Summary:

- Schlumberger, a leading oil and gas equipment/services provider, has announced a major M&A deal to acquire rival ChampionX for $8 billion.

- The energy sector has seen an acceleration in multi-billion dollar M&A deals, primarily in the upstream sector.

- This deal comes with significant operating and financial synergies, making SLB an attractive stock at a time of strong industry and pricing tailwinds.

Funtay

Introduction

After covering a wide range of energy companies in the past few months, I found another reason to discuss the energy sector – in this case, Schlumberger Ltd. (NYSE:SLB), one of the world’s leading oil and gas equipment/services providers.

Headquartered in Paris, Houston, London, and The Hague, the company, which changed its brand name to “SLB,” operates four divisions, each with unique capabilities to assist a wide range of energy companies in their daily operations:

- Digital & Integration

- Reservoir Performance

- Well Construction

- Production Systems

To use the company’s own words:

SLB’s four Divisions operate through a geographical structure of four Basins that are aligned with critical concentrations of activity: Americas Land, Offshore Atlantic, Middle East & North Africa, and Asia. The Basins are configured around common regional characteristics that enable us to deploy fit-for-purpose technologies, operating models, and skills to meet the specific customer needs in each Basin. – SLB 2023 10-K

These operations include products like real-time downhole measures to improve downtime for oil and gas companies.

I’m bringing this up because Schlumberger just announced a major M&A deal, buying its rival ChampionX (NASDAQ:CHX) in a deal worth roughly $8 billion.

This marks yet another multi-billion dollar M&A deal in a sector that has seen an acceleration in takeovers.

- Chevron (CVX) is trying to buy Hess (HES).

- Exxon Mobil (XOM) is in the process of buying Pioneer Natural Resources (PXD).

- Diamondback Energy (FANG) recently announced a merger with Endeavor Energy Resources (private).

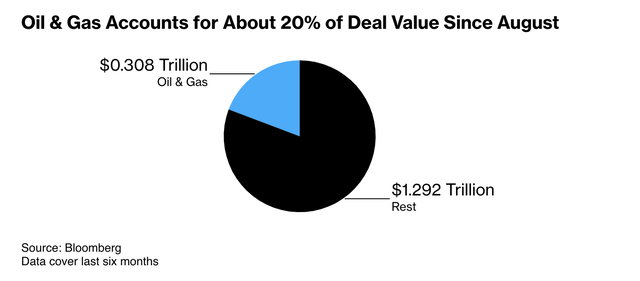

In fact, between August 2023 and February 12, 2024, oil and gas M&A accounted for roughly a fifth of all deals, which is a huge number.

What’s interesting is that almost all of these deals were in the upstream sector, meaning the companies that actually produce oil and gas. A deal this big in the services sector is much rarer.

In light of these developments, I’m writing this article because of two reasons:

- I’m updating the SLB bull case after I wrote my most recent bullish article on October 30, titled “The Energy Rebound – SLB Seems Way Too Cheap.”

- We’ll dive into the M&A deal and figure out what this means for the company and the industry.

So, let’s get to it!

A Merger That Makes A Lot Of Sense

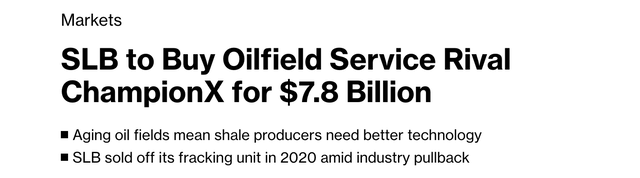

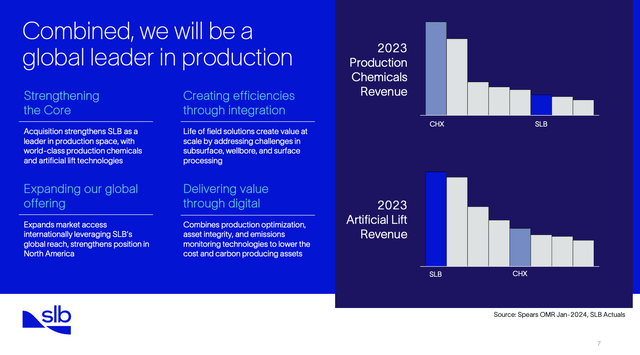

On April 2, SLB agreed to officially acquire its smaller rival, oilfield service provider ChampionX, in a $7.8 billion all-stock deal.

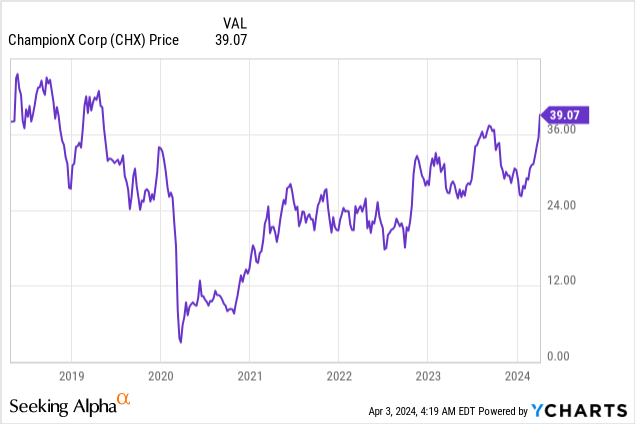

According to Bloomberg, this deal values ChampionX at $40.59 per share. That’s a premium of roughly 15% compared to its close on April 1.

Given that CHX is now trading at $39.07, less than 4% below the agreed takeover price, shows that the market has high expectations that the deal will get government approval.

However, it needs to be said that this deal combines the fourth and fifth-biggest players in the production chemicals market.

Although I do not expect major headwinds, it’s hard to tell what regulators will make of this deal at a time when big companies keep gaining influence.

If you’re a CHX shareholder, you will receive 0.735 SLB shares for each CHX share you own.

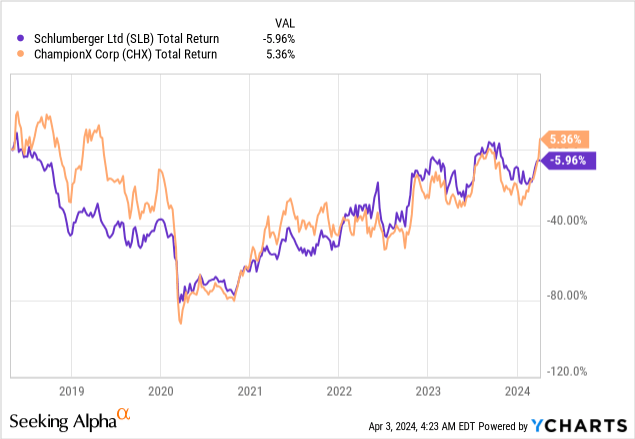

Although SLB shares have outperformed CHX by more than 40 points over the past five years, the performance since 2018 is almost identical.

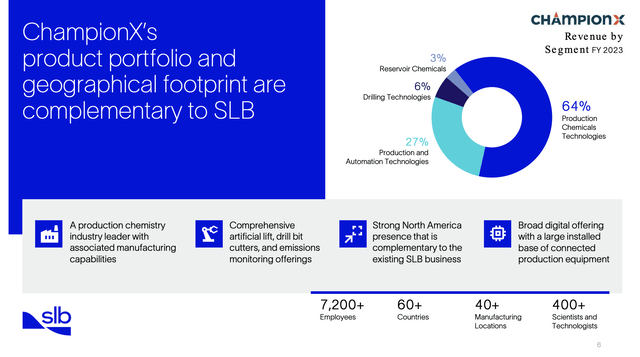

The high correlation between CHX and SLB makes sense, as both operate in the same industry. ChampionX, for example, operates in more than 60 nations, employing more than 7,200 people in key segments, including Production Chemicals Technologies, Production and Automated Technologies, Drilling Technologies, and Reservoir Chemicals.

In other words, this company has a massive footprint in critical oil and gas production areas.

To give you an example of its added value, this is how the company’s products can help producers get more value from their assets:

Our reservoir modeling capability and chemistry expertise provides enhanced hydrocarbon recovery solutions to oil and gas producers. These solutions are intended to enable our customers to increase oil recovery in oilfields and improve return on investment by extending the economic life of fields in a safe and responsible manner, both onshore and offshore, as well as reduce their carbon footprint. – CHX 2023 10-K

With that said, there are a few reasons why SLB made the offer to acquire all of CHX.

During its special call, the company said that CHX’s assets expand SLB’s footprint in the less cyclical and growing production space, particularly in production chemicals.

As the quote above shows, these chemicals play a major role in improving operational performance and reservoir recovery.

Secondly, the merger accelerates customer performance through technology capabilities and digital leadership.

Both SLB and ChampionX have made significant investments in digitalization and emerging technologies such as artificial intelligence (“AI”)

This is what EY said about applying AI in the oil and gas sector:

It has the potential to unlock efficiencies across the oil and gas value chain. From initial exploration activities all the way through to the end user, it is inspiring new ways to approaching exploration, development, production, transportation, refining and sales.

Essentially, by incorporating ChampionX’s technology solutions into its portfolio, SLB aims to improve new value creation and efficiency improvements across the production lifecycle.

Last but not least, SLB’s international leadership complements ChampionX’s massive footprint in North America.

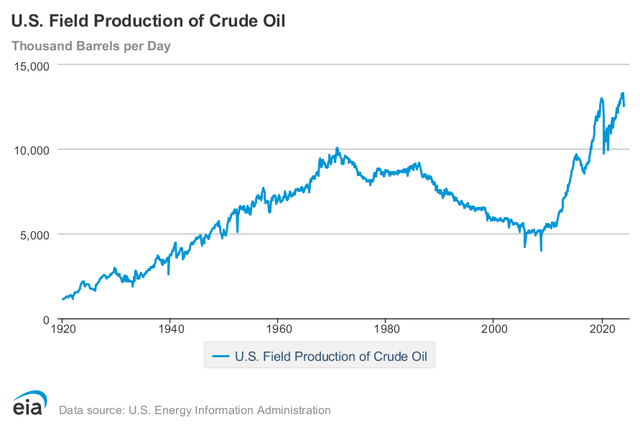

This geographical decision makes sense, as the U.S. is still seeing oil production growth due to its shale industry. Although it is just an assumption, I expect that SLB may expect that the implementation of AI and other technologies could unlock even more value from maturing shale plays in the United States, potentially extending the life of current drilling projects.

Energy Information Administration

As my largest investment is in Texas Pacific Land (TPL), which is a royalty play in the Permian basin, I am quite excited to see how new technologies could potentially boost production.

Needless to say, CHX also sees benefits, as it believes that joining SLB unlocks value for both its customers and shareholders.

It also needs to be said that the all-stock transaction underscores how much CHX believes in the future of this deal. After all, if (for some reason) you were bought out by a company you didn’t like, you would probably take cash instead of a stake in the new business.

Speaking of value, the merger is expected to generate significant synergies, including pretax synergies of roughly $400 million within the first three years.

These synergies will primarily come from cost reductions, supply chain optimization, and revenue synergies, with a focus on expanding ChampionX’s international footprint.

Moreover, the deal is expected to be accretive to free cash flow per share in 2025 and earnings per share in 2026. This means that, at that point, the M&A deal is expected to be a net benefit for both companies.

SLB is highly confident that it can achieve these goals, as it also noted plans to return $3 billion to shareholders in 2024 and $4 billion in 2025, driven by incremental buybacks, organic free cash flow growth, and proceeds from the ChampionX business.

To put these numbers into perspective, note that SLB has a $78 billion market cap. $3 billion in pre-merger shareholder distributions is roughly 4% of its market cap. SLB currently has a base dividend that yields 2%.

Recent Developments & Valuation

There are a few other things I wanted to briefly bring up.

For example, on March 27, the Wall Street Journal wrote that SLB invested roughly $400 million in a carbon-capture venture from Norway, which would allow SLB to combine its own research with the startup and become a bigger player in this emerging segment of the energy sector.

Adding to that, SLB is benefitting from a rebound in demand.

In 4Q23, the company said it expects a typical pattern of activity, potentially followed by stronger growth in the second quarter and even more momentum in 2H24.

As a result, on a year-on-year basis, we expect first quarter revenue growth in the low-teens and EBITDA growth in the mid-teens. This will be followed by an activity rebound in the second quarter and further acceleration of growth in the second half of the year, particularly in the international markets. – SLB 4Q23 Earnings Call

Although I do not have intel from producers, the oil price has broken out, making it even more likely that SLB will report stronger-than-expected numbers.

TradingView (NYMEX WTI Crude Oil)

Generally speaking, from my research over the past few quarters, I believe that $75 WTI is usually supportive of higher investments in oil production in North America. Right now, we’re $10 above that.

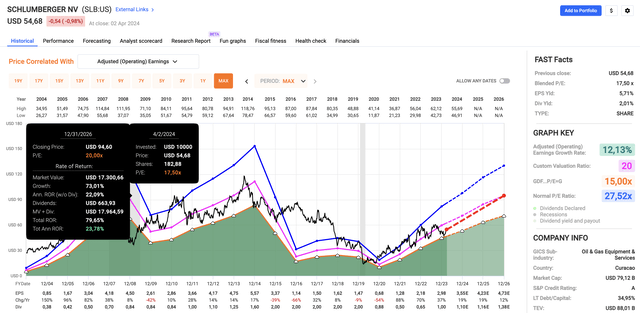

With that said, even without the ChampionX deal, SLB is highly attractively valued.

Using the data in the chart below:

- SLB trades at a blended P/E ratio of 17.5x.

- The long-term normalized P/E ratio is 27.5x (the blue line in the chart below).

- However, because this normalized P/E ratio is highly impacted by volatile earnings, I believe applying a 20x multiple is more appropriate (pink line).

- EPS growth is expected to be 19% in both 2024 and 2025, with 12% growth in 2026.

- Although EPS expectations are subject to change, they point to a fair stock price of $95, which is 72% above the current price.

The current consensus price target is $68, which I expect to be hiked significantly in the months ahead.

That said, given the attractiveness of the energy sector and SLB in particular, I’m not surprised that CHX accepted an all-stock deal. If I were a CHX shareholder, I would prefer that as well.

Takeaway

The recent merger announcement between Schlumberger and ChampionX marks a significant move in the energy sector, particularly in the services segment.

This $7.8 billion all-stock deal shows SLB’s strategic expansion into less cyclical and growing production areas, complemented by ChampionX’s extensive footprint in North America.

The merger aims to leverage technology, particularly in digitalization and artificial intelligence, to enhance operational performance and reservoir recovery.

With expected synergies and shareholder returns, the deal positions SLB for future growth amidst a rebounding energy market.

Pros & Cons

Pros:

- Strategic Merger: The acquisition of ChampionX expands SLB’s presence in the production sector, offering the potential for synergies and enhanced operational performance.

- Technology Integration: Leveraging ChampionX’s digital and AI capabilities complements SLB’s focus on innovation.

- International Leadership: SLB’s global footprint combined with ChampionX’s North American footprint creates opportunities for market expansion.

- Shareholder Returns: Planned distributions and expected synergies signal the potential for increased shareholder value over time.

Cons:

- Regulatory Approval: Although I believe the deal will be approved, regulatory risks should not be underestimated.

- Market Fluctuations: Oil and gas prices could influence SLB’s stock price and financials.

- Execution Risks: Integrating ChampionX’s operations and realizing synergies comes with challenges.

- Industry Challenges: Despite the merger, SLB operates in a competitive and cyclical industry, with risks that could negatively influence its longer-term outlook.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.