Summary:

- The evolving use of Generative AI is poised to become a key catalyst in the Azure vs. AWS battle, highlighting the strategic differences between Microsoft and Amazon.

- MSFT’s strategic integration of OpenAI tech into its software enhances its competitive edge beyond a mere cloud add-on feature.

- With its more limited product range compared to MSFT, AMZN may find it difficult to monetize the substantial capital required to lead in the AI era.

Chip Somodevilla

Investment Thesis

With Amazon (AMZN) expanding its Generative AI portfolio, the attention is now on Microsoft’s (NASDAQ:MSFT) partnership with OpenAI. Although this alliance is technologically influential, it hasn’t translated to financial gains proportionate to its influence or at least big enough to counter Azure’s slowing growth.

MSFT earns revenue on most if not all, ChatGPT prompts and answers. However, prices are set competitively. The partnership does, however, augment Azure with a chatbot service, a feature other cloud providers are eager to replicate. AMZN, through its collaboration with Anthropic and Alphabet (GOOG)(GOOGL) with its Bard project is a notable example of this trend in action.

Despite AMZN’s moves in Generative AI, we believe that it is MSFT that is poised to redefine the sector. MSFT has been leveraging its strong foothold in enterprise and personal computing software as a key strategy to challenge AWS’s cloud dominance. By integrating OpenAI tech into these products, MSFT is elevating its competitive edge. Unlike AMZN’s AWS, generative AI is not just a new add-on feature for its Cloud service; it’s a revolution of its enterprise software and personal computing capabilities, the primary edge of MSFT over AMZN in the ongoing battle for cloud market dominance.

We believe 2024 will mark a crucial turning point in the Azure vs. AWS public cloud battle, with advancements in Generative AI sharply highlighting the strategic differences between AMZN and MSFT, creating a catalyst that would narrow AMZN’s valuation premium over MSFT. In this transformative period, we lean towards a positive outlook for MSFT and a more cautious one for AMZN.

Tech or Retail? Decoding AMZN’s Identity in the AI-Driven World

As the first major cloud provider, AWS was able to solidify its brand image as a hallmark of innovation. Leveraging its first mover advantage and understanding customer needs, it quickly started rolling out new services, increasing AWS’s appeal, especially among Small and Medium Businesses with few resources to build cloud programs independently. Its meteoric growth and market opportunity captured investors’ imagination.

It was easy to forget that AMZN is, at its core, an e-commerce company. Despite accounting for only 16% of AMZN sales, AWS constitutes three-quarters of operating income. The prevailing perception became that AMZN is a tech company, which is true. Still, this broad brush overlooks the company’s strategic trajectory, an increasingly important element in the AI era. This misalignment is the foundation of our investment hypothesis.

AMZN’s foray into cloud computing was born out of necessity, a solution to e-commerce infrastructure needs. Similarly, Amazon Robotics, Amazon Air, and Scout, while technology-driven, are extensions of its logistics and fulfillment network. Likewise, its incursions into the healthcare sector are not a departure but a strategic utilization of its established e-commerce framework.

Similarly, the company integrated Amazon Video, Amazon Music, Amazon Luna, and other services into its Amazon Prime service at no additional cost for Prime members, aiming to enhance the appeal of its fast-delivery, discount-price membership program. This pricing strategy embodies a bizarre take on a contemporary marketing approach. It is based on the principle that deeper consumer wallet penetration is achievable through the strength and comprehensiveness of the company’s ecosystem, where the whole is larger than the sum of parts. Apple (AAPL) often cites this concept, pointing out that its Apple Music customers are more likely to remain loyal to the iPhone brand. We believe that while Amazon Prime’s complementary services boost subscription rates, they don’t necessarily lead to higher spending on the e-commerce platform.

This brings us to AMZN’s vast array of devices, including Kindle Reader, Echo, and Fire Tablets, primarily designed to enhance shopping and content consumption and foster user engagement within AMZN’s ecosystem. Yet, they are not AMZN’s primary focus, as evidenced by their respective market positions, revenue impact, and pricing strategy, often at no profit.

AMZN’s product and service portfolio shows a clear trend: its strategy orbits around its e-commerce core. The further a venture strays from this nucleus, the less central it is to AMZN’s strategic vision.

When considering investment exposure to AI trends, one must assess its relevance to AMZN’s e-commerce core. AWS, as a significant part of AMZN’s portfolio and the primary monetization point of Generative AI, treats the tech more as an auxiliary add-on service, not different from AWS Redshift or AWS Quantum Computing tools. Although Generative AI innovations expand AWS’s Total Addressable Market, they remain peripheral to Amazon’s e-commerce essence. For example, a conversation-capable Alexa is incredible and will probably bring more traffic to the ecosystem — and might even justify AMZN’s $4 billion minority interest in Anthropic, which it acquired last September — but it barely justifies future investments and speculative projects necessary to lead in the AI sector. As the world progresses towards Artificial General Intelligence ‘AGI,’ there are growing questions about AMZN’s willingness to venture from its core e-commerce business into the expansive AI domain.

In contrast, MSFT’s deep-rooted focus on software development, productivity tools, and enterprise software, bolstered by a robust academic presence, allows for a more streamlined AI technology development and a clearer technology roadmap. Its swift moves, as seen in its OpenAI partnership, underscore its depth in the field. This strategy also aligns with its current standing. MSFT enterprise software products amplify the monetary benefits of Generative AI, differing from AWS, whose utilization is limited to enhancing programmers’ toolkits.

A review of academic contributions in AI and Machine Learning on platforms like Google Scholar indicates MSFT’s stronger presence than AMZN. This academic foundation positions MSFT favorably as AI branches closer to AGI, necessitating significant investments that might be too difficult for AMZN to monetize, especially as the AI domain ventures beyond its established ecosystem.

We believe that going into 2024, the strategic variances between MSFT and AMZN will become clearer, creating a catalyst that would bring AMZN’s valuation premium over MSFT down.

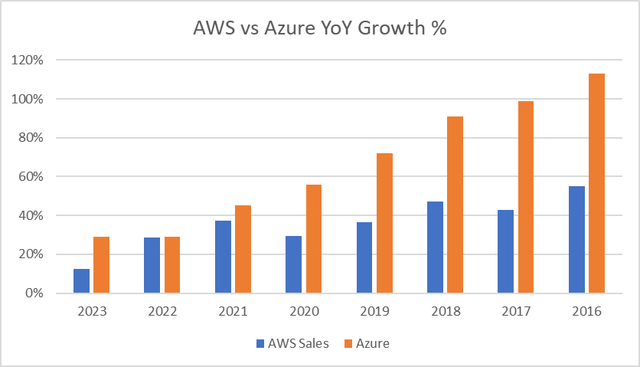

Azure Closing the Gap

Initially, AWS’s lead wasn’t due to its superiority but Azure’s inferiority. AWS went unchallenged for four years, and when Azure finally launched in 2010, it had inferior microchips, slower product rollout, a smaller geographical footprint, and fewer services. Today, we don’t see AWS as having the ‘moat’ it once had. What this means to investors is the potential to capture changing competitive dynamics before the P/E ratio between the two adjusts.

AMZN, MSFT. Chart created by the author

Competitive Issues

AMZN’s aggressive and innovative approach has reshaped global commerce. Starting with books, it now plans to start selling cars. Beyond e-commerce and AWS, its aggressive growth strategy (shaped by its core business) is evident in its new ventures, including pharmacy drug sales (Amazon Pharmacy), primary healthcare (One Medical), semiconductors (Graviton, Inferentia, and Trainium), electronics manufacturing (Kindle, Fire Tablet), telecommunications (Kuiper), robotics (Kiva Systems/Amazon Robotics), drone deliveries (Amazon Prime Air/Scout) and others.

AMZN’s daring moves, some of which have turned lucrative, have captivated public attention and attracted growth investors willing to pay higher premiums than MSFT’s steady-growth, dividend-paying stock.

However, AMZN’s disruptive approach hasn’t excited everyone, especially some of its potential AWS customers. For example, due to competitive concerns, Volkswagen (OTCPK:VWAGY)(OTCPK:VLKAF)(OTCPK:VWAPY) and Walmart (WMT) chose Azure over AWS.

As cloud services extend beyond storage and computing, AMZN’s e-commerce growth aspirations clash with AWS’s. MSFT, on the other hand, is known for its close relations with the enterprise sector, with agnostic software operations tailored to their needs.

Microsoft’s Diversified Operations vs Amazon’s Disruptive Model

In 2024, we expect solid growth from MSFT and AMZN, but it’s unlikely to mirror the transformative impact of Generative AI. Our analysis indicates that current market participants prioritize the democratization of Generative AI over immediate monetization. ChatGPT, except for its most recent versions, is free. GitHub Copilot costs $9/month, unmatching its significant productivity benefits. MSFT’s Copilot app is free for Android and Apple devices, and the Copilot browser is free, too. As the industry pioneer, OpenAI and, by extension, MSFT had the advantage of setting the market tone, including pricing, oscillating between a modest monthly subscription fee and free service.

Pricing in the Cloud sector typically follows a pay-as-you-go model, a structure pioneered by AWS in 2006 with its Elastic Computing service. MSFT’s Azure gives enterprise customers direct access to OpenAI modules, allowing them to develop customized chatbots. The cost for this service is competitively priced between $0.0015 and $0.06 per 1k tokens, with the price varying based on the specific GPT version used. Given that each token represents 0.75 words, Azure’s GPT service is scalable.

To gauge the financial impact of this service, consider the US book publishing industry as a proxy of what to expect in terms of revenue. In 2023, the industry produced approximately 4.9 million books. If, hypothetically, all these books, each averaging 45,000 words, were generated using Azure GPT service, the potential revenue would range between $441,000 and $17.6 million, barely changing MSFT’s overall financial trajectory.

The industry’s focus on ecosystem building over immediate financial returns will prompt a renewed market focus on the strategic divergences between AMZN and MSFT, providing a catalyst that would help narrow the PE gap between the two Cloud giants. MSFT, with its broad product portfolio, is positioned to derive more benefits from OpenAI than AWS from Anthropic, especially when considering OpenAI’s leading edge in the market.

Segment Performance

Operating Systems and Devices

Our analysis indicates that in the short term, Generative AI is unlikely to significantly boost financial returns in the Operating System ‘OS’ market, specifically Windows OS and AMZN’s Fire OS. Similarly, this trend extends to device sales, including AMZN’s Fire Tablet, Kindle Reader, and MSFT’s Surface Tablets and Laptops. We expect a limited rollout of the new AI-enhanced Alexa in the year’s second half at the latest, with a full commercial launch in 2025, allowing for time for testing. Although the Echo will create some hype, the primary catalyst will remain on strategic long-term positioning, where MSFT leads.

In the Medium and long run, we see a disruptive opportunity to reimagine the OS User Experience ‘UX,’ allowing for more personalized computing. For example, in the future, users might be able to change their laptop configurations using simple natural language commands, uncovering many features currently hidden from digitally inexperienced users.

The potential for market impact appears more significant for MSFT than AMZN, primarily due to MSFT’s larger market share in enterprise software and its strategic emphasis on Windows OS, as manifested in new product rollouts, such as Windows Copilot. The future influence of the Anthropic/Amazon partnership in redefining the Fire OS mobile operating system landscape is an intriguing prospect and could theoretically alter the competitive landscape, i.e., Fire Tablets taking market share from iPads. However, unless we see a strategic shift in AMZN’s focus, these prospects remain highly speculative, highlighting the difference between AMZN and MSFT regarding exposure to Generative AI. We believe these strategic differences will become more prevalent in 2024, offering a catalyst that would decrease AMZN’s valuation premium over MSFT.

In the three months ended September 2023, we saw stabilization in Windows OS sales, rising 5% YoY after a rough fiscal year in the twelve months ended June 2023, which saw sales decline 13% YoY, as higher cost of living impacted Laptop and Tablet sales. The rise in Windows OS sales is likely a result of direct demand from enterprise customers upgrading their older Windows rather than increased demand from OEMs such as Dell (DELL) and HP (HPQ), which continue to struggle amidst weak consumer demand as mirrored in their September quarter results, similar to MSFT’s Surface, which declined 22% and relatively better than Apple (AAPL) Mac sales, which declined 34% during the same period.

We expect similar dynamics in 2024, with Windows and Surface outperforming peers but directionally following the market trend, mirroring a balance between an accommodative competitive advantage in Generative AI integration with Windows applications, contradicted by a lack of transformative or disruptive product rollout.

MSFT’s recent hiring of a new Chief Product Officer and Chief Marketing Officer is a direct response to the AI era’s demands. It is interesting that while MSFT is hiring AI-centric talent at top positions, AMZN is hiring those made redundant by MSFT, with the ex-MSFT CPO being recently hired and quickly promoted to AMZN’s CPO position.

We expect new transformative products to emerge in the medium term, though not in 2024. Satya Nadella’s tenure is likely coming to an end as well, with the CEO’s role likely ending after laying the foundation for these future products, bridging MSFT into a new era that necessitates a different leadership.

Integrated Development Environments

Generative AI is set to bring significant changes to the IDE sector, fuelled by chatbots’ ability to translate natural language into computer code. MSFT leads in the IDE space, with its widely-used products, GitHub and Visual Studio, far outpacing AWS Cloud9 in market share. This advantage places MSFT at the forefront of capitalizing on the Generative AI trend within the IDE industry.

However, investors should manage their revenue growth expectations for MSFT and AMZN IDE offerings. The emphasis remains on widening technology access instead of immediate profits. This is reflected in competitive pricing, like GitHub Copilot at $9-$19 per month and AWS’s CodeWhisperer, which is free for individual users and costs $19 for enterprise-level service. These strategies indicate a long-term vision for ecosystem growth.

Gaming

MSFT Gaming revenue increased by 8.5% in the September quarter, rebounding from FY 2023 lows. In a similar trend, Sony (SONY)(OTCPK:SNEJF) also reported an 8% increase in gaming revenue for September. The completion of the Activision Blizzard deal in October 2023 is expected to boost MSFT gaming sales in the December quarter.

AMZN’s cloud gaming service, Luna, is still in its early stages compared to established players like MSFT and Sony. It is also mostly a cloud-streaming game service as opposed to an established Gaming Studio. We also don’t see a strategic focus on the service, which is complementary to Prime subscribers.

Generative AI image and code generation capabilities will likely lower the costs of producing games, enhancing the profitability of MSFT’s gaming studio and rendering it the better bet on Generative AI than AMZN Luna.

Ad Revenue

LinkedIn and Bing’s ad-based businesses are underperforming, especially compared to AMZN. LinkedIn sales grew by only 8% in the September quarter, continuing its declining growth trend. Bing’s research and news advertising revenue increased by just 5% during the same period, a particularly disappointing figure given the anticipated synergies from new features such as Edge Copilot. In stark contrast, AMZN ad sales soared to $12 billion, up 26% from last year. Industry performance varied widely, with Meta (META) reporting a 23% sales increase, Snap (SNAP) and Pinterest (PINS) delivering 5% and 11%, respectively, while Alphabet (GOOG)(GOOGL) ad revenue increased 13%.

We see a need for MSFT to revamp its Bing strategy, especially with AMZN poised to adopt an ad model for its Prime Video, intensifying the competition for ad dollars.

Enterprise Software and Personal Productivity Tools

Microsoft Dynamics is making a strong market impact, with its sales soaring by 22% in the September quarter, a robust improvement from the 13.5% growth in FY 2023. This surge positions Dynamics closer to the $8.5 billion quarterly sales benchmark set by its competitors SAP (SAP) and Salesforce (CRM), both reporting a more modest 11% growth in the same period, underscoring Dynamic’s accelerated growth and increasing market presence.

MS Office products increased by 14% in the September quarter, with growth rebounding to historical averages after a soft performance in FY 2023. Growth was primarily driven by enterprise customers upgrading to new MS Office versions. Consumer sales growth remains subdued, rising 3% during the quarter despite price increases, mirroring a challenging consumer market but also a rebound opportunity going into 2024.

Summary

MSFT and AMZN share a powerful growth engine in the Cloud market, yet they offer different value propositions to shareholders. MSFT is known for its stability and consistent growth, backed by a diversified product range and a history of paying dividends, appealing to investors seeking steady and lower-risk growth. Conversely, AMZN is primarily seen as a growth-focused investment driven by its e-commerce dominance and disruptive model.

MSFT’s ground-breaking integration of OpenAI and its software products (Edge, Windows, GitHub, and others) increases its competitive moat. This advantage over AMZN remains valid regardless of AMZN’s progress (or lack thereof) in advancing its Generative AI capabilities, highlighting the stability of our investment hypothesis, a rare instance in a rapidly changing technological landscape. MSFT’s and AMZN’s relative price-to-earnings ‘P/E’ valuations don’t reflect these evolving dynamics, suggesting a misalignment that supports our outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.