Summary:

- Berkshire Hathaway’s recent purchase increases its stake in Occidental Petroleum Corporation to 28%, highlighting confidence in the company’s long-term potential despite oil price volatility.

- Occidental’s CrownRock acquisition boosts production and FCF, enhancing shareholder value and positioning the company for strong returns at current oil prices.

- The company’s commitment to carbon capture technology addresses climate risks, potentially lowering future costs and mitigating long-term environmental impacts.

- With a solid balance sheet, debt reduction, and planned share buybacks, Occidental Petroleum is well-positioned for substantial shareholder returns.

jetcityimage

At roughly $46/share, Berkshire Hathaway (BRK.A) (BRK.B) bought another 9 million shares of Occidental Petroleum this past week. Berkshire Hathaway now has a massive 264 million shares of Occidental Petroleum Corporation (NYSE:OXY), a 28% stake. He also continues to have hefty ownership in preferred stock at an 8% yield from the company’s acquisition of Anadarko.

As we’ll see throughout this article, this reaffirms our last recommendation to invest in the company, with the company’s valuation now disconnected from its cash flow potential.

Occidental Petroleum and Oil Prices

Occidental Petroleum is beholden to oil prices like any other company, and oil prices are notoriously fickle. That doesn’t mean that Occidental Petroleum’s share price doesn’t swing with daily oil price movements, as investors still seem to be surprised by such volatility.

Occidental Petroleum Investor Presentation

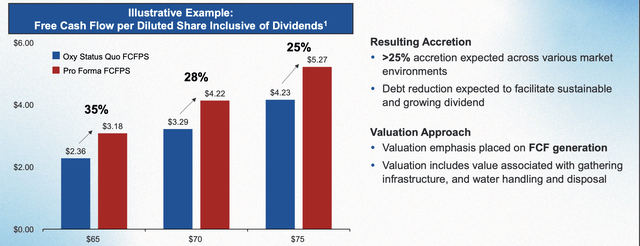

Occidental Petroleum does an impressive job of highlighting its cash flow sensitivities and the potential impacts of prices. The company loses roughly $260 million in cash flow per $1 barrel/change in oil prices, and given capital costs don’t necessarily scale down, that also means the company loses in terms of FCF. Now, there are some tax savings, etc., but it’s still noticeable.

In the most recent quarter, the company had $1.5 billion in FCF, and its pro forma with CrownRock FCF is still expected to be a ~7% yield at $65 WTI. However, the breakeven on moving towards a yield of 0 happens at below $50 WTI, which is a level that’s definitely been hit numerous times. We see it as a risk, but a manageable one.

We expect oil prices to remain around their present levels, where they’ve sat for the last few years, as supply and demand seem fairly balanced. Occidental Petroleum has a lower FCF yield than some peers, but at current share prices and oil prices is approaching a strong double-digit FCF yield.

Essentially, our recommendation is that investors ignore the nuances of oil price variance and look at the long-term market.

Occidental Petroleum CrownRock

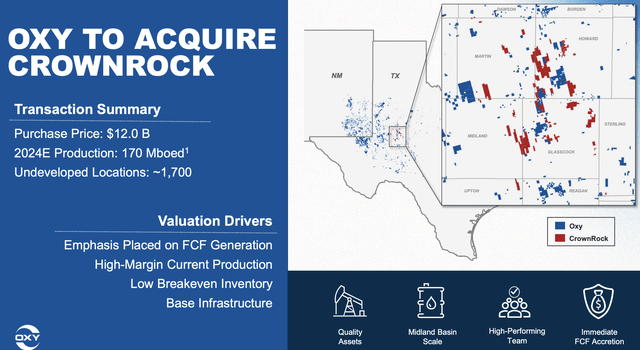

Another factor we don’t feel is reflected in the company’s share price is its closed acquisition of CrownRock in Aug. 2024.

Occidental Petroleum Investor Presentation

The acquisition was a decently expensive one at $12 billion but added 170 thousand barrels/day of production with acreage that was strongly synergistic with the company’s existing acreage. It added ~1700 undeveloped locations and the company presumed no synergies within the acquisition. Still, we expect some synergy with takeaway capacity and growth.

The company is also funding the acquisition primarily through cash, with just under 30 million new shares issued. The acquisition closed at the start of August, and we expect it to be quite profitable going forward. At current WTI prices of $70/barrel, the acquisition is expected to improve annual FCF from $3.29/share to $4.22.

That puts the company at almost a 10% FCF ratio.

Occidental Petroleum Carbon Neutral

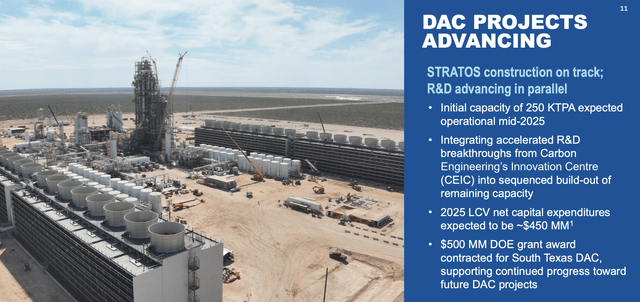

Occidental Petroleum is a leader in direct air carbon capture and is continuing to advance its Stratos project.

Occidental Petroleum Investor Presentation

The project is not cheap, BlackRock has invested $550 million and Occidental Petroleum is investing hundreds of millions as well. However, it’s expected to result in 250 thousand tonnes per year of carbon capture capacity at ~$500/tonne in costs. Occidental Petroleum thinks that costs can keep going down. Now, what’s economical?

It depends. However, we foresee direct air capture as necessary to handling climate change in a world with some very difficult to remove emissions. With 1 tonne of carbon ~= to 100 gallons of gas, the current prices are ~$5/gallon in gas. Too much to remove all emissions, but there’s definitely potential as the cost declines.

Given that carbon emissions and their impacts are an existential threat to firms such as Occidental Petroleum, this is worth paying close attention to. For perspective, current global emissions are almost 40 billion tonnes/year, so to make a big impact would be hundreds of billions or trillions. Still, for tough-to-remove emissions, like airlines, there’s potential.

Occidental Petroleum Shareholder Returns

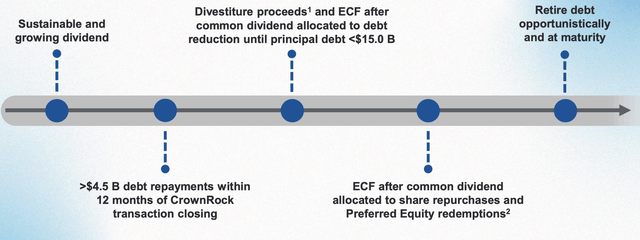

Occidental Petroleum is committed to continuing its history of shareholder returns.

Occidental Petroleum Investor Presentation

The company has a modest almost 2% dividend yield, but it’s paid off substantial debt since the CrownRock transition closing, and it’s planning to reduce principal debt to less than $15 billion. The company is now looking at share repurchases and preferred equity redemptions, with preferred equity terms mandating redemption at a 10% premium.

Given the company’s current share price, we’d love to see share buybacks, which we expect will help strengthen shareholder returns. Overall, that makes Occidental Petroleum a valuable investment choice, as the company has a strong balance sheet and substantial FCF it can allocate towards returns.

Thesis Risk

Despite Occidental Petroleum’s strong portfolio of assets, the risks that it faces remain similar to those of other oil companies. A recession causing a decline in oil demand and a substantial decline in oil prices would hurt the company’s ability to continue driving shareholder returns. That would make the company a poor long-term investment.

Conclusion

Occidental Petroleum is a unique company with a strong portfolio of assets. The company has several advantages, including its recently closed CrownRock acquisition, low portfolio breakeven, direct air capture assets to cover climate change downside risk, and a strong portfolio of assets that it can drill.

We’re not surprised that Berkshire Hathaway, as the largest shareholder, is “buying the dip.” While Berkshire Hathaway has said it would rather not own the company outright, a fair and interesting price is always worth adding on, and we expect similar behavior should there be additional dips in the company’s share price.

Overall, we recommend investing in Occidental Petroleum.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.