Summary:

- ChatGPT is innovating the Search business, by making it part of the productivity tools, sold for subscription.

- Alphabet has 57% of revenue from Google Search, which is the ads-based model.

- Alphabet must adapt the business model, and reorganize to compete with Microsoft with productivity tools or with Amazon with Cloud services.

- In the meantime, it’s risky to hold the Alphabet stock, as its core business model is threatened.

Prykhodov

What’s Alphabet’s business model?

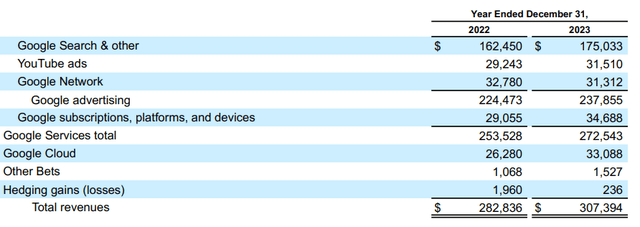

Here is the fact, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has 77% of total revenue coming from the digital advertising business, and 57% of total revenue comes directly from the ads on Google Search.

Basically, Google has 91.37% market share in the global search market, and when we search the web for whatever reason, we see the ads, and we click on those ads. Alphabet gets paid for each click, and for each ad that we see. That’s Alphabet’s business model – digital ads.

Here is breakdown of Alphabet’s sales by segment:

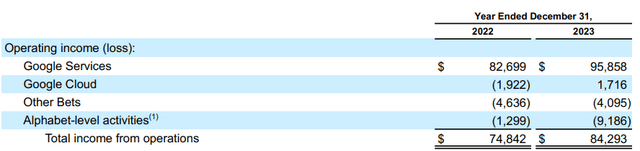

But more importantly, Alphabet’s profits come directly from the ads – the Google Services segment. In 2022 all other segments had losses, while in 2024 Google Cloud turned profitable, but accounting for less than 2% of Google Services profits. Thus, Alphabet’s profitability is entirely reliant on digital ads.

Alphabet actually warns of 1) slower growth and 2) lower margins in the 2023 10K report, the Management Discussion section, section “Trends in Our Business and Financial Effect”.

Users’ behaviors and advertising continue to shift online as the digital economy evolves. The continuing evolution of the online world has contributed to the growth of our business and our revenues since inception. We expect that this evolution will continue to benefit our business and our revenues, although at a slower pace than we have experienced historically, in particular, after the outsized growth in our advertising revenues during the COVID-19 pandemic.

Users continue to access our products and services using diverse devices and modalities (smartphones, wearables, connected TVs, and smart home devices), which allows for new advertising formats that may benefit our revenues but adversely affect our margins. We expect these trends to continue to affect our revenues and put pressure on our margins.

Here is the problem, desktop search has very high margins, but most people are now using other modalities to search, which have lower margins. In addition, Alphabet believes that the post-Covid growth is unsustainable.

But here is the bigger problem

The big problem with Google Search is the “annoying” ads – but that’s how Alphabet makes money. The recent innovation with the ChatGPT is potentially an existential threat to the Alphabet’s ad-based business model.

Here is what the founder of OpenAI (ChatGPT) Sam Altman thinks about the ads:

I kind of hate ads just as an aesthetic choice. I think ads needed to happen on the internet for a bunch of reasons, to get it going, but it’s a momentary industry. The world is richer now. I like that people pay for ChatGPT and know that the answers they’re getting are not influenced by advertisers. I’m sure there’s an ad unit that makes sense for LLMs, and I’m sure there’s a way to participate in the transaction stream in an unbiased way that is okay to do, but it’s also easy to think about the dystopic visions of the future where you ask ChatGPT something and it says, “Oh, you should think about buying this product,” or, “You should think about going here for your vacation,” or whatever.”

ChatGPT is essentially a chatbot – you ask a question and you get an answer. And that could be a new way of searching for information.

But here is the deal – there are no ads in ChatGPT. It seems like people are paying for the subscription to access advanced versions of ChatGPT, or it’s free – with no ads.

Sam Altman does not want to compete with Google Search, or to improve Google Search, Altman wants to create a new way of searching for information – ads free.

So, that’s essentially the Google Search killer, not right away, but eventually. More precisely, that’s the Google Search business model killer. Google can easily incorporate LLM into Search, but the problem is it cannot include the ads.

Alphabet must adapt or die

Thus, obviously, Alphabet has to adapt, it has to create a new business model. Apparently, Alphabet plans to charge subscription for the advanced AI Search, but apparently it still plans to deliver the ads – even for the premium version. That’s not going to work if the competitors offer ad-free AI search.

Let’s look at the main competitor in Search – Microsoft (MSFT), which currently has a 3% market share in search with Bing. Microsoft invested in OpenAI and incorporated ChatGPT in Search as the Copilot.

Microsoft sells productivity tools, and it can offer Copilot as one of the tools. It’s a new way of incorporating Search (as information gathering) with the analytics (Excel spreadsheets) and report preparation (MS Word). The same principle can apply to any workload – such as creativity and others. So, Search becomes only the first part – information gathering. Alphabet can try to copy Microsoft’s all-inclusive productivity subscription model, but it will be very costly.

The point is Alphabet has to adapt the business model to be less reliant on ads and more on subscriptions. Or, alternatively try to compete with the Cloud services, taking a note from Amazon (AMZN), whose only growth driver now is AWS.

Current metrics

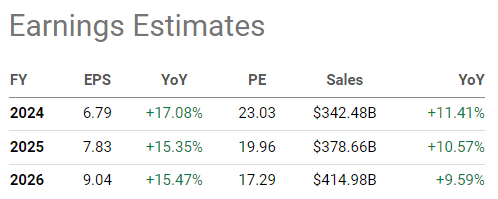

Alphabet is facing a serious threat and must reorganize. The current revenue/earnings estimates for Alphabet don’t incorporate the threat from ChatGPT to Google Search ad revenues.

Even so, Alphabet is expected to have a gradually declining growth rate in revenues over the next 3 years, to less than 10% in 2026. This is consistent with the growth warning in the 10K report. Earnings are expected to grow around 15%. But this estimate does not consider the profit margin warning from the 10K statement (due to change in modality).

Seeking Alpha

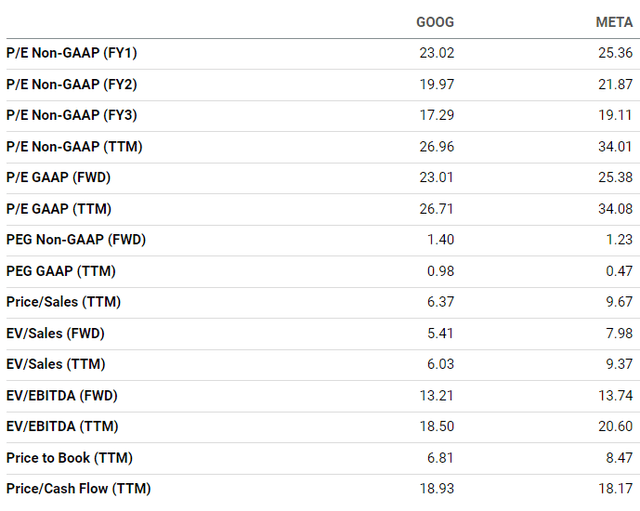

Alphabet is currently overvalued with the ttm PE ratio at 26 and ttm PS ratio at 6.37, but it’s not a bubble. The forward PE ratio is at 23, which suggests that earnings growth expectations are not exuberant – confirming the 15% earnings growth estimates. Meta (META) could be comparable to Alphabet, because it has virtually all revenue from digital ads, although the business model is very different. Meta is more expensive than Alphabet based on the ttm PE at 34, and slightly more expensive based on forward PE at 26.

Based on the current metrics, both Alphabet and Meta are overvalued, but Alphabet is cheaper than Meta – which signals that the market is pricing slower growth, and it’s actually negative for Alphabet.

Implications

Alphabet is facing a serious threat to its main business model – Google Search. Microsoft is innovating the Search business, making ChatGPT (Copilot) part of the productivity tools. Thus, the Search part is bundled with other productivity tools and sold as a subscription.

Alphabet recognizes this threat and it’s working on the adjustment (Gemini). However, in the meantime, the risk of holding Alphabet stock is too high. Thus, my rating for Alphabet is a Sell.

The risk to this bearish thesis is as follows:

- The AI regulations, like the EU AI Act, could stop the progress of Gen AI, which could benefit the traditional ad-based Search model, although this would not be a positive for the broad tech sector, and thus Alphabet stock.

- Obviously, Alphabet could adapt and adjust quickly to the new environment and transition to the new business model without any significant negative effect on earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.