Summary:

- CNC demonstrated solid performance in Q3 2023, with a significant increase in EPS and total revenue growth.

- CNC’s Health Benefits Ratio remained strong at 87%, positioning the company for future growth.

- CNC’s strategic initiatives and market expansions, including Medicaid expansion, support its positive growth outlook, but its current share price lacks a margin of safety.

ljubaphoto

Investment action

I recommended a holding rating for Centene Corporation (NYSE:CNC) when I wrote about it the last time, opting for a conservative stance until CNC demonstrated progress in executing its plans and aligning with its FY24 guidance. The third quarter shows CNC’s solid performance, with a noteworthy EPS increase of over 50% and a year-over-year total revenue growth of roughly 6%. Furthermore, the growth in the marketplace segment and strong HBR performance position CNC well for future growth. However, the current share price hovers near my model’s target price, presenting a limited margin of safety and upside potential. Thus, I continue to uphold my hold rating for CNC.

Review

CNC showcased a robust financial performance in the third quarter of 2023. The company reported $35 billion in premium and service revenue. This was complemented by an impressive adjusted diluted EPS of $2, marking a significant rise of over 50% from the previous year’s third quarter EPS of $1.30. Notably, this EPS exceeded their internal forecast by $0.20, underscoring the company’s ability to outperform expectations.

The Health Benefit Ratio [HBR], a key metric reflecting the company’s financial health, stood firm at 87% for the consolidated figures. This was slightly better than what the company had anticipated, and the positive variance was primarily attributed to the commercial segment. Specifically, the Medicaid HBR was reported at a stable 90%. In terms of growth, CNC’s continues to capture growth from redeterminations. The previous quarter saw a growth of 200,000 members, and this momentum continued into the third quarter with an addition of 386,000 members. This consistent growth, combined with a solid HBR performance, positions CNC favorably for anticipated revenue growth and margin expansion in the forthcoming quarters.

CNC’s growth trajectory in the third quarter of 2023 is marked by a combination of strategic initiatives and market expansions that underscore its commitment to serving a broader demographic. One of the significant growth drivers is the impending Medicaid expansion in North Carolina, slated for later this year. This expansion is anticipated to bring a larger segment of the population under CNC’s care, further solidifying its position in the Medicaid market.

In addition to North Carolina, CNC has also secured a significant win in Oklahoma, encompassing both broad Medicaid and sole-source foster care. This expansion is scheduled to commence on April 1, 2024. The company’s growth strategy doesn’t stop there. They are actively eyeing a pipeline of complex populations expected to transition into managed care over the upcoming years. A case in point is the recent Request for Proposal in Georgia.

The Marketplace segment is crucial for CNC’s expansion strategy. It’s not just a noteworthy asset for CNC, but also shows promise as a major income source. Already, the revenue from this division has surpassed that from the Medicare Advantage sector, with projections indicating a wider gap in 2024. This growth is further accentuated by the prescription drug plan business. Though revenue wise it may appear modest, its growth outlook for 2024 is optimistic. Participants in this sector contribute to pharmacy spending and are potential Medicare Advantage Prescription Drug candidates down the line.

Valuation

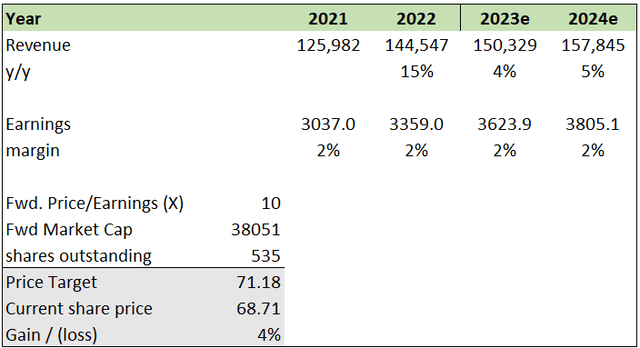

I believe CNC can grow at mid-single digit for FY24 and FY25. The 15% revenue increase in 2022 was largely attributed to strategic acquisitions, notably Magellan Health. However, as of 2023, there have been no new acquisition announcements from CNC; hence, a moderation in the growth rate is expected. The anticipated mid-single-digit growth can be attributed to the company’s robust health benefits ratio, showcasing CNC’s financial health. Additionally, the marketplace segment has undergone remarkable expansion, further supporting a consistent growth outlook. The sustained growth in the marketplace, coupled with a solid HBR performance, aligns CNC favorably for projected revenue growth in the subsequent quarters. Lastly, CNC’s dedication to business growth is apparent through its aggressive market expansion strategies. A notable example is the expansion into Oklahoma, set to kick off in mid-2024. With these factors in play, I hold a positive outlook on CNC’s positioning for future growth.

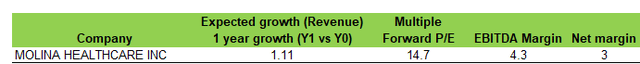

CNC is currently trading at approximately 10x forward P/E, while its peer is trading at approximately 14x. Considering that CNC’s EBITDA margin of 2.3% is lower than its peer’s margin of approximately 4.3%, along with a lower net margin of about 2% compared to its peer’s roughly 3% and a higher debt/equity ratio of about 0.75 versus its peer’s around 0.65, I believe that its current forward P/E of roughly 10x is justified. My price target for CNC stands at approximately $71, representing an upside of 4%, which does not offer a substantial margin of safety. Based on my analysis of CNC, I maintain my hold rating even though it is a high-quality stock with a positive growth outlook.

Risk and final thoughts

One upside risk to my hold rating could arise if CNC’s marketplace expansion and strategic initiatives result in greater revenue growth than what the market currently anticipates. Given that CNC’s financial metrics like EBITDA and net margins are closely aligned with its peers, should these metrics improve and edge closer to their peers’ due to the benefits from these initiatives, its current forward P/E of 10x might trend closer to its peers’ 14x. At a 12x forward P/E, the share price appreciation is estimated to be around 24%.

Given the robust financial performance displayed by CNC in the third quarter, alongside its strategic market expansions and steady growth in its marketplace segment, there’s a positive growth outlook for the company. However, when comparing its financial metrics against peers, its current lower valuation is justified. My price target indicates that CNC’s current traded price lacks a margin of safety for investors. Despite the positive growth trajectory and market expansion initiatives, the financial metrics signal a cautious approach. Hence, I maintain my hold rating for CNC.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.