Summary:

- Chevron agreed to acquire Hess Corp. in an all-stock transaction worth $53 billion. Including debt, the total enterprise value was $60 billion.

- The deal includes Hess’ valuable assets in Guyana, which will deliver high-quality, low-cost production growth and significant upside to recoverable oil estimates.

- Hess also has a large leasehold in the Bakken and excellent assets in the Gulf of Mexico and the North Malay Bay in Asia.

- Some think Chevron overpaid. Some think Hess sold out too cheap.

- Today, I’ll dig into the Hess portfolio and offer my opinion for your consideration.

dk_photos

John Hess – CEO of Hess Corp. (NYSE:HES) – has agreed to sell his company to Chevron (NYSE:CVX) for $171/share in an all-stock transaction worth an estimated $53 billion in Chevron (CVX) stock. Including debt, the transaction has a total enterprise value of $60 billion. On the heels of my recent Seeking Alpha article Chevron Buys Low, Exxon Buys High, some of my followers might say that Chevron paid too much for Hess. On the surface, and even in comparison to Exxon’s (XOM) recent deal to buy Pioneer Natural Resources (PXD), that may appear to be the case. Others think that HES shareholders got shortchanged. Today, I will dig into the details of this transaction and offer my opinion.

Deal Valuation

As I mentioned in the article referenced above, here are recent valuation data points to consider based on the price the acquirees paid for the target’s proven reserves:

- ConocoPhillips (COP) bought Concho Resources for $13.30/boe.

- Chevron bought Noble Energy for $5/boe.

- Chevron bought and PDC Energy for $7/boe.

- Exxon has agreed to buy Pioneer Natural Resources (PXD) for $25/boe.

From this perspective, Chevron is paying $60 billion for HES’s year-end 2022 proven reserves of an estimated 1.26 billion boe. That equates to $47.62/boe, almost double what Exxon paid for PXD’s proved reserves.

Unlike for the Noble and PDC Energy deals, Chevron didn’t offer any valuation metrics other than a slide showing a 2024 estimate for Hess would equate to an EV/EBITDA ratio of ~7x, which is certainly reasonable.

Yet considering I said Exxon’s deal for PXD was too expensive, Chevron’s purchase of HES must be really, really expensive, right? Wrong. Here’s why.

First off, the four deals listed in the bullets above were all for shale-centric companies. HES is a much more diversified play. Let’s take a closer look.

Guyana

Obviously, Guyana is the crown jewel of the Hess portfolio. As you know, Guyana is a deepwater offshore convention oil field – an elephant field which was the largest discovery in the world over the last 10 years.

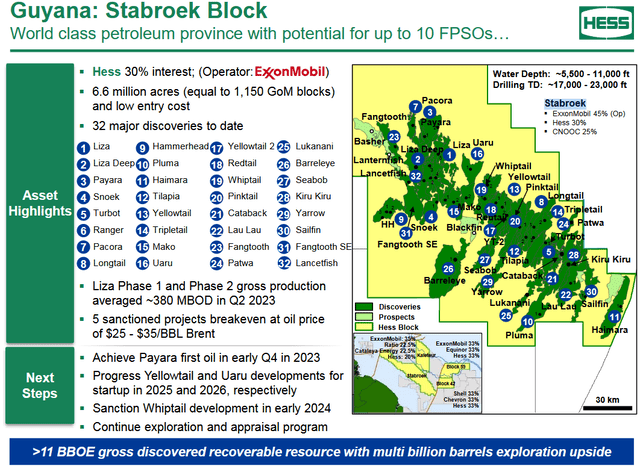

The slide below from a recent Barclays presentation summarizes the multitude of discoveries (32 so far) on Hess’ Stabroek Block:

The most recent recoverable oil estimate for Stabroek is 11 billion boe. All things being equal (but realizing they seldom are …), Hess’ 30% stake in Stabroek means that its share of that estimate would be 3.3 billion boe. But remember, as mentioned earlier, Hess’ 2022 year-end proved reserves estimate was only 1.26 billion boe. Yet as soon as you add in a couple more billion (high potential …) boe out of Guyana to Hess’ proved reserves estimate, it makes a huge difference: For instance, $60 billion for 3.26 billion boe of proved reserves equates to $18.40/boe, which is actually more than $6/boe less than what Exxon paid for PXD.

Further, and if the previous 32 major Stabroek discoveries so far are any indication, the estimate for an incremental addition of 2 billion boe of added proved reserves for Hess could quite easily turn out to be pessimistic. Indeed, at this time, another 12 exploratory wells are either being drilled or planned to be drilled in Guyana in the near future. That is, Guyana still represents a multi-billion boe upside for Hess (i.e. Chevron).

Note: The five sanctioned projects (so far) all have breakeven points between $25-$35/bbl Brent.

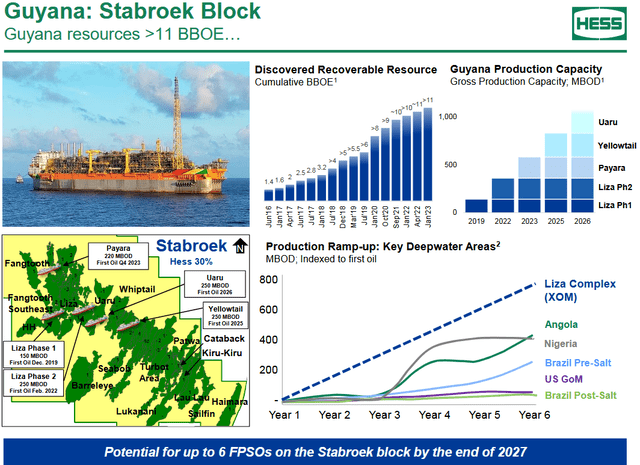

And remember, “Guyana” is a conventional reservoir (actually, a group of reservoirs). This means steady production for many years to come with – unlike shale – minimal incremental capex requirements once full production is reached. Consider this: The current 1.2 million boe/d production target for Stabroek, and based on the most recent 11 billion boe/d estimate of recoverable reserves, means that Guyana could pump 1 million boe/d for over 25 years.

It’s also important to realize that Hess already has made significant capex investments in the infrastructure required to bring Guyana into production: Specifically, for the FPSOs (floating production storage and offloading vessels) needed (two are already online). The company says there’s a clear line-of-sight into six FPSOs for Stabroek by 2027, and that could go as high as 10 FPSOs before all the discoveries are brought online.

The latest Stabroek discovered recoverable resource estimates and production capacity ramp schedule are shown below:

The Bakken

Hess also owns a 465,000 acre leasehold in the Bakken where it’s the operator with a 75% working interest. In Q2, Hess produced 181,000 boe/d from the Bakken, which was +29% yoy. The Bakken is a free cash flow machine for Hess and is the primary one that enabled Hess to take on the large capex obligation for Guyana. Indeed, Hess’ production out of the Bakken in Q2 was still significantly greater than its share of Guyana production (110,000 boe/d).

Hess has an estimated 2,100 drilling sites left in the Bakken, and I’m sure Chevron will plan – just as it did in the Permian – to wisely increase production to a plateau which it can sustain for many years to come. Currently, Hess is using a 4-rig drilling program to continue growing Bakken production up to 200,000 boe/d.

Gulf of Mexico

Hess also owns excellent producing assets in the Gulf of Mexico – assets which Chevron is very familiar with. I say that because the Tubular Bells field in the GoM is co-owned by the two companies (~57% Hess, ~43% Chevron) with Hess as the operator.

In Q2, Hess produced 32,000 boe/d in the GoM as compared to 29,000 boe/d in Q2 of last year. Meantime, the recent Pickerel-1 exploration well (Hess 100% owner) encountered ~90 feet of net pay of high quality crude. Planning is underway to tie back this well to the Tubular Bells production facility. First oil is expected in mid-2024. This will be another boost for Chevron’s production profile in the GoM as, post the deal, it will be the operator and own 100% of Tubular Bells’ production.

In addition, Hess generates stable long-term cash flow from high-quality gas assets in Asia (North Malay Bay).

Other Considerations

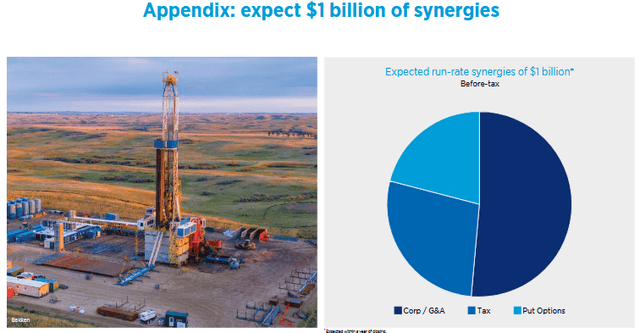

Hess had implemented considerable put options in order to reduce the risk of its large cap-ex obligation for Guyana. In Chevron’s presentation this morning, CEO Mike Worth said Chevron will wind down the put options strategy – likely because Chevron’s size, diversity, and strong balance sheet do not require any commodity price downside protection. This is important because, according to the pie chart shown below, eliminating the put option strategy alone will save an estimated $200 million annually for the combined companies:

During the Q&A part of the presentation, some attractive tax considerations (likely shown above under G&A, dark blue in the pie chart) were discussed. Apparently, Hess’ domestic revenue was not large enough to enable it to take all the tax breaks it could have otherwise been taking, but CVX’s domestic revenue is large enough for the combined entities to do so.

Meantime, along with the acquisition announcement, Chevron squeezed in two goodies for existing Chevron shareholders (and for future Hess shareholders):

- An 8% dividend increase.

- A $2.5 billion increase in the annual share buyback plan.

These two announcements speak volumes (at least to me…) about Chevron’s confidence in the Hess acquisition. Post the acquisition, Chevron says it remains well positioned to fund both capex and to meet its dividend obligation with Brent at $50/bbl. At pixel time, Brent is trading at $89.95/bbl), or nearly $40 above its “breakeven” point.

Did Hess Sell Too Low?

During the Chevron presentation’s Q&A session this morning, and if the questions were any indication, the analysts’ consensus appeared to signal their belief that Hess sold out too low. In an interview with CNBC earlier today, Paul Sankey of Sankey Research said: “It is a little bit of a light price.” Sankey said he expected more than a 5% premium for Hess. “That does raise questions for the rest of the sector, I think, who don’t have the asset base of Hess.”

However, this is a great deal for Hess shareholders because, if for no other reason, their dividend will go from $1.75/share to $6.04/share this year and to an estimated $6.52/share next year.

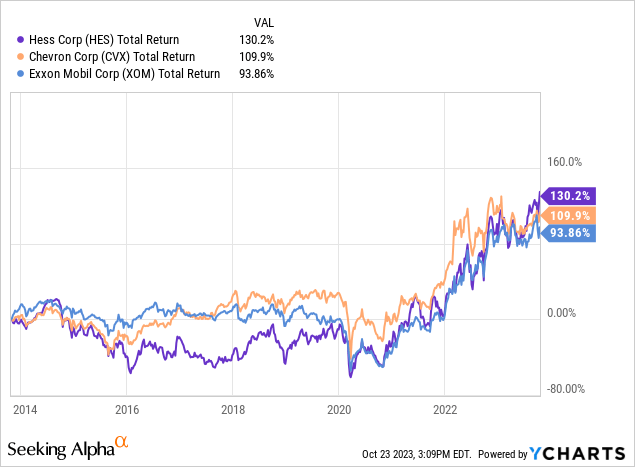

Secondly, as John Hess pointed out today, Hess stock was up more than 90% last year (the No. 2 total return company in the entire S&P 500). The point is, Hess already has delivered excellent total returns for its shareholders and unleashed strong shareholder value. Now, with this transaction, Hess shareholders will gain a huge increase in annual dividend income from Chevron to go along with the capital appreciation they got from HES shares over the past few years.

So, let’s see: $60 billion and a huge increase in the dividend. Not bad! Especially for a company that was started 90 years ago by John Hess’ father delivering fuel directly to consumers in an old truck. I’m quite certain Chevron’s very attractive dividend – and its dividend growth potential – was a big factor in the Hess family’s decision to sell.

Also, it’s important to point out that John Hess will become a member of the Chevron board. Hess is very well respected in the industry and by governments across the world. He will be an excellent addition to the Chevron board of directors.

Summary and Conclusion

At first blush, it appeared that Chevron paid too much for Hess. Yet, after digging into the details of the Hess portfolio, and the clear line of sight for significant high-quality, low-cost production growth, many analysts thought CEO John Hess sold too low.

By my analysis, the truth is in between because this is truly a “win-win” for both companies. As a shareholder of both Exxon and Chevron, I’m much more pleased with this transaction as compared to Exxon’s purchase of Pioneer Resources which was, just like XTO, too expensive (at least in my opinion). In this case, Chevron bought Hess just as the company was on the cusp of a big increase in production – and with excellent prospects for significant growth in proved reserves.

HES is a Hold. Hess shareholders who want to sell prior to the acquisition’s closer should look at the conversion rate ( 1.0250 shares of Chevron for each Hess share) to guide their timing.

Chevron remains my No. 1 pick in the O&G space. Based on the attractive Hess acquisition, the upcoming 8% increase in the dividend (to an estimated $6.52/annually, or ~4%), the $2.5 billion increase in Chevron’s annual share buyback plan (to $20 billion/year) and, at pixel time, the $5.64 haircut to Chevron’s stock price today, I reiterate my BUY recommendation on CVX.

I’ll end with a 10-year total returns comparison of the three main companies mentioned in this article:

As you can see, Hess beat both of the super majors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX, XOM, COP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.