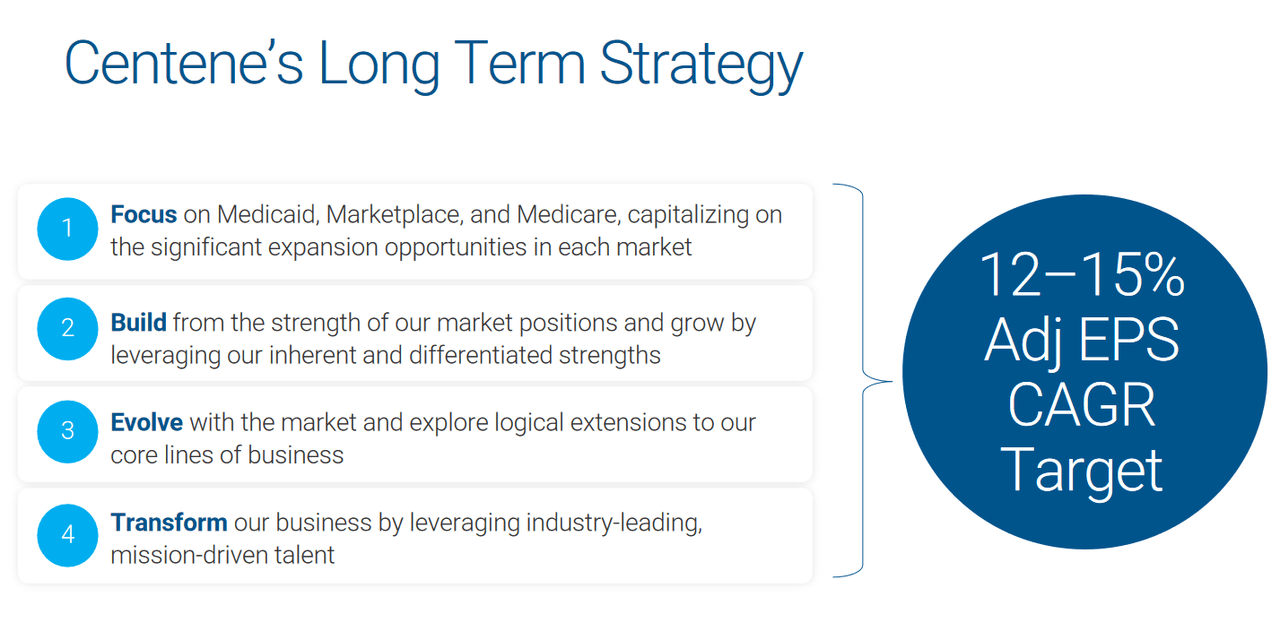

Long Term Targets (Earnings Presentation)

The long-term target for the business is to have a CAGR EPS growth of 12 – 15%, which is probable if the margins improve. An unnoticed tailwind I think could help with this is the establishment of government spending for CNC. By 2030 the projected government-sponsored program spendings are to be $3.9 billion. A 55% increase from 2021 numbers. Centene has maintained a laser focus on market opportunities like Medicaid, Marketplace, and Medicare. CNC view them as quite untapped markets still. Seeing as CNC focuses on providing programs and services to underinsured and uninsured families, they offer a vital product to clients.

Earnings Preview

We aren’t far off from the coming report from CNC and I think we are in for another strong quarterly report. The results are posted on July 28 and as I expect strong results, the share price might very well jump after the release. This is why I think getting in before is a good idea and hence my buy rating.

I will be looking at the membership growth, a number I think could reach near or above 29 million. I find it likely we see it going above that line as the company has been actively investing and proactive in entering new markets. EPS estimates are at $2.05 per share, a number that would continue valuing CNC very low. A beat here seems likely I think as with more membership growth stronger bottom-line results are reasonable to assume. Despite having this article so close to the earnings, I don’t see any significant catalyst that would be upsetting the buy case, which is why I am confident in rating CNC a buy still.

Value For Investors

Looking at what investors can collect right now from CNC, it’s not a dividend, unfortunately. I do see it quite likely that CNC eventually establishes one as the margins grow and FCF becomes even larger. FCF reached over $7 billion in the last 12 months, enough to buy a large portion of shares outstanding. This brings me to what investors are currently getting from CNC, share buybacks. Since 2021 the shares outstanding have decreased by 2.6%. But they have over $15 billion in cash right now and sooner or later some of that will be needed to be used somewhere. Stashing that much when the long-term debts are $17.9 billion doesn’t make sense. They could become completely debt-free overnight if they diverted the cash flows and used all the cash for it. But I feel like a better use would be to introduce a dividend and authorize a larger buyback program.

Valuation

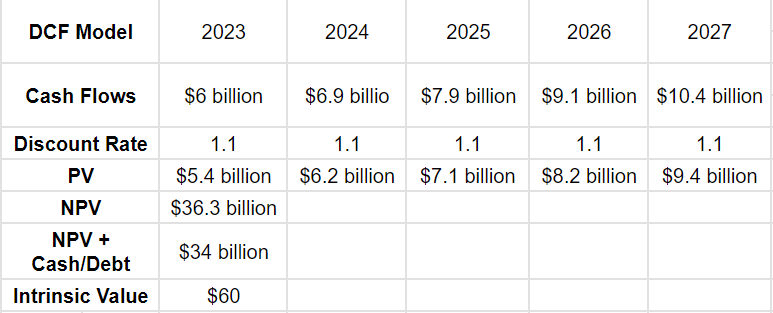

DCF (Author)

When we look at the intrinsic value of CNC, we land at $60 per share, even with all the cash and debt accounted for. This concludes that CNC isn’t trading below its intrinsic value right now. But I have a 10% discount ratio here to that if disregarded would net a higher intrinsic value of course. The reason I could see it disregarded is the fact that downside risk seems limited and the state of the balance sheet is phenomenal. That means less FCF would be necessary to pay down debt and could instead be diverted to dividends and buybacks. For me, I am comfortable with still buying CNC at these price levels, even after discovering its trading above its intrinsic value. Being in a business like CNC I believe will still yield market-beating returns over the long run.

Investor Takeaway

Centene has been in operation since 1984 and focuses on providing services to underinsured or uninsured families in the United States. The first report in 2023 was a success and the guidance for the year was raised. Given the EPS outlook, CNC is just trading at a p/e of around 10 now. Given the fantastic balance sheet that they boast, there seems to be a limited downside risk here. You are investing in a solid business that is still growing margins. It might have been easy to conclude from the article, but I am bullish on CNC stock and will be rating them a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.